United Kingdom: 2016 Article IV Consultation-Press Release

... toward supporting stability and reducing uncertainty. In the event the UK stays in the EU, steady growth is expected to continue over the next few years. Growth is projected to strengthen in late 2016 as referendum-related effects, which appear to have weighed on growth so far this year, wane and th ...

... toward supporting stability and reducing uncertainty. In the event the UK stays in the EU, steady growth is expected to continue over the next few years. Growth is projected to strengthen in late 2016 as referendum-related effects, which appear to have weighed on growth so far this year, wane and th ...

Risk-Adjusted Performance of Private Equity Investments

... well as the possibility of transferring risk to the lenders. The leverage risk usually changes over the holding period: being initially high, but subsequently diminishing due to debt redemption and increasing equity values. With knowledge of the equity betas over time, we can create a mimicking port ...

... well as the possibility of transferring risk to the lenders. The leverage risk usually changes over the holding period: being initially high, but subsequently diminishing due to debt redemption and increasing equity values. With knowledge of the equity betas over time, we can create a mimicking port ...

Population ageing systems in and pension Latin America

... rates have tended to follow reductions in mortality after a relatively short time lag, in most cases less than two decades (Bravo, 1992). Taken all together, these trends imply that ageing, as measured either by the “old” proportion of the population or by the old-age dependency ratio, is going to a ...

... rates have tended to follow reductions in mortality after a relatively short time lag, in most cases less than two decades (Bravo, 1992). Taken all together, these trends imply that ageing, as measured either by the “old” proportion of the population or by the old-age dependency ratio, is going to a ...

Chapter 11

... means of financing that project, but rather against the weighted average cost of financing all projects for the firm. This principle recognizes that the availability of one source of financing is dependent on other sources. Once a common overall cost is determined, the “colony destroying device” yie ...

... means of financing that project, but rather against the weighted average cost of financing all projects for the firm. This principle recognizes that the availability of one source of financing is dependent on other sources. Once a common overall cost is determined, the “colony destroying device” yie ...

2010 FOURTH QUARTER AND FULL YEAR EARNINGS REVIEW AND 2011 OUTLOOK

... had the first back-to-back market share increase since 1993 and the largest sales percentage increase of any full-line automaker • Ford of Canada reported an 11% sales increase in the Fourth Quarter, finishing 2010 as the best-selling automaker for the first time in more than 50 years • Ford Brazil ...

... had the first back-to-back market share increase since 1993 and the largest sales percentage increase of any full-line automaker • Ford of Canada reported an 11% sales increase in the Fourth Quarter, finishing 2010 as the best-selling automaker for the first time in more than 50 years • Ford Brazil ...

The safe asset meme - Université Paris

... met by short-duration currency swaps Not only US supplies safe assets – Germany, UK, Norway, Switzerland, even emerging markets (McCauley 2012) – and ‘U.S. financial assets have not been demonstrably more attractive than those of other industrial economies’ (Gruber and Kamin 2008) So are quantities ...

... met by short-duration currency swaps Not only US supplies safe assets – Germany, UK, Norway, Switzerland, even emerging markets (McCauley 2012) – and ‘U.S. financial assets have not been demonstrably more attractive than those of other industrial economies’ (Gruber and Kamin 2008) So are quantities ...

CHAPTER 1

... c. point-of-sale terminals. d. NOW accounts. ANSWER: c 56. Other industrialized countries, such as Japan, Mexico, and Canada, have currencies that have value because they are a. traded in the foreign exchange market. b. based upon the American dollar. c. accepted in trade and used to make payments. ...

... c. point-of-sale terminals. d. NOW accounts. ANSWER: c 56. Other industrialized countries, such as Japan, Mexico, and Canada, have currencies that have value because they are a. traded in the foreign exchange market. b. based upon the American dollar. c. accepted in trade and used to make payments. ...

PDF Download

... suggestions. Maximilian Rupps provided excellent research assistance. All remaining errors are our own. The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management. ...

... suggestions. Maximilian Rupps provided excellent research assistance. All remaining errors are our own. The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management. ...

THE IMPACT OWNERSHIP STRUCTURE ON THE

... take for their investments. Company’s performance can be evaluated in three dimensions. The first dimension is company’s productivity, or processing inputs into outputs efficiently. The second is profitability dimension, or the level of which company’s earnings are bigger than its costs. The third d ...

... take for their investments. Company’s performance can be evaluated in three dimensions. The first dimension is company’s productivity, or processing inputs into outputs efficiently. The second is profitability dimension, or the level of which company’s earnings are bigger than its costs. The third d ...

Test Bank for Quiz-2 FINA252 Financial Management

... operation cash flow for this year is $1420.00. True or False? A. True B. False ...

... operation cash flow for this year is $1420.00. True or False? A. True B. False ...

Actuarial Methods for Valuing Illiquid Assets

... The valuation of illiquid assets is a vast topic, which is very much in a state of development. Based on comments made by investment professionals during the preparation of the proposal, this is a very challenging area of research. Generally, the investment industry will look with great interest on ...

... The valuation of illiquid assets is a vast topic, which is very much in a state of development. Based on comments made by investment professionals during the preparation of the proposal, this is a very challenging area of research. Generally, the investment industry will look with great interest on ...

ISS research paper template

... series data was used covering the period 1970 to 2006. Domestic borrowing was found to have an incomplete crowding out effect on private credit. The study also revealed that the domestic borrowing does not impact on private credit through interest rate and credit availability seem to be more relevan ...

... series data was used covering the period 1970 to 2006. Domestic borrowing was found to have an incomplete crowding out effect on private credit. The study also revealed that the domestic borrowing does not impact on private credit through interest rate and credit availability seem to be more relevan ...

CENTRAL BANK OF THE REPUBLIC OF TURKEY Durmu YILMAZ

... Problems in credit markets linger to some extent and unemployment rates remain at high levels, which in turn increase future uncertainties. ...

... Problems in credit markets linger to some extent and unemployment rates remain at high levels, which in turn increase future uncertainties. ...

Document

... ratios tend to be less diagnostic than those looked at earlier. The reason is that, if a firm is making poor profits and has low profitability, the reason will probably lie in areas such as its operating methods, and this will show up in ratios such as the turnover ratios defined above. Thus, profit ...

... ratios tend to be less diagnostic than those looked at earlier. The reason is that, if a firm is making poor profits and has low profitability, the reason will probably lie in areas such as its operating methods, and this will show up in ratios such as the turnover ratios defined above. Thus, profit ...

Debt Levels and Share Price - a Sensitivity Analysis on Vestas

... EUR 30.03. The company’s optimal capital structure is thereafter determined, by employing the two sub-frameworks of the trade-off theory: static and dynamic. The results point out that Vestas is currently either around optimum debt levels (in the dynamic trade-off case), or below them (in the static ...

... EUR 30.03. The company’s optimal capital structure is thereafter determined, by employing the two sub-frameworks of the trade-off theory: static and dynamic. The results point out that Vestas is currently either around optimum debt levels (in the dynamic trade-off case), or below them (in the static ...

Financial Capability in the United States

... that had not been seen for many decades. A substantial decline in residential real estate prices, a roughly 50% collapse in the stock market and unemployment rates at 25-year highs combined to erode personal balance sheets, straining the abilities of many to meet their short-term obligations and pla ...

... that had not been seen for many decades. A substantial decline in residential real estate prices, a roughly 50% collapse in the stock market and unemployment rates at 25-year highs combined to erode personal balance sheets, straining the abilities of many to meet their short-term obligations and pla ...

What Drives Long-term Capital Flows? A Theoretical and Empirical

... the ability to borrow is somewhat limited by capital market imperfections (see Obstfeld and Rogoff [2000]). This suggests that for a neoclassical model to help us understand variations in borrowing behaviour, some type of imperfection in capital markets is needed. What form should this imperfection ...

... the ability to borrow is somewhat limited by capital market imperfections (see Obstfeld and Rogoff [2000]). This suggests that for a neoclassical model to help us understand variations in borrowing behaviour, some type of imperfection in capital markets is needed. What form should this imperfection ...

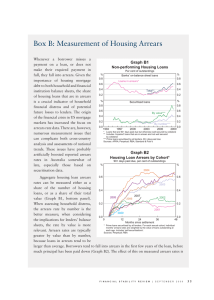

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.