chapter 3 - UniMAP Portal

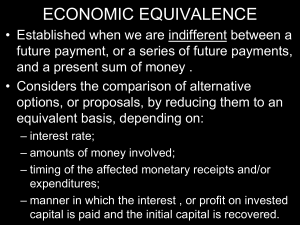

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

Senior Loan Term Sheet

... interest rate protection agreements entered into with any Lender (or any affiliate of any Lender) will be secured by substantially all the assets of Holdings, the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral ...

... interest rate protection agreements entered into with any Lender (or any affiliate of any Lender) will be secured by substantially all the assets of Holdings, the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral ...

The Freedom Recovery Plan

... former lender, or a subsequent assignee of title to the home and the Recovery Lease) and the tenant (the former homeowner, with no right of assignment or sublease). The Recovery Lease is the result of a settlement under the Plan in which the lender becomes the sole owner of the home and the borrower ...

... former lender, or a subsequent assignee of title to the home and the Recovery Lease) and the tenant (the former homeowner, with no right of assignment or sublease). The Recovery Lease is the result of a settlement under the Plan in which the lender becomes the sole owner of the home and the borrower ...

mortgage loan terms - Yorkshire Building Society

... • checking that any insurance of the Property which you have arranged is adequate for our purposes; • insuring the Property. 6.4 Arrears Charges. If your Loan Account falls into arrears, then we will charge you arrears administration fees. The time from when we start charging these fees and the amou ...

... • checking that any insurance of the Property which you have arranged is adequate for our purposes; • insuring the Property. 6.4 Arrears Charges. If your Loan Account falls into arrears, then we will charge you arrears administration fees. The time from when we start charging these fees and the amou ...

finance company

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

... • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt expense and administrative costs of home equity loans are lower and have become a very attractive pr ...

Introduction to Personal Finance

... Buying things on credit was Uncommon Illegal for lenders to charge interest rates high enough to make a profit. Lending money was not a money making business. Small loan sharks offered loans at EXTREMELY high interest rates ...

... Buying things on credit was Uncommon Illegal for lenders to charge interest rates high enough to make a profit. Lending money was not a money making business. Small loan sharks offered loans at EXTREMELY high interest rates ...

top 2016 developments in real estate

... Bedford-Stuyvesant neighborhood of New York City. This loan was funded through the website of Haitou360, an investment service in New York with offices in China. The loan involved a 13% return for the Chinese investors, who funded the loan in Chinese renminbi, but will be paid in U.S. dollars becaus ...

... Bedford-Stuyvesant neighborhood of New York City. This loan was funded through the website of Haitou360, an investment service in New York with offices in China. The loan involved a 13% return for the Chinese investors, who funded the loan in Chinese renminbi, but will be paid in U.S. dollars becaus ...

The Five C`s of Credit

... need a fully articulated business strategy and be ready to answer the hard questions about how your business is going to succeed over the long term. Most lenders also require a formal written business plan. The following list of questions is a starting point, but your particular business or industry ...

... need a fully articulated business strategy and be ready to answer the hard questions about how your business is going to succeed over the long term. Most lenders also require a formal written business plan. The following list of questions is a starting point, but your particular business or industry ...

business plans

... enough cash to repay current debt and provide a reasonable investment to the owners. It will also serve as a profit and loss statement projected one year into the future. The budget serves as a feasibility study to determine if the venture will be successful. It is unusual for the budget of a newly ...

... enough cash to repay current debt and provide a reasonable investment to the owners. It will also serve as a profit and loss statement projected one year into the future. The budget serves as a feasibility study to determine if the venture will be successful. It is unusual for the budget of a newly ...

Tightest Credit Market in 16 Years Rejects Bernanke`s Bid

... after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standards in the U.S. are so high and inflexible that former Federal Reserve Chairman Ben S. Bernanke, no ...

... after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standards in the U.S. are so high and inflexible that former Federal Reserve Chairman Ben S. Bernanke, no ...

Word

... purchase of real estate for rent. The rates were low throughout the whole year 2015, regardless of the fixation period. Nevertheless, those who negotiated the loan in June with the fixation of the interest rate over 1 and up to 5 years (2.32%), reached the most advantageous conditions, even historic ...

... purchase of real estate for rent. The rates were low throughout the whole year 2015, regardless of the fixation period. Nevertheless, those who negotiated the loan in June with the fixation of the interest rate over 1 and up to 5 years (2.32%), reached the most advantageous conditions, even historic ...

UK property markets

... (a) Per cent of buy-to-let mortgages originated over the five quarters to 2015 Q1 for which interest payments would exceed 125% of rental income for a given rise in mortgage interest rates. (b) Per cent of owner-occupier mortgages originated over the five quarters to 2015 Q1 for which interest payme ...

... (a) Per cent of buy-to-let mortgages originated over the five quarters to 2015 Q1 for which interest payments would exceed 125% of rental income for a given rise in mortgage interest rates. (b) Per cent of owner-occupier mortgages originated over the five quarters to 2015 Q1 for which interest payme ...

How Risk-Based Loans Would Help Students Achieve Better

... education—even though they could yield higher pay-offs—as well as in home ownership, retirement plans, and entrepreneurship. Finally, to the extent that income-contingent repayment plans allow loan-balance forgiveness after a certain number of years, they increase the likelihood of financial losses ...

... education—even though they could yield higher pay-offs—as well as in home ownership, retirement plans, and entrepreneurship. Finally, to the extent that income-contingent repayment plans allow loan-balance forgiveness after a certain number of years, they increase the likelihood of financial losses ...

The Impact of High Lending Rates on Borrowers` Ability to pay Back

... the respondents (borrowers) were also of the view that the current lending rate was rather too high. It was also found out that high lending rates affected borrowers’ ability to pay back because they cannot make enough returns from their businesses to service their loans. Based on this notion, the b ...

... the respondents (borrowers) were also of the view that the current lending rate was rather too high. It was also found out that high lending rates affected borrowers’ ability to pay back because they cannot make enough returns from their businesses to service their loans. Based on this notion, the b ...

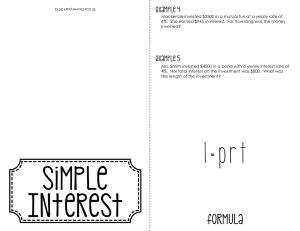

I = prt - SWMStbradford

... A bank offers an annual simple interest rate of 7% on home improvement loans. How much would Tony owe is he borrowed $8,000 for 18 months? ...

... A bank offers an annual simple interest rate of 7% on home improvement loans. How much would Tony owe is he borrowed $8,000 for 18 months? ...

Well Worth Saving: How the New Deal Safeguarded Home Ownership

... general meaning of paying off debt over time with regular payments. Shortterm balloon mortgages had long been the most common contract form, but the expansion of B&Ls led to a large number of borrowers with B&L-style contracts known as share-accumulation contracts, explained further below. To borrow ...

... general meaning of paying off debt over time with regular payments. Shortterm balloon mortgages had long been the most common contract form, but the expansion of B&Ls led to a large number of borrowers with B&L-style contracts known as share-accumulation contracts, explained further below. To borrow ...

Code of Advertising Practice for Banks_June2010

... (i) The calculation of the EIR for every loan product has to include all upfront administration/processing fees regardless of whether these fees are fixed or variable. (ii) Upfront administration/processing fees which vary according to the loan tenors or loan amounts must be included in the calculat ...

... (i) The calculation of the EIR for every loan product has to include all upfront administration/processing fees regardless of whether these fees are fixed or variable. (ii) Upfront administration/processing fees which vary according to the loan tenors or loan amounts must be included in the calculat ...

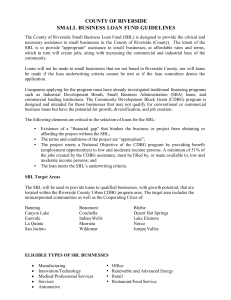

county of riverside small business loan fund guidelines

... created/retained shall be held by Target Income group persons. ...

... created/retained shall be held by Target Income group persons. ...

DOCX - World bank documents

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

REAL ESTATE SETTLEMENT PROCEDURES ACT (RESPA) T E

... each credit report that Countrywide ordered. Countrywide passed that cost onto each customer who “locked in” a loan. The cost of the credit report Countrywide ordered for a customer who did not ultimately get a loan through Countrywide could not be passed on but was instead absorbed by Countrywide. ...

... each credit report that Countrywide ordered. Countrywide passed that cost onto each customer who “locked in” a loan. The cost of the credit report Countrywide ordered for a customer who did not ultimately get a loan through Countrywide could not be passed on but was instead absorbed by Countrywide. ...

Corporation Tax treatment of interest-free loans and other

... IFRS, FRS 101 and FRS 102 while in 2016 small companies will be expected to apply FRS 102 (either in full or under Section 1A). In each case the requirements for financial instruments under the new accounting standards will differ from that under Old UK GAAP (where FRS 26 has not been applied). One ...

... IFRS, FRS 101 and FRS 102 while in 2016 small companies will be expected to apply FRS 102 (either in full or under Section 1A). In each case the requirements for financial instruments under the new accounting standards will differ from that under Old UK GAAP (where FRS 26 has not been applied). One ...

What can a lender learn from a loan application?

... payments. In 1992, the borrowers had obtained a home loan for about $53,000 to build a house. The borrowers had subsequently found it necessary to take out a series of loans, each one refinancing the last and for a larger amount, in order to meet interest and expenses. The case concerned a loan ent ...

... payments. In 1992, the borrowers had obtained a home loan for about $53,000 to build a house. The borrowers had subsequently found it necessary to take out a series of loans, each one refinancing the last and for a larger amount, in order to meet interest and expenses. The case concerned a loan ent ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.