Screening techniques, sustainability and risk adjusted returns.

... companies of the total 43 539 listed companies, you would have excluded 0,000643 %. This example of course does not tell the whole story since some markets may not be tradeable due to poor liquidity, political unrest or any other factors that may make the market undesirable from an investor's perspe ...

... companies of the total 43 539 listed companies, you would have excluded 0,000643 %. This example of course does not tell the whole story since some markets may not be tradeable due to poor liquidity, political unrest or any other factors that may make the market undesirable from an investor's perspe ...

THIS FILE GENERATED BY THE FUND LIBRARY. (c) The Fund

... potential bargains whether it be from insights into a particular country or a company. Short workMost investors don't understand the extent that some mutual fund managers use shorting strategies to capitalize when the markets are overvalued. Peter Cundill is a big shorter. In a March 20, 1996 memo t ...

... potential bargains whether it be from insights into a particular country or a company. Short workMost investors don't understand the extent that some mutual fund managers use shorting strategies to capitalize when the markets are overvalued. Peter Cundill is a big shorter. In a March 20, 1996 memo t ...

Promotion of unregulated collective investment schemes

... regime which must be addressed. Whilst the logic would indicate that the way to address it should be to address the poor advice and improve the quality of that advice to comply with FSA rules, the reaction seems to have been to remove the possibility altogether both for compliance and non compliant ...

... regime which must be addressed. Whilst the logic would indicate that the way to address it should be to address the poor advice and improve the quality of that advice to comply with FSA rules, the reaction seems to have been to remove the possibility altogether both for compliance and non compliant ...

Agency costs

... There is increasing empirical evidence on the differences in corporate governance among countries. In a series of influential papers La Porta et al. (1997,1998,1999,2002) have argued that the extent of legal protection of outside investors from expropriation of outsider shareholders or managers, is ...

... There is increasing empirical evidence on the differences in corporate governance among countries. In a series of influential papers La Porta et al. (1997,1998,1999,2002) have argued that the extent of legal protection of outside investors from expropriation of outsider shareholders or managers, is ...

ETF - iOCBC

... particular needs before making a commitment to trade or purchase the investment product. You should consider carefully and exercise caution in making any trading decision whether or not you have received advice from any financial adviser. If you choose not to seek independent financial advice, pleas ...

... particular needs before making a commitment to trade or purchase the investment product. You should consider carefully and exercise caution in making any trading decision whether or not you have received advice from any financial adviser. If you choose not to seek independent financial advice, pleas ...

Nuveen Build America Bond Fund

... portfolio of taxable municipal securities known as “Build America Bonds” (or “BABs”), as described further in this prospectus. The Fund believes there could be an opportunity to capitalize on the developing market for BABs by investing in taxable municipal issues at attractive market yields relative ...

... portfolio of taxable municipal securities known as “Build America Bonds” (or “BABs”), as described further in this prospectus. The Fund believes there could be an opportunity to capitalize on the developing market for BABs by investing in taxable municipal issues at attractive market yields relative ...

KIM - Birla Sun Life Fixed Term Plan

... existing folio number as provided would apply to the said investment and the registered details would prevail over any conflicting information furnished in this form. The AMC reserves the right to assign any of the existing Folio Number of the investor against multiple applications and / or subseque ...

... existing folio number as provided would apply to the said investment and the registered details would prevail over any conflicting information furnished in this form. The AMC reserves the right to assign any of the existing Folio Number of the investor against multiple applications and / or subseque ...

A CLEAR AND SIMPLE

... and their prices fluctuate based on a number of factors including the company’s potential profitability. As a result, they tend to be too volatile for short-term investors. However, it’s widely accepted that equities have the potential for better returns over medium and longer terms. It’s also worth ...

... and their prices fluctuate based on a number of factors including the company’s potential profitability. As a result, they tend to be too volatile for short-term investors. However, it’s widely accepted that equities have the potential for better returns over medium and longer terms. It’s also worth ...

Investment consultants` recommendations of fund managers

... substantial influence on the investment allocation decisions of plan sponsors?); and, third, whether these recommendations predict a fund’s performance. The funds that are rated by investment consultants are products aimed at institutional, rather than retail, investors. Clearly, a large literature ...

... substantial influence on the investment allocation decisions of plan sponsors?); and, third, whether these recommendations predict a fund’s performance. The funds that are rated by investment consultants are products aimed at institutional, rather than retail, investors. Clearly, a large literature ...

Does Corporate Governance Predict Firms` Market

... that voluntary choose 50% outside boards and for large firms, which are required by law to have 50% outside directors, so it cannot be explained by endogenous firm choice. highly policy-relevant. ...

... that voluntary choose 50% outside boards and for large firms, which are required by law to have 50% outside directors, so it cannot be explained by endogenous firm choice. highly policy-relevant. ...

managed futures and hedge funds: a match made in

... of their portfolio without, under the assumptions made, giving up much in terms of expected return. ...

... of their portfolio without, under the assumptions made, giving up much in terms of expected return. ...

How Do Private Equity Investments Perform Compared to Public

... those to public equity. We focus on Kaplan and Schoar’s (2005) PME, which directly compares an investment in a PE fund to an equivalently-timed investment in the relevant public market. The PME calculation discounts (or invests) all cash distributions and residual value to the fund at the public mar ...

... those to public equity. We focus on Kaplan and Schoar’s (2005) PME, which directly compares an investment in a PE fund to an equivalently-timed investment in the relevant public market. The PME calculation discounts (or invests) all cash distributions and residual value to the fund at the public mar ...

Living Annuity 3.4MB

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

Deutsche AM Flagship Fund Reporting

... First digit = Total Return; second digit = Consistent Return; third digit = Preservation; fourth digit = Expense ...

... First digit = Total Return; second digit = Consistent Return; third digit = Preservation; fourth digit = Expense ...

NBER WORKING PAPER SERIES MUTUAL FUND PERFORMANCE WITH LEARNING ACROSS FUNDS

... As with any joint distribution, one can talk about the prior for one set of (true) fund alphas conditional on the alphas for other funds. Though BMW and PS model priors in different ways, a common feature is that the prior belief about a given fund’s alpha is taken to be independent of the prior for ...

... As with any joint distribution, one can talk about the prior for one set of (true) fund alphas conditional on the alphas for other funds. Though BMW and PS model priors in different ways, a common feature is that the prior belief about a given fund’s alpha is taken to be independent of the prior for ...

Systemic Risk and Hedge Funds

... The term “systemic risk” is commonly used to describe the possibility of a series of correlated defaults among financial institutions—typically banks—that occurs over a short period of time, often caused by a single major event. A classic example is a banking panic in which large groups of depositor ...

... The term “systemic risk” is commonly used to describe the possibility of a series of correlated defaults among financial institutions—typically banks—that occurs over a short period of time, often caused by a single major event. A classic example is a banking panic in which large groups of depositor ...

Forthcoming, Journal of Empirical Finance Measuring The Market

... Lastly, we added funds based on private sources. ...

... Lastly, we added funds based on private sources. ...

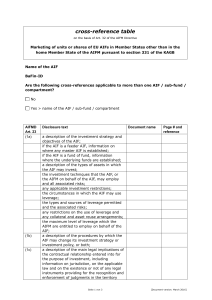

cross-reference table on the basis of Art. 32 of the AIFM Directive

... where the AIF is established; the identity of the AIFM, the AIF’s depositary, auditor and any other service providers and a description of their duties and the investors’ rights; a description of how the AIFM complies with the requirements of Article 9 (7); a description of: any delegated management ...

... where the AIF is established; the identity of the AIFM, the AIF’s depositary, auditor and any other service providers and a description of their duties and the investors’ rights; a description of how the AIFM complies with the requirements of Article 9 (7); a description of: any delegated management ...

Direct Investing in Private Equity

... groups to invest with (Lerner, et al., 2007; Hochberg and Rauh, 2011). In this context, the interest on the part of institutional investors in undertaking direct investments—and thus bypassing intermediaries—calls for a detailed evaluation. Towards this end, we compile a proprietary dataset of direc ...

... groups to invest with (Lerner, et al., 2007; Hochberg and Rauh, 2011). In this context, the interest on the part of institutional investors in undertaking direct investments—and thus bypassing intermediaries—calls for a detailed evaluation. Towards this end, we compile a proprietary dataset of direc ...

The Relation Between University Endowment Fund Size and

... that there are a few main reasons why alumni donate. These qualities include if the alumni collegiate experience was excellent and alumni wealth levels. Donations per alumni are lower in public institutions compared to private institutions. This is because a larger proportion of wealthier individual ...

... that there are a few main reasons why alumni donate. These qualities include if the alumni collegiate experience was excellent and alumni wealth levels. Donations per alumni are lower in public institutions compared to private institutions. This is because a larger proportion of wealthier individual ...

report on corporate governance and on the ownership structure

... ACEA – report on corporate governance and on the ownership structure – financial year 2016 With regard to takeovers, the Company's Articles of Association do not waive the provisions of art. 104, paragraphs 1 and 1-bis, of the CFA, nor are neutralisation rules, as contemplated by art. 104-bis of th ...

... ACEA – report on corporate governance and on the ownership structure – financial year 2016 With regard to takeovers, the Company's Articles of Association do not waive the provisions of art. 104, paragraphs 1 and 1-bis, of the CFA, nor are neutralisation rules, as contemplated by art. 104-bis of th ...

Balanced Income Portfolio Interim Management Report of Fund

... make an investment in the securities of an issuer for which CIBC WM, CIBC World Markets Corp., or any affiliate of CIBC (a Related Dealer) acts as an underwriter during the offering of such securities at any time during the 60-day period following the completion of the offering of the securities (in ...

... make an investment in the securities of an issuer for which CIBC WM, CIBC World Markets Corp., or any affiliate of CIBC (a Related Dealer) acts as an underwriter during the offering of such securities at any time during the 60-day period following the completion of the offering of the securities (in ...

aon corporation - cloudfront.net

... ended December 31, 1995, including financial statements, is being mailed to stockholders, together with this Proxy Statement, beginning on or about March 9, 1996. No part of such Annual Report shall be regarded as proxy-soliciting material or as a communication by means of which any solicitation is ...

... ended December 31, 1995, including financial statements, is being mailed to stockholders, together with this Proxy Statement, beginning on or about March 9, 1996. No part of such Annual Report shall be regarded as proxy-soliciting material or as a communication by means of which any solicitation is ...

1 EVALUATING THE SHAREHOLDER PRIMACY THEORY

... company. The interests of the company are usually regarded by courts as those of the company’s shareholders.13 However, recent Australian government inquiries have confirmed the legal competence of directors to adopt a broader set of interests in pursuing corporate strategy.14 Directors are, under ...

... company. The interests of the company are usually regarded by courts as those of the company’s shareholders.13 However, recent Australian government inquiries have confirmed the legal competence of directors to adopt a broader set of interests in pursuing corporate strategy.14 Directors are, under ...

An Overview of Fee Structures in Real Estate Funds and Their

... Clearly, extensions can be easily drawn to fees based on cash flow or rental income. Furthermore, extensions can be made to other methodologies (e.g., commitment, drawn commitment, invested equity, etc.) however, the assumptions (e.g., the rate at which committed capital is drawn) may become more te ...

... Clearly, extensions can be easily drawn to fees based on cash flow or rental income. Furthermore, extensions can be made to other methodologies (e.g., commitment, drawn commitment, invested equity, etc.) however, the assumptions (e.g., the rate at which committed capital is drawn) may become more te ...