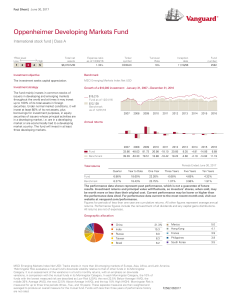

Oppenheimer Developing Markets Fund - Vanguard

... portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not guarantee its value, performance, or any particular rate of return. Mid-Cap: Concentrat ...

... portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not guarantee its value, performance, or any particular rate of return. Mid-Cap: Concentrat ...

Document

... Investment options are offered through a group variable annuity contract (Forms 902-GAQC-09 or 902-GAQC-09(CT) or 902-GAQC09(OR)) underwritten by United of Omaha Life Insurance Company for contracts issued in all states except New York. United of Omaha Life Insurance Company, Omaha, NE 68175 is lice ...

... Investment options are offered through a group variable annuity contract (Forms 902-GAQC-09 or 902-GAQC-09(CT) or 902-GAQC09(OR)) underwritten by United of Omaha Life Insurance Company for contracts issued in all states except New York. United of Omaha Life Insurance Company, Omaha, NE 68175 is lice ...

Review of Statistics in Finance

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

FM11 Ch 04 Mini

... initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated with one another--if the economy does well, so do stocks in general, and vice versa. Correlation coefficients between stocks generally range from +0.5 to +0.7. A single stock selected ...

... initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated with one another--if the economy does well, so do stocks in general, and vice versa. Correlation coefficients between stocks generally range from +0.5 to +0.7. A single stock selected ...

A BEHAVIORAL MODEL OF THE PERFORMANCES FOR E

... Shiller, Cochrane-Piazzesi empirical mechanisms (a high slope of the yield curve predicts excess high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a h ...

... Shiller, Cochrane-Piazzesi empirical mechanisms (a high slope of the yield curve predicts excess high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a h ...

Assume that you recently graduated with a major in

... your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated with one another--if the economy does well, so do stocks in general, and vice versa. Correlation coefficients between stocks generally range from +0.5 to +0.7. A ...

... your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated with one another--if the economy does well, so do stocks in general, and vice versa. Correlation coefficients between stocks generally range from +0.5 to +0.7. A ...

Finance Glossary

... Interest Rates and Bond Valuation Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the ...

... Interest Rates and Bond Valuation Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the ...

Finance 419

... Some researchers have now been able to get U.S. stock return data back to the early 1800s. See for example “Stocks for the Long Run” by Jeremy Siegel http://www.wharton.edu/research/1998.html Also, do we want to create our sample estimate using only data from U.S. markets? The U.S. “won” the major w ...

... Some researchers have now been able to get U.S. stock return data back to the early 1800s. See for example “Stocks for the Long Run” by Jeremy Siegel http://www.wharton.edu/research/1998.html Also, do we want to create our sample estimate using only data from U.S. markets? The U.S. “won” the major w ...

Expected Return Standard Deviation

... CAPM Terminologies: Systematic and Unsystematic risk In the development of portfolio theory Markowitz (1958) defined the variance of the rate of return as the appropriate measure of risk. However this can be sub-divided into two general types of risk: systematic and unsystematic risk. William Sh ...

... CAPM Terminologies: Systematic and Unsystematic risk In the development of portfolio theory Markowitz (1958) defined the variance of the rate of return as the appropriate measure of risk. However this can be sub-divided into two general types of risk: systematic and unsystematic risk. William Sh ...

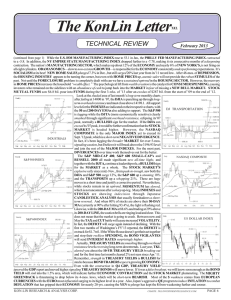

The KonLin Letter page 6.pmd

... smashed through significant overhead resistance, eclipsing its’07 peak, normally a BULLISH sign for the market. If the DJIA can exceed its’07 peak, it would be further confirmation that the STOCK MARKET is headed higher. However, the NASDAQ COMPOSITE is the only MAJOR INDEX yet to exceed its Sept.’1 ...

... smashed through significant overhead resistance, eclipsing its’07 peak, normally a BULLISH sign for the market. If the DJIA can exceed its’07 peak, it would be further confirmation that the STOCK MARKET is headed higher. However, the NASDAQ COMPOSITE is the only MAJOR INDEX yet to exceed its Sept.’1 ...

What Is Diversification?

... Virtually every investment has some type of risk associated with it. The stock market rises and falls. An increase in interest rates can cause a decline in the bond market. No matter what you decide to invest in, risk is something you must consider. One key to successful investing is managing risk w ...

... Virtually every investment has some type of risk associated with it. The stock market rises and falls. An increase in interest rates can cause a decline in the bond market. No matter what you decide to invest in, risk is something you must consider. One key to successful investing is managing risk w ...

Combining active and passive managements in a portfolio

... to which active managers truly add value, for example by studies focusing on managers’ ‘active share’ against their performance benchmarks. Also, those benchmarks may be more tailored to managers’ individual styles. For example, if an active manager specialises in small-cap U.S. value stocks, why no ...

... to which active managers truly add value, for example by studies focusing on managers’ ‘active share’ against their performance benchmarks. Also, those benchmarks may be more tailored to managers’ individual styles. For example, if an active manager specialises in small-cap U.S. value stocks, why no ...

2. Predictability of asset returns Deterministic and Random Walk

... 2b. Stochastic Approach Initiated by Markowitz (1952) who considered the optimization of investment decisions under uncertainty, the so called mean-variance analysis, with the main consequence of the advantages of diversification in order to reduce the risk, measured here as the variance of the exp ...

... 2b. Stochastic Approach Initiated by Markowitz (1952) who considered the optimization of investment decisions under uncertainty, the so called mean-variance analysis, with the main consequence of the advantages of diversification in order to reduce the risk, measured here as the variance of the exp ...

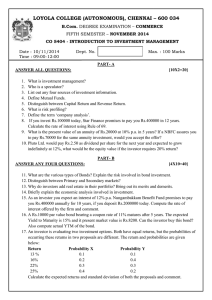

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

... 12. Distinguish between Primary and Secondary markets? 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promise ...

Growth/Value/Momentum Returns as a Function of the Cross

... Robustness is lacking due to severe problems with outliers (Knez and Ready 1997) ...

... Robustness is lacking due to severe problems with outliers (Knez and Ready 1997) ...

Now let`s look more formally at how the theoretical regression model

... changes linearly with X - has a few important implications. • Normal distributions are symmetric and since the error term subtracts the mean, the errors must be centered at zero, they have a mean of zero. • Since only the mean changes, the standard deviation of each of these normal distributions is ...

... changes linearly with X - has a few important implications. • Normal distributions are symmetric and since the error term subtracts the mean, the errors must be centered at zero, they have a mean of zero. • Since only the mean changes, the standard deviation of each of these normal distributions is ...

Compared to U.S. Treasury investors, should U.S. Agency MBS

... Interestingly, half of the large excess relative returns (positive and negative) were observed during the 2008-2009 global financial Sources: Amundi SB calculations, based on data from Bloomberg Indices. crisis. Although U.S. Agency Mortgages suffered no credit or liquidity issues, all spread assets ...

... Interestingly, half of the large excess relative returns (positive and negative) were observed during the 2008-2009 global financial Sources: Amundi SB calculations, based on data from Bloomberg Indices. crisis. Although U.S. Agency Mortgages suffered no credit or liquidity issues, all spread assets ...

Deconstructing the time in the market mantra

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

Document

... experiences. The borrowing cost varies with nominal interest rate. But most people’s earnings are not adjusted for inflation. This is probably also true for rental incomes, minimum wages and other relatively fixed incomes. ...

... experiences. The borrowing cost varies with nominal interest rate. But most people’s earnings are not adjusted for inflation. This is probably also true for rental incomes, minimum wages and other relatively fixed incomes. ...

Identifying Opportunity. Navigating Risk.

... rates were: REITs (-9.1%) and utility stocks (-10.7%). Strangely enough major domestic large cap, mid cap and small cap indices as well as international developed and emerging market indices all ended within a fairly tight range, with the best performance coming from the growth stock laden NASDAQ Co ...

... rates were: REITs (-9.1%) and utility stocks (-10.7%). Strangely enough major domestic large cap, mid cap and small cap indices as well as international developed and emerging market indices all ended within a fairly tight range, with the best performance coming from the growth stock laden NASDAQ Co ...

Weekly Commentary 10-13-14 PAA

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or s ...

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or s ...

The Risk-Return Relationship in Asean-5 Stock Markets

... The high-risk portfolios cannot regularly offer the higher return than lower risk portfolios although the period of the market index return is positive. Investing in the stock market will benefit the investors in the long-term and not in the short-run speculation. In periods of negative risk premium ...

... The high-risk portfolios cannot regularly offer the higher return than lower risk portfolios although the period of the market index return is positive. Investing in the stock market will benefit the investors in the long-term and not in the short-run speculation. In periods of negative risk premium ...

Quiz 3

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

Systematic risk

... The tangency portfolio M is the market portfolio ◦ All assets included in this portfolio are weighted in proportion to their market value ◦ Because portfolio M contains all risky assets, it is a completely diversified portfolio. Only systematic risk remains in the market portfolio. ◦ Systematic risk ...

... The tangency portfolio M is the market portfolio ◦ All assets included in this portfolio are weighted in proportion to their market value ◦ Because portfolio M contains all risky assets, it is a completely diversified portfolio. Only systematic risk remains in the market portfolio. ◦ Systematic risk ...

Intelligent Considerations During Short

... This is not to say that investors should fail to make strategic shifts to their investments or rebalance portfolios over time. Working with an experienced financial advisor is beneficial to ensure consistent rebalancing and making appropriate strategic changes to asset class weightings based on the ...

... This is not to say that investors should fail to make strategic shifts to their investments or rebalance portfolios over time. Working with an experienced financial advisor is beneficial to ensure consistent rebalancing and making appropriate strategic changes to asset class weightings based on the ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.