mortny m McCormally 3-14

... Number and severity of federal and state banking agency enforcement actions are increasing Number and severity of state attorneys general enforcement actions are increasing Enhanced coordination between banking agencies and FTC is likely to increase number and severity of FTC enforcement actio ...

... Number and severity of federal and state banking agency enforcement actions are increasing Number and severity of state attorneys general enforcement actions are increasing Enhanced coordination between banking agencies and FTC is likely to increase number and severity of FTC enforcement actio ...

Chapter 1

... diversify. Also, liabilities of some financial intermediaries (depository institutions) are ...

... diversify. Also, liabilities of some financial intermediaries (depository institutions) are ...

PowerPoint-presentasjon

... • Borrowers are personally liable for their debt, also for outstanding debt post foreclosure and forced sale • Swift foreclosure regime upon non-payment • Individual borrowers have tight relationship with their lenders • Transparent information about borrowers ...

... • Borrowers are personally liable for their debt, also for outstanding debt post foreclosure and forced sale • Swift foreclosure regime upon non-payment • Individual borrowers have tight relationship with their lenders • Transparent information about borrowers ...

Determinants of Asset Quality

... npli,t = α1 + β1bcyclei,t + β2inflationi,t + β3reeri,t + β4int_ri,t + β5unratei,t + β6t_trade +β7bcpi,t +β8bcp*cyclei,t + εi,t (3) for panel data i = 1,...., 96 and t = 1998,....,2005. ...

... npli,t = α1 + β1bcyclei,t + β2inflationi,t + β3reeri,t + β4int_ri,t + β5unratei,t + β6t_trade +β7bcpi,t +β8bcp*cyclei,t + εi,t (3) for panel data i = 1,...., 96 and t = 1998,....,2005. ...

Credit

... The item used as security must be left at the pawnshop until the loan is repaid The amount of loan is only half the market value of the item used as security The finance charge is high & the maturity is short If fail to repay, you will lose the item to the creditor ...

... The item used as security must be left at the pawnshop until the loan is repaid The amount of loan is only half the market value of the item used as security The finance charge is high & the maturity is short If fail to repay, you will lose the item to the creditor ...

Determinants of Microfinance Loan Performance and Fluctuation Over the Business Cycle

... reduces external financing inefficiencies and lowers the cost of borrowing. Over the business cycle, borrowers’ net worth increases and decreases procyclically. The result of these fluctuations is that external financing becomes more expensive during bad economic periods, which amplifies the real b ...

... reduces external financing inefficiencies and lowers the cost of borrowing. Over the business cycle, borrowers’ net worth increases and decreases procyclically. The result of these fluctuations is that external financing becomes more expensive during bad economic periods, which amplifies the real b ...

Chapter 1 Master.tst

... D) Consumer credit was not a profitable industry TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 16) True financial security is achieved when your money begins to generate an income -your money ...

... D) Consumer credit was not a profitable industry TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 16) True financial security is achieved when your money begins to generate an income -your money ...

Disclosure of Model and Assumptions Used to Determine RMBS

... The Model – The NAIC engagement requires PIMCO Advisory to conduct a loan level analysis of US RMBS using their proprietary non-agency mortgage model. The PIMCO Advisory analytical process actually refers to and consists of four sub-steps: a macroeconomic model, a mortgage loan credit model, a capit ...

... The Model – The NAIC engagement requires PIMCO Advisory to conduct a loan level analysis of US RMBS using their proprietary non-agency mortgage model. The PIMCO Advisory analytical process actually refers to and consists of four sub-steps: a macroeconomic model, a mortgage loan credit model, a capit ...

Building a greener society

... • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

... • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

CGAP

... microloan customers after two years. Carmen wants to make MicroFin sustainable, and her vision of "sustainability" is an ambitious one. She sees a demand for MicroFin's services far exceeding anything that donor agencies could finance. To meet this demand, MicroFin must eventually be able to fund mo ...

... microloan customers after two years. Carmen wants to make MicroFin sustainable, and her vision of "sustainability" is an ambitious one. She sees a demand for MicroFin's services far exceeding anything that donor agencies could finance. To meet this demand, MicroFin must eventually be able to fund mo ...

presenation

... Non-bank housing lenders will have to register with the Bank of Lithuania and to comply with RLS ...

... Non-bank housing lenders will have to register with the Bank of Lithuania and to comply with RLS ...

Real Estate Principles

... indicates less demand relative to supply and vice versa Rent or price level – trends in rents and prices indicate changes in the balance between supply and demand Quantity of new construction started – indicates new supply that will be coming into the market Quantity of new construction completed – ...

... indicates less demand relative to supply and vice versa Rent or price level – trends in rents and prices indicate changes in the balance between supply and demand Quantity of new construction started – indicates new supply that will be coming into the market Quantity of new construction completed – ...

Continuing the Effort to Restore Liquidity in Commercial Real Estate

... Lack of new CRE loans: Banks are not lending on new transactions but, rather, temporarily extending existing loans at maturity (rather than foreclosing) and categorizing them as “new loans.” Scarcity of credit is making it very difficult to find new loans at institutionally sized proceeds and terms, ...

... Lack of new CRE loans: Banks are not lending on new transactions but, rather, temporarily extending existing loans at maturity (rather than foreclosing) and categorizing them as “new loans.” Scarcity of credit is making it very difficult to find new loans at institutionally sized proceeds and terms, ...

4 ccr 725-3 mortgage loan originators and mortgage companies 1

... 1. “Adjustable rate mortgage” means a mortgage in which the teaser rate, payment rate, or interest rate changes periodically and, in some cases, may adjust according to corresponding fluctuations in an index. 2. “Adjustment date” means the date the teaser rate, payment rate, or interest rate changes ...

... 1. “Adjustable rate mortgage” means a mortgage in which the teaser rate, payment rate, or interest rate changes periodically and, in some cases, may adjust according to corresponding fluctuations in an index. 2. “Adjustment date” means the date the teaser rate, payment rate, or interest rate changes ...

PRODUCT GUIDELINES FHA STANDARD and HIGH BALANCE

... Borrowers must have sufficient credit history to generate a valid FICO score, or borrowers must meet the non-traditional or insufficient credit guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Author ...

... Borrowers must have sufficient credit history to generate a valid FICO score, or borrowers must meet the non-traditional or insufficient credit guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Author ...

How To Finance Your Rosati`s Pizza Pub.pub

... The key to getting your loan is knowing what the lender wants and then how to show the lender you’re ready mentally and financially to become a successful owner. Using our process you can get your business plan created quickly and get the cash you require. ...

... The key to getting your loan is knowing what the lender wants and then how to show the lender you’re ready mentally and financially to become a successful owner. Using our process you can get your business plan created quickly and get the cash you require. ...

Glossary-to-financial-market-statistics

... Condominium are a special property form where the tenant owns a private apartment in a multi-dwelling building, as distinct from tenant-owner apartments where the tenant is a member of an economic association (tenantowners association), which in turn owns the real estate. In Sweden, condominium has ...

... Condominium are a special property form where the tenant owns a private apartment in a multi-dwelling building, as distinct from tenant-owner apartments where the tenant is a member of an economic association (tenantowners association), which in turn owns the real estate. In Sweden, condominium has ...

Announcement 09-02

... Selling Guide, Part X, 402.24: Rental Income. Rental income from other properties owned by the borrower must be supported by two years’ federal income tax returns. DU messages permitting reduced rental income documentation must be disregarded and full documentation must be obtained. The borrower mus ...

... Selling Guide, Part X, 402.24: Rental Income. Rental income from other properties owned by the borrower must be supported by two years’ federal income tax returns. DU messages permitting reduced rental income documentation must be disregarded and full documentation must be obtained. The borrower mus ...

Growth rate

... A flatter yield curve in 2012 will put downward pressure on NIMs by making ST borrowing and LT lending less lucrative. Banks/CUs are reevaluating their “GAP” strategy due to changing interest rate forecasts. The interchange fee cap rule was implemented on October 1, 2011. This will cap the maximum f ...

... A flatter yield curve in 2012 will put downward pressure on NIMs by making ST borrowing and LT lending less lucrative. Banks/CUs are reevaluating their “GAP” strategy due to changing interest rate forecasts. The interchange fee cap rule was implemented on October 1, 2011. This will cap the maximum f ...

Mortgage Lending Rules - American Bankers Association

... responsibilities, fair lending, and other areas. These continuous rule expansions have made mortgages the riskiest and most labor-intensive products that banks can offer. The stifling burdens brought by these regulatory changes have made it difficult for institutions to stay profitable or even conti ...

... responsibilities, fair lending, and other areas. These continuous rule expansions have made mortgages the riskiest and most labor-intensive products that banks can offer. The stifling burdens brought by these regulatory changes have made it difficult for institutions to stay profitable or even conti ...

In any secured financing, a borrower`s undertakings relating to

... provides, for example, that the secured party may not enforce its security interest in the rights that are otherwise subject to an enforceable anti‐assignment term. To further protect a borrower against breaching its anti‐assignment obligations, this workaround is typically qualified so that ...

... provides, for example, that the secured party may not enforce its security interest in the rights that are otherwise subject to an enforceable anti‐assignment term. To further protect a borrower against breaching its anti‐assignment obligations, this workaround is typically qualified so that ...

Financial Intermediaries and the Design of Loan

... technology into farming. With the movement inland away from the most fertile coastal regions, farmers were increasingly faced with having to buy an existing run or settle on poorer land, both requiring increased investment. In addition, there was a strong trend towards purchase of the freehold on th ...

... technology into farming. With the movement inland away from the most fertile coastal regions, farmers were increasingly faced with having to buy an existing run or settle on poorer land, both requiring increased investment. In addition, there was a strong trend towards purchase of the freehold on th ...

What Negative Libor Would Mean For The Lending

... Libor that then on-lend in their various credit agreements (otherwise known as “match funding”) or (2) use Libor as a proxy for the costs associated with holding deposits so that match funding is not necessary, meaning Libor reflects their costs for making those loans and the spread is compensation ...

... Libor that then on-lend in their various credit agreements (otherwise known as “match funding”) or (2) use Libor as a proxy for the costs associated with holding deposits so that match funding is not necessary, meaning Libor reflects their costs for making those loans and the spread is compensation ...

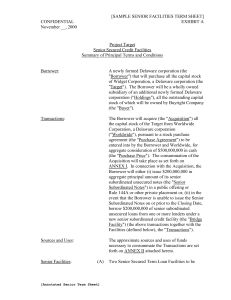

Senior Loan Term Sheet

... interest rate protection agreements entered into with any Lender (or any affiliate of any Lender) will be secured by substantially all the assets of Holdings, the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral ...

... interest rate protection agreements entered into with any Lender (or any affiliate of any Lender) will be secured by substantially all the assets of Holdings, the Borrower and each existing and each subsequently acquired or organized wholly-owned subsidiary of Holdings (collectively, the "Collateral ...

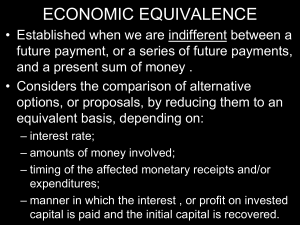

chapter 3 - UniMAP Portal

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.