Threat of entry and debt maturity: evidence from airlines

... threat of entry is reflected into the stock price, firms may be less likely to issue equity to reduce leverage, suggesting that the leverage ratio is not going to change (Baker and Wurgler (2002)). Finally, issuing equity when a firm faces rollover failure may actually result in a transfer of value ...

... threat of entry is reflected into the stock price, firms may be less likely to issue equity to reduce leverage, suggesting that the leverage ratio is not going to change (Baker and Wurgler (2002)). Finally, issuing equity when a firm faces rollover failure may actually result in a transfer of value ...

Can the capital gains to land be included in "savin

... costs, the investment-output ratio in Japan drops, but the ratio is still on average three times that in the United States. ...

... costs, the investment-output ratio in Japan drops, but the ratio is still on average three times that in the United States. ...

What`s changed in the international financial system and its

... Initiative (MDRI) in 2005 have all helped move debt cancellation forward. There is a danger, however, that new loans to developing countries, especially if disbursed at commercial rates, will lead to a new debt crisis in the South. The World Bank has already increased its lending activities by 54 pe ...

... Initiative (MDRI) in 2005 have all helped move debt cancellation forward. There is a danger, however, that new loans to developing countries, especially if disbursed at commercial rates, will lead to a new debt crisis in the South. The World Bank has already increased its lending activities by 54 pe ...

Monetary Policy with Interest on Reserves

... programs, the Federal Reserve has accumulated another $2.5 Trillion of assets, and created about $2.5 trillion of additional reserves in exchange. The Fed bought US treasury bonds and mortgagebacked securities, and created interest-paying reserves in exchange. (We could say “printed money,” but it’s ...

... programs, the Federal Reserve has accumulated another $2.5 Trillion of assets, and created about $2.5 trillion of additional reserves in exchange. The Fed bought US treasury bonds and mortgagebacked securities, and created interest-paying reserves in exchange. (We could say “printed money,” but it’s ...

questions in real estate finance

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

Global Financial Stability Report(Chapter 1): Potent Policies for

... producers, a number of factors have muted the positive impact of a supply-driven oil decline, especially for net oil importers (see the section on Emerging Market Economies and China’s Complex Transition). Two explanations are discussed that bear heavily on financial stability (see the April 2016 WE ...

... producers, a number of factors have muted the positive impact of a supply-driven oil decline, especially for net oil importers (see the section on Emerging Market Economies and China’s Complex Transition). Two explanations are discussed that bear heavily on financial stability (see the April 2016 WE ...

5 Comparison with the Previous Convergence Programme and

... Starting in January 2005, the process of accelerated depreciation of movable property has been speeded up, and the tax support for corporate science and research expenditures has increased. In July 2005, the amount of time for registration in commercial registers has been reduced, which simplifies t ...

... Starting in January 2005, the process of accelerated depreciation of movable property has been speeded up, and the tax support for corporate science and research expenditures has increased. In July 2005, the amount of time for registration in commercial registers has been reduced, which simplifies t ...

PORTUGAL - Observador

... concerns. It should also help to raise inflation over the forecast horizon. A sharply weaker euro and lower oil prices have improved the short-term outlook. In the medium term, growth is projected to moderate, as several remaining challenges, notably low investment, high leverage, and structural bot ...

... concerns. It should also help to raise inflation over the forecast horizon. A sharply weaker euro and lower oil prices have improved the short-term outlook. In the medium term, growth is projected to moderate, as several remaining challenges, notably low investment, high leverage, and structural bot ...

Housing, Mortgage Bailout Guarantees and the

... with more highly levered households paying higher interest rates. This result is important because it provides a concise characterization of the mortgage price function which allows to easily deal with the continuous choice by households of mortgage contracts with endogenous interest rates. It also ...

... with more highly levered households paying higher interest rates. This result is important because it provides a concise characterization of the mortgage price function which allows to easily deal with the continuous choice by households of mortgage contracts with endogenous interest rates. It also ...

word_link - Alexander`s Inc.

... three-year mortgage loan with Union Bank of Switzerland. The Company expects to increase this loan by $30,000,000 of which approximately $15,000,000 will be used to partially fund a renovation of the Mall (estimated to cost $30,000,000 in total) and $15,000,000 will be used to pay its liability to F ...

... three-year mortgage loan with Union Bank of Switzerland. The Company expects to increase this loan by $30,000,000 of which approximately $15,000,000 will be used to partially fund a renovation of the Mall (estimated to cost $30,000,000 in total) and $15,000,000 will be used to pay its liability to F ...

documentos de trabajo

... and the financial sector experienced a great boom. These domestic developments went hand in hand with the opening up of international capital markets that had been closed since the 1982 debt crisis. However, new foreign credit during the 1990s predominantly took the form of bond finance, not of bank ...

... and the financial sector experienced a great boom. These domestic developments went hand in hand with the opening up of international capital markets that had been closed since the 1982 debt crisis. However, new foreign credit during the 1990s predominantly took the form of bond finance, not of bank ...

Positive ruble interest rates to raise propensity to save in Russia

... impede reaching the 4% inflation target. High interest rates encourage savings and weaken lending activity, which in turn removes consumption stimuli and restrains inflation. We expect the Bank of Russia to cut its key interest rate from 10% to 8–8.5% in 2017 and further to 5.5% by 2020. On average, ...

... impede reaching the 4% inflation target. High interest rates encourage savings and weaken lending activity, which in turn removes consumption stimuli and restrains inflation. We expect the Bank of Russia to cut its key interest rate from 10% to 8–8.5% in 2017 and further to 5.5% by 2020. On average, ...

CRT066436A Post Brexit debt markets Web

... subsequent days, many commentators drew comparisons to the start of the financial crisis of 2008. But while on that occasion, the economic thunderstorm caught many by surprise, this time most appear to have had umbrellas at the ready. From a lending perspective, what was immediately striking in the ...

... subsequent days, many commentators drew comparisons to the start of the financial crisis of 2008. But while on that occasion, the economic thunderstorm caught many by surprise, this time most appear to have had umbrellas at the ready. From a lending perspective, what was immediately striking in the ...

Leverage, Default, and Forgiveness

... In the calendar year 1990 I decided to spend my Yale sabbatical at the Wall Street investment bank Kidder Peabody. As a theoretical economist I wanted to see what models real world practitioners used. Among other things, I learned for the first time about the securitization and tranching of mortgages ...

... In the calendar year 1990 I decided to spend my Yale sabbatical at the Wall Street investment bank Kidder Peabody. As a theoretical economist I wanted to see what models real world practitioners used. Among other things, I learned for the first time about the securitization and tranching of mortgages ...

Origins and Measurement of Financial Repression: The

... advanced economies to implement. At the same time, outstanding debts and deficits are large enough that other traditional mechanisms for achieving fiscal balance, such as reductions in government expenditures or asset sales, are viewed by many as insufficient to make a material impact on sovereig ...

... advanced economies to implement. At the same time, outstanding debts and deficits are large enough that other traditional mechanisms for achieving fiscal balance, such as reductions in government expenditures or asset sales, are viewed by many as insufficient to make a material impact on sovereig ...

1 The Capital Structure Choice in Tax Contrasting

... Relative to the studies about companies in developed countries, there have been a limited number of empirical studies that used data from developing countries. For example, the capital structure choice of Malaysian, Mauritius, Zimbabwean, Hungarian and Portugese, Turkish and Chinese companies have ...

... Relative to the studies about companies in developed countries, there have been a limited number of empirical studies that used data from developing countries. For example, the capital structure choice of Malaysian, Mauritius, Zimbabwean, Hungarian and Portugese, Turkish and Chinese companies have ...

Chapter 16 -- Operating and Financial Leverage

... A single ratio value cannot be interpreted identically for all firms as some firms have greater debt capacity. ...

... A single ratio value cannot be interpreted identically for all firms as some firms have greater debt capacity. ...

FREE Sample Here

... The most important aspect of ratio analysis is the judgment used when interpreting the results to reach an overall conclusion concerning a firm’s financial position. The analyst should be aware of, and include in the interpretation, the fact that: (1) large firms with many different divisions are di ...

... The most important aspect of ratio analysis is the judgment used when interpreting the results to reach an overall conclusion concerning a firm’s financial position. The analyst should be aware of, and include in the interpretation, the fact that: (1) large firms with many different divisions are di ...

Financial Stability Report November 2011 Contents

... The Reserve Bank Act requires the Bank to produce a Financial Stability Report twice a year. This document must report on the soundness and efficiency of the financial system and the measures undertaken by the Reserve Bank to achieve its statutory purpose. The Report must contain the information nec ...

... The Reserve Bank Act requires the Bank to produce a Financial Stability Report twice a year. This document must report on the soundness and efficiency of the financial system and the measures undertaken by the Reserve Bank to achieve its statutory purpose. The Report must contain the information nec ...

Evaluation Cultures? On Invoking `Culture` in the Analysis of

... agencies in the event of defaults on the underlying mortgages. Because investors could thus ignore the risk of default, they focussed primarily on a different risk: prepayment. Deliberate government intervention in the US mortgage market after the Great Depression (at the peak of which, ‘nearly 10 p ...

... agencies in the event of defaults on the underlying mortgages. Because investors could thus ignore the risk of default, they focussed primarily on a different risk: prepayment. Deliberate government intervention in the US mortgage market after the Great Depression (at the peak of which, ‘nearly 10 p ...

How Homeowners Choose between Fixed and Adjustable Rate

... which shows monthly mortgage volumes from July 2003 to April 2011) and in most developed countries has risen substantially over the past decade. ...

... which shows monthly mortgage volumes from July 2003 to April 2011) and in most developed countries has risen substantially over the past decade. ...

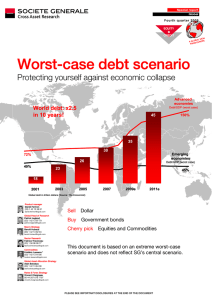

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.