2016 Report on Corporate Governance and Ownership Structure

... capitalisation threshold; after 22 September 2008, it had been moved to the Standard segment. 1.2. Company Organisational Structure The management and control model adopted by the Company is the traditional one set forth in the Italian Civil Code, featuring the Board of Directors and the Board of St ...

... capitalisation threshold; after 22 September 2008, it had been moved to the Standard segment. 1.2. Company Organisational Structure The management and control model adopted by the Company is the traditional one set forth in the Italian Civil Code, featuring the Board of Directors and the Board of St ...

SCHEDULE 14A (RULE 14A-101) INFORMATION REQUIRED IN

... Inc., our advisor (Wells Capital), and Wells Management Company, Inc., our property manager (Wells Management), based upon recommendations from Wells Capital, and to set the terms and conditions of such options in accordance with the 2000 Employee Stock Option Plan. During the last fiscal year, the ...

... Inc., our advisor (Wells Capital), and Wells Management Company, Inc., our property manager (Wells Management), based upon recommendations from Wells Capital, and to set the terms and conditions of such options in accordance with the 2000 Employee Stock Option Plan. During the last fiscal year, the ...

The UK equity gap

... In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held across much of the science and technology sectors, and m ...

... In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held across much of the science and technology sectors, and m ...

collective investment schemes in emerging markets

... When promoters of investment schemes are allowed to solicit funds from the broad investing public for collective investment without a well-defined legal and regulatory framework, the risks are high of breach of the operators’ obligations toward investors. The risk is particularly high since CIS typi ...

... When promoters of investment schemes are allowed to solicit funds from the broad investing public for collective investment without a well-defined legal and regulatory framework, the risks are high of breach of the operators’ obligations toward investors. The risk is particularly high since CIS typi ...

Predicting Mutual Fund Performance: The Win

... Are there truly-talented mutual fund managers who consistently generate additional riskadjusted returns? If yes, how can we identify those managers? Avramov and Wermers (2006) find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutua ...

... Are there truly-talented mutual fund managers who consistently generate additional riskadjusted returns? If yes, how can we identify those managers? Avramov and Wermers (2006) find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutua ...

SRC review guide for general-purpose governments

... Explanation: Government-wide and fund financial statements must be presented using an all-inclusive format. That is, all changes to equity normally should be reported as part of the results of operations for the current period rather than treated as a direct adjustment to equity. There are three exc ...

... Explanation: Government-wide and fund financial statements must be presented using an all-inclusive format. That is, all changes to equity normally should be reported as part of the results of operations for the current period rather than treated as a direct adjustment to equity. There are three exc ...

UK Angola Investment Forum

... Investing Investment regulations Objectives of the investment law • Grow the economy in all provinces • Increase national productive capacity and efficiency • Promote partnerships with Angolans • Increase employment and capacity of Angolans • Increase exports and reduce imports • Rehabilitate, expa ...

... Investing Investment regulations Objectives of the investment law • Grow the economy in all provinces • Increase national productive capacity and efficiency • Promote partnerships with Angolans • Increase employment and capacity of Angolans • Increase exports and reduce imports • Rehabilitate, expa ...

Franklin Flexible Alpha Bond Fund Prospectus

... As co-lead portfolio managers, Messrs. Molumphy and Bayston are jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual sec ...

... As co-lead portfolio managers, Messrs. Molumphy and Bayston are jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual sec ...

Effects of Local Director Markets on Corporate Boards

... also has a positive effect on a firm’s proportion of independent directors with executive experience. Furthermore, firms located near major universities, law firms, technology firms, and financial institutions have higher percentages of independent directors with academic, legal, technological and ...

... also has a positive effect on a firm’s proportion of independent directors with executive experience. Furthermore, firms located near major universities, law firms, technology firms, and financial institutions have higher percentages of independent directors with academic, legal, technological and ...

LONG TERM PORTFOLIO - American Psychological Association

... These funds are institutional funds for purposes of Uniform Prudent Management of Institutional Funds Act of 2007, D.C. Code §§ 44-1631 through 44-1639, (“UPMIFA”). As APA does not manage endowment funds, compliance with UPMIFA is limited to only those provisions relevant to the prudent management o ...

... These funds are institutional funds for purposes of Uniform Prudent Management of Institutional Funds Act of 2007, D.C. Code §§ 44-1631 through 44-1639, (“UPMIFA”). As APA does not manage endowment funds, compliance with UPMIFA is limited to only those provisions relevant to the prudent management o ...

Venture Capita Report

... but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, meaning the companies were likely to be cash flow positive rather than e ...

... but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, meaning the companies were likely to be cash flow positive rather than e ...

PRIVATE EQUITY FOR THE COMMON MAN

... shown to exceed (often far exceed) fee structures on mutual funds, private equity funds, venture capital funds, and hedge funds Unlisted REITs offer high dividend yields and post share prices that do not vary over time, and as such are promoted as high-yielding fixed-income substitutes even though t ...

... shown to exceed (often far exceed) fee structures on mutual funds, private equity funds, venture capital funds, and hedge funds Unlisted REITs offer high dividend yields and post share prices that do not vary over time, and as such are promoted as high-yielding fixed-income substitutes even though t ...

Understanding the New Tennessee Small Business Investment

... While investments in risky new ventures are as old as commerce itself, the current venture capital landscape only dates back to 1946, with the formation of the American Research and Development Corporation as the first true venture capital firm.25 However, this innovation did not significantly chang ...

... While investments in risky new ventures are as old as commerce itself, the current venture capital landscape only dates back to 1946, with the formation of the American Research and Development Corporation as the first true venture capital firm.25 However, this innovation did not significantly chang ...

Investor Preferences and Demand for Active Management

... to the control of investor sentiment. While investor sentiment may lead to a strong demand for either the downside protection or upside potential at a particular point in time, our framework allows for the coexistence of the demands for both downside protection and upside seeking and can differenti ...

... to the control of investor sentiment. While investor sentiment may lead to a strong demand for either the downside protection or upside potential at a particular point in time, our framework allows for the coexistence of the demands for both downside protection and upside seeking and can differenti ...

Management Fee Evaluation

... any potential change in control of Janus Capital, the investment adviser to the Funds. These basic principles were communicated to Janus Capital on September 27, 2016, and were intended to be shared with Henderson. On October 3, 2016, Janus announced that it had entered into a definitive Agreement a ...

... any potential change in control of Janus Capital, the investment adviser to the Funds. These basic principles were communicated to Janus Capital on September 27, 2016, and were intended to be shared with Henderson. On October 3, 2016, Janus announced that it had entered into a definitive Agreement a ...

The Development of Collective Investment

... Unlike conventional companies that usually seek to make profits from producing goods and services; corporate CISs seek to give their shareholders good returns on their investments. The shareholders’ funds are used to invest in other assets usually financial assets to generate a return for the shareh ...

... Unlike conventional companies that usually seek to make profits from producing goods and services; corporate CISs seek to give their shareholders good returns on their investments. The shareholders’ funds are used to invest in other assets usually financial assets to generate a return for the shareh ...

The Effect of the Recent Financial Crisis on Defined

... De Jong et al. (2008) describe several objectives pension funds are faced with when determining their asset allocation. Firstly, the fund is interested in a good risk-return trade-off, similar to all other investors. Secondly, in contrast to traditional investors, a pension fund has specific long-te ...

... De Jong et al. (2008) describe several objectives pension funds are faced with when determining their asset allocation. Firstly, the fund is interested in a good risk-return trade-off, similar to all other investors. Secondly, in contrast to traditional investors, a pension fund has specific long-te ...

ELETROBRÁS -Centrais Elétricas Brasileiras S.A. – 135 MINUTES

... Article 3 – “caput” - ELETROBRÁS has its head offices in the Federal Capital and central office in the City of Rio de Janeiro - RJ, and shall operate directly or through its subsidiaries or companies to which it may become associated, and aiming to carrying out its corporate purpose, create offices ...

... Article 3 – “caput” - ELETROBRÁS has its head offices in the Federal Capital and central office in the City of Rio de Janeiro - RJ, and shall operate directly or through its subsidiaries or companies to which it may become associated, and aiming to carrying out its corporate purpose, create offices ...

Choosing Not to Choose - The Australia Institute

... Many employers do not need to choose a default superannuation fund because their workers are employed under awards or agreements that nominate a specific default fund. In fact, such default arrangements apply to most employers and most employees and the new national industrial relations system will ...

... Many employers do not need to choose a default superannuation fund because their workers are employed under awards or agreements that nominate a specific default fund. In fact, such default arrangements apply to most employers and most employees and the new national industrial relations system will ...

submission on the safety of superannuation

... with the objective of creating a pool of personal wealth sufficient to provide retirement incomes to individual contributors. As a result of the mandatory employer contribution requirements operating within Australia, it is appropriate that the Parliament and the Government establish a regulatory fr ...

... with the objective of creating a pool of personal wealth sufficient to provide retirement incomes to individual contributors. As a result of the mandatory employer contribution requirements operating within Australia, it is appropriate that the Parliament and the Government establish a regulatory fr ...

Institutional Investors and Corporate Behavior

... and well-researched views on corporate governance. Our findings suggest the desirability of reorienting academic inquiry toward three questions. First, does the perceived importance of corporate-governance “best practices” translate into improved corporate performance? Second, are institutional inve ...

... and well-researched views on corporate governance. Our findings suggest the desirability of reorienting academic inquiry toward three questions. First, does the perceived importance of corporate-governance “best practices” translate into improved corporate performance? Second, are institutional inve ...

UNCTAD`s Global Action Menu for Investment Facilitation

... Facilitating investment is crucial for the post-2015 development agenda, with developing countries facing an annual SDG-financing gap of $2.5 trillion. Facilitating investment is also one of the five areas of reform outlined in the UNCTAD Road Map. Investment promotion and facilitation work hand in ...

... Facilitating investment is crucial for the post-2015 development agenda, with developing countries facing an annual SDG-financing gap of $2.5 trillion. Facilitating investment is also one of the five areas of reform outlined in the UNCTAD Road Map. Investment promotion and facilitation work hand in ...

A Comparative Study of Venture Capital Performance in the US and

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...

Full Academic Article

... defendants), have sold shares during the class period (16 % of named defendants), or have been on the board for the entire class period. It’s also higher when the lead plaintiff is an institutional investor and when the lawsuit is filed under Sec. 11. Irrespective of litigation, shareholders can al ...

... defendants), have sold shares during the class period (16 % of named defendants), or have been on the board for the entire class period. It’s also higher when the lead plaintiff is an institutional investor and when the lawsuit is filed under Sec. 11. Irrespective of litigation, shareholders can al ...

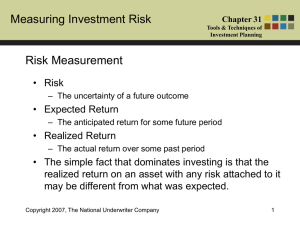

Chapter 31 Tools & Techniques of Investment Planning

... splitting one’s investment equally between the two securities completely eliminates all variability. • There is no risk reduction advantage to adding perfectly positively correlated assets to one’s portfolio. • In the real world, instances of either perfectly negatively correlated or perfectly posit ...

... splitting one’s investment equally between the two securities completely eliminates all variability. • There is no risk reduction advantage to adding perfectly positively correlated assets to one’s portfolio. • In the real world, instances of either perfectly negatively correlated or perfectly posit ...