objective straightforward communications generating potential

... Write Income is solely focused on generating yield through dividends and derivatives strategies with a focus on seeking to generate a high single-digit yield. This strategy is comprised of firms that have sustainable business models, attractive balance sheets and strong cash flow generation with a h ...

... Write Income is solely focused on generating yield through dividends and derivatives strategies with a focus on seeking to generate a high single-digit yield. This strategy is comprised of firms that have sustainable business models, attractive balance sheets and strong cash flow generation with a h ...

Guidelines for Transfers of Registered Plans

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

Financial Accounting and Accounting Standards

... Focus reports assets held in a trustee or agency capacity for others. ...

... Focus reports assets held in a trustee or agency capacity for others. ...

Is it Overreaction? The Long-Horizon Performance of Value and

... Focus on NASDAQ stocks above the 80th P/S percentile ...

... Focus on NASDAQ stocks above the 80th P/S percentile ...

Finding Opportunities — Tackling today`s uncertain

... prolonged period of low-and-slow growth combined with heightened uncertainty. Therefore, most companies have stayed on the defensive, keeping costs down and staying clear of the risks associated with expansion. Consequently, opportunities to fuel the growth component of investment portfolios are in ...

... prolonged period of low-and-slow growth combined with heightened uncertainty. Therefore, most companies have stayed on the defensive, keeping costs down and staying clear of the risks associated with expansion. Consequently, opportunities to fuel the growth component of investment portfolios are in ...

University of Louisville Endowment Fund Statement of Investment

... Recommend to the Board of Directors investment goals, objectives, performance measurement standards and portfolio guidelines that are consistent with the Foundation’s needs. Recommend to the Board of Directors an asset allocation strategy and investment manager structure designed to meet the Foundat ...

... Recommend to the Board of Directors investment goals, objectives, performance measurement standards and portfolio guidelines that are consistent with the Foundation’s needs. Recommend to the Board of Directors an asset allocation strategy and investment manager structure designed to meet the Foundat ...

Private Equity Funds in Namibia: Venturing Forth

... • Clear exit strategies • Captive vs independent funds • Fees and “carry” ...

... • Clear exit strategies • Captive vs independent funds • Fees and “carry” ...

please click here

... beneficiary nomination and pay the entire benefit of approx $1 million to Linda. 6. Daniel challenged the appointment of Linda and Peter as trustees of the fund. 7. The court held that both Linda and Peter were validly appointed ...

... beneficiary nomination and pay the entire benefit of approx $1 million to Linda. 6. Daniel challenged the appointment of Linda and Peter as trustees of the fund. 7. The court held that both Linda and Peter were validly appointed ...

Due Diligence - Risk Profiling Tool

... within the funds and within the most appropriate tax wrapper. Our on-going proposition is confirmed in our On-going Services and Proposition document. The breakdown of our service costs are detailed within this and are agreed with the client when the transaction is arranged. We constantly review all ...

... within the funds and within the most appropriate tax wrapper. Our on-going proposition is confirmed in our On-going Services and Proposition document. The breakdown of our service costs are detailed within this and are agreed with the client when the transaction is arranged. We constantly review all ...

FINDING RELATIVE VALUE OPPORTUNITIES IN FIXED INCOME

... yields decline to even more negative nominal rates and therefore they could make a capital gain by selling this investment to someone else at a higher price; otherwise known as the “greater fool” theory. ...

... yields decline to even more negative nominal rates and therefore they could make a capital gain by selling this investment to someone else at a higher price; otherwise known as the “greater fool” theory. ...

Thailand - Green Climate Fund

... Thailand is highly vulnerable to climate change impacts such as reduction in agriculture and food production and reduced fresh water availability. It is also at risk from climate change hazards such as droughts, floods, sea level rise and vector-borne diseases. Maplecroft Climate Change Vulnerabilit ...

... Thailand is highly vulnerable to climate change impacts such as reduction in agriculture and food production and reduced fresh water availability. It is also at risk from climate change hazards such as droughts, floods, sea level rise and vector-borne diseases. Maplecroft Climate Change Vulnerabilit ...

Investment Philosophy - St. Croix Valley Foundation

... the total long-term portfolio, with a targeted average of 45%. International Equities will represent 5% to 15% of the market value of the total long-term portfolio, with a targeted average of 10%. Equities authorized for purchase include common and preferred stocks, warrants, ADR, REITS, MLPs, and c ...

... the total long-term portfolio, with a targeted average of 45%. International Equities will represent 5% to 15% of the market value of the total long-term portfolio, with a targeted average of 10%. Equities authorized for purchase include common and preferred stocks, warrants, ADR, REITS, MLPs, and c ...

Financial Planner`s Approach to Investment Selections for Clients

... One of the inherent benefits of mutual fund investing is their generally broad diversification across many stocks and or bonds within their asset class. Some fund managers have, however, sought to enhance returns by concentrating more heavily on a particular company or companies that they believe wi ...

... One of the inherent benefits of mutual fund investing is their generally broad diversification across many stocks and or bonds within their asset class. Some fund managers have, however, sought to enhance returns by concentrating more heavily on a particular company or companies that they believe wi ...

File - Skagit Community Foundation

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

Communications Plan

... Trustees/directors who are not “official” board spokespeople will often find that they are asked to discuss Board business in their day-to-day contacts within the community. It is important that directors/trustees demonstrate Board unity in these informal situations. 5. Give consistent messages and ...

... Trustees/directors who are not “official” board spokespeople will often find that they are asked to discuss Board business in their day-to-day contacts within the community. It is important that directors/trustees demonstrate Board unity in these informal situations. 5. Give consistent messages and ...

What`s In a Quartile

... performance below the 25th percentile of funds in the same vintage year were classified as “bottom-quartile” and so forth. We then divided the dataset into two groups of funds. The first group contained those funds that were the only venture capital fund raised by a particular firm (the “singlefund” ...

... performance below the 25th percentile of funds in the same vintage year were classified as “bottom-quartile” and so forth. We then divided the dataset into two groups of funds. The first group contained those funds that were the only venture capital fund raised by a particular firm (the “singlefund” ...

TIPS Index Fund - Get Retirement Right

... Company, Omaha, NE 68175, which accepts full responsibility for all its contractual obligations under the contract. Payments and values provided by this contract that are based on investment results of the separate account are variable and specific dollar amounts are not guaranteed. Investment optio ...

... Company, Omaha, NE 68175, which accepts full responsibility for all its contractual obligations under the contract. Payments and values provided by this contract that are based on investment results of the separate account are variable and specific dollar amounts are not guaranteed. Investment optio ...

New firm brings KKR funds to smaller Canadian investors

... are pleased to be starting this new partnership with Cygnus," Mike Gaviser, managing director at KKR, said in a statement. The Cygnus and KKR partnership is spearheaded by four managing partners who had been looking for opportunities to start a new asset management business in Canada. Along with Mr. ...

... are pleased to be starting this new partnership with Cygnus," Mike Gaviser, managing director at KKR, said in a statement. The Cygnus and KKR partnership is spearheaded by four managing partners who had been looking for opportunities to start a new asset management business in Canada. Along with Mr. ...

The Swedish AP Funds` co-ordination of carbon footprint reporting

... apply different investment strategies and allocate the pension assets under their management in different ways. As long-term owners and managers of Swedish pension assets, the AP Funds have a responsibility to generate maximum possible benefit for the Swedish pension system through responsible inves ...

... apply different investment strategies and allocate the pension assets under their management in different ways. As long-term owners and managers of Swedish pension assets, the AP Funds have a responsibility to generate maximum possible benefit for the Swedish pension system through responsible inves ...

Triloma EIG Global Energy Funds Participate in First Privately

... Crown is a privately held company located in Midland, Texas, that is focused on acquiring and developing oil and natural gas exploration properties primarily in the northern Delaware Basin region, which is the western part of the larger Permian Basin. The notes, which mature in 2019, are floating ra ...

... Crown is a privately held company located in Midland, Texas, that is focused on acquiring and developing oil and natural gas exploration properties primarily in the northern Delaware Basin region, which is the western part of the larger Permian Basin. The notes, which mature in 2019, are floating ra ...

Investment Fund Sample Portfolios

... An easy way to create a diversified portfolio is to use index funds and so-called “hybrid”, or lifestyle, funds. The straightforward investment management strategy of Index Funds and the asset allocation strategy of lifestyle funds are designed to appeal to investors who would prefer to track the ma ...

... An easy way to create a diversified portfolio is to use index funds and so-called “hybrid”, or lifestyle, funds. The straightforward investment management strategy of Index Funds and the asset allocation strategy of lifestyle funds are designed to appeal to investors who would prefer to track the ma ...

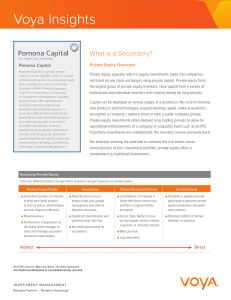

What is a Secondary? - Voya Investment Management

... attractiveness of investment opportunities available to investors and adversely affecting the terms upon which investments can be made. This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management (“Voya IM”) con ...

... attractiveness of investment opportunities available to investors and adversely affecting the terms upon which investments can be made. This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management (“Voya IM”) con ...

23 June 2017 DANSKE INVEST HEDGE FIXED INCOME

... 3. The Fund may not invest more than 20 per cent of its net assets in transferable securities or money market instruments issued by the same body or bodies belonging to the same group of bodies. The Fund may not invest more than 20 per cent. of its net assets in deposits made with the same body or b ...

... 3. The Fund may not invest more than 20 per cent of its net assets in transferable securities or money market instruments issued by the same body or bodies belonging to the same group of bodies. The Fund may not invest more than 20 per cent. of its net assets in deposits made with the same body or b ...