What Causes Herding: Information Cascade or Search Cost ?

... empirical results support the latter rather than the much more popular former. The main implication of our results would help, on the one hand, investors in general to locate at any given period the most cost-efficient market to trade, which lowers average trading cost and raise market trading volum ...

... empirical results support the latter rather than the much more popular former. The main implication of our results would help, on the one hand, investors in general to locate at any given period the most cost-efficient market to trade, which lowers average trading cost and raise market trading volum ...

Essilor (EI FP)-Buy: Bigger playing field becomes reality

... Essilor remains by far a “captain of industry” in the corrective lenses but also in the optical instruments market. The expansion in new markets (sun and online) supported by the global roll-out of direct-to-consumer marketing campaigns (a game changer in our view as it is targeting directly end con ...

... Essilor remains by far a “captain of industry” in the corrective lenses but also in the optical instruments market. The expansion in new markets (sun and online) supported by the global roll-out of direct-to-consumer marketing campaigns (a game changer in our view as it is targeting directly end con ...

Risk-Based Capital for Insurers in the United States

... Frederick S. Townsend The summaries of the debaters’ statements are identified by their names. John Nigh Companies can do the following to improve their RBC ratios: • Enhance capital - Receive investment from a parent company (i.e., get cash infusion into surplus), - Use reinsurance, - Structure fin ...

... Frederick S. Townsend The summaries of the debaters’ statements are identified by their names. John Nigh Companies can do the following to improve their RBC ratios: • Enhance capital - Receive investment from a parent company (i.e., get cash infusion into surplus), - Use reinsurance, - Structure fin ...

The Impact of the French Securities Transaction Tax on Market

... due to arbitrage. Moreover, the reliability of their results suffers from small size of their control group that consists of only four ADRs. Liu (2007) relies on a similar methodology to analyze STT change in 1989 in Japan. His control group consists of 22 Japanese ADRs and he finds a negative impa ...

... due to arbitrage. Moreover, the reliability of their results suffers from small size of their control group that consists of only four ADRs. Liu (2007) relies on a similar methodology to analyze STT change in 1989 in Japan. His control group consists of 22 Japanese ADRs and he finds a negative impa ...

Financial Liberalization and Emerging Stock Market Volatility

... univariate tests reveal ARCH effects for our six emerging economies. So far, all these results were to be expected, and they do not add much new evidence to results already known. [Insert Table 1 here] In the upper panel of Figures 1a-6a we show the evolution of the stock returns of each country duri ...

... univariate tests reveal ARCH effects for our six emerging economies. So far, all these results were to be expected, and they do not add much new evidence to results already known. [Insert Table 1 here] In the upper panel of Figures 1a-6a we show the evolution of the stock returns of each country duri ...

ROYAL BANK OF CANADA

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

Global Style Portfolios Based on Country Indices

... There is now considerable evidence supporting the view that there are sources of return beyond traditional asset classes. Size, value and momentum risk premia are regarded as separate, independent sources of excess returns from the equity market premium. The existence of multiple risk premia means t ...

... There is now considerable evidence supporting the view that there are sources of return beyond traditional asset classes. Size, value and momentum risk premia are regarded as separate, independent sources of excess returns from the equity market premium. The existence of multiple risk premia means t ...

BEA Union Investment Series Product Key Facts

... The Sub-Fund invests directly or indirectly in equities and thus is subject to the risks generally associated with equity investment. Factors affecting the stock values include but not limited to changes in investment sentiment, political, economic and social environment and liquidity and volatility ...

... The Sub-Fund invests directly or indirectly in equities and thus is subject to the risks generally associated with equity investment. Factors affecting the stock values include but not limited to changes in investment sentiment, political, economic and social environment and liquidity and volatility ...

economic theory of depletable resources: an

... A virgin wilderness can remain unspoiled forever, absent human intervention, although its precise composition will change over time. We can consider many different uses of the resource, only some of which would be the consumptive use envisioned under the definition above. At one extreme of nonconsum ...

... A virgin wilderness can remain unspoiled forever, absent human intervention, although its precise composition will change over time. We can consider many different uses of the resource, only some of which would be the consumptive use envisioned under the definition above. At one extreme of nonconsum ...

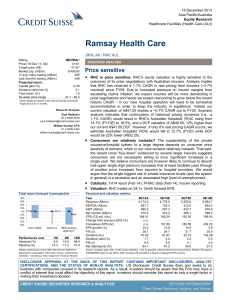

Ramsay Health Care 2013 12 18 - Price sensitive

... beds for medical patients (general medical, psych and rehab) have grown in line with operating theatre additions. While surgical patients represent the majority of RHC's Australian admissions, we estimate that medical patients are ~35-40% of the total. As theatres are not a volume measure for these ...

... beds for medical patients (general medical, psych and rehab) have grown in line with operating theatre additions. While surgical patients represent the majority of RHC's Australian admissions, we estimate that medical patients are ~35-40% of the total. As theatres are not a volume measure for these ...

PRINCIPLES OF FINANCIAL ENGINEERING

... Market professionals and investors take long and short positions on elementary assets such as stocks, default-free bonds and debt instruments that carry a default risk. There is also a great deal of interest in trading currencies, commodities, and, recently, volatility. Looking from the outside, an ...

... Market professionals and investors take long and short positions on elementary assets such as stocks, default-free bonds and debt instruments that carry a default risk. There is also a great deal of interest in trading currencies, commodities, and, recently, volatility. Looking from the outside, an ...

Criminal Complaint

... multiple, bogus orders that the trader does not intend to have executed-for example, multiple orders to sell a financial product at different price points-and then quickly modifies or cancels those orders before they are executed. The purpose of these bogus orders is to trick other market participan ...

... multiple, bogus orders that the trader does not intend to have executed-for example, multiple orders to sell a financial product at different price points-and then quickly modifies or cancels those orders before they are executed. The purpose of these bogus orders is to trick other market participan ...

The impact of dark trading and visible fragmentation on market quality

... universe of trading platforms, provides stronger identification of fragmentation and allows for improved liquidity metrics. Our main finding is that the effect of visible fragmentation on global liquidity is generally positive, while the effect of dark trading is negative. An increase in dark tradin ...

... universe of trading platforms, provides stronger identification of fragmentation and allows for improved liquidity metrics. Our main finding is that the effect of visible fragmentation on global liquidity is generally positive, while the effect of dark trading is negative. An increase in dark tradin ...

Arbitrage Opportunities

... in the FX market is an example of perfect substitutes with convertibility and is not affected by these traditional impediments to arbitrage We explicitly model the process by which arbitrageurs trade upon observing a violation of an arbitrage parity. Each arbitrageur maximizes her trading profits, ...

... in the FX market is an example of perfect substitutes with convertibility and is not affected by these traditional impediments to arbitrage We explicitly model the process by which arbitrageurs trade upon observing a violation of an arbitrage parity. Each arbitrageur maximizes her trading profits, ...

Revisiting The Inadvertent Investment Company

... are investment pools that trade primarily or exclusively in commodity contracts (e.g., futures contracts and options on futures contracts), that engage in no trading of securities, except for cash management purposes, are outside the reach of the Company Act and are regulated exclusively by the Comm ...

... are investment pools that trade primarily or exclusively in commodity contracts (e.g., futures contracts and options on futures contracts), that engage in no trading of securities, except for cash management purposes, are outside the reach of the Company Act and are regulated exclusively by the Comm ...

wp0112 - University of Cambridge

... efficiency and innovation than US rate of return regulation, and to pass the resulting benefits to customers. Experience has varied between sectors and over time. However, for the most part the combination of competition across the networks and incentive regulation of the networks themselves, couple ...

... efficiency and innovation than US rate of return regulation, and to pass the resulting benefits to customers. Experience has varied between sectors and over time. However, for the most part the combination of competition across the networks and incentive regulation of the networks themselves, couple ...

Hedge Funds and Systemic Risk

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

Mastering The Markets

... half of the meaning required to arrive at a correct analysis. The other half of the meaning is found in the price spread. Volume always indicates the amount of activity going on, the corresponding price spread shows the price movement on that volume. This book explains how the markets work, and, mor ...

... half of the meaning required to arrive at a correct analysis. The other half of the meaning is found in the price spread. Volume always indicates the amount of activity going on, the corresponding price spread shows the price movement on that volume. This book explains how the markets work, and, mor ...

The Term Structure of the Risk-Return Tradeoff

... empirical research, such as the short-term interest rate, the dividend-price ratio, and the yield spread between long-term and short-term bonds.2 These variables enable us to capture horizon effects on stock market risk, inflation risk, and real interest rate risk. Campbell and Viceira (2002) have s ...

... empirical research, such as the short-term interest rate, the dividend-price ratio, and the yield spread between long-term and short-term bonds.2 These variables enable us to capture horizon effects on stock market risk, inflation risk, and real interest rate risk. Campbell and Viceira (2002) have s ...

ECO 110 - Spring 2011 Study Guide

... with next day delivery to his home at a cost of $175, or to drive to campus tomorrow to buy the books at the university bookstore at a cost of $170. Last week he drove to campus to buy a concert ticket because they offered 25 percent off the regular price of $16. 11. According to the cost-benefit pr ...

... with next day delivery to his home at a cost of $175, or to drive to campus tomorrow to buy the books at the university bookstore at a cost of $170. Last week he drove to campus to buy a concert ticket because they offered 25 percent off the regular price of $16. 11. According to the cost-benefit pr ...

Momentum Effect: Empirical Evidence from Karachi Stock Exchange

... Momentum Effect: Empirical Evidence from Karachi Stock Exchange examined the sample of 1705 companies from 20 emerging countries from 1982 to 1997. He reported the momentum effect in 17 out of 20 countries with a slightly change in methodology, i.e. ranking the stock portfolios; top 30%, middle 40% ...

... Momentum Effect: Empirical Evidence from Karachi Stock Exchange examined the sample of 1705 companies from 20 emerging countries from 1982 to 1997. He reported the momentum effect in 17 out of 20 countries with a slightly change in methodology, i.e. ranking the stock portfolios; top 30%, middle 40% ...