March 2017 Dear All, Please find below a rundown of recent

... https://www.fnlondon.com/articles/state-street-to-vote-against-companies-that-lack-female-directors20170307. “Funds giant State Street Global Advisors is embarking on a push to get large firms to put more women on their boards by voting against directors if they fail to make female appointments, The ...

... https://www.fnlondon.com/articles/state-street-to-vote-against-companies-that-lack-female-directors20170307. “Funds giant State Street Global Advisors is embarking on a push to get large firms to put more women on their boards by voting against directors if they fail to make female appointments, The ...

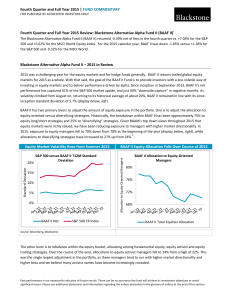

Fourth Quarter and Full Year 2015

... Performance data quoted represents past performance and is no guarantee of future results. Investment results will fluctuate so that an investor’s shares, if repurchased in a tender offer, may be worth more or less than original cost. Current performance may be higher or lower than performance data ...

... Performance data quoted represents past performance and is no guarantee of future results. Investment results will fluctuate so that an investor’s shares, if repurchased in a tender offer, may be worth more or less than original cost. Current performance may be higher or lower than performance data ...

Wilson Kattelus

... To account for special assessments when only the benefited taxpayers, and not the government, are obligated to pay interest and principal on the special assessment debt The government must not have indicated in any way its intent to be responsible for the debt The government is simply acting as an a ...

... To account for special assessments when only the benefited taxpayers, and not the government, are obligated to pay interest and principal on the special assessment debt The government must not have indicated in any way its intent to be responsible for the debt The government is simply acting as an a ...

Selling an Idea or a Product

... Ethics in Investment Management Violators of regulations set by the Security and Exchange Commission(SEC) or the national Association of Securities Dealers(NASD) can: • Be stripped of the right to transact business on any exchange. • Be required to compensate the client for monetary damages • Be re ...

... Ethics in Investment Management Violators of regulations set by the Security and Exchange Commission(SEC) or the national Association of Securities Dealers(NASD) can: • Be stripped of the right to transact business on any exchange. • Be required to compensate the client for monetary damages • Be re ...

Glossary - Salvus Master Trust

... most risky type of investment as their value tends to go up and down more than other investment types, in some cases quite dramatically. However, shares are widely considered to offer the greatest potential for returns. Due to the potential for significant gains or losses in value, shares are better ...

... most risky type of investment as their value tends to go up and down more than other investment types, in some cases quite dramatically. However, shares are widely considered to offer the greatest potential for returns. Due to the potential for significant gains or losses in value, shares are better ...

T t l d p t t - The University of Chicago Booth School of Business

... Consider the case of a two-year-old fund that, by the end of September of year t, has fallen 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will ...

... Consider the case of a two-year-old fund that, by the end of September of year t, has fallen 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will ...

Specific Investment Policy and Procedures – Restricted and

... benchmarking tools using the environment, social and governance categories. All reporting for that fiscal year will measure portfolio performance against the established target return. 4.01 SJU Risk Tolerance The Fund portfolios have a balanced mandate focused on generating income with some growth p ...

... benchmarking tools using the environment, social and governance categories. All reporting for that fiscal year will measure portfolio performance against the established target return. 4.01 SJU Risk Tolerance The Fund portfolios have a balanced mandate focused on generating income with some growth p ...

The role of hedge funds (II)

... There are good reasons to doubt the regulated counterparties' ability to impose market discipline on hedge funds, especially when hedge funds have become an important source of their revenue. Fierce competition for prime brokerage business is likely to put pressure on these institutions to compromis ...

... There are good reasons to doubt the regulated counterparties' ability to impose market discipline on hedge funds, especially when hedge funds have become an important source of their revenue. Fierce competition for prime brokerage business is likely to put pressure on these institutions to compromis ...

Asian High Yield Outlook

... This information is for Investment Professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only dir ...

... This information is for Investment Professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only dir ...

A Switch Criterion for Defined Contribution Pension Schemes

... into bonds (in order to limit the risk), but considers also actual returns from the financial market through a dynamic criterion for the second and definitive switch • numerical results are good in comparison with other investment strategies for DC schemes • it considers both the accumulation and th ...

... into bonds (in order to limit the risk), but considers also actual returns from the financial market through a dynamic criterion for the second and definitive switch • numerical results are good in comparison with other investment strategies for DC schemes • it considers both the accumulation and th ...

Navigating 5 years of emerging market corporate debt

... For more information please visit aberdeen-asset.com Other important information Aberdeen Global is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organized as a Société d’Invetissement á Capital Variable (a “SICAV”). The information contained in this marketing document is ...

... For more information please visit aberdeen-asset.com Other important information Aberdeen Global is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organized as a Société d’Invetissement á Capital Variable (a “SICAV”). The information contained in this marketing document is ...

Goldman Sachs Funds: Questions and Answers on Market Timing

... According to media reports, these are industry-wide inquiries, and in the case of the Securities and Exchange Commission informational requests have reportedly been made broadly across all of the major fund companies and broker/dealers. Goldman Sachs has received requests for information and we have ...

... According to media reports, these are industry-wide inquiries, and in the case of the Securities and Exchange Commission informational requests have reportedly been made broadly across all of the major fund companies and broker/dealers. Goldman Sachs has received requests for information and we have ...

Eikon Private Equity PDF

... • Mergers & Acquisitions: Over 1,100,000 global M&A transactions from the 1970s to present, including 350,000+ US-target and 750,000+ non-US-target transactions • Debt Capital Markets: Over 900,000 bond deals since the 1960s, including investment-grade, high-yield, and emerging market corporate bond ...

... • Mergers & Acquisitions: Over 1,100,000 global M&A transactions from the 1970s to present, including 350,000+ US-target and 750,000+ non-US-target transactions • Debt Capital Markets: Over 900,000 bond deals since the 1960s, including investment-grade, high-yield, and emerging market corporate bond ...

Group investment fund return

... Add Boxes 8 and 9. Print your answer in Box 13. This amount should be included in the fund’s income tax return. ...

... Add Boxes 8 and 9. Print your answer in Box 13. This amount should be included in the fund’s income tax return. ...

- Franklin Templeton Investments

... company continued to pursue several products addressing large therapeutic areas of unmet need. ...

... company continued to pursue several products addressing large therapeutic areas of unmet need. ...

fund facts - CI Investments

... CI Preferred Pricing offers separate classes of securities that charge progressively lower combined management and administration fees compared to Class FT8 securities. Under CI Preferred Pricing, if you purchase Class FT8 securities, we will automatically switch your Class FT8 securities into the m ...

... CI Preferred Pricing offers separate classes of securities that charge progressively lower combined management and administration fees compared to Class FT8 securities. Under CI Preferred Pricing, if you purchase Class FT8 securities, we will automatically switch your Class FT8 securities into the m ...

Corporate Superannuation Association

... has to be funded and this is done to a large extent by fund levies. Our organisation has repeatedly raised issues, in submissions to Treasury on levy methodologies, regarding the equity of the distribution of these levies (which, through “capping”, place a disproportionately high burden on medium si ...

... has to be funded and this is done to a large extent by fund levies. Our organisation has repeatedly raised issues, in submissions to Treasury on levy methodologies, regarding the equity of the distribution of these levies (which, through “capping”, place a disproportionately high burden on medium si ...

To: Clients and Friends June 30, 2004 The articles below contain

... Regulatory Services shows an increase in the registration with the SEC by hedge fund advisers. The survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers ...

... Regulatory Services shows an increase in the registration with the SEC by hedge fund advisers. The survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers ...

RCF presentation

... Property developers and construction companies lack access to sufficient financing to absorb their substantial project flow. Newly developed commercial and residential space is pre-sold prior to completion. Most owners of significant property portfolios has historically focused on sourcing asset ...

... Property developers and construction companies lack access to sufficient financing to absorb their substantial project flow. Newly developed commercial and residential space is pre-sold prior to completion. Most owners of significant property portfolios has historically focused on sourcing asset ...

Shan Yan - Eli Broad College of Business

... Bank Debt, Flexibility, and the Use of Proceeds from Asset Sales (with Ted Fee, Joshua Pierce, Hoontaek Seo) Abstract: In the theory of financial intermediation, bank debt is often characterized as being more readily renegotiable than public debt. Banks are also conjectured to gain valuable non-pub ...

... Bank Debt, Flexibility, and the Use of Proceeds from Asset Sales (with Ted Fee, Joshua Pierce, Hoontaek Seo) Abstract: In the theory of financial intermediation, bank debt is often characterized as being more readily renegotiable than public debt. Banks are also conjectured to gain valuable non-pub ...

Investment Trusts Schroder Income Growth Fund plc

... This factsheet should not be taken as any indication the company held any particular investments at any particular date other than the stated date. Nothing in this factsheet should be construed as advice and is therefore not a recommendation to buy or sell shares. If you are interested in this fund ...

... This factsheet should not be taken as any indication the company held any particular investments at any particular date other than the stated date. Nothing in this factsheet should be construed as advice and is therefore not a recommendation to buy or sell shares. If you are interested in this fund ...

Stable Value: Not all funds are created equal

... longer duration than other funds, which can lead to longer discontinuance provisions for these funds. When examining fees, you may find management fees, wrap contract fees, trustee fees, and various other fees. Calculating fees can be somewhat challenging because each fund breaks out their fees diff ...

... longer duration than other funds, which can lead to longer discontinuance provisions for these funds. When examining fees, you may find management fees, wrap contract fees, trustee fees, and various other fees. Calculating fees can be somewhat challenging because each fund breaks out their fees diff ...

“Lost” Decade 2000 – 2009

... they approach the target date. Different funds will have varying degrees of exposure to equities as they approach and pass the target date. As such, the fund’s objectives and investment strategies may change over time. The target date is the approximate date when investors plan to start withdrawing ...

... they approach the target date. Different funds will have varying degrees of exposure to equities as they approach and pass the target date. As such, the fund’s objectives and investment strategies may change over time. The target date is the approximate date when investors plan to start withdrawing ...

Vanguard High Growth Index Fund

... mainly in growth assets, and is designed for investors with a high tolerance for risk who are seeking long-term capital growth. The Fund targets a 10% allocation to income asset classes and a 90% allocation to growth asset ...

... mainly in growth assets, and is designed for investors with a high tolerance for risk who are seeking long-term capital growth. The Fund targets a 10% allocation to income asset classes and a 90% allocation to growth asset ...