Takaful In Malaysia By Bakarudin Ishak - .:: Al Huda

... MALAYSIAN ISLAMIC FINANCIAL SYSTEM • Comprehensive Islamic financial system covering all financial sectors – operating in parallel with conventional financial system • Diversities of players – Twelve full-fledged Islamic banking institutions – 2 domestic Islamic banks – 3 full-fledged foreign owned ...

... MALAYSIAN ISLAMIC FINANCIAL SYSTEM • Comprehensive Islamic financial system covering all financial sectors – operating in parallel with conventional financial system • Diversities of players – Twelve full-fledged Islamic banking institutions – 2 domestic Islamic banks – 3 full-fledged foreign owned ...

Islamic critique (1)

... In this variety of sale the offer (to sell something) is shifted from the present to a future date; for instance, one person would say to another ‘I sell you this house of mine at such a price as of the beginning of next year’ and the other replies: ‘I accept’. The majority of jurists are of the vie ...

... In this variety of sale the offer (to sell something) is shifted from the present to a future date; for instance, one person would say to another ‘I sell you this house of mine at such a price as of the beginning of next year’ and the other replies: ‘I accept’. The majority of jurists are of the vie ...

Download attachment

... but with an Islamic touch that requires a unique “filtration” process to select appropriate shares. The filtration process ensures that the mode, operation, and capital structure of each business the fund invests in are compatible with Islamic law, eliminating companies engaged in prohibited activit ...

... but with an Islamic touch that requires a unique “filtration” process to select appropriate shares. The filtration process ensures that the mode, operation, and capital structure of each business the fund invests in are compatible with Islamic law, eliminating companies engaged in prohibited activit ...

Muhammad Zubair Mughal Chief Executive Officer

... and now many IMFI’s are utilizing this concept to secure the fund for Islamic Microfinance. AlHuda Center of Islamic Banking and Economics (CIBE) has also established a crowd funding system which is available to integrate with any Islamic Microfinance institution. ...

... and now many IMFI’s are utilizing this concept to secure the fund for Islamic Microfinance. AlHuda Center of Islamic Banking and Economics (CIBE) has also established a crowd funding system which is available to integrate with any Islamic Microfinance institution. ...

PowerPoint Template

... • Musyarakah mutanaqisah is a form of Musyarakah (partnership) in which one of the partner promises to purchase the equity share of other partner gradually until the title of the equity is completely transferred to him. • This transaction starts with the formation of partnership, after which buying ...

... • Musyarakah mutanaqisah is a form of Musyarakah (partnership) in which one of the partner promises to purchase the equity share of other partner gradually until the title of the equity is completely transferred to him. • This transaction starts with the formation of partnership, after which buying ...

Download attachment

... be possible to defend allegations even after several hundred years of infancy. Islamic Banking is a reality of present time reached here after several attempts and experiences; it was always initiated with good intentions; to label it with bad names or calling it a fraud, does either show negative t ...

... be possible to defend allegations even after several hundred years of infancy. Islamic Banking is a reality of present time reached here after several attempts and experiences; it was always initiated with good intentions; to label it with bad names or calling it a fraud, does either show negative t ...

Document

... •Need to understand Islamic worldview especially Islamic vision of economics •Islamic / shari’ah boundaries of economics and finance must be ...

... •Need to understand Islamic worldview especially Islamic vision of economics •Islamic / shari’ah boundaries of economics and finance must be ...

Weigert v. Trade Wind Ventures, Inc.

... of $215,000 and did not return buyer's deposit. *914 The contract terms are clear and unambiguous and the evidence is undisputed that seller breached its contract to sell the vessel and Mr. Braverman breached his guarantee. As damages on the breach of the sales contract, buyer is entitled to the ben ...

... of $215,000 and did not return buyer's deposit. *914 The contract terms are clear and unambiguous and the evidence is undisputed that seller breached its contract to sell the vessel and Mr. Braverman breached his guarantee. As damages on the breach of the sales contract, buyer is entitled to the ben ...

real estate licensees acting as buyer`s agent

... Obtain a buyer’s representation agreement or contract. Disclose the nature of the licensee’s relationship with the party, and redefine and disclose if the relationship changes. Work on behalf of, and in the best interest of, the buyer(s), including advocating and negotiating on behalf of the b ...

... Obtain a buyer’s representation agreement or contract. Disclose the nature of the licensee’s relationship with the party, and redefine and disclose if the relationship changes. Work on behalf of, and in the best interest of, the buyer(s), including advocating and negotiating on behalf of the b ...

Download attachment

... exclusively in the context of conventional banking markets. For example, there has recently been some discussion of the role 'market discipline' exerted by bank shareholders and depositors in constraining the risk taking behaviour of bank management. At the same time, there is growing interest in, a ...

... exclusively in the context of conventional banking markets. For example, there has recently been some discussion of the role 'market discipline' exerted by bank shareholders and depositors in constraining the risk taking behaviour of bank management. At the same time, there is growing interest in, a ...

hirepurchase - Learning Financial Management / FrontPage

... systems and benefits the economy because markets can expand while minimising the seller's exposure to risk of default. Equally, HP is advantageous both to private consumers because it spreads the cost of expensive items over an extended time period, and to certain business consumers in that the bala ...

... systems and benefits the economy because markets can expand while minimising the seller's exposure to risk of default. Equally, HP is advantageous both to private consumers because it spreads the cost of expensive items over an extended time period, and to certain business consumers in that the bala ...

Demand or Patron Driven Acquisitions—Let the User Decide

... • University presses, other well-respected publishers • Publication date • Purchase price and Short Term Loan price • Non-mediated STL, Autopurchase after 3 STLs ...

... • University presses, other well-respected publishers • Publication date • Purchase price and Short Term Loan price • Non-mediated STL, Autopurchase after 3 STLs ...

Steel Slag Aggregate Size Price per ton Sales Representative: Paul

... the time of loading. Credit terms for all invoices are payable net 30 days from the date of the invoice. Any outstanding balance over 30 days will be assessed a finance charge of 1% per month. ...

... the time of loading. Credit terms for all invoices are payable net 30 days from the date of the invoice. Any outstanding balance over 30 days will be assessed a finance charge of 1% per month. ...

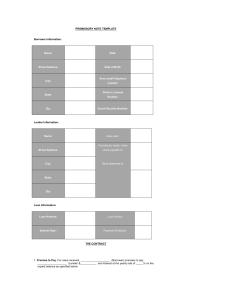

Promissory Note Template

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

Download attachment

... for the balance. In case of urboun deposit, this is deducted from the purchase price if the customer proceeds with the sale. If not, the customer looses his deposit, even if the deposit is more than the loss incurred by the bank. In order to make it safer for Islamic banks, it should make the contra ...

... for the balance. In case of urboun deposit, this is deducted from the purchase price if the customer proceeds with the sale. If not, the customer looses his deposit, even if the deposit is more than the loss incurred by the bank. In order to make it safer for Islamic banks, it should make the contra ...

section b - Fluor

... referred to as Contractor. The Contractor shall furnish all personnel and services (except as may be expressly set forth in the contract) and otherwise do all things necessary for, or incidental to the performance of the Work. ...

... referred to as Contractor. The Contractor shall furnish all personnel and services (except as may be expressly set forth in the contract) and otherwise do all things necessary for, or incidental to the performance of the Work. ...

Introduction to Islamic Banking By Mazher Ali Bokhari

... 4) Partners, relationship investor and traders, buyer or seller relationship ...

... 4) Partners, relationship investor and traders, buyer or seller relationship ...

Derivatives in Islamic Finance – An Overview

... Futures transactions not permissible. For two reasons; ...

... Futures transactions not permissible. For two reasons; ...

Formulario_-_Bono_del_Tesoro_Noviembre

... 2. That subject to the terms, conditions and procedures established in the Ministerial Resolution No. 017-2013DdCP of November 14, 2013 my proposal is the following: ISIN Code Maturity PAL634445OA2 ...

... 2. That subject to the terms, conditions and procedures established in the Ministerial Resolution No. 017-2013DdCP of November 14, 2013 my proposal is the following: ISIN Code Maturity PAL634445OA2 ...

Special Topics in Finance: Chapter 1,2,3,and 4 Summary FINA4351

... sharia laws, ensuring sanctity of contract by disclosing all the information pertaining to a contract and avoidance of gharar or any deceptive activities. Growth of Islamic finance has been achieved through setting up of transitional bodies such as Islamic Finance Services Board and Accounting and ...

... sharia laws, ensuring sanctity of contract by disclosing all the information pertaining to a contract and avoidance of gharar or any deceptive activities. Growth of Islamic finance has been achieved through setting up of transitional bodies such as Islamic Finance Services Board and Accounting and ...

Download attachment

... z Murabaha is sale of a commodity at cost plus margin; it must fulfill all the conditions of a valid sale z It may be spot sale or a deferred/credit sale z Deferred sale Murabaha is used as financing mode by Islamic Banks z Deferred price becomes a debt and shall be dealt with as a loan transaction ...

... z Murabaha is sale of a commodity at cost plus margin; it must fulfill all the conditions of a valid sale z It may be spot sale or a deferred/credit sale z Deferred sale Murabaha is used as financing mode by Islamic Banks z Deferred price becomes a debt and shall be dealt with as a loan transaction ...

In the name of Allah(j.j)

... unemployment rate--less chance of depression-even if, can easily be countered. ...

... unemployment rate--less chance of depression-even if, can easily be countered. ...

Islamic Finance OR By Dr. Aly Khorshid

... finance, Visiting Fellow ICMA centre Henley business school University of Reading, CEO of Islamic finance with Elite Horizon economic consultancy, his role includes Structuring, Endorsing and advising on Shariah complaint products with particular experience in Capital and stock market products, He i ...

... finance, Visiting Fellow ICMA centre Henley business school University of Reading, CEO of Islamic finance with Elite Horizon economic consultancy, his role includes Structuring, Endorsing and advising on Shariah complaint products with particular experience in Capital and stock market products, He i ...