Inside Job – Vocabulary Asset Backed Security (ABS) An asset

... determined by an accredited credit rating agency, and usually pay periodic payments that are similar to coupon payments. Furthermore, the mortgage must have originated from a regulated and authorized financial institution. NOTES: Investors in a mortgage-backed security are essentially lending money ...

... determined by an accredited credit rating agency, and usually pay periodic payments that are similar to coupon payments. Furthermore, the mortgage must have originated from a regulated and authorized financial institution. NOTES: Investors in a mortgage-backed security are essentially lending money ...

MEMBER: Investment Industry Regulatory Organization of Canada

... across the Middle East, we can quickly see that this is not the typical investment environment commonplace only a decade ago. Unlike the 1980s or 90s, given the predominant increase in global dramas, it has becoming increasingly apparent that investors should start considering ‘macro’ events as a hi ...

... across the Middle East, we can quickly see that this is not the typical investment environment commonplace only a decade ago. Unlike the 1980s or 90s, given the predominant increase in global dramas, it has becoming increasingly apparent that investors should start considering ‘macro’ events as a hi ...

Securities Purchase Ad

... grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of insufficient fund, we will calculate and provide the facility amount based on your securities portfolio margin value and execute your buy order without your separate ...

... grasp every investment opportunity for higher potential returns in the dynamic market. Operation Mechanism of the Service: In case of insufficient fund, we will calculate and provide the facility amount based on your securities portfolio margin value and execute your buy order without your separate ...

Capital Market

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

- SlideBoom

... application, while other categories of investors have to pay 100 % advance along with the application. ...

... application, while other categories of investors have to pay 100 % advance along with the application. ...

Financial Resources Rules Liquid Capital Computation Part 1

... ¾ Beneficially owned cash, bank deposits (time deposit maturity not > 6 months) and accrued interests on time deposits [s.20] ¾ Fees / commissions arising from regulated activities [s.35] - accruals which will be first due for payment or billing within next 3 months - which have been due/billed and ...

... ¾ Beneficially owned cash, bank deposits (time deposit maturity not > 6 months) and accrued interests on time deposits [s.20] ¾ Fees / commissions arising from regulated activities [s.35] - accruals which will be first due for payment or billing within next 3 months - which have been due/billed and ...

Case Study: Globalization of Finance and current financial crisis

... U.S.Promise not to close its market Other G20 countries promised too Are bail-outs of domestic industries acts of ...

... U.S.Promise not to close its market Other G20 countries promised too Are bail-outs of domestic industries acts of ...

With new “Vaccine Bonds” Japanese Investors will have the

... continued poverty in adulthood. With funds provided by IFFIm, by the year 2015, the GAVI Alliance aims to protect an additional 500 million children through vaccination. Over US$1.08 billion have already been disbursed using funds IFFIm raised through bonds bought by Japanese and other investors aro ...

... continued poverty in adulthood. With funds provided by IFFIm, by the year 2015, the GAVI Alliance aims to protect an additional 500 million children through vaccination. Over US$1.08 billion have already been disbursed using funds IFFIm raised through bonds bought by Japanese and other investors aro ...

Document

... Journalize entries for short-term debt securities, including: the purchase, the investment revenue, and the sale 5.02 Journalize entries for long-term debt securities, including: the purchase, the investment revenue, and the sale 5.03 Journalize entries for short-term equity securities, including: t ...

... Journalize entries for short-term debt securities, including: the purchase, the investment revenue, and the sale 5.02 Journalize entries for long-term debt securities, including: the purchase, the investment revenue, and the sale 5.03 Journalize entries for short-term equity securities, including: t ...

Ryerson Holding Corp (Form: 4, Received: 08/15/2014 16:34:46)

... Ms. Mary Ann Sigler is associated with Platinum Equity, LLC and its affiliated investment funds. Platinum Equity, LLC manages its affiliated investment funds, including Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P., Platin ...

... Ms. Mary Ann Sigler is associated with Platinum Equity, LLC and its affiliated investment funds. Platinum Equity, LLC manages its affiliated investment funds, including Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P., Platin ...

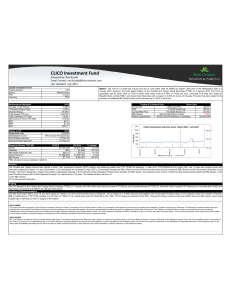

CLICO Investment Fund

... This report has been prepared by First Citizens Investment Services Limited, a subsidiary of First Citizens Bank Limited. It is provided for informational purposes only and without any obligation, whether contractual or otherwise. All information contained herein has been obtained from sources that ...

... This report has been prepared by First Citizens Investment Services Limited, a subsidiary of First Citizens Bank Limited. It is provided for informational purposes only and without any obligation, whether contractual or otherwise. All information contained herein has been obtained from sources that ...

Slide set 1

... Purpose: (like that of other markets): transfer resources (funding) to where they are needed • Macroeconomic view: blood circulation of national economy • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

... Purpose: (like that of other markets): transfer resources (funding) to where they are needed • Macroeconomic view: blood circulation of national economy • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

Privatization and Politics - FGV

... Published ranking of a debtor’s or issuer’s credit quality, based on detailed financial analysis by an external credit assessment institution (rating agency), specifically related to an entity’s ability to meet its debt obligations. Ratings are used by lenders to decide on approval of credit applica ...

... Published ranking of a debtor’s or issuer’s credit quality, based on detailed financial analysis by an external credit assessment institution (rating agency), specifically related to an entity’s ability to meet its debt obligations. Ratings are used by lenders to decide on approval of credit applica ...

Chapter03 - U of L Class Index

... adjusted quickly to reflect current information Weak-form - all information contained in past price movements is reflected in current market prices Semistrong-form - current prices reflect all publicly available information Strong-form current prices reflect all pertinent information, both pub ...

... adjusted quickly to reflect current information Weak-form - all information contained in past price movements is reflected in current market prices Semistrong-form - current prices reflect all publicly available information Strong-form current prices reflect all pertinent information, both pub ...

Pros and Cons of Capital Market

... The FDI inflows had aggregated to $24.29 billion in 2013-14 as against $ 22.42 billion in 2012-13. Today India and China are considered as most attractive FDI destinations in the world. Turnover - The total amount of equity issues mobilised in the Primary market stood at 15,474 crore in 2012-13 as a ...

... The FDI inflows had aggregated to $24.29 billion in 2013-14 as against $ 22.42 billion in 2012-13. Today India and China are considered as most attractive FDI destinations in the world. Turnover - The total amount of equity issues mobilised in the Primary market stood at 15,474 crore in 2012-13 as a ...

0001193125-17-038153

... The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (howe ...

... The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (howe ...

INTRODUCTION TO

... documents which include intention to lend the securities belonging to the scheme, the exposure limit regarding securities lending both for the scheme as well as for a single intermediary and the risks associated with stock-lending ...

... documents which include intention to lend the securities belonging to the scheme, the exposure limit regarding securities lending both for the scheme as well as for a single intermediary and the risks associated with stock-lending ...

Intercontinental Exchange, Inc. (Form: 4, Received: 03/14

... Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number ...

... Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number ...

Notice of a bondholder intention to sell a certain number of bonds to

... Hereby ____________________ (the full name of a bondholder) notifies of its intention to sell series 03 documentary interest-bearing non-convertible pay-to-bearer bonds issued by "Southern Telecommunications Company" PJSC, subject to mandatory centralized safe custody, state registration number of t ...

... Hereby ____________________ (the full name of a bondholder) notifies of its intention to sell series 03 documentary interest-bearing non-convertible pay-to-bearer bonds issued by "Southern Telecommunications Company" PJSC, subject to mandatory centralized safe custody, state registration number of t ...

No. SEC/Enforcement/645/2007/ May 25, 2008 Prime Insurance

... explanations submitted to the Commission vide letter dated April 16, 2008, in respect of the said notice. The Commission, considering the issuer’s explanations/submissions, has decided to dispose of the proceedings against Prime Insurance Company Limited by placing on record the Commission’s dissati ...

... explanations submitted to the Commission vide letter dated April 16, 2008, in respect of the said notice. The Commission, considering the issuer’s explanations/submissions, has decided to dispose of the proceedings against Prime Insurance Company Limited by placing on record the Commission’s dissati ...

Celsion Corporation Announces $5.4 Million Registered Direct

... shares of common stock underlying such warrants) was filed with and declared effective by the Securities and Exchange Commission (the "SEC"). A prospectus supplement relating to the offering of shares of common stock or shares of common stock underlying the pre-funded warrants to be issued will be f ...

... shares of common stock underlying such warrants) was filed with and declared effective by the Securities and Exchange Commission (the "SEC"). A prospectus supplement relating to the offering of shares of common stock or shares of common stock underlying the pre-funded warrants to be issued will be f ...

4 - Cengage

... Recording Investee Net Income (Equity Method) For the year ending on December 31, 2010, Flanders Corporation reported net income of $105,000. ...

... Recording Investee Net Income (Equity Method) For the year ending on December 31, 2010, Flanders Corporation reported net income of $105,000. ...

Valuation Hierarchy Determination of Fair Value Assets

... Cash equivalents include highly liquid investments with original maturities of 90 days or less. Actively traded money market funds are measured at their NAV and classified as Level 1. The Company’s remaining cash equivalents are classified as Level 2 and measured at amortized cost, which is a reason ...

... Cash equivalents include highly liquid investments with original maturities of 90 days or less. Actively traded money market funds are measured at their NAV and classified as Level 1. The Company’s remaining cash equivalents are classified as Level 2 and measured at amortized cost, which is a reason ...