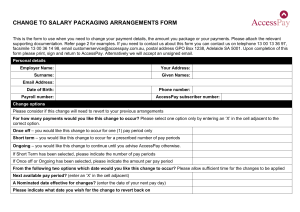

Change to Salary Packaging Arrangements Form - JAWS

... If Short Term has been selected, please indicate the number of pay periods If Once off or Ongoing has been selected, please indicate the amount per pay period From the following two options which date would you like this change to occur? Please allow sufficient time for the changes to be applied Nex ...

... If Short Term has been selected, please indicate the number of pay periods If Once off or Ongoing has been selected, please indicate the amount per pay period From the following two options which date would you like this change to occur? Please allow sufficient time for the changes to be applied Nex ...

Form K (Agency Disclosure)

... (e) Referral of the client to other licensed professionals for expert advice related to material matters that are not within the expertise of the licensed agent. A real estate licensee does not act as an attorney, tax advisor, surveyor, appraiser, environmental expert, or structural or mechanical en ...

... (e) Referral of the client to other licensed professionals for expert advice related to material matters that are not within the expertise of the licensed agent. A real estate licensee does not act as an attorney, tax advisor, surveyor, appraiser, environmental expert, or structural or mechanical en ...

rotating electric machines electric drives, electronic

... contracts concluded between the company VUES Brno s.r.o. as a sales organisation and their business partners in case that such terms and conditions are not stipulated in the contracts themselves. In case of divergence between the Contract and these Commercial Terms, the stipulations of the Contract ...

... contracts concluded between the company VUES Brno s.r.o. as a sales organisation and their business partners in case that such terms and conditions are not stipulated in the contracts themselves. In case of divergence between the Contract and these Commercial Terms, the stipulations of the Contract ...

Basic Principles of Islamic Economy and Finance

... solutions to these problems. There are several schools of thought on how these questions are answered or how these functions are carried out. These schools vary from neoclassical economics to Marxian economics, of which the Keynesians and the monetarists were the famous ones until 1970s. New classic ...

... solutions to these problems. There are several schools of thought on how these questions are answered or how these functions are carried out. These schools vary from neoclassical economics to Marxian economics, of which the Keynesians and the monetarists were the famous ones until 1970s. New classic ...

Bidding

... The general starting point forbidding is that the offer is not binding – even if it is submitted in writing. Only when both the vendor and the purchaser have signed a purchase contract for the property ( incl. land ortenantowned apartment) does the purchase become binding. Prior to this either party ...

... The general starting point forbidding is that the offer is not binding – even if it is submitted in writing. Only when both the vendor and the purchaser have signed a purchase contract for the property ( incl. land ortenantowned apartment) does the purchase become binding. Prior to this either party ...

Marketing Alternatives to Manager Risk

... Risk of adverse basis change Margin requirements increase interest costs & may cause cash flow problems Contracts only in fixed increments Requires knowledge of futures & basis Eliminates gain from rising cash price ...

... Risk of adverse basis change Margin requirements increase interest costs & may cause cash flow problems Contracts only in fixed increments Requires knowledge of futures & basis Eliminates gain from rising cash price ...

Marketing Alternatives to Manager Risk

... Risk of adverse basis change Margin requirements increase interest costs & may cause cash flow problems Contracts only in fixed increments Requires knowledge of futures & basis Eliminates gain from rising cash price ...

... Risk of adverse basis change Margin requirements increase interest costs & may cause cash flow problems Contracts only in fixed increments Requires knowledge of futures & basis Eliminates gain from rising cash price ...

Review of Topics for Midterm 2

... DF: Marginal benefit -- the benefit a person receives from consuming one more unit of a good. The marginal benefit is measured as the maximum amount that a person is willing to pay for it. So, the marginal benefit of a hamburger is the maximum amount of other goods and services a person is willing t ...

... DF: Marginal benefit -- the benefit a person receives from consuming one more unit of a good. The marginal benefit is measured as the maximum amount that a person is willing to pay for it. So, the marginal benefit of a hamburger is the maximum amount of other goods and services a person is willing t ...

Grad Finale PPT - Valparaiso University

... May help make repayment more manageable by combining several federal loans into one monthly payment at one fixed interest rate. www.studentloans.gov ...

... May help make repayment more manageable by combining several federal loans into one monthly payment at one fixed interest rate. www.studentloans.gov ...

Code of Responsible Borrowing.dpp

... this, it’s important to talk to someone independent not another money lender. We suggest you talk with a budget adviser, who will offer free, confidential and non-judgemental advice. There’s more than 150 budgeting services around the country. Find your nearest service by contacting: ...

... this, it’s important to talk to someone independent not another money lender. We suggest you talk with a budget adviser, who will offer free, confidential and non-judgemental advice. There’s more than 150 budgeting services around the country. Find your nearest service by contacting: ...

How do Interest Rates Work - Wealthcare Securities Pvt. Ltd.

... Governments sell bonds and other securities for the same reason. ...

... Governments sell bonds and other securities for the same reason. ...

IAIB 3101-Fiqh ul Muaamalath *II

... – if possessed with the consent of the seller, title or ownership will be passed to the buyer but usage of subject matter will be impermissible – Buyer must return the goods to the seller – However if the defect is rectified the sale becomes valid ...

... – if possessed with the consent of the seller, title or ownership will be passed to the buyer but usage of subject matter will be impermissible – Buyer must return the goods to the seller – However if the defect is rectified the sale becomes valid ...

MARKETING ISLAMIC BANKING PRODUCTS IN MALAYSIA

... Although the market has gradually embraced Islamic banking products, the marketing of the products is not really encouraging. One of the main problems is that the information concerning the Islamic banking products is limited and not sufficient to convince the consumers. It is important to disclose ...

... Although the market has gradually embraced Islamic banking products, the marketing of the products is not really encouraging. One of the main problems is that the information concerning the Islamic banking products is limited and not sufficient to convince the consumers. It is important to disclose ...

malaysian experience in implementation of the banking and

... conventional system, interests are given (pre-promised) with a guarantee of repayment and a fixed percentage return while in the Islamic system, investors share a fixed percentage of profit when it occurs i.e. the share of the two practices will vary according to the profit achieved. Banks get back ...

... conventional system, interests are given (pre-promised) with a guarantee of repayment and a fixed percentage return while in the Islamic system, investors share a fixed percentage of profit when it occurs i.e. the share of the two practices will vary according to the profit achieved. Banks get back ...

Download attachment

... normally require them to pledge or charge their property in order to secure the payment or settlement of the debt. This pledge or charge is principally based on the concept of alrahn. The concept of al-rahn 2 is one of the means provided in Shariah to achieve the main objective of Shariah in mu’amal ...

... normally require them to pledge or charge their property in order to secure the payment or settlement of the debt. This pledge or charge is principally based on the concept of alrahn. The concept of al-rahn 2 is one of the means provided in Shariah to achieve the main objective of Shariah in mu’amal ...

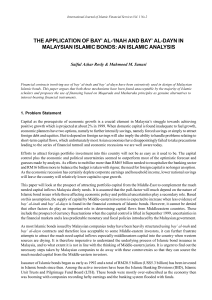

Download attachment

... raise capital, the supply of Islamic global Islamic funds can indeed become the much needed source of capital for Malaysia’s economic recovery. However, this may not be the case as the argument against bay’ al-’inah securitization and the trading of Islamic bonds on a discount basis through the bay’ ...

... raise capital, the supply of Islamic global Islamic funds can indeed become the much needed source of capital for Malaysia’s economic recovery. However, this may not be the case as the argument against bay’ al-’inah securitization and the trading of Islamic bonds on a discount basis through the bay’ ...

murabaha - AlHuda CIBE

... (b) however, if the asset is to be acquired from the customer, or from a third party, the Ijarah contract shall not be executed unless and until the institution has acquired that asset. ...

... (b) however, if the asset is to be acquired from the customer, or from a third party, the Ijarah contract shall not be executed unless and until the institution has acquired that asset. ...

PDF

... and economic justice and also equitable distribution of income and wealth in society (SeyedJavadin et al, 2014). The market for Islamic banking has grown rapidly over the past few years, and this robust growth is expected to continue for the foreseeable future. In many markets, Islamic banking has e ...

... and economic justice and also equitable distribution of income and wealth in society (SeyedJavadin et al, 2014). The market for Islamic banking has grown rapidly over the past few years, and this robust growth is expected to continue for the foreseeable future. In many markets, Islamic banking has e ...

96F1280F901F932A692570CA0020990A

... contract of sale. This would be part of the normal process of settlement where certain payments, such as council rates, are adjusted and levied. It will be an offence under clause 78M for a person to give false or misleading information in any of their reports. A ...

... contract of sale. This would be part of the normal process of settlement where certain payments, such as council rates, are adjusted and levied. It will be an offence under clause 78M for a person to give false or misleading information in any of their reports. A ...

Dr. Ausaf Ahmad - Indian Centre For Islamic Finance

... Silver for Silver, Wheat for What, barley for barley, dates for dates, salt for salt - like for like, hand to hand. Whoever pays more or takes more, indulges in Riba. The taker and giver are alike (in guilt). ...

... Silver for Silver, Wheat for What, barley for barley, dates for dates, salt for salt - like for like, hand to hand. Whoever pays more or takes more, indulges in Riba. The taker and giver are alike (in guilt). ...

Derivatives

... • the clearing corporation requires both parties to a futures contract are required to place a deposit with the corporation itself. • This practice is called posting margin in a margin account. • The margin deposits serve as a guarantee that when the contract comes due, the parties will be able to m ...

... • the clearing corporation requires both parties to a futures contract are required to place a deposit with the corporation itself. • This practice is called posting margin in a margin account. • The margin deposits serve as a guarantee that when the contract comes due, the parties will be able to m ...

Czy wiesz, jakie produkty spożywcze wkładasz do koszyka

... Every consumer who buys things through direct selling may withdraw from the purchase within 10 days of the purchase within giving the reason. This option is not available if you buy on the trader’s premises or in a traditional shop. The form of withdrawal from the contract can be downloaded from the ...

... Every consumer who buys things through direct selling may withdraw from the purchase within 10 days of the purchase within giving the reason. This option is not available if you buy on the trader’s premises or in a traditional shop. The form of withdrawal from the contract can be downloaded from the ...

Download attachment

... ultimate owner of wealth and people are trustees. Therefore, ownership of property by individuals is a trust (amanah). This leads to a new concept of accountability unknown to the western system. It is much wider than the concept of private accountability. This accountability can only be discharged ...

... ultimate owner of wealth and people are trustees. Therefore, ownership of property by individuals is a trust (amanah). This leads to a new concept of accountability unknown to the western system. It is much wider than the concept of private accountability. This accountability can only be discharged ...

World Islamic Banking: Growth and Challenges Ahead*

... Review of Business and Economics Studies bank in Malaysia. Bank Islam Malaysia Berhad (BIMB) was set up in July 1983 with paid-up capital of RM 80million (Arif, 1988 and BIMB). The Organization of Islamic Countries (OIC) established Islamic Development Bank (IDB) in December 1973 with the purpose t ...

... Review of Business and Economics Studies bank in Malaysia. Bank Islam Malaysia Berhad (BIMB) was set up in July 1983 with paid-up capital of RM 80million (Arif, 1988 and BIMB). The Organization of Islamic Countries (OIC) established Islamic Development Bank (IDB) in December 1973 with the purpose t ...