Prepared by, and after recording

... ACCELERATION; REMEDIES. At any time during the existence of an Event of Default, Lender, at Lender's option, may declare the Indebtedness to be immediately due and payable without further demand, and may invoke the power of sale and any one or more other remedies permitted by applicable law or provi ...

... ACCELERATION; REMEDIES. At any time during the existence of an Event of Default, Lender, at Lender's option, may declare the Indebtedness to be immediately due and payable without further demand, and may invoke the power of sale and any one or more other remedies permitted by applicable law or provi ...

Policy and Procedures All Licensed Dealers are welcomed to

... Bidder Badges and Guest/Driver Badges will be displayed in a visible manner at all times. The auctioneer will not acknowledge or accept bids from anyone who does not have a visible Bidders Badge provided by Alliance Auto Auction, L.L.C. Alliance will not be responsible for any statements or represen ...

... Bidder Badges and Guest/Driver Badges will be displayed in a visible manner at all times. The auctioneer will not acknowledge or accept bids from anyone who does not have a visible Bidders Badge provided by Alliance Auto Auction, L.L.C. Alliance will not be responsible for any statements or represen ...

TIME VALUE OF MONEY FROM AN ISLAMIC

... In trade financing services, Muslim banks offer mark up services to their clients. This involves instances where the banks purchase a certain commodity for the client and then agree on the amount that the client is to pay the bank; with some added profit. Leasing is another method used in trade fina ...

... In trade financing services, Muslim banks offer mark up services to their clients. This involves instances where the banks purchase a certain commodity for the client and then agree on the amount that the client is to pay the bank; with some added profit. Leasing is another method used in trade fina ...

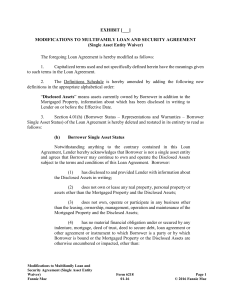

6218 - Fannie Mae

... Property or the Disclosed Assets or otherwise approved by Lender) so long as such trade payables (1) are not evidenced by a promissory note, (2) are payable within sixty (60) days of the date incurred, and (3) as of any date, do not exceed, in the aggregate, two percent (2%) of the original principa ...

... Property or the Disclosed Assets or otherwise approved by Lender) so long as such trade payables (1) are not evidenced by a promissory note, (2) are payable within sixty (60) days of the date incurred, and (3) as of any date, do not exceed, in the aggregate, two percent (2%) of the original principa ...

quotation and tender policy

... waived for the purchase of those goods and services only available from one lone supplier. Instead, a “sole source” form must be completed and approved by the appropriate signing authority. If the proposed purchase is made using an Oracle Government Financial (OGF) electronic requisition, the “sole ...

... waived for the purchase of those goods and services only available from one lone supplier. Instead, a “sole source” form must be completed and approved by the appropriate signing authority. If the proposed purchase is made using an Oracle Government Financial (OGF) electronic requisition, the “sole ...

Multifamily Revenue Bond Program Guidelines For Bond Issues

... housing opportunities at rents affordable to Brevard County residents of low and moderate income. The Multifamily Housing Revenue Bond Financing Program (the “Multifamily Housing Bond Program”) was developed to stimulate the production of affordable housing by providing low interest loans for Develo ...

... housing opportunities at rents affordable to Brevard County residents of low and moderate income. The Multifamily Housing Revenue Bond Financing Program (the “Multifamily Housing Bond Program”) was developed to stimulate the production of affordable housing by providing low interest loans for Develo ...

continued

... to exchange payments in the future based on the movement of some agreed-upon price or rate. A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other ...

... to exchange payments in the future based on the movement of some agreed-upon price or rate. A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other ...

continued

... to exchange payments in the future based on the movement of some agreed-upon price or rate. A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other ...

... to exchange payments in the future based on the movement of some agreed-upon price or rate. A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other ...

Legal Elements of the Development Process Acquiring Real Property

... Development Approvals • Inclusion of Approvals in Sale — see sample. If going to get these provisions, Buyer is going to pay for them. • Sale subject to obtaining Approvals — Definition of Approvals—see Exhibit to NJ ...

... Development Approvals • Inclusion of Approvals in Sale — see sample. If going to get these provisions, Buyer is going to pay for them. • Sale subject to obtaining Approvals — Definition of Approvals—see Exhibit to NJ ...

French Civil Law - Sales - Earnest Money

... dealing with earnest money, the application of these articles under both systems is quite different. Article 2463 of the Louisiana Civil Code provides that "if the promise to sell has been made with the giving of earnest, each of the contracting parties is at liberty to recede from his promise." (Em ...

... dealing with earnest money, the application of these articles under both systems is quite different. Article 2463 of the Louisiana Civil Code provides that "if the promise to sell has been made with the giving of earnest, each of the contracting parties is at liberty to recede from his promise." (Em ...

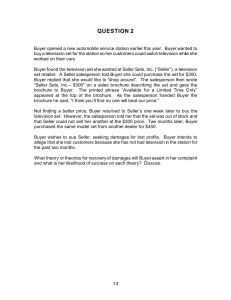

question 2 - Amazon Simple Storage Service (S3)

... set, offered perfect tender, and expected to make a contract with Seller for one TV, she has accepted the contract. When she was informed by Seller that there were no more in stock, this was, in effect, a breach on the part of Seller. Since it went directly to the essence of the contract (the TV), i ...

... set, offered perfect tender, and expected to make a contract with Seller for one TV, she has accepted the contract. When she was informed by Seller that there were no more in stock, this was, in effect, a breach on the part of Seller. Since it went directly to the essence of the contract (the TV), i ...

Guide on AXS Payment

... transaction limit, to pay for the Invoice in full. E.G.. Invoice Amount of S$4,000 and daily NETS limit of S$2,000 - You will need to make Payment #1 S$2,000, Payment #2 S$2,000 on separate days as you have reached your personal daily NETS limit. ...

... transaction limit, to pay for the Invoice in full. E.G.. Invoice Amount of S$4,000 and daily NETS limit of S$2,000 - You will need to make Payment #1 S$2,000, Payment #2 S$2,000 on separate days as you have reached your personal daily NETS limit. ...

REO Resources - Florida Realtors

... real estate business, technical ability and access. One avenue to asset managers is doing Broker Price Opinions. You may be called upon to do a BPO for another transaction, which is a good opportunity to break into the market. What is a REO listing? REO stands for real estate owned, also known as ba ...

... real estate business, technical ability and access. One avenue to asset managers is doing Broker Price Opinions. You may be called upon to do a BPO for another transaction, which is a good opportunity to break into the market. What is a REO listing? REO stands for real estate owned, also known as ba ...

New Hampshire Security Instrument for Bond

... PARTIES’ INTENT REGARDING MERGER. It is the intent of the parties hereto that (A) in the event that Lender or any of Lender’s successors, assigns or transferees obtains title to the Mortgaged Property pursuant to this Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or othe ...

... PARTIES’ INTENT REGARDING MERGER. It is the intent of the parties hereto that (A) in the event that Lender or any of Lender’s successors, assigns or transferees obtains title to the Mortgaged Property pursuant to this Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or othe ...

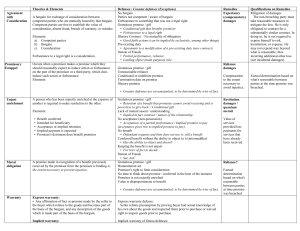

Contracts Grid – Hammond

... To charge any person upon any agreement authorizing or employing an agent or broker to purchase or sell real estate for compensation or commission To charge the estate of any deceased person upon any agreement which by its terms is not to be performed during the lifetime of the promisor • Counter de ...

... To charge any person upon any agreement authorizing or employing an agent or broker to purchase or sell real estate for compensation or commission To charge the estate of any deceased person upon any agreement which by its terms is not to be performed during the lifetime of the promisor • Counter de ...

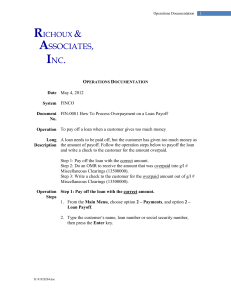

How To Process Overpayment on a Loan Payoff

... 3. Press the Enter key beside the Date: and Check Number: fields to accept the default or change if necessary. 4. Type the customer’s name in the Pay to: field and press the Enter key. 5. In the Acct # field type in g/l # for Miscellaneous Clearings (1350000) and press the Enter key. 6. In the Debit ...

... 3. Press the Enter key beside the Date: and Check Number: fields to accept the default or change if necessary. 4. Type the customer’s name in the Pay to: field and press the Enter key. 5. In the Acct # field type in g/l # for Miscellaneous Clearings (1350000) and press the Enter key. 6. In the Debit ...

THE RATIONALITY PROHIBITION OF RIBA

... Usury (henceforth called as riba) in fact has long been known and have been progressing in meaning. The study of riba was not only discussed seriously by Muslims but also other religions. If flashed back to more than two thousand years ago, the study of riba has been discussed by non-Muslims, such a ...

... Usury (henceforth called as riba) in fact has long been known and have been progressing in meaning. The study of riba was not only discussed seriously by Muslims but also other religions. If flashed back to more than two thousand years ago, the study of riba has been discussed by non-Muslims, such a ...

An Introduction To Interest Rate Hedging

... form of “derivative contract,” an agreement whose value varies depending on the value or amount of some underlying index, here an interest rate. In commercial real estate finance, the most common Hedge consists of a “rate cap.” When Borrower purchases a rate cap, the “issuer” of that rate cap, often ...

... form of “derivative contract,” an agreement whose value varies depending on the value or amount of some underlying index, here an interest rate. In commercial real estate finance, the most common Hedge consists of a “rate cap.” When Borrower purchases a rate cap, the “issuer” of that rate cap, often ...

Optional Language for Transactions with Index

... Corrections to Published Prices. If the Floating Price published, announced or made available on a given day and used or to be used to determine a relevant price is subsequently corrected by the relevant Price Source (i) within 30 days of the original publication, announcement or availability, or (i ...

... Corrections to Published Prices. If the Floating Price published, announced or made available on a given day and used or to be used to determine a relevant price is subsequently corrected by the relevant Price Source (i) within 30 days of the original publication, announcement or availability, or (i ...

LOMBE CHIBESAKUNDA v RAJAN LEKHRAJ MAHTANI (1998) S.J.

... difference between the contract price and the market or current price at the time the goods ought to have been delivered or at the time of the refusal to deliver. The rationale appears to have been based on the duty to mitigate whereby the buyer would be expected to go forthwith into the market and ...

... difference between the contract price and the market or current price at the time the goods ought to have been delivered or at the time of the refusal to deliver. The rationale appears to have been based on the duty to mitigate whereby the buyer would be expected to go forthwith into the market and ...

§ 58-58-23

... Misstatements of age or gender. – A provision that if the age or gender of any person upon whose life the contract is made has been misstated, the amount payable or benefits accruing under the contract shall be such as the stipulated payment or payments to the insurer would have been according to th ...

... Misstatements of age or gender. – A provision that if the age or gender of any person upon whose life the contract is made has been misstated, the amount payable or benefits accruing under the contract shall be such as the stipulated payment or payments to the insurer would have been according to th ...

Discharge of a guarantee

... Guarantees are complex instruments. Lawyers go to great efforts to ensure that the terms of a guarantee are watertight. Despite this, there are a number of circumstances which can result in the discharge of a guarantee. One particular minefield is dealings between the lender and the borrower during ...

... Guarantees are complex instruments. Lawyers go to great efforts to ensure that the terms of a guarantee are watertight. Despite this, there are a number of circumstances which can result in the discharge of a guarantee. One particular minefield is dealings between the lender and the borrower during ...

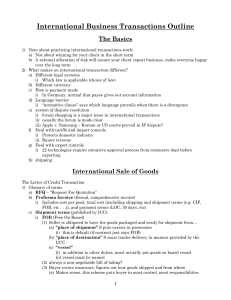

International Business Transactions-SBA

... (a) the occurrence of a contingency “the non-occurrence of which was a basic assumption on which the contract was made, OR (b) by compliance in good faith with any applicable foreign or domestic governmental regulation or order whether or not it later proves to be invalid. ii) Applies only to seller ...

... (a) the occurrence of a contingency “the non-occurrence of which was a basic assumption on which the contract was made, OR (b) by compliance in good faith with any applicable foreign or domestic governmental regulation or order whether or not it later proves to be invalid. ii) Applies only to seller ...