Week Four Review Questions and Problems

... The return on Japanese investment is now worth less in dollars. Therefore, the investor’s return will be less after the currency adjustment. EXAMPLE: Assume a Canadian investor in the Japanese market has a 30% gain in one year, but the Yen declines in value relative to the dollar by 10%. The percent ...

... The return on Japanese investment is now worth less in dollars. Therefore, the investor’s return will be less after the currency adjustment. EXAMPLE: Assume a Canadian investor in the Japanese market has a 30% gain in one year, but the Yen declines in value relative to the dollar by 10%. The percent ...

Capital Marketing

... beta (β) of a stock or portfolio is a number describing sensitivity of its returns with that of the financial market as a whole It is calculated as follows: ...

... beta (β) of a stock or portfolio is a number describing sensitivity of its returns with that of the financial market as a whole It is calculated as follows: ...

Chapter 7 12

... $50,000 cash. Unfortunately her will requires that the Alcan stock not be sold for one year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, thi ...

... $50,000 cash. Unfortunately her will requires that the Alcan stock not be sold for one year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, thi ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

Real Estate Investment

... properties The Asset Market deals with Financial Capital Much more a function of Money flows over time ...

... properties The Asset Market deals with Financial Capital Much more a function of Money flows over time ...

Strategic Finanancial Management

... Index Funds her risk would be slightly lowered, but because the returns of the index funds are cyclical as are the High-Tech Company, she would experience significant losses if the economy were to turn poor, which based upon the probability’s, will occur 40% of the time. This combination would not b ...

... Index Funds her risk would be slightly lowered, but because the returns of the index funds are cyclical as are the High-Tech Company, she would experience significant losses if the economy were to turn poor, which based upon the probability’s, will occur 40% of the time. This combination would not b ...

Portfolio Analysis and Theory in a Nutshell

... The Price of Risk • If systematic risk is priced, than high beta stocks should have an average return, over the ups and downs in the market, higher than the market index. • The high Beta stock has greater systematic risk because when the market goes down the high Beta stock will go down even more. ...

... The Price of Risk • If systematic risk is priced, than high beta stocks should have an average return, over the ups and downs in the market, higher than the market index. • The high Beta stock has greater systematic risk because when the market goes down the high Beta stock will go down even more. ...

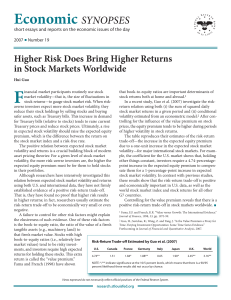

Higher Risk Does Bring Higher Returns in Stock Markets Worldwide

... ple, the coefficient for the U.S. market shows that, holding asset pricing theories: For a given level of stock market other things constant, investors require a 4.74-percentagevolatility, the more risk-averse investors are, the higher the point increase in the expected equity premium to compenexpec ...

... ple, the coefficient for the U.S. market shows that, holding asset pricing theories: For a given level of stock market other things constant, investors require a 4.74-percentagevolatility, the more risk-averse investors are, the higher the point increase in the expected equity premium to compenexpec ...

ARK_letter10-07 - ARK Financial Services

... A liquidity crisis developed and changed the mood of the entire market: “Investors and lenders became increasingly suspicious of each other and unwilling to lend, driving up interest rates for all sorts of borrowers,” according to a WSJ article’s account of August’s events. How should you respond to ...

... A liquidity crisis developed and changed the mood of the entire market: “Investors and lenders became increasingly suspicious of each other and unwilling to lend, driving up interest rates for all sorts of borrowers,” according to a WSJ article’s account of August’s events. How should you respond to ...

International Monetary System and Exchange

... Australia, New Zealand, Canada, Mexico, Chile and Peru.” “The agreement aims to maintain “high standards” on labor, environment, and intellectual property..” e.g., “protect pharmaceutical patents, release information on copyright infringers, and set up environmental standards.” The agreement cou ...

... Australia, New Zealand, Canada, Mexico, Chile and Peru.” “The agreement aims to maintain “high standards” on labor, environment, and intellectual property..” e.g., “protect pharmaceutical patents, release information on copyright infringers, and set up environmental standards.” The agreement cou ...

draft1 140212

... 2. Anglo American Beta and total risk and return for 2011/12 Anglo’s beta of 1.64 (see appendix 1) shows that its stock’s increasing volatility in comparison to the market and even the overall mining sector which has a beta of 1.33. With a higher beta and thus greater risk you would assume greater r ...

... 2. Anglo American Beta and total risk and return for 2011/12 Anglo’s beta of 1.64 (see appendix 1) shows that its stock’s increasing volatility in comparison to the market and even the overall mining sector which has a beta of 1.33. With a higher beta and thus greater risk you would assume greater r ...

Risk and Return: Extensions

... CAPM/SML concepts are based on expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thi ...

... CAPM/SML concepts are based on expectations, yet betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness. Other models are being developed that will one day replace the CAPM, but it still provides a good framework for thi ...

How do you assess multi-asset funds?

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

How_Much_International

... do not move in lockstep, giving us an opportunity to reduce risk by adding asset classes with low correlations to our domestic portfolio. Recent experience bears this out. During the 90s delusional investors convinced themselves that the US market was just about the only place on the planet that was ...

... do not move in lockstep, giving us an opportunity to reduce risk by adding asset classes with low correlations to our domestic portfolio. Recent experience bears this out. During the 90s delusional investors convinced themselves that the US market was just about the only place on the planet that was ...

The Benefits of High-Quality in an Uncertain Environment

... many, just as had been the case leading up to the Brexit referendum. Both votes have come to be seen as expressions of populist discontent with the status quo, and may predict strengthened populist movements elsewhere. Indeed, the “no” vote in the recent Italian constitutional referendum could be sa ...

... many, just as had been the case leading up to the Brexit referendum. Both votes have come to be seen as expressions of populist discontent with the status quo, and may predict strengthened populist movements elsewhere. Indeed, the “no” vote in the recent Italian constitutional referendum could be sa ...

Voluminous Data Can be Simplified to Inform Business Decisions

... Standard deviation is a popular basic mathematical concept to measure risk. Standard deviation measures the average amount by which individual data points differ from the mean. It is calculated by first subtracting the mean from each value, and then squaring, summing and averaging the differences to ...

... Standard deviation is a popular basic mathematical concept to measure risk. Standard deviation measures the average amount by which individual data points differ from the mean. It is calculated by first subtracting the mean from each value, and then squaring, summing and averaging the differences to ...

Bond Valuation - Duke University

... Portfolio-risk cannot be diversified. Investors demand a premium on non-diversifiable risk only, hence portfolio or market risk. Beta measures the market risk, hence it is the correct measure for non-diversifiable risk. ...

... Portfolio-risk cannot be diversified. Investors demand a premium on non-diversifiable risk only, hence portfolio or market risk. Beta measures the market risk, hence it is the correct measure for non-diversifiable risk. ...

Risk

... normal period organizations and people are likely to be seeking out insurance to protect them and mitigate risk; this is why we see a beta pretty close to the market. Finally, in a weak economy organizations may be trying to cut costs, and excess insurance may be one of these areas. Additionally sin ...

... normal period organizations and people are likely to be seeking out insurance to protect them and mitigate risk; this is why we see a beta pretty close to the market. Finally, in a weak economy organizations may be trying to cut costs, and excess insurance may be one of these areas. Additionally sin ...

October 2011 - Roof Advisory Group

... In reality, politicians of all stripes, both here and abroad, have been anything but a friend to the markets and economy of late. Their recent blunders, missteps and apparent inability to grasp some of the most basic economic principles have sent investors and businesses ducking for cover and the ma ...

... In reality, politicians of all stripes, both here and abroad, have been anything but a friend to the markets and economy of late. Their recent blunders, missteps and apparent inability to grasp some of the most basic economic principles have sent investors and businesses ducking for cover and the ma ...

PowerPoint-Präsentation

... Much harder to create value through financial activities Changes in asset price respond only to new information. This implies that asset prices move almost randomly. Berlin, 04.01.2006 ...

... Much harder to create value through financial activities Changes in asset price respond only to new information. This implies that asset prices move almost randomly. Berlin, 04.01.2006 ...

Chapter 011 Risk and Return

... 2. The percentage of a portfolio's value that is represented by a single security is referred to as the portfolio weight. 3. The concept of investing in a variety of diverse assets to reduce risk is diversification. 4. The efficient set of portfolios contains all portfolios: A) with maximal expected ...

... 2. The percentage of a portfolio's value that is represented by a single security is referred to as the portfolio weight. 3. The concept of investing in a variety of diverse assets to reduce risk is diversification. 4. The efficient set of portfolios contains all portfolios: A) with maximal expected ...

Empirical Evidence : CAPM and APT

... Hyp. 2 : No systematic effects of non-beta risk E(g3(t)) = 0 Hyp. 3 : Positive return-risk trade off E(g1(t)) = [ERm(t) – ER0(t)] > 0 ...

... Hyp. 2 : No systematic effects of non-beta risk E(g3(t)) = 0 Hyp. 3 : Positive return-risk trade off E(g1(t)) = [ERm(t) – ER0(t)] > 0 ...

Low Volatility Equity Fact Sheet

... failure of the other party to the instrument to meet its obligations. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific company, issuer or sector. There may be times when stocks in the fund’s portfolio ...

... failure of the other party to the instrument to meet its obligations. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific company, issuer or sector. There may be times when stocks in the fund’s portfolio ...

Nedgroup Investments Positive Return Fund

... The annualised TER shown above is for the 12 month period to 30 September 2009. This percentage of the average Net Asset Value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. A higher TER does not necessarily imply a poor return, nor does a low T ...

... The annualised TER shown above is for the 12 month period to 30 September 2009. This percentage of the average Net Asset Value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. A higher TER does not necessarily imply a poor return, nor does a low T ...

Document

... The number of stocks selected depends on a unique cut off rate such that all stocks with higher ratios of Excess return to beta will be included and all stocks with lower ratios excluded. ...

... The number of stocks selected depends on a unique cut off rate such that all stocks with higher ratios of Excess return to beta will be included and all stocks with lower ratios excluded. ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.