Patriot National, Inc. - corporate

... The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act, but shall be subject to all other provisions of the Act (how ...

... The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act, but shall be subject to all other provisions of the Act (how ...

CTRIP COM INTERNATIONAL LTD (Form: SC 13G/A

... hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following. ...

... hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following. ...

Debt position of the Government of India

... These assets are also shown at book value i.e., it does not take into account depreciation/appreciation in the value of assets as per current market rates. This statement includes only assets the ownership of which vests in Central Government, and it excludes assets created by State Governments and ...

... These assets are also shown at book value i.e., it does not take into account depreciation/appreciation in the value of assets as per current market rates. This statement includes only assets the ownership of which vests in Central Government, and it excludes assets created by State Governments and ...

SYNGENTA AG - FURTHER EXTENDED TENDER OFFER OPTION

... entitlements. (See also "Special Risks - Valuation Disparity".) Except in unusual cases, securities deliverable as a result of equity option exercise are settled through National Securities Clearing Corporation (“NSCC”). ...

... entitlements. (See also "Special Risks - Valuation Disparity".) Except in unusual cases, securities deliverable as a result of equity option exercise are settled through National Securities Clearing Corporation (“NSCC”). ...

continued from cover - Association Reserves

... As the liquid portion of the reserve assets grows (from earnings as well as from new reserve contributions), additional amounts will become investable into the non-liquid portion. Newly investable funds are defined as those in excess of the base liquid portion. Combine these newly investable funds w ...

... As the liquid portion of the reserve assets grows (from earnings as well as from new reserve contributions), additional amounts will become investable into the non-liquid portion. Newly investable funds are defined as those in excess of the base liquid portion. Combine these newly investable funds w ...

Chapter 2.3

... shares held by investors are called ____________________________ shares. Sometimes the company issuing the stock buys some of its own shares back. These shares then become __________________________ stock and are no longer considered to be outstanding. 3. When a company decides to offer securities t ...

... shares held by investors are called ____________________________ shares. Sometimes the company issuing the stock buys some of its own shares back. These shares then become __________________________ stock and are no longer considered to be outstanding. 3. When a company decides to offer securities t ...

New rules on collateral for securities in repurchase agreements

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

HouseStyle

... (the “New Ordinary Shares”) of the Company at a subscription price of 35.468597530 pence per New Ordinary Share. Based on this subscription price, the gross proceeds of the issue are GBP 170 million. The New Ordinary Shares being issued represent an increase of approximately 0.7 per cent. in the Com ...

... (the “New Ordinary Shares”) of the Company at a subscription price of 35.468597530 pence per New Ordinary Share. Based on this subscription price, the gross proceeds of the issue are GBP 170 million. The New Ordinary Shares being issued represent an increase of approximately 0.7 per cent. in the Com ...

Board Consolidated Biography Page

... DOUGLAS R. NICHOLS (Board Treasurer) Douglas R. Nichols’ career in the financial industry spans over twenty-five years and includes experience as a CPA in tax, audit, and accounting. In 1991, he founded First London Securities Corporation where he currently serves as President as well as Senior Advi ...

... DOUGLAS R. NICHOLS (Board Treasurer) Douglas R. Nichols’ career in the financial industry spans over twenty-five years and includes experience as a CPA in tax, audit, and accounting. In 1991, he founded First London Securities Corporation where he currently serves as President as well as Senior Advi ...

Disclosure of G-SIB indicators

... b. Unused portion of committed lines extended to other financial institutions c. Holdings of securities issued by other financial institutions: (1) Secured debt securities (2) Senior unsecured debt securities (3) Subordinated debt securities (4) Commercial paper (5) Equity securities (6) Offsetting ...

... b. Unused portion of committed lines extended to other financial institutions c. Holdings of securities issued by other financial institutions: (1) Secured debt securities (2) Senior unsecured debt securities (3) Subordinated debt securities (4) Commercial paper (5) Equity securities (6) Offsetting ...

Answers to Chapter 1 Questions

... significant amounts of their portfolio risk. Further, for equal investments in different securities, as the number of securities in an FI=s asset portfolio increases portfolio risk falls, albeit at a diminishing rate. What is really going on here is that FIs can exploit the law of large numbers in m ...

... significant amounts of their portfolio risk. Further, for equal investments in different securities, as the number of securities in an FI=s asset portfolio increases portfolio risk falls, albeit at a diminishing rate. What is really going on here is that FIs can exploit the law of large numbers in m ...

Form: 6-K, Received: 02/26/2016 18:51:31

... Under the private placement transaction, Banro issued 50,000,000 common shares and 2.5 million Warrants to RFWB, for total gross proceeds to the Company of US$8.75 million. These Warrants have the same terms as the Warrants issued under the term loan transaction as set forth above. RFWB holds approx ...

... Under the private placement transaction, Banro issued 50,000,000 common shares and 2.5 million Warrants to RFWB, for total gross proceeds to the Company of US$8.75 million. These Warrants have the same terms as the Warrants issued under the term loan transaction as set forth above. RFWB holds approx ...

CASLA membership form - Canadian Securities Lending Association

... Are you or will you be actually engaged in the business of securities lending/borrowing? Yes No Do you lend/borrow directly or via a third party? Market Third Party If yes, do/will you act in a principal or agency capacity? Principal Agent Are you a member of any other trade associations or exchang ...

... Are you or will you be actually engaged in the business of securities lending/borrowing? Yes No Do you lend/borrow directly or via a third party? Market Third Party If yes, do/will you act in a principal or agency capacity? Principal Agent Are you a member of any other trade associations or exchang ...

NATIONAL INSTRUMENTS CORP (Form: 4, Received: 05/02/2017

... 3. Date of Earliest Transaction (MM/DD/YYYY) ...

... 3. Date of Earliest Transaction (MM/DD/YYYY) ...

Globalstrategyweekly report 20120706

... Deutsche Bank Securities Inc., Goldman, Sachs & Co., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC or Unilever United States, Inc., 700 Sylvan Avenue, Englewood Cliffs, New Jersey 07632, United States of America (telephone number +1 201 894 7042). An electronic copy of the preliminary prospec ...

... Deutsche Bank Securities Inc., Goldman, Sachs & Co., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC or Unilever United States, Inc., 700 Sylvan Avenue, Englewood Cliffs, New Jersey 07632, United States of America (telephone number +1 201 894 7042). An electronic copy of the preliminary prospec ...

Main Market – key eligibility criteria

... companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – Premium and Standard Listing and several securities categories available to issuers s ...

... companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – Premium and Standard Listing and several securities categories available to issuers s ...

Chap. 5 How Securities are Traded Buying and Selling Securities

... • On the NYSE, and sometimes now NASDAQ, an investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price th ...

... • On the NYSE, and sometimes now NASDAQ, an investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price th ...

Submission - Review of the managed investments act 1998

... reshape mutual fund regulation in Canada by establishing a comprehensive system to better protect investors while still responding to the needs of the $427 billion mutual fund industry. A concept proposal on a new framework for regulating the mutual fund industry will be published for comment on Mar ...

... reshape mutual fund regulation in Canada by establishing a comprehensive system to better protect investors while still responding to the needs of the $427 billion mutual fund industry. A concept proposal on a new framework for regulating the mutual fund industry will be published for comment on Mar ...

CREF Money Market

... This money market annuity account is subject to a number of risks, which include the following: Active Management: The investment is actively managed and subject to the risk that the advisor’s usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, ...

... This money market annuity account is subject to a number of risks, which include the following: Active Management: The investment is actively managed and subject to the risk that the advisor’s usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, ...

11-08-2016 Presidential Elections

... the EU was dramatic, the road to that change is long and filled with many small changes along the way. Remember, our country may have a single leader, it is not a dictatorship and changes must be enacted by both the House and the Senate. The United States is not without its issues and concerns. A si ...

... the EU was dramatic, the road to that change is long and filled with many small changes along the way. Remember, our country may have a single leader, it is not a dictatorship and changes must be enacted by both the House and the Senate. The United States is not without its issues and concerns. A si ...

American Homeowner Preservation Dear

... Based on the foregoing, we hereby advise you that Client is an “accredited investor” as that term is defined in Rule 501(a) under the Securities Act because: [CHECK ONE] 1. At the time of this subscription, the Client is a natural person and has an individual net worth, or spousal joint net worth wi ...

... Based on the foregoing, we hereby advise you that Client is an “accredited investor” as that term is defined in Rule 501(a) under the Securities Act because: [CHECK ONE] 1. At the time of this subscription, the Client is a natural person and has an individual net worth, or spousal joint net worth wi ...

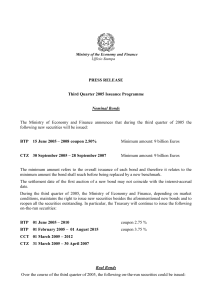

Third Quarter 2005 Issuance Programme

... The Treasury will offer the BTP€i at auction – usually on a monthly basis - according to market conditions. The auctions will take place in the second half of the month, one business day prior to the medium-long-term auction. The Treasury will announce the bonds to be issued, and the relative maximu ...

... The Treasury will offer the BTP€i at auction – usually on a monthly basis - according to market conditions. The auctions will take place in the second half of the month, one business day prior to the medium-long-term auction. The Treasury will announce the bonds to be issued, and the relative maximu ...