countrywide financial corporation and the subprime mortgage

... Firstly, this type of reform instituted does not promote long-term economic progress. It incentivizes behavior that is counterproductive to financial prosperity. Secondly, not enough significant reform materialized to ensure that institutions act in the best interest of all parties involved and that ...

... Firstly, this type of reform instituted does not promote long-term economic progress. It incentivizes behavior that is counterproductive to financial prosperity. Secondly, not enough significant reform materialized to ensure that institutions act in the best interest of all parties involved and that ...

Saunders Cornett Chapter 27

... This chapter discusses the growing role of loan sales and other techniques that can be used to address the control of credit risk in FIs. The use of loan sales is not new and may even involve foreign loans. With development of secondary markets for many types of loans, and securitized variants, loan ...

... This chapter discusses the growing role of loan sales and other techniques that can be used to address the control of credit risk in FIs. The use of loan sales is not new and may even involve foreign loans. With development of secondary markets for many types of loans, and securitized variants, loan ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 4Q16

... Year over year borrowings increased 34.5% due largely to securitization of residential mortgages in order to make up the funding gap between the growth in assets and deposits. Securitization programs have increased by 31.5% in 4Q16 while all other borrowings decreased. There are currently 17 indepen ...

... Year over year borrowings increased 34.5% due largely to securitization of residential mortgages in order to make up the funding gap between the growth in assets and deposits. Securitization programs have increased by 31.5% in 4Q16 while all other borrowings decreased. There are currently 17 indepen ...

Housing Finance in Emerging Markets: Policy and

... Credit Reports and Credit Scoring are used to determine credit stability and allow instant feedback on credit quality Credit scoring is a statistical modeling technique that evaluates the degree of risk posed by a prospective borrower or existing customer Automated Underwriting combines credit repor ...

... Credit Reports and Credit Scoring are used to determine credit stability and allow instant feedback on credit quality Credit scoring is a statistical modeling technique that evaluates the degree of risk posed by a prospective borrower or existing customer Automated Underwriting combines credit repor ...

1 Introduction 2 Analytical Framework

... will abstain from taking loans and making investments. ...

... will abstain from taking loans and making investments. ...

UNCTAD’s Seventh Debt Management Conference Towards Sovereign, Democratic, Responsible Lending

... and conditions, including: • Make clear statements of purpose, amount, interest rates, fees and charges, grace and maturity periods, and beneficiaries of loans. • No confidential side-letters and any related host government agreements must be included in the loan documentation. • Borrowers spend fun ...

... and conditions, including: • Make clear statements of purpose, amount, interest rates, fees and charges, grace and maturity periods, and beneficiaries of loans. • No confidential side-letters and any related host government agreements must be included in the loan documentation. • Borrowers spend fun ...

Best Of Times Often Have Followed Worst Of Times

... major lenders outside the program have also reported tighter credit. The ARC program provides business owners with short-term loans of up to $35,000 that may be used temporarily to cover payments on existing debt. The SBA is subsidizing the loans, making them interest free to business owners. No rep ...

... major lenders outside the program have also reported tighter credit. The ARC program provides business owners with short-term loans of up to $35,000 that may be used temporarily to cover payments on existing debt. The SBA is subsidizing the loans, making them interest free to business owners. No rep ...

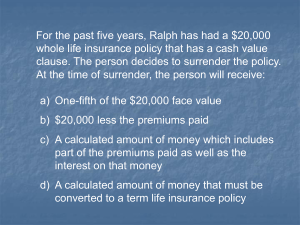

questions in real estate finance

... Allows the lender to adjust the contract interest rate periodically to reflect changes in market interest rates. This change in the rate is generally reflected by a change in the monthly payment Provisions to limit rate changes Initial rate is generally less than FRM rate ...

... Allows the lender to adjust the contract interest rate periodically to reflect changes in market interest rates. This change in the rate is generally reflected by a change in the monthly payment Provisions to limit rate changes Initial rate is generally less than FRM rate ...

Pre-Qualified vs. Pre-Approved - What`s The

... lender “pre-qualifies” them for a mortgage this means that they have been “pre-approved” for a home loan. Unfortunately, there's a world of difference between these two terms. If you've ever been confused by the two, we’ll bring you up to speed on how these terms differ and why a misunderstanding ca ...

... lender “pre-qualifies” them for a mortgage this means that they have been “pre-approved” for a home loan. Unfortunately, there's a world of difference between these two terms. If you've ever been confused by the two, we’ll bring you up to speed on how these terms differ and why a misunderstanding ca ...

2009 - Homex

... org.mx) the statistics of new homes being built by home builders registered. registered. New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...

... org.mx) the statistics of new homes being built by home builders registered. registered. New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...

Econ Unit 2 Personal Finance Notes

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

... borrowers can get themselves into serious financial trouble! Credit Cards v. Debit Cards When you use a credit card, you are borrowing money from the credit issuers as a loan that you will pay back with interest APR is the annual percentage rate that is charged for borrowing; these rates vary (usu ...

Mortgage Credit & Subprime Lending: Implications of a

... originated in 2004-2006 period. Implies $200250 billion mark-to-market loss for CDO holders. • Spreads on cash and derivative transactions involving subprime loans have widened considerably. Entire class of complex structured assets is discredited, perhaps for years, though secondary market for coll ...

... originated in 2004-2006 period. Implies $200250 billion mark-to-market loss for CDO holders. • Spreads on cash and derivative transactions involving subprime loans have widened considerably. Entire class of complex structured assets is discredited, perhaps for years, though secondary market for coll ...

Loan Agreement - Act respecting financial assistance for education

... her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rule will also apply to a borrower who is no longer deemed to be experie ...

... her last known address. This agreement will be deemed accepted by the borrower if he or she does not request that the lender modify the terms and conditions of the agreement within 15 days of the date on which it was sent. This rule will also apply to a borrower who is no longer deemed to be experie ...

Mortgage Loans

... residential mortgage loans. Entities that are not depository institutions typically are required to be state licensed to engage in the business of making residential mortgage loans. Lien — A legal claim on ownership of the house stemming from a debt. Loan Amount — The dollar amount of the credit tha ...

... residential mortgage loans. Entities that are not depository institutions typically are required to be state licensed to engage in the business of making residential mortgage loans. Lien — A legal claim on ownership of the house stemming from a debt. Loan Amount — The dollar amount of the credit tha ...

RAMS Family Law guidelines

... Part A - For parties where the court has made an order on the lender Guidelines for parties involved in family law proceedings where the court has made an order on the bank. 1. In the course of a family court proceeding, the court may make an order requiring the lender to relieve one of you from you ...

... Part A - For parties where the court has made an order on the lender Guidelines for parties involved in family law proceedings where the court has made an order on the bank. 1. In the course of a family court proceeding, the court may make an order requiring the lender to relieve one of you from you ...

A Time-Series Analysis of US Savings and Loan Performance: Major Trends and Policy Issues After the Housing Crisis:

... 1977 chiefly offered banking institutions deregulatory incentives to provide loans to lowand moderate-income borrowers, mainly those classified as subprime borrowers. Furthermore, the ―Federal Housing Administration, which guarantees mortgage loans of many first-time borrowers, liberalized its rule ...

... 1977 chiefly offered banking institutions deregulatory incentives to provide loans to lowand moderate-income borrowers, mainly those classified as subprime borrowers. Furthermore, the ―Federal Housing Administration, which guarantees mortgage loans of many first-time borrowers, liberalized its rule ...

2017 2018 policy i borrowing framework policy

... benefits. It gives the Issuer a benchmark for further issues. If there are several large maturities that are listed / quoted, it may be possible that a small add-on issue could be put into the market at a lower cost than a new issue. A Municipal Bond issue is an alternative to Bank loans or struct ...

... benefits. It gives the Issuer a benchmark for further issues. If there are several large maturities that are listed / quoted, it may be possible that a small add-on issue could be put into the market at a lower cost than a new issue. A Municipal Bond issue is an alternative to Bank loans or struct ...

Modeling and Forecasting Customer Behavior for Revolving Credit

... any particular time, but may take part or all of the funds at any time over a period of several years. This agreement is common in situations in which a business must pay obligations but its operating cashflow varies, for e.g. seasonally. At any given time, the balance due may fluctuate from zero to ...

... any particular time, but may take part or all of the funds at any time over a period of several years. This agreement is common in situations in which a business must pay obligations but its operating cashflow varies, for e.g. seasonally. At any given time, the balance due may fluctuate from zero to ...

Going Into Debt $$$

... Bankruptcy – the inability to pay debts based on the income received Buying on credit is a serious consumer activity During bankruptcy creditors must give up much of what they own and are still responsible to pay certain debts (taxes). Personal bankruptcy remains on your record for 10 years and make ...

... Bankruptcy – the inability to pay debts based on the income received Buying on credit is a serious consumer activity During bankruptcy creditors must give up much of what they own and are still responsible to pay certain debts (taxes). Personal bankruptcy remains on your record for 10 years and make ...

Trends in loans to the private sector and their fundamental

... Netherlands have seen rather sharp rises in house prices recently, accompanied by a strong demand for mortgage refinancing. In addition, inter-country differences in non-interest components of the cost of loans (e.g. collateral requirements and other conditions attached to contracts) can be relevant ...

... Netherlands have seen rather sharp rises in house prices recently, accompanied by a strong demand for mortgage refinancing. In addition, inter-country differences in non-interest components of the cost of loans (e.g. collateral requirements and other conditions attached to contracts) can be relevant ...

Jumpstart Financial Literacy

... b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...

... b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...

LCQ12: Measures to combat unscrupulous business practices of

... Legislative Council today (November 2): Question: In recent months, quite a number of members of the public have relayed to me that fraudulent cases involving financial intermediaries (intermediaries) have frequently occurred, even with some victims who had been charged exorbitant intermediary fees ...

... Legislative Council today (November 2): Question: In recent months, quite a number of members of the public have relayed to me that fraudulent cases involving financial intermediaries (intermediaries) have frequently occurred, even with some victims who had been charged exorbitant intermediary fees ...

Riding the Stagecoach to Hell: A Qualitative Analysis of

... As in the private sector, the HOLC and the FHA discouraged lending to black borrowers and recommended the use of restrictive covenants. In addition, however, federal authorities developed a new discriminatory tool known as the “residential security map,” which was used to color-code neighborhoods in ...

... As in the private sector, the HOLC and the FHA discouraged lending to black borrowers and recommended the use of restrictive covenants. In addition, however, federal authorities developed a new discriminatory tool known as the “residential security map,” which was used to color-code neighborhoods in ...

Jumpstart Financial Literacy

... b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...

... b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...

The Collateral Consequences of Payday Loan Debt

... Each year, over twelve million Americans use payday loans often in an attempt to solve a financial crisis.1 Payday loans and their companion car title loans often charge exorbitant rates in exchange for cash. A typical payday loan has an annualized interest rate of 391%.2 A significant body of resea ...

... Each year, over twelve million Americans use payday loans often in an attempt to solve a financial crisis.1 Payday loans and their companion car title loans often charge exorbitant rates in exchange for cash. A typical payday loan has an annualized interest rate of 391%.2 A significant body of resea ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.