Economic Policy Objectives and Challenges in Tanzania

... A framework for engagement with successful reformers among low-income countries A non-financial instrument But: Of equal strength as IMF lending facilities ...

... A framework for engagement with successful reformers among low-income countries A non-financial instrument But: Of equal strength as IMF lending facilities ...

Document

... doubtless present output in the UK would be £50 bn more without any cuts... But without the cuts, bigger debt would be passed on. And if the increased probability of our ending up in a Greek-like situation by 10%, is it not be worth the price? But what happens if all countries take the advice of spe ...

... doubtless present output in the UK would be £50 bn more without any cuts... But without the cuts, bigger debt would be passed on. And if the increased probability of our ending up in a Greek-like situation by 10%, is it not be worth the price? But what happens if all countries take the advice of spe ...

Policy Review Medium Term Debt Strategy

... External borrowing can lead to enhanced economic growth when invested in priority capital projects and infrastructure. The Government has, in the past, delineated priority projects to which external funding revenues would flow. The American Chamber of Commerce in Zambia (AmCham) encourages continued ...

... External borrowing can lead to enhanced economic growth when invested in priority capital projects and infrastructure. The Government has, in the past, delineated priority projects to which external funding revenues would flow. The American Chamber of Commerce in Zambia (AmCham) encourages continued ...

O Why High Yield Corporate Bonds Will Remain Attractive in 2012

... aggregate level and some of the other sectors in the economy is that firms have cut debt levels more deeply and profits are rising quite sharply. Of course this is not true for all firms in the advanced countries but it is true for enough in the economy at the macro level to resonate. Interestingly, ...

... aggregate level and some of the other sectors in the economy is that firms have cut debt levels more deeply and profits are rising quite sharply. Of course this is not true for all firms in the advanced countries but it is true for enough in the economy at the macro level to resonate. Interestingly, ...

M09a_FinancialCrisis

... • Fixed exchange rate to maintain credibility and low inflation following a period of hyperinflation • Growing government debt • GDP began to decline in 1999 (by 4%) • Loss of confidence and capital flight led to a rise in interest payments that worsened the fiscal situation • Domestic run on banks ...

... • Fixed exchange rate to maintain credibility and low inflation following a period of hyperinflation • Growing government debt • GDP began to decline in 1999 (by 4%) • Loss of confidence and capital flight led to a rise in interest payments that worsened the fiscal situation • Domestic run on banks ...

Unit 3: Economic Indicators WebQuest

... How much is each U.S. citizen’s share of the debt? $ _________________________________________ How much each day does the national debt increase? ...

... How much is each U.S. citizen’s share of the debt? $ _________________________________________ How much each day does the national debt increase? ...

Hyperinflation and state bankruptcies: an acute threat?

... Caroline Hilb Paraskevopoulos – Greece, Portugal, Ireland and even AAA borrower United States: mounting national debts and the growing fear of defaults are dominating the financial markets. And the question of whether the debt burden will unleash galloping double digit inflation rates is a further w ...

... Caroline Hilb Paraskevopoulos – Greece, Portugal, Ireland and even AAA borrower United States: mounting national debts and the growing fear of defaults are dominating the financial markets. And the question of whether the debt burden will unleash galloping double digit inflation rates is a further w ...

Slide 1 - World Bank

... – Buy a portfolio of EM securities, as Bernanke is doing with student loans and credit card debt – Give the resources to the IFC to manage ...

... – Buy a portfolio of EM securities, as Bernanke is doing with student loans and credit card debt – Give the resources to the IFC to manage ...

Impact of Macroprudential Policy Measures on Economic Dynamics: Simulation Using

... • Inevitably aspects of structure are arbitrary - Banks can’t raise capital - Boom is always ‘false’ and of fixed duration - No household or firm balance sheets or ‘debt overhang’ ...

... • Inevitably aspects of structure are arbitrary - Banks can’t raise capital - Boom is always ‘false’ and of fixed duration - No household or firm balance sheets or ‘debt overhang’ ...

20070306_Richard

... • The Government overlooked negative signals for two years • The Government resisted an IMF program • Authorities were wary of disturbing the BZD/USD currency peg • Officials eventually “came to their senses” • The restructuring was successful and valuable lessons were learned • Conclusion: It’s nev ...

... • The Government overlooked negative signals for two years • The Government resisted an IMF program • Authorities were wary of disturbing the BZD/USD currency peg • Officials eventually “came to their senses” • The restructuring was successful and valuable lessons were learned • Conclusion: It’s nev ...

The Rivoli Company has no debt outstanding and

... If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. Bonds can be sold at a cost , rd, of 7%. Rivoli is a no-growth firm. Hence, all its earnings ate paid out as dividends, and earnings are expectationall ...

... If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. Bonds can be sold at a cost , rd, of 7%. Rivoli is a no-growth firm. Hence, all its earnings ate paid out as dividends, and earnings are expectationall ...

Cabot Financial (Europe) Limited, the UK`s leading debt purchaser

... Sean Webb, Chief Operating Officer of Cabot Financial (Ireland) Limited, commented. “We believe that there are significant opportunities for the expansion of the debt purchase industry within Ireland. Cabot Financial is a pioneer of debt purchase within the UK and, combined with our existing experti ...

... Sean Webb, Chief Operating Officer of Cabot Financial (Ireland) Limited, commented. “We believe that there are significant opportunities for the expansion of the debt purchase industry within Ireland. Cabot Financial is a pioneer of debt purchase within the UK and, combined with our existing experti ...

Page number problem in Japanese

... 1832, the nation has spent half its time in various stages of default or restructuring. At one point in the middle of the 19th century, Greece was in default—meaning out of compliance with debt obligations—for 53 straight years, according to This Time Is Different: Eight Centuries of Financial Folly ...

... 1832, the nation has spent half its time in various stages of default or restructuring. At one point in the middle of the 19th century, Greece was in default—meaning out of compliance with debt obligations—for 53 straight years, according to This Time Is Different: Eight Centuries of Financial Folly ...

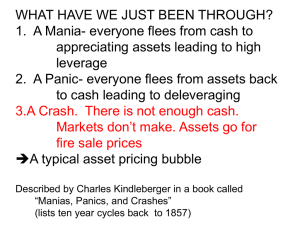

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.