Welcome to the Good Sense Budget Course

... shouldn’t have to wait for what we want. • Debt is expected and unavoidable. • Our self-worth is directly connected to our possessions and what we do. • A little more money will solve all our problems. • Life should be easy and fair. ...

... shouldn’t have to wait for what we want. • Debt is expected and unavoidable. • Our self-worth is directly connected to our possessions and what we do. • A little more money will solve all our problems. • Life should be easy and fair. ...

The Argentina Debt Case* Jayati Ghosh

... The immediate effect of this would be to disable Argentina from repaying $832 million of debt to other bondholders (who have already received around 90 per cent of their debt) unless it also pays the holdouts in full, thereby forcing the country into technical default. Economy Minister Alex Kicillof ...

... The immediate effect of this would be to disable Argentina from repaying $832 million of debt to other bondholders (who have already received around 90 per cent of their debt) unless it also pays the holdouts in full, thereby forcing the country into technical default. Economy Minister Alex Kicillof ...

The Fed`s 405% problem

... The official reason is that the economic data in the past three months was weaker than expected. Indeed, the economy slowed from an already sluggish pace in H1 and modestly higher mortgage rates threatened to inflict material damage in the housing market. Time will show if this U-turn was a policy m ...

... The official reason is that the economic data in the past three months was weaker than expected. Indeed, the economy slowed from an already sluggish pace in H1 and modestly higher mortgage rates threatened to inflict material damage in the housing market. Time will show if this U-turn was a policy m ...

Eighth UNCTAD Debt Management Conference Principles for Promoting Responsible Sovereign Lending and Borrowing

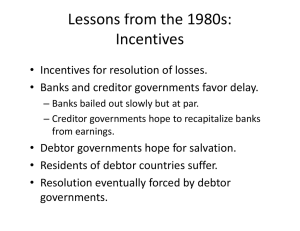

... • Situation that led to the default – Spiraling debt burden and default over USD 82 Bn of bonded debt ...

... • Situation that led to the default – Spiraling debt burden and default over USD 82 Bn of bonded debt ...

apropos… - ETHENEA

... deleveraging cycle developed markets have just gone through, the reduction in savings is more likely to have other consequences, such as higher unemployment in the ...

... deleveraging cycle developed markets have just gone through, the reduction in savings is more likely to have other consequences, such as higher unemployment in the ...

Debt Market Monitor

... Musings on longer-term inflation and interest rates After nearly exhausting the topic of a potential interest rate increase, the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate inc ...

... Musings on longer-term inflation and interest rates After nearly exhausting the topic of a potential interest rate increase, the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate inc ...

**** 1 - E-SGH

... Terra Securities (Norway) – 28.11.2007 American Freedom Mortgage Inc. (USA) – 30.1.2007 ...

... Terra Securities (Norway) – 28.11.2007 American Freedom Mortgage Inc. (USA) – 30.1.2007 ...

The Debt Ceiling and the Road Ahead

... The yield on the 10-year Treasury note can serve as a barometer of anxiety levels; the higher the yield goes, the more bond prices will fall, indicating increasing anxiety in the bond markets. Regardless of whether the debt ceiling stays the same, several significant auctions of Treasury securities ...

... The yield on the 10-year Treasury note can serve as a barometer of anxiety levels; the higher the yield goes, the more bond prices will fall, indicating increasing anxiety in the bond markets. Regardless of whether the debt ceiling stays the same, several significant auctions of Treasury securities ...

Opening Statement on the Long-Term Debt and Total Loss

... The current proposal builds on these undertakings. As staff will explain more fully in a moment, the core of the proposal is a requirement that the parent holding companies of systemically important U.S. banking firms maintain outstanding a substantial amount of unsecured long-term debt issued to un ...

... The current proposal builds on these undertakings. As staff will explain more fully in a moment, the core of the proposal is a requirement that the parent holding companies of systemically important U.S. banking firms maintain outstanding a substantial amount of unsecured long-term debt issued to un ...

The balance sheet: Telling a balanced story

... resources. At first blush, 50% profit growth sounds good. But what if a company funds that growth by doubling the number of shares outstanding? ROI would decline. ROI measures profitability relative to the capital invested in the business, a useful way to assess companies with a capitalization struc ...

... resources. At first blush, 50% profit growth sounds good. But what if a company funds that growth by doubling the number of shares outstanding? ROI would decline. ROI measures profitability relative to the capital invested in the business, a useful way to assess companies with a capitalization struc ...

CHAPTER 1

... c. What is the market value of the firm (equity plus debt) after the change in capital structure? d. What is the debt ratio after the change in structure? e. Who (if anyone) gains or loses? Now try the next question. ...

... c. What is the market value of the firm (equity plus debt) after the change in capital structure? d. What is the debt ratio after the change in structure? e. Who (if anyone) gains or loses? Now try the next question. ...

GDP Indexed bonds

... Brady Bonds Value Recovery Rights (VRRs) GDP VRRs (Costa Rica, Bulgaria, Bosnia) Ciudad de Buenos Aires Options on US economic statistics (Longitude-DB-GS) Inflation-indexed bonds ...

... Brady Bonds Value Recovery Rights (VRRs) GDP VRRs (Costa Rica, Bulgaria, Bosnia) Ciudad de Buenos Aires Options on US economic statistics (Longitude-DB-GS) Inflation-indexed bonds ...

Debt As % of GDP III

... monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ratio. And rather than losing income to rentals, families built significant equity net worth through home ownership. 8) When the cost of debt (interest rates) fell from well over ...

... monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ratio. And rather than losing income to rentals, families built significant equity net worth through home ownership. 8) When the cost of debt (interest rates) fell from well over ...

HBW with speaker notes - North Carolina Cooperative Extension

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

How far we`ve come, how little we`ve changed

... Reflecting over the last fifteen months it’s amazing how far we’ve come, how little we’ve changed, and perhaps how far we have yet to go. Twelve months ago, we were in the midst of a financial panic (which is beginning to be referred to as the Great Recession) where the worst fears were that the glo ...

... Reflecting over the last fifteen months it’s amazing how far we’ve come, how little we’ve changed, and perhaps how far we have yet to go. Twelve months ago, we were in the midst of a financial panic (which is beginning to be referred to as the Great Recession) where the worst fears were that the glo ...

Doing More with Less - Eastern Caribbean Central Bank

... Avoid falling into the dreaded “debt trap” because once in, it can prove extremely difficult to get out. Firstly, we should all have a structured budget in place which is used from month to month to clearly identify our income and expenses. The budget will highlight w ...

... Avoid falling into the dreaded “debt trap” because once in, it can prove extremely difficult to get out. Firstly, we should all have a structured budget in place which is used from month to month to clearly identify our income and expenses. The budget will highlight w ...

July 2011 - Cypress Financial Planning

... form of Treasury bills, notes and bonds. If every US citizen donated $47,000 to the government, the debt would be entirely paid off! While these numbers seem staggering, economists measure the total debt load of a country by comparing it to the size of that country, as measured by its Gross Domestic ...

... form of Treasury bills, notes and bonds. If every US citizen donated $47,000 to the government, the debt would be entirely paid off! While these numbers seem staggering, economists measure the total debt load of a country by comparing it to the size of that country, as measured by its Gross Domestic ...

CIBC first Canadian bank to tap Europe`s negative yields

... first non-European bank to do so. In March, Germany’s Berlin Hype was the first lender to borrow at negative rates, cashing in on a hunger for quality debt, coupled with Europe’s unique fixed-income markets. At the start of this month, nearly $12-trillion (U.S.) worth of government debt carried nega ...

... first non-European bank to do so. In March, Germany’s Berlin Hype was the first lender to borrow at negative rates, cashing in on a hunger for quality debt, coupled with Europe’s unique fixed-income markets. At the start of this month, nearly $12-trillion (U.S.) worth of government debt carried nega ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.