Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

130510496X_441953

... A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OTC notional See Figure 1.2 for exchange-trad ...

... A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OTC notional See Figure 1.2 for exchange-trad ...

Document

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

accf 5224

... Max is the chief financial officer of Vameda Corporation, a global manufacturer of mobile communication devices. Vameda is headquartered in Germany and reports its financial statements in Euros (EUR). Vameda expects to make major financial transactions in the coming months; one of them is as follows ...

... Max is the chief financial officer of Vameda Corporation, a global manufacturer of mobile communication devices. Vameda is headquartered in Germany and reports its financial statements in Euros (EUR). Vameda expects to make major financial transactions in the coming months; one of them is as follows ...

10 Reasons to Consider Adding Managed Futures to

... *1) Managed Futures: CASAM CISDM CTA Equal Weighted; 2) Stocks: MSCI World; ...

... *1) Managed Futures: CASAM CISDM CTA Equal Weighted; 2) Stocks: MSCI World; ...

Yen Interest Rate Swaps

... swaps desk in Tokyo with UK updates from the London desk after Asian hours. Real-time pricing is available in addition to ISDA® endorsed twice daily reference fixings. These reference points show fair value interest rates during the trading day. Tradition JPY swaps prices are used to compose the ISD ...

... swaps desk in Tokyo with UK updates from the London desk after Asian hours. Real-time pricing is available in addition to ISDA® endorsed twice daily reference fixings. These reference points show fair value interest rates during the trading day. Tradition JPY swaps prices are used to compose the ISD ...

Capital Markets Institutions, Instruments, and Risk

... Price Convergence on the Delivery Date 289 A Closer Look at the Theoretical Futures Price 289 General Principles of Hedging with Futures 291 Risks Associated with Hedging 291 Short Hedge and Long Hedge 292 Hedging Illustrations 292 The Role of Linear Payoff Derivatives in Financial Markets 303 Effec ...

... Price Convergence on the Delivery Date 289 A Closer Look at the Theoretical Futures Price 289 General Principles of Hedging with Futures 291 Risks Associated with Hedging 291 Short Hedge and Long Hedge 292 Hedging Illustrations 292 The Role of Linear Payoff Derivatives in Financial Markets 303 Effec ...

Sample Questions - U of L Class Index

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

Mariner Investment Group Adds Fourth Portfolio Team to Mariner

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

Risk management through introduction of futures contracts in tea

... • The contract should be closed out either by actual delivery or by cash settlement. The goods supplied under the actual delivery option should be certified by an agency operating under the aegis of the futures market organizer, who could be the broker presently licensed by the auction organizer, wh ...

... • The contract should be closed out either by actual delivery or by cash settlement. The goods supplied under the actual delivery option should be certified by an agency operating under the aegis of the futures market organizer, who could be the broker presently licensed by the auction organizer, wh ...

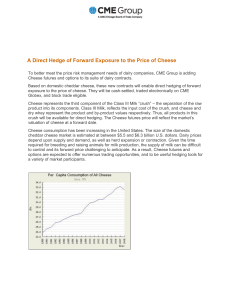

A Direct Hedge of Forward Exposure to the Price of Cheese

... A Direct Hedge of Forward Exposure to the Price of Cheese To better meet the price risk management needs of dairy companies, CME Group is adding Cheese futures and options to its suite of dairy contracts. Based on domestic cheddar cheese, these new contracts will enable direct hedging of forward exp ...

... A Direct Hedge of Forward Exposure to the Price of Cheese To better meet the price risk management needs of dairy companies, CME Group is adding Cheese futures and options to its suite of dairy contracts. Based on domestic cheddar cheese, these new contracts will enable direct hedging of forward exp ...

semester v cm05bba05 – investment management

... b. Securities in a depository are fungible c. Securities in a depository are held in dematerialized form d. Dematerialized securities have distinct numbers 93. SEBI has prescribed code of conduct for the sub broker in _____________ a. Indian contract Act,1872 b. Securities Contract (Regulation) Act ...

... b. Securities in a depository are fungible c. Securities in a depository are held in dematerialized form d. Dematerialized securities have distinct numbers 93. SEBI has prescribed code of conduct for the sub broker in _____________ a. Indian contract Act,1872 b. Securities Contract (Regulation) Act ...

Derivatives Market

... sell the futures to each other based on their contrarian view about the stock. And let’s say the expiry date for settlement of the futures contract is after 5 days. ...

... sell the futures to each other based on their contrarian view about the stock. And let’s say the expiry date for settlement of the futures contract is after 5 days. ...

Securities Markets

... Measure only the change in prices of a defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

... Measure only the change in prices of a defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

print to PDF - Willis Owen

... Commodities can be used for both diversification purposes and as a reduction in risk against certain outcomes and, when these two objectives align, there is a strong case for using them according to Pataki. A constant diversifier, gold can be used in risk management to protect against infrequent or ...

... Commodities can be used for both diversification purposes and as a reduction in risk against certain outcomes and, when these two objectives align, there is a strong case for using them according to Pataki. A constant diversifier, gold can be used in risk management to protect against infrequent or ...

OUTER LIMITS As Funds Leverage Up, Fears of Reckoning Rise

... Wall Street itself is one of the biggest users of leverage. Last year, the nation's four largest securities firms financed $3.3 trillion of assets with $129.4 billion of shareholders' equity, a leverage ratio of 25.5 to 1, according to research firm Sanford C. Bernstein & Co. In 2002, those same fi ...

... Wall Street itself is one of the biggest users of leverage. Last year, the nation's four largest securities firms financed $3.3 trillion of assets with $129.4 billion of shareholders' equity, a leverage ratio of 25.5 to 1, according to research firm Sanford C. Bernstein & Co. In 2002, those same fi ...

Derivatives and Risk Management

... a. A derivative is an indirect claim security that derives its value, in whole or in part, by the market price (or interest rate) of some other security (or market). Derivatives include options, interest rate futures, exchange rate futures, commodity futures, and swaps. b. According to COSO, enterpr ...

... a. A derivative is an indirect claim security that derives its value, in whole or in part, by the market price (or interest rate) of some other security (or market). Derivatives include options, interest rate futures, exchange rate futures, commodity futures, and swaps. b. According to COSO, enterpr ...

Citco Bank Canada Leverage Ratio Public Disclosure for Q1 2017

... Replacement cost associated with all derivative transactions (i.e. net of eligible cash variation margin) ...

... Replacement cost associated with all derivative transactions (i.e. net of eligible cash variation margin) ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... value of an underlying asset, Apanardet al. (2014). The underlying entity can be an asset, index, or interest rate, and is commonly called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements ...

... value of an underlying asset, Apanardet al. (2014). The underlying entity can be an asset, index, or interest rate, and is commonly called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements ...

Document

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

Chap31

... weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

... weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

JAMES M. SANFORD, CFA 107 STONEY HILL ROAD SAG

... associate and capital markets professional. Serve as convertible bond capital markets liaison, participating on convertible new issue pitches to investment banking clients, pricing up hypothetical new bond issues, alerting investment bankers to trends in convertib ...

... associate and capital markets professional. Serve as convertible bond capital markets liaison, participating on convertible new issue pitches to investment banking clients, pricing up hypothetical new bond issues, alerting investment bankers to trends in convertib ...

CADC2005

... •Assess client “readiness” levels and focus efforts accordingly • Sponsor or provide risk conferences, seminars or training sessions • Understand each client plan’s primary objective and benchmark(s) • Understand the client’s current portfolio asset mix • Deal in “knowns” such as annualized 4-5 year ...

... •Assess client “readiness” levels and focus efforts accordingly • Sponsor or provide risk conferences, seminars or training sessions • Understand each client plan’s primary objective and benchmark(s) • Understand the client’s current portfolio asset mix • Deal in “knowns” such as annualized 4-5 year ...

Current IASB Position Participating Contracts

... • changes in the (estimated) risk adjustment that relate to future coverage and other services for deviation risks to be born in future (not all changes + overstroked the over stroked text which is not needed even though it is a fact) • and, as sole measurement peculiarity of direct participating co ...

... • changes in the (estimated) risk adjustment that relate to future coverage and other services for deviation risks to be born in future (not all changes + overstroked the over stroked text which is not needed even though it is a fact) • and, as sole measurement peculiarity of direct participating co ...

2010-11-12 MFR Yves Smith_1

... “In 2003, when subprime market took off, real cash buyers were buying CDO’s. The weird confluence of event in 2004 -2005, real cash buyers, both in subprime market and CDO market, and this might be an accident, but the ISDA in 2005 allowed for standard contracts for credit default swaps on asset bac ...

... “In 2003, when subprime market took off, real cash buyers were buying CDO’s. The weird confluence of event in 2004 -2005, real cash buyers, both in subprime market and CDO market, and this might be an accident, but the ISDA in 2005 allowed for standard contracts for credit default swaps on asset bac ...