DEBT INSTRUMENTS Government Debt Securities (GDS

... Bonds are debt securities issued by the government or joint stock corporations for borrowing purposes. The maturity terms of private sector bonds can be one year or more and may be issued with fixed or variable interest rates. Private sector bonds are mostly sold through a consortium consisting of m ...

... Bonds are debt securities issued by the government or joint stock corporations for borrowing purposes. The maturity terms of private sector bonds can be one year or more and may be issued with fixed or variable interest rates. Private sector bonds are mostly sold through a consortium consisting of m ...

Chapter 3 – Outline

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

Medallion Signature Guarantees Transfer agents and issuers of

... Securities may be held in the name of the owner of the securities or in "street" name. Securities held in "street" name are held in the name of a brokerage firm for the benefit of the investor in the securities. Securities in "street" name do not need signature guarantees in order to be transferred. ...

... Securities may be held in the name of the owner of the securities or in "street" name. Securities held in "street" name are held in the name of a brokerage firm for the benefit of the investor in the securities. Securities in "street" name do not need signature guarantees in order to be transferred. ...

Securities and Exchange Commission v. Ralston Purina Co

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

Hannah Capital Markets Proposal April 2006 Economic History

... Economic historians have understandably written of capital markets before the First World War largely in terms of foreign investment and globalization. This paper seeks to examine the contrasts in the domestic capital markets for business enterprises in a comparative framework. The starting point is ...

... Economic historians have understandably written of capital markets before the First World War largely in terms of foreign investment and globalization. This paper seeks to examine the contrasts in the domestic capital markets for business enterprises in a comparative framework. The starting point is ...

Lesotho: Launching of the Maseru Securities Market On the 22nd

... secure environment that enhances investor confidence while on the other hand not too strict to suffocate market development. The MSM is a registered legal entity, and, in common with international practice, a philosophy of self-regulation by the markets will be adopted.. Thirdly the institutional fr ...

... secure environment that enhances investor confidence while on the other hand not too strict to suffocate market development. The MSM is a registered legal entity, and, in common with international practice, a philosophy of self-regulation by the markets will be adopted.. Thirdly the institutional fr ...

Summer Doldrums - RBC Wealth Management

... to the economy and the financial markets. Some weeks it’s optimism, other’s its pessimism. Some weeks it’s hope, the next fear…some weeks inflationary then the next deflationary. But at the end of it all, the gyrations only continue to add to one prevailing emotion: angst. The main point is these ma ...

... to the economy and the financial markets. Some weeks it’s optimism, other’s its pessimism. Some weeks it’s hope, the next fear…some weeks inflationary then the next deflationary. But at the end of it all, the gyrations only continue to add to one prevailing emotion: angst. The main point is these ma ...

Diapositive 1 - Brand Center

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

... This presentation may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business, strategy and plans of TOTAL GROUP that are subject to risk factors and uncertainties caused by ...

Roger Coffin, a lead Partner in our Regulatory Advisory

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

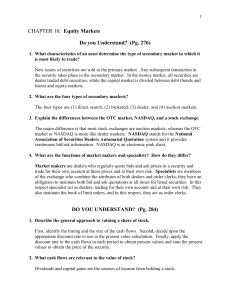

CHAPTER 10: Equity Markets

... The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer market ...

... The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer market ...

Document

... Passive Management: Buying and holding a diversified portfolio without attempting to identfy mispriced securities No attempt to find undervalued (mispriced) securities No attempt to time ...

... Passive Management: Buying and holding a diversified portfolio without attempting to identfy mispriced securities No attempt to find undervalued (mispriced) securities No attempt to time ...

Dollarama Closes Initial Public Offering

... Montreal, Canada – October 16, 2009 – Dollarama Inc. (the "Corporation") announced today the closing of its initial public offering of 17,142,857 common shares of the Corporation at a price of $17.50 per share resulting in gross proceeds of approximately $300 million. The common shares are listed on ...

... Montreal, Canada – October 16, 2009 – Dollarama Inc. (the "Corporation") announced today the closing of its initial public offering of 17,142,857 common shares of the Corporation at a price of $17.50 per share resulting in gross proceeds of approximately $300 million. The common shares are listed on ...

Manitoba Securities Commission

... Province of Manitoba. Membership: The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree ...

... Province of Manitoba. Membership: The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree ...

OFFICER`S CERTIFICATE TO: British Columbia Securities

... “Corporation”) to be held on September 7, 2016 and the special meeting of noteholders of Postmedia Network Inc. (“PNI”) to be held on September 7, 2016 (collectively, the “Meetings”) ...

... “Corporation”) to be held on September 7, 2016 and the special meeting of noteholders of Postmedia Network Inc. (“PNI”) to be held on September 7, 2016 (collectively, the “Meetings”) ...

... investment activity to which this communication relates will only be available to and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. This communication is not for public release, publication or dis ...

Government Securities

... Government securities are debt instruments issued by a national government as means of borrowing money. Bond holders receive interest payments based on the specified coupon rate, and principal payment, which is a repayment of the face value of the bond at maturity. n Uses: Government bonds offer: • ...

... Government securities are debt instruments issued by a national government as means of borrowing money. Bond holders receive interest payments based on the specified coupon rate, and principal payment, which is a repayment of the face value of the bond at maturity. n Uses: Government bonds offer: • ...

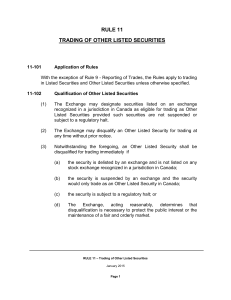

CSE RULE 11 – Trading of Other Listed Securities

... Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

... Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

ESTR.ASpA successfully places EUR 100 million senior notes BNP

... On 13 July 2015, E.s.tr.a. S.p.A. successfully finalised the issuance of €100 million senior unsecured and non-convertible notes; the notes are guaranteed by Centria S.r.l., a 100% owned subsidiary of Estra, and have been entirely subscribed for by institutional investors outside the United States o ...

... On 13 July 2015, E.s.tr.a. S.p.A. successfully finalised the issuance of €100 million senior unsecured and non-convertible notes; the notes are guaranteed by Centria S.r.l., a 100% owned subsidiary of Estra, and have been entirely subscribed for by institutional investors outside the United States o ...

Duff Young - Ontario Securities Commission

... But this is a wonderful report template. Back then I felt that the industry got a free ride because client accounts rose over time and people felt richer. But like the intentional complexity of cell phone plans, most consumers were unable to discern from their statements how much of that growth simp ...

... But this is a wonderful report template. Back then I felt that the industry got a free ride because client accounts rose over time and people felt richer. But like the intentional complexity of cell phone plans, most consumers were unable to discern from their statements how much of that growth simp ...

Non ERISA Collateral Schedule

... Corporate bonds issued by companies domiciled in one of the following countries where such corporate bond has an investment grade rating from at least one of Standard & Poor’s, Fitch, Moody’s or DBRS.* Australia Austria Belgium Canada Denmark Finland France Germany Ireland Italy Japan ...

... Corporate bonds issued by companies domiciled in one of the following countries where such corporate bond has an investment grade rating from at least one of Standard & Poor’s, Fitch, Moody’s or DBRS.* Australia Austria Belgium Canada Denmark Finland France Germany Ireland Italy Japan ...

TELEFÓNICA, S.A. (“TELEFÓNICA”) as provided in article 82 of the

... accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the "Securities Act"), for securities which have not been, and will not be, registered under the Securities Act or the laws of any state, and may not be offered or sold in the United States, absent registration or an exempt ...

... accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the "Securities Act"), for securities which have not been, and will not be, registered under the Securities Act or the laws of any state, and may not be offered or sold in the United States, absent registration or an exempt ...

SEC Form NELET-AF - Securities and Exchange Commission

... the payment of annual fee as (Type of Registration/License), including the annual fees for the following Branches: (Enumerate Branches) and, of the (State Number of Professionals Included in the List) Capital Market Professionals listed in the Annexes, for the year (Indicate Year). The undersigned P ...

... the payment of annual fee as (Type of Registration/License), including the annual fees for the following Branches: (Enumerate Branches) and, of the (State Number of Professionals Included in the List) Capital Market Professionals listed in the Annexes, for the year (Indicate Year). The undersigned P ...

Definition 1 Government bonds Bonds issued by public authorities

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...

... Contract between two parties concerning the selling of an asset at a reference price during a specified time frame, where the buyer of the put option gains the right, but not the obligation, to sell the underlying asset ...