IAS 39 Implementation Guidance Questions and Answers

... Fair value measurement considerations for investment funds Fair value measurement: large holding ...

... Fair value measurement considerations for investment funds Fair value measurement: large holding ...

Hong Kong Contracts

... they have made, but also enter into long term contracts to make sure that they have enough orders for their goods for a reasonable time ahead. They may have to enter into contracts with customers under which they are responsible for servicing the product, or guaranteeing it for a period. They will m ...

... they have made, but also enter into long term contracts to make sure that they have enough orders for their goods for a reasonable time ahead. They may have to enter into contracts with customers under which they are responsible for servicing the product, or guaranteeing it for a period. They will m ...

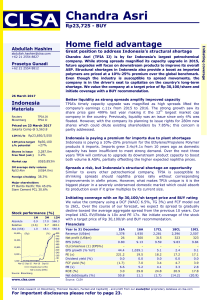

Home field advantage - Chandra Asri Petrochemical

... The country also lacks enough refineries and has to import refined petroleum including naphtha. Therefore, it comes as no surprise that the country is also a net importer of olefins and its derivatives. Over the past 10 years, imports of both ethylene and propylene have been somewhat stable. This is ...

... The country also lacks enough refineries and has to import refined petroleum including naphtha. Therefore, it comes as no surprise that the country is also a net importer of olefins and its derivatives. Over the past 10 years, imports of both ethylene and propylene have been somewhat stable. This is ...

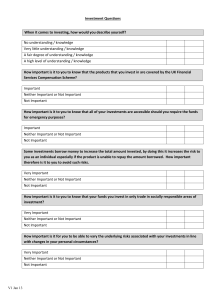

DT 20 questions - IndependentAdviceFrom.Me

... I have other savings and investments which I can use for most needs I may need this investment if I needed access to a significant amount of money I would almost certainly need access to this investment ...

... I have other savings and investments which I can use for most needs I may need this investment if I needed access to a significant amount of money I would almost certainly need access to this investment ...

Regulating Contract Formation: Precontractual Reliance, Sunk

... must spend $25,000 to prepare its bid. The expected cost of performance is one million dollars. If “sunk costs” do not matter, competition between the firms dictates that the winning bid should not exceed one million dollars. If so, how do the firms recover their pre-contractual costs? This puzzle s ...

... must spend $25,000 to prepare its bid. The expected cost of performance is one million dollars. If “sunk costs” do not matter, competition between the firms dictates that the winning bid should not exceed one million dollars. If so, how do the firms recover their pre-contractual costs? This puzzle s ...

Credit Default Swaps -new regulations and conversion

... In this section CDS contracts are introduced as well as the mechanics of a CDS contract will be explained. Also the size of the market is presented. Credit Default Swap (CDS) contracts are a way to make it possible to trade credit risk (O’kane 2003). The contract is a derivative contract, traded in ...

... In this section CDS contracts are introduced as well as the mechanics of a CDS contract will be explained. Also the size of the market is presented. Credit Default Swap (CDS) contracts are a way to make it possible to trade credit risk (O’kane 2003). The contract is a derivative contract, traded in ...

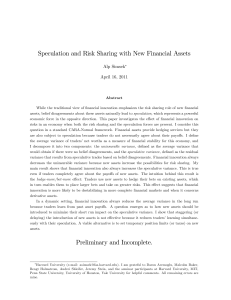

Speculation and Risk Sharing with New Financial Assets

... all of these risks, which might make them reluctant to take large positions. Suppose instead the Euro is also introduced for trade (which can be interpreted as “…nancial innovation” in this example). In this case, traders will complement their positions in the Franc by taking the opposite positions ...

... all of these risks, which might make them reluctant to take large positions. Suppose instead the Euro is also introduced for trade (which can be interpreted as “…nancial innovation” in this example). In this case, traders will complement their positions in the Franc by taking the opposite positions ...

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

... 6:00 p.m. are shipped on the same day the order is received. In addition, the Company estimates that over 90% of orders are received by its customers within two days of placing the order. The Company intends to increase its sales to existing dental customers by intensifying its direct marketing effo ...

... 6:00 p.m. are shipped on the same day the order is received. In addition, the Company estimates that over 90% of orders are received by its customers within two days of placing the order. The Company intends to increase its sales to existing dental customers by intensifying its direct marketing effo ...

Retail Inventory Method

... assumption, and is known as the LIFO retail inventory method. The first step in the LIFO retail inventory method is to compute ending inventory at retail in the same way as was done for the conventional retail inventory method illustrated earlier. The second step, the computation of the cost-to-reta ...

... assumption, and is known as the LIFO retail inventory method. The first step in the LIFO retail inventory method is to compute ending inventory at retail in the same way as was done for the conventional retail inventory method illustrated earlier. The second step, the computation of the cost-to-reta ...

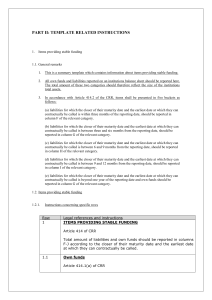

Annex VI

... Total assets issued by a credit institution which has been set up and is sponsored by a Member State central or regional government and the asset is guaranteed by that government and used to fund promotional loans granted on a non-competitive, not for profit basis in order to promote its public poli ...

... Total assets issued by a credit institution which has been set up and is sponsored by a Member State central or regional government and the asset is guaranteed by that government and used to fund promotional loans granted on a non-competitive, not for profit basis in order to promote its public poli ...

strategic asset allocation

... • Strategic asset allocation’s relative importance, compared with security selection and timing, for producing investment results in practice. • Adopting and implementing a strategic asset allocation is an effective way to exercise control over systematic risk exposures. • Strategic versus Tactical ...

... • Strategic asset allocation’s relative importance, compared with security selection and timing, for producing investment results in practice. • Adopting and implementing a strategic asset allocation is an effective way to exercise control over systematic risk exposures. • Strategic versus Tactical ...

Guidance on Substantive Merger Control

... 11 At the beginning of the substantive assessment of a transaction the market conditions pre merger are assessed with respect to the degree of market power or the existence of a dominant position. In a second stage it is examined whether the merger will create a (new) dominant position or (further) ...

... 11 At the beginning of the substantive assessment of a transaction the market conditions pre merger are assessed with respect to the degree of market power or the existence of a dominant position. In a second stage it is examined whether the merger will create a (new) dominant position or (further) ...

the effect of bargaining power on contract design

... it allocates the surplus and has no effect on size. Howev er, variations in price terms can change the optimal nonprice terms when there is a change in price. We give two instances of this phenomenon. First, a different price alters one (or both) party's rate of substitution be tween price and nonpr ...

... it allocates the surplus and has no effect on size. Howev er, variations in price terms can change the optimal nonprice terms when there is a change in price. We give two instances of this phenomenon. First, a different price alters one (or both) party's rate of substitution be tween price and nonpr ...

Intraday Periodicity Adjustments of Transaction Duration and Their

... substantially and ranges from 7360 to 14591, while the average duration per trade ranges from 1.6 seconds to 3.18 seconds. While the number of trades with the same time stamp are quite abundant for large-cap stocks, they are less frequent for small-cap stocks. We would also mention that there is som ...

... substantially and ranges from 7360 to 14591, while the average duration per trade ranges from 1.6 seconds to 3.18 seconds. While the number of trades with the same time stamp are quite abundant for large-cap stocks, they are less frequent for small-cap stocks. We would also mention that there is som ...

volatility as an asset class

... leverage effect: A decline in the value of a company’s equity results in an increase of the company’s balance sheet leverage, making its equity more risky and hence increasing the volatility of its share price. ...

... leverage effect: A decline in the value of a company’s equity results in an increase of the company’s balance sheet leverage, making its equity more risky and hence increasing the volatility of its share price. ...

The Usefulness of Derivative Disclosures by Chinese Listed

... the world have increasingly paid attention to the establishment of an effective governance system including the issuing of financial reporting rules for companies to disclose their derivative activities. By far derivativ~s research has predominately been based on western developed economies; little ...

... the world have increasingly paid attention to the establishment of an effective governance system including the issuing of financial reporting rules for companies to disclose their derivative activities. By far derivativ~s research has predominately been based on western developed economies; little ...

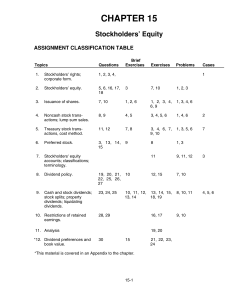

CHAPTER 15 Stockholders` Equity

... The major reasons for purchasing its own shares are: (1) to provide tax-efficient distributions excess cash to shareholders, (2) to increase earnings per share and return on equity, (3) provide stock for employee stock compensation contracts, (4) to thwart takeover attempts reduce the number of stoc ...

... The major reasons for purchasing its own shares are: (1) to provide tax-efficient distributions excess cash to shareholders, (2) to increase earnings per share and return on equity, (3) provide stock for employee stock compensation contracts, (4) to thwart takeover attempts reduce the number of stoc ...

Decimals and Liquidity: A study of the NYSE

... at any time has the BBO quotes. The fraction of time that any exchange has the BBO is an indication of its dominance in terms of liquidity supply and price discovery. We begin by investigating the fraction of total trading time that a BBO is in effect across the regional exchanges for decimal and co ...

... at any time has the BBO quotes. The fraction of time that any exchange has the BBO is an indication of its dominance in terms of liquidity supply and price discovery. We begin by investigating the fraction of total trading time that a BBO is in effect across the regional exchanges for decimal and co ...

The pricing of volatility risk across asset classes

... aggregate variance risk is shown to be negative as in Bakshi and Kapadia (2003a), Bondarenko (2004), and Carr and Wu (2009). Second, for the index option, Vi,t+1 = Vt+1 and βiV = 1. The first term, λ1 E ...

... aggregate variance risk is shown to be negative as in Bakshi and Kapadia (2003a), Bondarenko (2004), and Carr and Wu (2009). Second, for the index option, Vi,t+1 = Vt+1 and βiV = 1. The first term, λ1 E ...

Quote Stuffing - Mississippi State University`s College of Business

... Cartea and Penalva (2011) model the impact of HFT on financial markets using a model with three types of traders: liquidity traders, market makers, and high frequency traders. According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the ...

... Cartea and Penalva (2011) model the impact of HFT on financial markets using a model with three types of traders: liquidity traders, market makers, and high frequency traders. According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the ...