Module 26- The Federal Reserve System

... system, the U.S Federal Reserve System (the Fed) was created It created a fractional banking system Not a single central bank-but many district banks that carry out policy on a national level Fed not owned by the U.S. government-owned by member banks- independent from political control Membership of ...

... system, the U.S Federal Reserve System (the Fed) was created It created a fractional banking system Not a single central bank-but many district banks that carry out policy on a national level Fed not owned by the U.S. government-owned by member banks- independent from political control Membership of ...

Chapter 10

... • Exchange rate risk stems from the fact that currencies are constantly changing in value – Expected future payments in a foreign currency will likely be a different domestic currency amount from when the contract was signed – Firms that do business in more than one country are thus subject to excha ...

... • Exchange rate risk stems from the fact that currencies are constantly changing in value – Expected future payments in a foreign currency will likely be a different domestic currency amount from when the contract was signed – Firms that do business in more than one country are thus subject to excha ...

One Market, One Money? Well, Maybe . . . Sometimes

... questions are well known. To begin with, within the typical nation-state, some symbolic importance is still attached to the maintenance of a distinct national currency, which is a traditional trapping of national sovereignty. Economics does not help us to understand this matter, but it should not, f ...

... questions are well known. To begin with, within the typical nation-state, some symbolic importance is still attached to the maintenance of a distinct national currency, which is a traditional trapping of national sovereignty. Economics does not help us to understand this matter, but it should not, f ...

money, finance and human values, lessons from the twentieth

... In the Papers relating to the International economic Conference, held in Genoa in April-May 1922, the first resolution in the Report of the Second Commission (Finance) states: “The essential requisite for the reconstruction of Europe is the achievement by each country of stability in the value of it ...

... In the Papers relating to the International economic Conference, held in Genoa in April-May 1922, the first resolution in the Report of the Second Commission (Finance) states: “The essential requisite for the reconstruction of Europe is the achievement by each country of stability in the value of it ...

The Currency Hierarchy and the Center-Periphery - LaI FU

... periphery; unemployment; external imbalance; and, finally, the tendency towards deterioration of the terms of trade, i.e., the ratio of the unit price of exports and the unit price of imports from the periphery. Dualism, or more precisely, the structural heterogeneity, that appears in the periphery ...

... periphery; unemployment; external imbalance; and, finally, the tendency towards deterioration of the terms of trade, i.e., the ratio of the unit price of exports and the unit price of imports from the periphery. Dualism, or more precisely, the structural heterogeneity, that appears in the periphery ...

The Uselessness of Monetary Sovereignty

... Keynes rightly pointed out that forcing a wage reduction to cure involuntary unemployment was no solution by itself: the reason for long recessions is not the level of wages but the lack of variability of relative wages over time. ...

... Keynes rightly pointed out that forcing a wage reduction to cure involuntary unemployment was no solution by itself: the reason for long recessions is not the level of wages but the lack of variability of relative wages over time. ...

chap018_8e - Homework Market

... • Will the USD appreciate or depreciate relative to the Canadian dollar? – Since inflation is higher in the US, we would expect the US dollar to depreciate relative to the Canadian dollar ...

... • Will the USD appreciate or depreciate relative to the Canadian dollar? – Since inflation is higher in the US, we would expect the US dollar to depreciate relative to the Canadian dollar ...

Foreign Exchange Risk Management Guidance Note…

... counterparty themselves. However, there are implications for foreign exchange transactions. In particular, many investment managers buy stocks in emerging markets where there may be some political risk, and will instruct the Treasury department to buy or sell the currency according to the trade. In ...

... counterparty themselves. However, there are implications for foreign exchange transactions. In particular, many investment managers buy stocks in emerging markets where there may be some political risk, and will instruct the Treasury department to buy or sell the currency according to the trade. In ...

How Exchange Rate Influence a Country`s Import and

... role of exchange rates in a more globalized economy. Analyses the link between exchange rates and prices, shows that there is a moderate decline in exchange rate pass-through for the euro area. Next, it turns to the effect of exchange rate changes on trade flows. In addition, the overall impact of e ...

... role of exchange rates in a more globalized economy. Analyses the link between exchange rates and prices, shows that there is a moderate decline in exchange rate pass-through for the euro area. Next, it turns to the effect of exchange rate changes on trade flows. In addition, the overall impact of e ...

Bretton Woods System - Wharton Finance Department

... The purpose was to design a postwar international monetary system. The goal was exchange rate stability without the gold standard. ...

... The purpose was to design a postwar international monetary system. The goal was exchange rate stability without the gold standard. ...

Currency Boards - Cato Institute

... installed in the 1990s. All were installed in countries that were politically and/or economically very unstable. Furthermore, prior to the installation of currency boards, all countries had soft budget constraints and faced the prospect of continued instability. Argentina was attempting to cope with ...

... installed in the 1990s. All were installed in countries that were politically and/or economically very unstable. Furthermore, prior to the installation of currency boards, all countries had soft budget constraints and faced the prospect of continued instability. Argentina was attempting to cope with ...

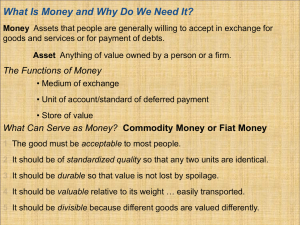

Money

... Many Iraqis continued to use currency with Saddam’s picture on it, even after he was forced from power. ...

... Many Iraqis continued to use currency with Saddam’s picture on it, even after he was forced from power. ...

The Operation and Demise of the Bretton Woods

... Thus the Bretton Woods system was set up as an adjustable peg system. The Agreement further obliged countries to remove restrictions on the current account while permitting them to maintain controls on transactions on capital account (so as to limit destabilizing capital flows). Capital controls and ...

... Thus the Bretton Woods system was set up as an adjustable peg system. The Agreement further obliged countries to remove restrictions on the current account while permitting them to maintain controls on transactions on capital account (so as to limit destabilizing capital flows). Capital controls and ...

T

... currency area literature typically has not.1 Yet, both areas of research help to articulate the costs and benefits of monetary integration. The discussion of the optimal currency area is much broader than an examination of the European Monetary System. It obviously applies to the question of whether ...

... currency area literature typically has not.1 Yet, both areas of research help to articulate the costs and benefits of monetary integration. The discussion of the optimal currency area is much broader than an examination of the European Monetary System. It obviously applies to the question of whether ...

In 1998 eleven EU member-states had met the convergence criteria

... They first take the form of a non-interest-bearing deposit with the Commission (fixed component equal to 0.2% of GDP and a variable one linked to the size of the deficit). Annual amount of the deposit might not exceed 0.5% of GDP. If the excessive deficit is not corrected after two years, the deposi ...

... They first take the form of a non-interest-bearing deposit with the Commission (fixed component equal to 0.2% of GDP and a variable one linked to the size of the deficit). Annual amount of the deposit might not exceed 0.5% of GDP. If the excessive deficit is not corrected after two years, the deposi ...

gatton.uky.edu

... – If other central banks maintained their fixed exchange rates, they would have needed to buy dollar denominated (foreign) assets, increasing their money supplies. – In effect, the monetary policies of other countries had to follow that of the US, which was not always optimal for their levels of out ...

... – If other central banks maintained their fixed exchange rates, they would have needed to buy dollar denominated (foreign) assets, increasing their money supplies. – In effect, the monetary policies of other countries had to follow that of the US, which was not always optimal for their levels of out ...

85051058I_en.pdf

... institutions as well. The postmodern view of central banking emphasizes the need to solve what are known as “time-inconsistency” problems, i.e., the inconsistency that arises when governments announce anti-inflation policies and then act against them in pursuit of political or electoral gains that e ...

... institutions as well. The postmodern view of central banking emphasizes the need to solve what are known as “time-inconsistency” problems, i.e., the inconsistency that arises when governments announce anti-inflation policies and then act against them in pursuit of political or electoral gains that e ...

Economics Principles and Applications

... • If exchange rate is too volatile, it can make trading riskier or require traders to acquire special insurance against foreign currency losses – Costs them money, time, and trouble ...

... • If exchange rate is too volatile, it can make trading riskier or require traders to acquire special insurance against foreign currency losses – Costs them money, time, and trouble ...

Does Currency Union Increase Intra-regional Trade? A Study on Euro:

... common language helps in successful communication, a common currency benefits trade and investment among countries (Madhur, 2002). It enhances intra-regional economic growth. Some economists argue that the primary effect of a currency union is reduction in inflation. Frankel and Rose (2002) also men ...

... common language helps in successful communication, a common currency benefits trade and investment among countries (Madhur, 2002). It enhances intra-regional economic growth. Some economists argue that the primary effect of a currency union is reduction in inflation. Frankel and Rose (2002) also men ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.