Lidy Nacpil - Jubilee South Asia Pacific Movement on - UN-NGLS

... b. The transformation of the financial system should begin in many places and these places include the Bretton Woods institutions. The zero draft acknowledges and prescribes much too great a role to these institutions in reforms and solutions, without recognizing the negative impacts their policies ...

... b. The transformation of the financial system should begin in many places and these places include the Bretton Woods institutions. The zero draft acknowledges and prescribes much too great a role to these institutions in reforms and solutions, without recognizing the negative impacts their policies ...

Comments on Mendoza

... 1. Is there anything such as an intrinsically sustainable debt per se? No: some debts just seem to be more sustainable than others, according to certain ad-hoc criteria and rules of thumb. Willingness to pay is difficult to model Senior and subordinated debts might not be equally sustainable 2. ...

... 1. Is there anything such as an intrinsically sustainable debt per se? No: some debts just seem to be more sustainable than others, according to certain ad-hoc criteria and rules of thumb. Willingness to pay is difficult to model Senior and subordinated debts might not be equally sustainable 2. ...

Section 2B - Financial Crisis of 2008

... 4. High and growing debt to income ratio of American households B. Because mortgage and home equity loans are tax deductible, but other forms of debt are not, household debt is concentrated in housing assets C. As a result, housing is hit especially hard when economic conditions weaken ...

... 4. High and growing debt to income ratio of American households B. Because mortgage and home equity loans are tax deductible, but other forms of debt are not, household debt is concentrated in housing assets C. As a result, housing is hit especially hard when economic conditions weaken ...

The Cycle of Civilization

... Misuse of debt, poor investments, poor collateral. Loss of confidence. Panic ...

... Misuse of debt, poor investments, poor collateral. Loss of confidence. Panic ...

Model of debt crisis, Romer 4th edition section 12.10

... • So there are two equilibria, one when the interest factor and the probability of default are low, one where no investor want to hold the debt • For a sufficiently large riskless rate RMIN (Figure 12.6 next) the red curve is on the right of the blue curve and the only equilibrium is π=1. You don’t ...

... • So there are two equilibria, one when the interest factor and the probability of default are low, one where no investor want to hold the debt • For a sufficiently large riskless rate RMIN (Figure 12.6 next) the red curve is on the right of the blue curve and the only equilibrium is π=1. You don’t ...

Production Can`t Be Faked A common assertion made about the

... services produced, but the point is, in a demand-side recession, more goods and services could have been produced. The previous production wasn’t ‘fake’ or unsustainable, you simple need to give more fuel to the fire, you simply need to manage your monetary policy in a manner such that spending grow ...

... services produced, but the point is, in a demand-side recession, more goods and services could have been produced. The previous production wasn’t ‘fake’ or unsustainable, you simple need to give more fuel to the fire, you simply need to manage your monetary policy in a manner such that spending grow ...

2017 MSW BW Public EP - Credit

... and do not necessarily reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System. ...

... and do not necessarily reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System. ...

Addicted to the Apocalypse

... and Erskine Bowles. It was, I suppose, predictable that Fix the Debt would respond to the latest budget deal with a press release trying to shift the focus to its favorite subject. But the organization wasn’t content with declaring that America’s long-run budget issues remain unresolved, which is tr ...

... and Erskine Bowles. It was, I suppose, predictable that Fix the Debt would respond to the latest budget deal with a press release trying to shift the focus to its favorite subject. But the organization wasn’t content with declaring that America’s long-run budget issues remain unresolved, which is tr ...

Irrecoverable Debts

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...

Goff 2008 Financial Crisis Slides

... Non-mortgage commercial loans a big part of the story Amplified by “moral hazard” Implied or explicit guarantees to banking/financial system contributed to too much risk-taking, too much debt (TBTF) ...

... Non-mortgage commercial loans a big part of the story Amplified by “moral hazard” Implied or explicit guarantees to banking/financial system contributed to too much risk-taking, too much debt (TBTF) ...

The Great Recession vs. The Great Depression

... aggregate demand with increased public spending (and debt) Friedman’s contribution: Keep the stock of money in circulation from declining to ensure that monetary liquidity is maintained These lessons have been learned and applied Debates about “how much?” and for “how long?” persist – no consensus h ...

... aggregate demand with increased public spending (and debt) Friedman’s contribution: Keep the stock of money in circulation from declining to ensure that monetary liquidity is maintained These lessons have been learned and applied Debates about “how much?” and for “how long?” persist – no consensus h ...

ppt version

... beginning in 2006-2007 Lenders not receiving expected payments Begins chain of financial firms in trouble because not receiving payments from other firms ...

... beginning in 2006-2007 Lenders not receiving expected payments Begins chain of financial firms in trouble because not receiving payments from other firms ...

New Financial Intermediaries: Private Equity and the Corporation

... Argues low‐growth, mature firms should return free cash flow to shareholders (dividends, stock repurchases) ...

... Argues low‐growth, mature firms should return free cash flow to shareholders (dividends, stock repurchases) ...

Elena Papadopoulou

... Party of the European Left –transform! europe “Together we can put an end to the problems of debt and austerity in Europe ...

... Party of the European Left –transform! europe “Together we can put an end to the problems of debt and austerity in Europe ...

Your Debt to Income Ratio

... the better chance you will have of repaying your debt, hence the better chance of being approved for a loan or mortgage. As well, lenders will take into consideration your record in repaying previous debts and how long you’ve been at your current job. Gross Debt Service ratio (GDSR) and Total Debt S ...

... the better chance you will have of repaying your debt, hence the better chance of being approved for a loan or mortgage. As well, lenders will take into consideration your record in repaying previous debts and how long you’ve been at your current job. Gross Debt Service ratio (GDSR) and Total Debt S ...

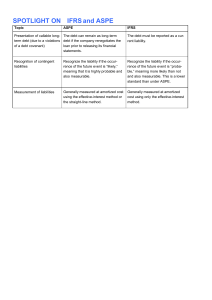

SPOTLIGHT ON*IFRS and ASPE

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.