Mr. Tietmeyer discusses the benefits, opportunities and pitfalls of

... A number of countries will closely watch the outcome of this experiment, which may change Europe considerably. This is true in particular of those countries of the European Union which do not wish to join the monetary union as yet. Accession candidates in central and eastern Europe, too, will of cou ...

... A number of countries will closely watch the outcome of this experiment, which may change Europe considerably. This is true in particular of those countries of the European Union which do not wish to join the monetary union as yet. Accession candidates in central and eastern Europe, too, will of cou ...

Currency competition between Euro and US Dollar

... determinants of the real euro-dollar exchange rate: the international real interest differentials, relative prices in the traded and non-traded goods sectors, the real oil price and the relative fiscal position. From 2001 on, many economists designed various kinds of models to analyse the determinan ...

... determinants of the real euro-dollar exchange rate: the international real interest differentials, relative prices in the traded and non-traded goods sectors, the real oil price and the relative fiscal position. From 2001 on, many economists designed various kinds of models to analyse the determinan ...

Fed Policy Liftoff and Emerging Markets

... downward reassessment of the probable returns from investing in emerging market economies. The taper scare prompted an overall drop in investment in riskier assets, including assets from emerging economies (Powell 2013). The effects on those economies, however, appeared to be related to each country ...

... downward reassessment of the probable returns from investing in emerging market economies. The taper scare prompted an overall drop in investment in riskier assets, including assets from emerging economies (Powell 2013). The effects on those economies, however, appeared to be related to each country ...

Foreign exchange

... Domestic & foreign residence are on equal footing in the purchase and sale of domestic and foreign assets. As a result, it is expected that opportunities for risk free profit making to be quickly and completely exploited. Thus, the most basic measure of international capital mobility is the di ...

... Domestic & foreign residence are on equal footing in the purchase and sale of domestic and foreign assets. As a result, it is expected that opportunities for risk free profit making to be quickly and completely exploited. Thus, the most basic measure of international capital mobility is the di ...

SP125: Can Central Banking Survive the IT Revolution?

... complex enough encryption algorithms is becoming a bigger problem. Breaking the code of e-money may not be too difficult with the high levels of computing power available today, and will only get worse in the future. A key issue that needs to be addressed is how to minimise the loss due to fraud, bo ...

... complex enough encryption algorithms is becoming a bigger problem. Breaking the code of e-money may not be too difficult with the high levels of computing power available today, and will only get worse in the future. A key issue that needs to be addressed is how to minimise the loss due to fraud, bo ...

Monetary Policy: Goals and Targets

... The Fed can also influence reserves by altering the interest rate charged on loans to commercial banks. (MB) ...

... The Fed can also influence reserves by altering the interest rate charged on loans to commercial banks. (MB) ...

money supply

... ◦ A store of value is an item that people can use to transfer purchasing power from the present to the future. ...

... ◦ A store of value is an item that people can use to transfer purchasing power from the present to the future. ...

A fundamental divide in economics, between those who see capitalism... system and those who celebrate the "invisible hand" of the... THE THEORY OF MONEY AND WORLD CAPITALISM

... costs. This conviction in turn springs from two sources: first, the expectation, whether owing to the prevalence of, or access to, adequate labour reserves, or the weakening of trade union resistance, that the price of domestic labour power would not rise "unduly"; and, secondly, the expectation th ...

... costs. This conviction in turn springs from two sources: first, the expectation, whether owing to the prevalence of, or access to, adequate labour reserves, or the weakening of trade union resistance, that the price of domestic labour power would not rise "unduly"; and, secondly, the expectation th ...

International Aspects of Current Monetary Policy

... the reserves that must be held today depend to a greater or lesser degree on deposits held in the fairly distant past. As banks cannot go backward in time, there is nothing they can do about historical deposits. Even if a short settlement period is provided to meet reserve requirements, the require ...

... the reserves that must be held today depend to a greater or lesser degree on deposits held in the fairly distant past. As banks cannot go backward in time, there is nothing they can do about historical deposits. Even if a short settlement period is provided to meet reserve requirements, the require ...

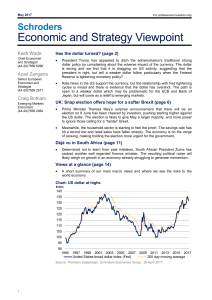

Market Bulletin MARKET INSIGHTS Should investors fear a rising dollar?

... Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to ch ...

... Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to ch ...

CURRENCY COMPETITION BETWEEN EURO AND US DOLLAR Li

... determinants of the real euro-dollar exchange rate: the international real interest differentials, relative prices in the traded and non-traded goods sectors, the real oil price and the relative fiscal position. From 2001 on, many economists designed various kinds of models to analyse the determinan ...

... determinants of the real euro-dollar exchange rate: the international real interest differentials, relative prices in the traded and non-traded goods sectors, the real oil price and the relative fiscal position. From 2001 on, many economists designed various kinds of models to analyse the determinan ...

Global Imbalances and the Transition to a Symmetric World

... Identifying the causes is a very difficult task, but one that is essential if the reforms necessary to avoid a new world crisis are to be put in place. In this article, we investigate some of the causes – global imbalances and unsatisfactory regulation of world liquidity – and the need for reform of ...

... Identifying the causes is a very difficult task, but one that is essential if the reforms necessary to avoid a new world crisis are to be put in place. In this article, we investigate some of the causes – global imbalances and unsatisfactory regulation of world liquidity – and the need for reform of ...

chapter 15 exchange-rate adjustments and the balance of payments

... 3. Assume that Brazil has a constant money supply and that it devalues its currency. The monetary approach to devaluation reasons that one of the following tends to occur for Brazil: a. Domestic prices rise—purchasing power of money falls—consumption falls b. Domestic prices rise—purchasing power of ...

... 3. Assume that Brazil has a constant money supply and that it devalues its currency. The monetary approach to devaluation reasons that one of the following tends to occur for Brazil: a. Domestic prices rise—purchasing power of money falls—consumption falls b. Domestic prices rise—purchasing power of ...

Document

... D. Selling borrowed currency in the hopes that there will be a large appreciation. 18. The demand for a currency is an example of A. an aggregate demand. B. a derived demand. C. spatial arbitrage. D. a perfectly elastic demand. 19. A depreciation of the Japanese yen relative to the U.S. dollar is il ...

... D. Selling borrowed currency in the hopes that there will be a large appreciation. 18. The demand for a currency is an example of A. an aggregate demand. B. a derived demand. C. spatial arbitrage. D. a perfectly elastic demand. 19. A depreciation of the Japanese yen relative to the U.S. dollar is il ...

Breaking point

... dered fairly disastrous for the risk markets in 2016 (Dax down almost 10 %, EuroStoxx down almost 8 %, and the S&P 500 temporarily down almost 10 %), it is instructive to take a closer look at the markets. In purely technical terms, many market players seem to have been yearning for the end of a ver ...

... dered fairly disastrous for the risk markets in 2016 (Dax down almost 10 %, EuroStoxx down almost 8 %, and the S&P 500 temporarily down almost 10 %), it is instructive to take a closer look at the markets. In purely technical terms, many market players seem to have been yearning for the end of a ver ...

Peter Bernholz INSTITUTIONAL REQUIREMENTS FOR STABLE MONEY INTEGRATED WORLD ECONOMY

... globalization of capital markets surely had not been foreseen when the Bretton Woods System was devised in 1944. Capital flows that change direction or accelerate are bound to bring about changes in real exchange rates and fluctuations in output. We have known this since the Kevnes-Ohlin debate on t ...

... globalization of capital markets surely had not been foreseen when the Bretton Woods System was devised in 1944. Capital flows that change direction or accelerate are bound to bring about changes in real exchange rates and fluctuations in output. We have known this since the Kevnes-Ohlin debate on t ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.