Annual Report - John Hancock Investments

... with maturities of 1 to 5 years; Barclays U.S. Aggregate Bond Index—tracks investment-grade corporate and government bonds; Citigroup 3-Month Treasury Bill Index—tracks short-term U.S. government debt instruments; Morningstar Financial—tracks funds that invest primarily in equity securities of finan ...

... with maturities of 1 to 5 years; Barclays U.S. Aggregate Bond Index—tracks investment-grade corporate and government bonds; Citigroup 3-Month Treasury Bill Index—tracks short-term U.S. government debt instruments; Morningstar Financial—tracks funds that invest primarily in equity securities of finan ...

STRATEGIC MANAGEMENT

... and allowing firms to implement strategies with some degree of risk is difficult ©2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a passw ...

... and allowing firms to implement strategies with some degree of risk is difficult ©2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a passw ...

Cornerstone Investor

... Price of HK$13.98, the mid-point of the estimated Offer Price range set forth in this prospectus, the total number of Shares to be subscribed for by the Cornerstone Investor would be 27,753,750 Shares, representing approximately 1.9% of our issued and outstanding share capital after the Global Offer ...

... Price of HK$13.98, the mid-point of the estimated Offer Price range set forth in this prospectus, the total number of Shares to be subscribed for by the Cornerstone Investor would be 27,753,750 Shares, representing approximately 1.9% of our issued and outstanding share capital after the Global Offer ...

Singapore Pilot paper (SGP)

... proposed acquisition develops. Exchange rate risks apply to any business dealing with revenue or capital flows between two or more currency zones. The case explicitly describes Chemco and JPX existing in different regions of the world. Whilst exchange rate volatility can undermine confidence in cash ...

... proposed acquisition develops. Exchange rate risks apply to any business dealing with revenue or capital flows between two or more currency zones. The case explicitly describes Chemco and JPX existing in different regions of the world. Whilst exchange rate volatility can undermine confidence in cash ...

DHFL Pramerica Dual Advantage Fund Series 1 to 3

... of these instances are: (i) coupon inflow; (ii) the instrument is called or bought back by the issuer (iii) in anticipation of any adverse credit event etc. In case of such deviations, the Scheme may invest in Bank CDs having highest ratings (i.e. A1+ or equivalent) / CBLOs / T-Bills. Deviation, if ...

... of these instances are: (i) coupon inflow; (ii) the instrument is called or bought back by the issuer (iii) in anticipation of any adverse credit event etc. In case of such deviations, the Scheme may invest in Bank CDs having highest ratings (i.e. A1+ or equivalent) / CBLOs / T-Bills. Deviation, if ...

THE IMPACT OF MINIMUM INVESTMENT BARRIERS ON SHORT END OF PERFORMANCE?

... known for conservative investment mandates, such as pension plans, have been investing heavily in the hedge fund industry. This has paved the way for further institutional capital flow into the industry as hedge funds are increasingly being viewed as mainstream and acceptable choices. Four, retail ...

... known for conservative investment mandates, such as pension plans, have been investing heavily in the hedge fund industry. This has paved the way for further institutional capital flow into the industry as hedge funds are increasingly being viewed as mainstream and acceptable choices. Four, retail ...

Vanguard Fixed Income Securities Funds Statement of Additional

... Restrictions on Holding or Disposing of Shares. There are no restrictions on the right of shareholders to retain or dispose of a Fund’s shares, other than those described in the Fund’s current prospectus and elsewhere in this Statement of Additional Information. Each Fund or class may be terminated ...

... Restrictions on Holding or Disposing of Shares. There are no restrictions on the right of shareholders to retain or dispose of a Fund’s shares, other than those described in the Fund’s current prospectus and elsewhere in this Statement of Additional Information. Each Fund or class may be terminated ...

Commonalities and Prescriptions in the Vertical Dimension of Global

... for the benefit of shareholders. On the other hand, corporations in Germany and other continental European countries are thought to operate for the common good-for the benefit of the shareholders, workers, creditors, and communities. At an abstract level, both generalizations are correct. Commentato ...

... for the benefit of shareholders. On the other hand, corporations in Germany and other continental European countries are thought to operate for the common good-for the benefit of the shareholders, workers, creditors, and communities. At an abstract level, both generalizations are correct. Commentato ...

EXECUTIVE REMUNERATION AND FIRM PERFORMANCE

... Director or Chair. The relationship between pay and TFP change is generally weak for all three measures of executive remuneration. A strong relationship between size and the executive remuneration measures is found, particularly for the Director. Although there is evidence of pay being used as a gov ...

... Director or Chair. The relationship between pay and TFP change is generally weak for all three measures of executive remuneration. A strong relationship between size and the executive remuneration measures is found, particularly for the Director. Although there is evidence of pay being used as a gov ...

the law of turkmenistan on investment activities in

... religious organizations, other juridical persons in the priority sectors of the economy, as well as for involving them in participation in state investment activities including implementation of special state complex programs by means of the issue and sale of shares, attraction of sharing payments a ...

... religious organizations, other juridical persons in the priority sectors of the economy, as well as for involving them in participation in state investment activities including implementation of special state complex programs by means of the issue and sale of shares, attraction of sharing payments a ...

Directive on Alternative Investment Fund Managers

... industry, but important operators in the mainstream financial market. We recognise that the aggregate activity of hedge funds could cause risk to financial stability, and so welcome the aspects of the Directive that attempt to reduce risk posed by fund managers. We think that coordinated regulation ...

... industry, but important operators in the mainstream financial market. We recognise that the aggregate activity of hedge funds could cause risk to financial stability, and so welcome the aspects of the Directive that attempt to reduce risk posed by fund managers. We think that coordinated regulation ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth funds are able to capture a wider range of return drivers and access more investment opportunities perhaps not available to their li ...

... of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth funds are able to capture a wider range of return drivers and access more investment opportunities perhaps not available to their li ...

Heartland Group, Inc.

... FORM N-Q QUARTERLY SCEHDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act File number: 811-04982 ...

... FORM N-Q QUARTERLY SCEHDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act File number: 811-04982 ...

A lifecycle investment solution

... is to say all members in the fund have the same asset mix regardless of their age, risk appetite or proximity to retirement. A traditional balanced fund will typically hold approximately 70% in growth assets and 30% in defensive assets, and this split will not change over the life of the fund. The i ...

... is to say all members in the fund have the same asset mix regardless of their age, risk appetite or proximity to retirement. A traditional balanced fund will typically hold approximately 70% in growth assets and 30% in defensive assets, and this split will not change over the life of the fund. The i ...

Proxy Advisory Business: Apotheosis or Apogee?

... The proxy advisory firms are a critical part of the process of establishing corporate governance best practices and standards within the corporate governance community. Their adoption of new “best” practices as part of their voting policies validates the practice as being truly “best,” and gives the ...

... The proxy advisory firms are a critical part of the process of establishing corporate governance best practices and standards within the corporate governance community. Their adoption of new “best” practices as part of their voting policies validates the practice as being truly “best,” and gives the ...

Investor Preferences and Demand for Active Management

... to investors because fund managers generate abnormal returns that covary positively with a component of the pricing kernel. Pastor and Stambaugh (2012) propose a model without time-varying managerial skill but with decreasing returns to scale. The large size of the active fund industry can be ration ...

... to investors because fund managers generate abnormal returns that covary positively with a component of the pricing kernel. Pastor and Stambaugh (2012) propose a model without time-varying managerial skill but with decreasing returns to scale. The large size of the active fund industry can be ration ...

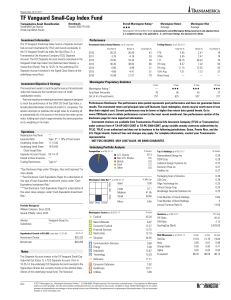

TF Vanguard Small-Cap Index Fund

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

Does pension funds` fiduciary duty prohibit the integration of

... hypothetical pension fund portfolios with five different degrees of responsibility in five different corporate environmental responsibility criteria (one aggregated measure and four disaggregated measures). It appears very reliably, as our econometric analysis explains between 89% and 98% of any pe ...

... hypothetical pension fund portfolios with five different degrees of responsibility in five different corporate environmental responsibility criteria (one aggregated measure and four disaggregated measures). It appears very reliably, as our econometric analysis explains between 89% and 98% of any pe ...

February 26, 2013 VIA ELECTRONIC MAIL Mr. Gary Barnett

... reports prepared by the FOF Manager or its agent, such as an administrator).13 Required disclosures also are designed to ensure that FOF investors understand that the Underlying Funds and the allocations to them will change over time. Fundamentally, FOF investors want the FOF Manager to use its expe ...

... reports prepared by the FOF Manager or its agent, such as an administrator).13 Required disclosures also are designed to ensure that FOF investors understand that the Underlying Funds and the allocations to them will change over time. Fundamentally, FOF investors want the FOF Manager to use its expe ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... Wells Real Estate Investment Trust, Inc. (the "Company") is a Maryland corporation formed on July 3, 1997. The Company is the sole general partner of Wells Operating Partnership, L.P. ("Wells OP"), a Delaware limited partnership organized for the purpose of acquiring, developing, owning, operating, ...

... Wells Real Estate Investment Trust, Inc. (the "Company") is a Maryland corporation formed on July 3, 1997. The Company is the sole general partner of Wells Operating Partnership, L.P. ("Wells OP"), a Delaware limited partnership organized for the purpose of acquiring, developing, owning, operating, ...

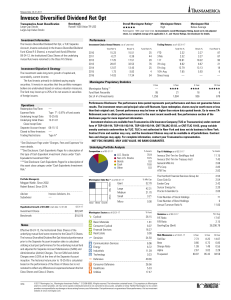

Invesco Diversified Dividend Ret Opt

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

Fidelity Retirement Master Trust

... Master Trust does not guarantee the repayment of capital. n Fidelity SaveEasy Funds are not savings deposits and involve investment risks and this product may not be suitable for everyone. Investors should also consider factors other than age and review their own investment objectives. n You shoul ...

... Master Trust does not guarantee the repayment of capital. n Fidelity SaveEasy Funds are not savings deposits and involve investment risks and this product may not be suitable for everyone. Investors should also consider factors other than age and review their own investment objectives. n You shoul ...

LLB Fund Overview - Quarterly Report 1 / 2017

... Dr. Thomas Mächtel Head of Business Management LLB Asset Management AG ...

... Dr. Thomas Mächtel Head of Business Management LLB Asset Management AG ...

#32842_30_Mutual Fund Regulation_P1 1..72

... has contributed to the popularity of money market funds as a tool for cash management and, in the view of the SEC, has encouraged many investors to “view investments in money funds as an alternative to either bank deposits or checking accounts.”8 Accordingly, the policy goal of the SEC in regulating ...

... has contributed to the popularity of money market funds as a tool for cash management and, in the view of the SEC, has encouraged many investors to “view investments in money funds as an alternative to either bank deposits or checking accounts.”8 Accordingly, the policy goal of the SEC in regulating ...

The Relationship with Other Treaty Standards

... operation of a hazardous industrial waste landfill in Mexico. The Mexican authorities refused, by way of an administrative resolution, an application for renewal of the required operating licence two years after the claimant’s investment. As part of its expropriation claim, the claimant argued that ...

... operation of a hazardous industrial waste landfill in Mexico. The Mexican authorities refused, by way of an administrative resolution, an application for renewal of the required operating licence two years after the claimant’s investment. As part of its expropriation claim, the claimant argued that ...