Soln Ch 21 Futures intro

... 15. The treasurer would like to buy the bonds today, but cannot. As a proxy for this purchase, T-bond futures contracts can be purchased. If rates do in fact fall, the treasurer will have to buy back the bonds for the sinking fund at prices higher than the prices at which they could be purchased tod ...

... 15. The treasurer would like to buy the bonds today, but cannot. As a proxy for this purchase, T-bond futures contracts can be purchased. If rates do in fact fall, the treasurer will have to buy back the bonds for the sinking fund at prices higher than the prices at which they could be purchased tod ...

Kein Folientitel - John Wiley & Sons

... Securities: fixed-income markets Bonds serve many purposes in national and international markets: Investors hold them because of their low risk profile and long maturities. Government bonds are widely used as hedging instruments, in the expectation that their development may compensate for loss ...

... Securities: fixed-income markets Bonds serve many purposes in national and international markets: Investors hold them because of their low risk profile and long maturities. Government bonds are widely used as hedging instruments, in the expectation that their development may compensate for loss ...

r~ erivatives" has become a code word for anything financial... )bites you when you least expect it. Everyone has read...

... the right, but not the obligation, to purchase or sell a security at some future date at a predetermined price. ...

... the right, but not the obligation, to purchase or sell a security at some future date at a predetermined price. ...

Diapositiva 1

... long time waiting for the correction and eventually run out of funds If a manager simply sells an asset judged to be overvalued, and the correction does not take place in a short time, it will lose clients. ...

... long time waiting for the correction and eventually run out of funds If a manager simply sells an asset judged to be overvalued, and the correction does not take place in a short time, it will lose clients. ...

RMS Policy - Adinath Capital Services Limited

... 1 .2) Margin: The underlying stake provided by the customer in the form of cash, FDR and/or stock to mitigate market (price) or settlement (auction) risk 1 .3) Exposure : The aggregate of the customer’s obligations arising out of buy + sell trades awaiting settlement in the cash segment and profit/ ...

... 1 .2) Margin: The underlying stake provided by the customer in the form of cash, FDR and/or stock to mitigate market (price) or settlement (auction) risk 1 .3) Exposure : The aggregate of the customer’s obligations arising out of buy + sell trades awaiting settlement in the cash segment and profit/ ...

pdf

... once a quarter) and are not known in advance. For simplicity, we will approximate this effect by assuming that the market can project dividends with good accuracy (a reasonable assumption over short time periods), while noting that any uncertainty will widen the bounds within which arbitrage can det ...

... once a quarter) and are not known in advance. For simplicity, we will approximate this effect by assuming that the market can project dividends with good accuracy (a reasonable assumption over short time periods), while noting that any uncertainty will widen the bounds within which arbitrage can det ...

Lawrence G. McDonald

... Volker Rule: modified from its initial form to include multiple exceptions for permitted activities, as well as “de minimus” allowances for investments in hedge funds and private equity. While proprietary trading was also more specifically defined based on what has been commonly referred to as the M ...

... Volker Rule: modified from its initial form to include multiple exceptions for permitted activities, as well as “de minimus” allowances for investments in hedge funds and private equity. While proprietary trading was also more specifically defined based on what has been commonly referred to as the M ...

Marketing plan Powerpoint

... Not having a any plan Selling all commodities at the same time (especially right off the combine) • Being unrealistic about what you the commodity will be worth. • Starting too late. ...

... Not having a any plan Selling all commodities at the same time (especially right off the combine) • Being unrealistic about what you the commodity will be worth. • Starting too late. ...

Transaction Exposure

... What causes transaction exposure? Purchasing or selling on credit. Borrowing or lending in foreign currency. Being party to unperformed forward contract. Acquiring assets/ incurring liabilities in foreign currency. ...

... What causes transaction exposure? Purchasing or selling on credit. Borrowing or lending in foreign currency. Being party to unperformed forward contract. Acquiring assets/ incurring liabilities in foreign currency. ...

Video Answers for Teachers

... Arbitration provides investors with a platform to resolve their disputes outside the courts with someone in the industry in a low cost way. ...

... Arbitration provides investors with a platform to resolve their disputes outside the courts with someone in the industry in a low cost way. ...

The Subprime Crisis And The Yin and Yang of Financial

... transactions can be done without owning the underlying entities and can generate huge gains or losses through leveraging Through CDS, banks found partners in hedge funds, where lightly regulated pools of capital are looking for high returns (as well as insurance companies and pension funds that were ...

... transactions can be done without owning the underlying entities and can generate huge gains or losses through leveraging Through CDS, banks found partners in hedge funds, where lightly regulated pools of capital are looking for high returns (as well as insurance companies and pension funds that were ...

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

Technical analysis

... problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several procedures for reporting expenses, assets, or lia ...

... problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several procedures for reporting expenses, assets, or lia ...

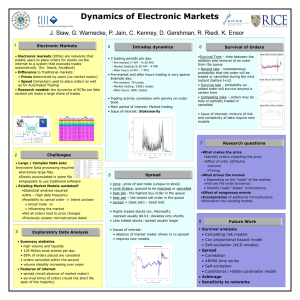

SciDAC Poster: INCITE

... • 3 trading periods per day: – Pre-market (7 AM – 9:30 AM) – Market trading (9:30 AM – 4 PM) – After hours (4 PM – 7 PM) ...

... • 3 trading periods per day: – Pre-market (7 AM – 9:30 AM) – Market trading (9:30 AM – 4 PM) – After hours (4 PM – 7 PM) ...

Lessons from the Swaps Cases

... reading of the Local Government Act 1972 which had long been taken to grant capacity to local authorities to enter into interest rate swaps transactions. Much of that decision revolved around an underlying conviction that there is something necessarily suspicious about derivatives.8 This conviction ...

... reading of the Local Government Act 1972 which had long been taken to grant capacity to local authorities to enter into interest rate swaps transactions. Much of that decision revolved around an underlying conviction that there is something necessarily suspicious about derivatives.8 This conviction ...

Diversifiable

... An insurance company sells a customer a guaranteed investment contract that promises to pay $1,000 five years from now for a one-time premium today of $783.53 (interest rate=5%). The insurance company can match its assets to this liabilities by buying a five-year government zero-coupon bond for less ...

... An insurance company sells a customer a guaranteed investment contract that promises to pay $1,000 five years from now for a one-time premium today of $783.53 (interest rate=5%). The insurance company can match its assets to this liabilities by buying a five-year government zero-coupon bond for less ...

Contract formation

... – Consideration- not all promises are enforced- must contain consideration to fall under legal review • Bargain- must be value for both sides • Reliance- one party must act on the assumption that the other party will comply with terms (borrow money to begin construction) • Past consideration or make ...

... – Consideration- not all promises are enforced- must contain consideration to fall under legal review • Bargain- must be value for both sides • Reliance- one party must act on the assumption that the other party will comply with terms (borrow money to begin construction) • Past consideration or make ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... derivative. Derivative contracts are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. The OTC derivative market is the largest market for derivatives and largely unregulated with respect to disclosure of information between part ...

... derivative. Derivative contracts are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. The OTC derivative market is the largest market for derivatives and largely unregulated with respect to disclosure of information between part ...

Chapter 259 South African Rand/US Dollar (ZAR/USD)

... Interpretations & Special Notices Section of Chapter 5. A Person seeking an exemption from position limits for bona fide commercial purposes shall apply to the Market Regulation Department on forms provided by the Exchange, and the Market Regulation Department may grant qualified exemptions in its s ...

... Interpretations & Special Notices Section of Chapter 5. A Person seeking an exemption from position limits for bona fide commercial purposes shall apply to the Market Regulation Department on forms provided by the Exchange, and the Market Regulation Department may grant qualified exemptions in its s ...

Chapter 8

... able to achieve without derivatives, or could achieve only at greater cost – Hedge risks that otherwise would not be possible to hedge – Make underlying markets more efficient (price discovery) – Reduce volatility of stock returns (by writing call options on stocks you own) – Minimize earnings volat ...

... able to achieve without derivatives, or could achieve only at greater cost – Hedge risks that otherwise would not be possible to hedge – Make underlying markets more efficient (price discovery) – Reduce volatility of stock returns (by writing call options on stocks you own) – Minimize earnings volat ...

numbering template.indd

... ERISA requirement that plan sponsor stock held by an ESOP must be appraised by an independent third party Assist Fiduciary in establishing fair market value ...

... ERISA requirement that plan sponsor stock held by an ESOP must be appraised by an independent third party Assist Fiduciary in establishing fair market value ...

Collateralized Debt Obligations – an overview

... CDO deals are motivated by the opportunity to add value by repackaging collateral into tranches (same motivation for most CMOs). In finance, market efficiency theory suggests that the securities of a CDO should have the same market value as its underlying collateral (taking into account correlation) ...

... CDO deals are motivated by the opportunity to add value by repackaging collateral into tranches (same motivation for most CMOs). In finance, market efficiency theory suggests that the securities of a CDO should have the same market value as its underlying collateral (taking into account correlation) ...

Foreign Exchange Risk in International Transactions

... Abstract. Every international business is affected by the ever-changing value of the currencies implied in contracts. While many of us consider this unpredictability a nuisance, the volatility of currencies around the world can mean the difference between success and failure for many exporters/impor ...

... Abstract. Every international business is affected by the ever-changing value of the currencies implied in contracts. While many of us consider this unpredictability a nuisance, the volatility of currencies around the world can mean the difference between success and failure for many exporters/impor ...

The Returns and Risks From Investing

... ◦ No guarantee future will be like the past ◦ Also no reason to assume that relative relationships will be much different in the future than they are now ◦ Especially useful in the long-run ...

... ◦ No guarantee future will be like the past ◦ Also no reason to assume that relative relationships will be much different in the future than they are now ◦ Especially useful in the long-run ...

on futures contracts

... – A long position benefits if interest rates fall. A bank that has short term loans funded by longer term debt could hedge its funding risk with a long position. ...

... – A long position benefits if interest rates fall. A bank that has short term loans funded by longer term debt could hedge its funding risk with a long position. ...