Securities Markets

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

Lecture 9 Financial Exchanges

... Price discovery (prices reflect current information) Fair competition (open access, nondiscrimination) Investor protection and confidence ...

... Price discovery (prices reflect current information) Fair competition (open access, nondiscrimination) Investor protection and confidence ...

Mankiw's "Ten Principles of Economics"

... Trade Can Make Everyone Better Off. Trade allows each person to specialize in the activities he or she does best. By trading with others, people can buy a greater variety of goods or services. Markets Are Usually a Good Way to Organize Economic Activity. Households and firms that interact in market ...

... Trade Can Make Everyone Better Off. Trade allows each person to specialize in the activities he or she does best. By trading with others, people can buy a greater variety of goods or services. Markets Are Usually a Good Way to Organize Economic Activity. Households and firms that interact in market ...

Changes to Result in Better Framework and Incentive Structure for

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

Weekly Market Report Week 24 2014

... cosmopolitan with Irish produce supplemented by cauliflower from Germany and France and cabbage from Spain, UK and Holland. Demand was steady at similar prices to week 23. Small volumes of new season Irish Swedes arrived on the market, and they traded at €8.00 per count of 10. Old crop Irish and UK ...

... cosmopolitan with Irish produce supplemented by cauliflower from Germany and France and cabbage from Spain, UK and Holland. Demand was steady at similar prices to week 23. Small volumes of new season Irish Swedes arrived on the market, and they traded at €8.00 per count of 10. Old crop Irish and UK ...

Securities Markets Primary Versus Secondary Markets How

... Spread: Spread: cost of trading with dealer ...

... Spread: Spread: cost of trading with dealer ...

Stocks and the Stock Market

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

Learning Goals

... • Electronic order routing system allows brokers to electronically send orders directly to specialist. • Useful for program trading ...

... • Electronic order routing system allows brokers to electronically send orders directly to specialist. • Useful for program trading ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author of the report, estimated that there was a similar proportion in Europe. “The results suggest that dark trading does not harm market quality at its current levels but the gains are not indefinit ...

... total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author of the report, estimated that there was a similar proportion in Europe. “The results suggest that dark trading does not harm market quality at its current levels but the gains are not indefinit ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

Key Vocabulary List

... Fiscal policy-Refers to the governmental allocation and collection of money within the state. Open outcry-A sort of auction for stocks in which traders verbally submit their offers. Opportunity costs-Economic choices where resources could have been used to create another item or used for another pur ...

... Fiscal policy-Refers to the governmental allocation and collection of money within the state. Open outcry-A sort of auction for stocks in which traders verbally submit their offers. Opportunity costs-Economic choices where resources could have been used to create another item or used for another pur ...

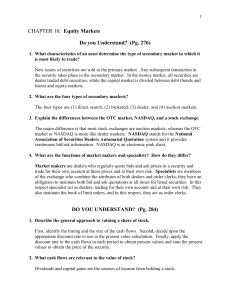

CHAPTER 10: Equity Markets

... dealer traded debt securities, while the capital market is divided between debt (bonds and loans) and equity markets. 2. What are the four types of secondary markets? The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC m ...

... dealer traded debt securities, while the capital market is divided between debt (bonds and loans) and equity markets. 2. What are the four types of secondary markets? The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC m ...

Stock PPT - Issaquah Connect

... Buy Low - Sell High Buy/Hold – Best Investing Strategy for the long term ...

... Buy Low - Sell High Buy/Hold – Best Investing Strategy for the long term ...

A Day in the Life of an ETF Portfolio Manager

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

Technical Analysis

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

Document

... This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's spec ...

... This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's spec ...

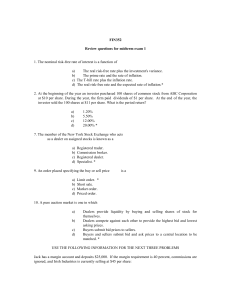

FIN432 - CSUN.edu

... 1. The nominal risk-free rate of interest is a function of a) The real risk-free rate plus the investment's variance. b) The prime rate and the rate of inflation. c) The T-bill rate plus the inflation rate. d) The real risk-free rate and the expected rate of inflation.* 2. At the beginning of the ye ...

... 1. The nominal risk-free rate of interest is a function of a) The real risk-free rate plus the investment's variance. b) The prime rate and the rate of inflation. c) The T-bill rate plus the inflation rate. d) The real risk-free rate and the expected rate of inflation.* 2. At the beginning of the ye ...

Stocks

... • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in one or more stocks by taking ...

... • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in one or more stocks by taking ...

Stock Market

... • Bull Market - When stock sells are on the rise • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market system failed, because no one was able to buy and sell stocks ...

... • Bull Market - When stock sells are on the rise • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market system failed, because no one was able to buy and sell stocks ...

assessing behaviour within an environment of uncertainty and risk

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

rainbow trading corporation spyglass trading. lp

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...