Obama`s Financial Plan, Round One

... enormous, virtually unregulated markets for credit default swaps and other derivatives. AIG (AIG) alone has soaked up more than $100 billion in taxpayer investment and Federal Reserve guarantees because it lacked the capital to back up its failed bets in that market. And its position is hardly uniqu ...

... enormous, virtually unregulated markets for credit default swaps and other derivatives. AIG (AIG) alone has soaked up more than $100 billion in taxpayer investment and Federal Reserve guarantees because it lacked the capital to back up its failed bets in that market. And its position is hardly uniqu ...

InOn Capital

... Distribu-ng the total amount of investment in different assets in order to reduce porLolio risk. In our opinion, diversifica-on consists in inves-ng not only in classical financial assets such as stocks, bonds, mutual funds or deriva-ves; for us to diversify means to ...

... Distribu-ng the total amount of investment in different assets in order to reduce porLolio risk. In our opinion, diversifica-on consists in inves-ng not only in classical financial assets such as stocks, bonds, mutual funds or deriva-ves; for us to diversify means to ...

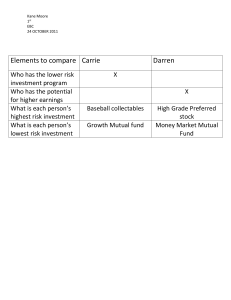

Chapter 1 - Ning.com

... financing new small business ventures that have the potential earn a great deal of money Looking for high ROI – 6 times their investment in 5 years Venture Capitalists want equity Looking ...

... financing new small business ventures that have the potential earn a great deal of money Looking for high ROI – 6 times their investment in 5 years Venture Capitalists want equity Looking ...

Description of Financial Instruments and

... stock shortly before it is offered to the public, at a specified and usually discounted price, and usually in proportion to the number of shares already owned. Rights provide leverage, the extent of which depends on the right’s exercise price relative to the price of the underlying security. Therefo ...

... stock shortly before it is offered to the public, at a specified and usually discounted price, and usually in proportion to the number of shares already owned. Rights provide leverage, the extent of which depends on the right’s exercise price relative to the price of the underlying security. Therefo ...

A Brief History of FE

... Assume that Prof. Chen had invented an formula which we can use to predict market movements very accurately. What would happen if this formula was unveiled to the public? ...

... Assume that Prof. Chen had invented an formula which we can use to predict market movements very accurately. What would happen if this formula was unveiled to the public? ...

Investment Analysis (FIN 383)

... 19. If a treasury note has a bid price of $982.50, the quoted bid price in the Wall Street Journal would be __________. A) 98:08 B) 98:25 C) 98:50 D) 98:40 19. a (98+08/32)% of par (1000) = 982.50 20. Why do call options with exercise prices higher than the price of the underlying stock sell for pos ...

... 19. If a treasury note has a bid price of $982.50, the quoted bid price in the Wall Street Journal would be __________. A) 98:08 B) 98:25 C) 98:50 D) 98:40 19. a (98+08/32)% of par (1000) = 982.50 20. Why do call options with exercise prices higher than the price of the underlying stock sell for pos ...

Back to basics on Risk Management – Futures

... Futures contracts are exchange-traded and therefore, standardised contracts. Forward contracts, on the other hand, are private agreements between two parties. The private nature of Forward contracts means that there is a chance that a party may default on its side of the agreement. In contrast, Futu ...

... Futures contracts are exchange-traded and therefore, standardised contracts. Forward contracts, on the other hand, are private agreements between two parties. The private nature of Forward contracts means that there is a chance that a party may default on its side of the agreement. In contrast, Futu ...

Futures, Forwards, Options and Swaps FOCUS OF THE CHAPTER

... Financial Futures and Forwards Future contracts are agreements to accept (buy) or make delivery of (sell) an asset on a particular future date at a price struck today. In a spot market (cash market), the asset is delivered at the same time as the determination of price. Future contracts are made bot ...

... Financial Futures and Forwards Future contracts are agreements to accept (buy) or make delivery of (sell) an asset on a particular future date at a price struck today. In a spot market (cash market), the asset is delivered at the same time as the determination of price. Future contracts are made bot ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

PPT

... extremely helpful financial instruments. • They can reduce risk, allowing firms and individual to enter into agreements that they could not have otherwise. • Derivatives can also be used an insurance against future events. • This chapter will provide an introduction to the use and abuse of derivativ ...

... extremely helpful financial instruments. • They can reduce risk, allowing firms and individual to enter into agreements that they could not have otherwise. • Derivatives can also be used an insurance against future events. • This chapter will provide an introduction to the use and abuse of derivativ ...

Lecture Notes

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

... monetary exposure of the parties under the terms of the derivative instrument. As money usually is not due until the specified date of performance of the parties' obligations, lack of up-front commitment of cash may obscure the eventual monetary significance of the parties' obligations. An often ove ...

Allan Thomson, CEO, Dreadnought Capital, South Africa

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

Macroprudential_Tsatsaronis_Presentation

... interactions that can be used for analysis of macrofinancial risk How can we calibrate the instruments of policy? ...

... interactions that can be used for analysis of macrofinancial risk How can we calibrate the instruments of policy? ...

NATIONAL ASSEMBLY

... Whether the Public Investment Corporation holds any financial interest in certain companies (name furnished) in the form of (a) equity, (b) debt or (c) any other form; if not, why not; if so, what (i) was the initial value of the financial interest, (ii) was the date of the transaction, (iii) is the ...

... Whether the Public Investment Corporation holds any financial interest in certain companies (name furnished) in the form of (a) equity, (b) debt or (c) any other form; if not, why not; if so, what (i) was the initial value of the financial interest, (ii) was the date of the transaction, (iii) is the ...

Institute of Actuaries of India Subject ST5 – Finance and Investment A

... suggested by CFO but the strategy is fraught with risks Highlight the lack of expertise of the company in entering into the deal Futures trading in chemical X have recently started. What if the exchange finds that the required volumes are not to their expectations and discontinue it. Company will be ...

... suggested by CFO but the strategy is fraught with risks Highlight the lack of expertise of the company in entering into the deal Futures trading in chemical X have recently started. What if the exchange finds that the required volumes are not to their expectations and discontinue it. Company will be ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... Quanto swap: Pay S&P 500 return, receive CAC-40 + swap spread Notional principal ($millions) ...

... Quanto swap: Pay S&P 500 return, receive CAC-40 + swap spread Notional principal ($millions) ...

Interest Rate Risk

... Preserving principal – this means to protect UNDP cash and investment asset in US$ term against sovereign risk, credit risk, foreign currency exchange risk (see definitions below). b. Liquidity –to ensure that the cash and investment asset investment periods are structured in such a way as to meet o ...

... Preserving principal – this means to protect UNDP cash and investment asset in US$ term against sovereign risk, credit risk, foreign currency exchange risk (see definitions below). b. Liquidity –to ensure that the cash and investment asset investment periods are structured in such a way as to meet o ...

financial engineer / front office quantitative researcher

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

chapter overview

... 10. The pros and cons of forward contracts and swaps lie within how each works. A forward contract can be arranged between a purchaser and a seller, and is dependent upon each participant’s beliefs of what will happen in the future. Sometimes it can be difficult to match counterparties to such contr ...

... 10. The pros and cons of forward contracts and swaps lie within how each works. A forward contract can be arranged between a purchaser and a seller, and is dependent upon each participant’s beliefs of what will happen in the future. Sometimes it can be difficult to match counterparties to such contr ...

Price discrimination Suppose a monopolist produces its output at a

... firm’s goal is to maximize profit by selecting the amount of output to sell in each market. Call these two amounts q1 and q2, with Q = q1 + q2. Let demand in the first market be given by P1 = f(q1) and in the second market by P2 = g(q2). The firm’s profit is the sum of price times quantity in each m ...

... firm’s goal is to maximize profit by selecting the amount of output to sell in each market. Call these two amounts q1 and q2, with Q = q1 + q2. Let demand in the first market be given by P1 = f(q1) and in the second market by P2 = g(q2). The firm’s profit is the sum of price times quantity in each m ...

The primary objective of business financial

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

Class Intro and Introduction to Futures

... Planting decisions can be made a full year (or more) before the crop price is realized Users provide year-round demand Livestock feeding, biofuel production, food demand ...

... Planting decisions can be made a full year (or more) before the crop price is realized Users provide year-round demand Livestock feeding, biofuel production, food demand ...

CHAPTER 10: Equity Markets

... appropriate discount rate to use in the present value calculation. Finally, apply the discount rate to the cash flows in each period to obtain present values and sum the present values to obtain the price of the security. 2. What cash flows are relevant to the value of stock? Dividends and capital g ...

... appropriate discount rate to use in the present value calculation. Finally, apply the discount rate to the cash flows in each period to obtain present values and sum the present values to obtain the price of the security. 2. What cash flows are relevant to the value of stock? Dividends and capital g ...