International Markets

... • Some forward-forward swaps are also being used (both transactions are forward) • Frequently used between banks (including Central Banks) • Consider two banks: Citibank (US) and Lloyds (UK) – If Citibank needs pounds, it can agree to exchange dollars for pounds with Lloyds today and also agree to a ...

... • Some forward-forward swaps are also being used (both transactions are forward) • Frequently used between banks (including Central Banks) • Consider two banks: Citibank (US) and Lloyds (UK) – If Citibank needs pounds, it can agree to exchange dollars for pounds with Lloyds today and also agree to a ...

Sudden stops, external debt and the exchange rate

... (2009)).7 Britain could presumably have allowed the pound ...

... (2009)).7 Britain could presumably have allowed the pound ...

Sudamericana S.R.L.- case(Word)

... facing the impossibility to meet debt payments, defaulted on the larger part of the public debt, totaling more than 93,000 million dollars. Rodríguez Saá resigned before the end of the year. Eduardo Duhalde was appointed by Congress to take his place. Under Duhalde direction, Argentina devaluated it ...

... facing the impossibility to meet debt payments, defaulted on the larger part of the public debt, totaling more than 93,000 million dollars. Rodríguez Saá resigned before the end of the year. Eduardo Duhalde was appointed by Congress to take his place. Under Duhalde direction, Argentina devaluated it ...

Document

... a) the international value of the Canadian dollar Outflow of funds increases demand for other currencies and increases the supply of the Canadian dollar (CAD), causing value of CAD to depreciate b) Canadian net exports Depreciation of CAD causes Canadian products to look less expensive to consumers ...

... a) the international value of the Canadian dollar Outflow of funds increases demand for other currencies and increases the supply of the Canadian dollar (CAD), causing value of CAD to depreciate b) Canadian net exports Depreciation of CAD causes Canadian products to look less expensive to consumers ...

Nature of Money

... Responsible for development of contemporary international banking models in US, Europe and Japan Three major institutions emerging were: IMF, WBG, and GATT; BIS already existed System, but not principles, brought to an end in 1971 when US went off gold standard ...

... Responsible for development of contemporary international banking models in US, Europe and Japan Three major institutions emerging were: IMF, WBG, and GATT; BIS already existed System, but not principles, brought to an end in 1971 when US went off gold standard ...

FRBSF L CONOMIC

... holdings have risen about 35%. This reflects low interest rates, which reduce the opportunity cost of holding currency. It’s also due to worries about the economy and the health of the banking system, both here and abroad. In fact, nearly two-thirds of U.S. currency is held outside our borders (see ...

... holdings have risen about 35%. This reflects low interest rates, which reduce the opportunity cost of holding currency. It’s also due to worries about the economy and the health of the banking system, both here and abroad. In fact, nearly two-thirds of U.S. currency is held outside our borders (see ...

Carbaugh, International Economics 9e, Chapter 16

... To the special drawing right (SDR), a basket established by the IMF Carbaugh, Chap. 16 ...

... To the special drawing right (SDR), a basket established by the IMF Carbaugh, Chap. 16 ...

Chapter 4

... The exchange rate of any currency refers to the rate at which it can be exchanged for U.S. dollars, unless specified otherwise. Like any other product sold in markets, the price of a currency is determined by the demand for that currency relative to supply. At any point in time, a currency sho ...

... The exchange rate of any currency refers to the rate at which it can be exchanged for U.S. dollars, unless specified otherwise. Like any other product sold in markets, the price of a currency is determined by the demand for that currency relative to supply. At any point in time, a currency sho ...

Money and Banking - Porterville College Home

... International Banking Facilities (IBFs) were legalized by the Federal Reserve Board in December 1981. An IBF is a division of a U.S. bank that is allowed to receive deposits from and make loans to nonresidents of the U.S. without the restrictions that apply to domestic U.S. banks. This allows domest ...

... International Banking Facilities (IBFs) were legalized by the Federal Reserve Board in December 1981. An IBF is a division of a U.S. bank that is allowed to receive deposits from and make loans to nonresidents of the U.S. without the restrictions that apply to domestic U.S. banks. This allows domest ...

Document

... Assume you work at the central bank of a small country that is considering an expansionary monetary policy to speed up the level of economic activity. Given fixed exchange rates, advise the president of your country what will happen to net exports if the country pursues a policy of monetary expansio ...

... Assume you work at the central bank of a small country that is considering an expansionary monetary policy to speed up the level of economic activity. Given fixed exchange rates, advise the president of your country what will happen to net exports if the country pursues a policy of monetary expansio ...

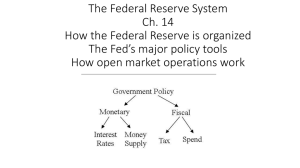

PPT - Ch. 14 The Federal Reserve System

... be paid each year until repayment, an IOU. • People buy bonds because they pay interest and are a safe investment. • Yield: the rate of return on a bond. ...

... be paid each year until repayment, an IOU. • People buy bonds because they pay interest and are a safe investment. • Yield: the rate of return on a bond. ...

A D F C

... illustrates the negative consequences of default externally and domestically. The default occurred following three years of severe recession, a dramatic reduction in foreign direct investment, high inflation, high interest rates and a large budget deficit. GDP declined by 10.9% (The Economist, 2010) ...

... illustrates the negative consequences of default externally and domestically. The default occurred following three years of severe recession, a dramatic reduction in foreign direct investment, high inflation, high interest rates and a large budget deficit. GDP declined by 10.9% (The Economist, 2010) ...

DIGITAL CURRENCIES AND P2P BLOCKCHAIN LEDGERS (1) By

... currency have a stable value over time. Hyperinflation, as experienced by certain countries in Europe after the second world war, can negate this role of a currency, which then drives people to store gold, jewellery and other physical assets. It is useful to compare a digital currency on these three ...

... currency have a stable value over time. Hyperinflation, as experienced by certain countries in Europe after the second world war, can negate this role of a currency, which then drives people to store gold, jewellery and other physical assets. It is useful to compare a digital currency on these three ...

Dollarization - Peterson Institute for International Economics

... United States has supported large-scale rescue packages for emergingmarket economies in Latin America (including Argentina, Brazil, and Mexico); even if a de jure official safety net with the United States is not in the cards for dollarized emerging economies, the US Treasury, along with the IMF, wi ...

... United States has supported large-scale rescue packages for emergingmarket economies in Latin America (including Argentina, Brazil, and Mexico); even if a de jure official safety net with the United States is not in the cards for dollarized emerging economies, the US Treasury, along with the IMF, wi ...

SUGGESTED SOLUTIONS TO CHAPTER 7 PROBLEMS

... If B&D didn't produce overseas, but instead exported from its U.S. plants, then currency changes would lead to much greater swings in its profits. Note that B&D's domestic profitability is also affected by currency changes since it faces competition in the U.S. from foreign companies such as Japan' ...

... If B&D didn't produce overseas, but instead exported from its U.S. plants, then currency changes would lead to much greater swings in its profits. Note that B&D's domestic profitability is also affected by currency changes since it faces competition in the U.S. from foreign companies such as Japan' ...

1 Chronic Macro-economic and Financial Imbalances in the World

... slowed, and partially even reversed, this trend. We know from pre-crisis data by the Peterson Institute of International Economics (see, for instance, Matthew Adler and Gary Clyde Hufbauer, 2008) that, whereas nominal world GDP increased fourfold from 1980 to 2006, (bi-lateral) trade flows hexpanded ...

... slowed, and partially even reversed, this trend. We know from pre-crisis data by the Peterson Institute of International Economics (see, for instance, Matthew Adler and Gary Clyde Hufbauer, 2008) that, whereas nominal world GDP increased fourfold from 1980 to 2006, (bi-lateral) trade flows hexpanded ...

Exchange Rate Systems

... Advantages of Fixed Exchange Rates 1. Avoid Currency Fluctuations. If the value of currencies fluctuate significantly this can cause problems for firms engaged in trade. 1. For example if a firm is exporting to the US, a rapid appreciation in sterling would make its exports uncompetitive and theref ...

... Advantages of Fixed Exchange Rates 1. Avoid Currency Fluctuations. If the value of currencies fluctuate significantly this can cause problems for firms engaged in trade. 1. For example if a firm is exporting to the US, a rapid appreciation in sterling would make its exports uncompetitive and theref ...

Introduction to International Business

... However, as a beneficiary of cheap goods made in China, how do you feel about the U.S.’ efforts to force China to raise its currency? ...

... However, as a beneficiary of cheap goods made in China, how do you feel about the U.S.’ efforts to force China to raise its currency? ...

Federal Reserve System and Monetary Policy NOTES

... – The Fed does not rely on appropriations from congress (that is money to run it) – The governors’ terms end in January of even numbered years, so one president does not get to appoint many governors ...

... – The Fed does not rely on appropriations from congress (that is money to run it) – The governors’ terms end in January of even numbered years, so one president does not get to appoint many governors ...

Exchange Rate Determination I: Prices and the Real Exchange Rate

... banks Standard Chartered, HSBC, and, now, Bank of China. During the 1970’s, the banks faced little limitation on money creation. In July of 1982, the HK dollar was depreciating at a rate of 7.7% per year. In 1983, Britain and the People’s Republic were engaged in talks about the terms on which H ...

... banks Standard Chartered, HSBC, and, now, Bank of China. During the 1970’s, the banks faced little limitation on money creation. In July of 1982, the HK dollar was depreciating at a rate of 7.7% per year. In 1983, Britain and the People’s Republic were engaged in talks about the terms on which H ...

From Gold to the Ecu: The International Monetary System in

... colonies, along with some other countries, pegged their currencies to sterling, thus inaugurating the Sterling Area. The United States clung to gold for another year and a half, then allowed the dollar’s exchange rate to float from April 1933 through January 1934. Official transactions manipulated t ...

... colonies, along with some other countries, pegged their currencies to sterling, thus inaugurating the Sterling Area. The United States clung to gold for another year and a half, then allowed the dollar’s exchange rate to float from April 1933 through January 1934. Official transactions manipulated t ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.