Solutions to Chapter 9

... 20. Risk reduction is most pronounced when the stock returns vary against each other. When one firm does poorly, the other will tend to do well, thereby stabilizing the return of the overall portfolio. By contrast stock returns that move together provide no risk reduction. If stock returns are inde ...

... 20. Risk reduction is most pronounced when the stock returns vary against each other. When one firm does poorly, the other will tend to do well, thereby stabilizing the return of the overall portfolio. By contrast stock returns that move together provide no risk reduction. If stock returns are inde ...

Sample Questions Conceptual

... A) Riskier assets will, on average, earn lower returns. B) The reward for bearing risk is known as the standard deviation. C) Based on historical data, there is no reward for bearing risk. D) An increase in the risk of an investment will result in a decreased risk premium. E) In general, the higher ...

... A) Riskier assets will, on average, earn lower returns. B) The reward for bearing risk is known as the standard deviation. C) Based on historical data, there is no reward for bearing risk. D) An increase in the risk of an investment will result in a decreased risk premium. E) In general, the higher ...

all cap equity - Eagle Asset Management

... Standard Deviation – Standard Deviation is a measure of the dispersal or uncertainty in a random variable. For example, if a financial variable is highly volatile, it has a high Standard Deviation. Standard Deviation is frequently used as a measure of the volatility of a random financial variable. ...

... Standard Deviation – Standard Deviation is a measure of the dispersal or uncertainty in a random variable. For example, if a financial variable is highly volatile, it has a high Standard Deviation. Standard Deviation is frequently used as a measure of the volatility of a random financial variable. ...

Sample Questions

... A) Riskier assets will, on average, earn lower returns. B) The reward for bearing risk is known as the standard deviation. C) Based on historical data, there is no reward for bearing risk. D) An increase in the risk of an investment will result in a decreased risk premium. E) In general, the higher ...

... A) Riskier assets will, on average, earn lower returns. B) The reward for bearing risk is known as the standard deviation. C) Based on historical data, there is no reward for bearing risk. D) An increase in the risk of an investment will result in a decreased risk premium. E) In general, the higher ...

DENZIO L IKUNGWA - Institute of Bankers in Malawi

... Capital Market Line – CML ; A line used in the capital asset pricing model to illustrate the rates of return for efficient portfolios depending on the risk-free rate of return and the level of risk (standard deviation) for a particular portfolio. The CML is derived by drawing a tangent line from the ...

... Capital Market Line – CML ; A line used in the capital asset pricing model to illustrate the rates of return for efficient portfolios depending on the risk-free rate of return and the level of risk (standard deviation) for a particular portfolio. The CML is derived by drawing a tangent line from the ...

Equities Could See a Setback, But This Bull Market Isn`t Over

... For more information or to subscribe, please visit nuveen.com. The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New ...

... For more information or to subscribe, please visit nuveen.com. The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New ...

Select Consulting, Inc.

... While the bond market did not start 2013 with the same enthusiasm of the stock market, its long anticipated demise appears to remain in hibernation. High quality bonds as measured by the Barclays Aggregate Bond Index were essentially flat over the first three months of the year, despite a slight mov ...

... While the bond market did not start 2013 with the same enthusiasm of the stock market, its long anticipated demise appears to remain in hibernation. High quality bonds as measured by the Barclays Aggregate Bond Index were essentially flat over the first three months of the year, despite a slight mov ...

Sample Questions

... payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments are made at the end of the month; also note that the future value (FV) for the mortgage will be zero, ...

... payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments are made at the end of the month; also note that the future value (FV) for the mortgage will be zero, ...

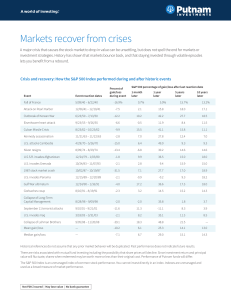

Markets recover from crises

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

ch13_IM_1E

... Solutions to Problems at End of Chapter Composition of the Market Portfolio 1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a riskless government security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively ...

... Solutions to Problems at End of Chapter Composition of the Market Portfolio 1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a riskless government security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively ...

FIN550 final exam

... 16. What was BMC’S current ratio at year-end 2004? 17. What was BMC’S net profit margin? 18. What was BMC’S fixed asset turnover ratio? ...

... 16. What was BMC’S current ratio at year-end 2004? 17. What was BMC’S net profit margin? 18. What was BMC’S fixed asset turnover ratio? ...

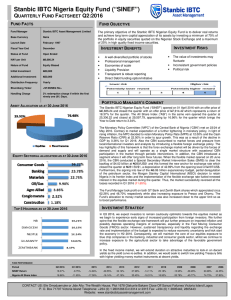

Nigerian Equity Fund - Stanbic IBTC Asset Management

... rising inflation, the MPC decided to retain Monetary Policy Rate (MPR) at 12.00% and the Cash Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investor ...

... rising inflation, the MPC decided to retain Monetary Policy Rate (MPR) at 12.00% and the Cash Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investor ...

Ken Lambden - Standing back from the turmoil

... A natural reaction to aggressively falling markets is to fill portfolios with defensive stocks in the hope that the worst falls in profitability will be avoided but at this stage that’s not necessarily where the opportunities lie. Defensive sectors such as utilities, food and health care have delive ...

... A natural reaction to aggressively falling markets is to fill portfolios with defensive stocks in the hope that the worst falls in profitability will be avoided but at this stage that’s not necessarily where the opportunities lie. Defensive sectors such as utilities, food and health care have delive ...

BMO Asset Management Global Equity Fund

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

Low Volatility Equity Strategies: New And Improved?

... market efficiency. Furthermore, within that cap-weighted market portfolio, CAPM makes the intuitive prediction that stocks that contribute the most to portfolio risk, so-called ‘high beta’ stocks, should have higher expected returns than ‘low beta’ stocks. Though this view of the nature of the risk/ ...

... market efficiency. Furthermore, within that cap-weighted market portfolio, CAPM makes the intuitive prediction that stocks that contribute the most to portfolio risk, so-called ‘high beta’ stocks, should have higher expected returns than ‘low beta’ stocks. Though this view of the nature of the risk/ ...

Marketline Nov 13 - Cascade Investment Advisors

... The Dow surged another 3.5% last month, the NASDAQ matching with 3.6%. The S&P lagged slightly at 2.7%. This will be one of the best stock market years on record. This month’s “common question” is: now that the market is trading at new highs, what do we do about protecting portfolios in the inevitab ...

... The Dow surged another 3.5% last month, the NASDAQ matching with 3.6%. The S&P lagged slightly at 2.7%. This will be one of the best stock market years on record. This month’s “common question” is: now that the market is trading at new highs, what do we do about protecting portfolios in the inevitab ...

Stocks vs. Bonds: A Decade of Record Disparity

... resulting from last year’s global financial crisis and stocks’ abysmal performance over the past decade is the gaping disparity between stock and bond returns. The chart on this page illustrates the striking performance differential between the annualized return of the S&P 500 Stock Index and 10-yea ...

... resulting from last year’s global financial crisis and stocks’ abysmal performance over the past decade is the gaping disparity between stock and bond returns. The chart on this page illustrates the striking performance differential between the annualized return of the S&P 500 Stock Index and 10-yea ...

Investing During a Non-Normal Market Environment

... than is suitable for some investors. For that reason, investors overall thinking should be geared toward either allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent ...

... than is suitable for some investors. For that reason, investors overall thinking should be geared toward either allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent ...

smarterinsightTM - Donald Wealth Management

... Markets will be markets Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, ...

... Markets will be markets Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, ...

Risk Analysis - Purdue Agriculture

... – They are willing to take a chance that they will get a return greater than $6,000 ...

... – They are willing to take a chance that they will get a return greater than $6,000 ...

Questions from Chapter 3 - Purdue Agricultural Economics

... c. a plot of interest rates versus term, also called the term structure of interest rates. d. all of the above ...

... c. a plot of interest rates versus term, also called the term structure of interest rates. d. all of the above ...

Investment Analysis

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

Doll commentary - MidWestOne Investment Services

... shown for illustrative purposes only. Index returns include reinvestment of income and do not reflect investment advisory and other fees that would reduce performance in an actual client account. All indices are unmanaged and unavailable for direct investment. ...

... shown for illustrative purposes only. Index returns include reinvestment of income and do not reflect investment advisory and other fees that would reduce performance in an actual client account. All indices are unmanaged and unavailable for direct investment. ...

Reinvestment Risk

... Assuming credit risk requires that additional resources be devoted to the investment program ...

... Assuming credit risk requires that additional resources be devoted to the investment program ...

CHAPTER 5 Risk and Rates of Return - Course ON-LINE

... Inefficient portfolios will lie below it. In other words, this equation does not describe equilibrium returns on non-efficient portfolios or on individual securities. ...

... Inefficient portfolios will lie below it. In other words, this equation does not describe equilibrium returns on non-efficient portfolios or on individual securities. ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.