Expected Utility Maximization and Tail Risk

... loss in the tail of the distribution. Yamai and Yoshiba (2002a) point out the same problem in the use of VaR for managing options and loan portfolios. Those studies, however, do not give a definition of tail risk. A number of comparative studies have been done on expected shortfall and VaR.1 Those s ...

... loss in the tail of the distribution. Yamai and Yoshiba (2002a) point out the same problem in the use of VaR for managing options and loan portfolios. Those studies, however, do not give a definition of tail risk. A number of comparative studies have been done on expected shortfall and VaR.1 Those s ...

Policies and Procedures

... trades / deals actions of the client, the same shall borne by the client.The right to sell client’s securities or close client’s positions, without giving notice to the client, on account of non payment of client’s due. Without prejudice to the stock brokers other right (Including the right to refer ...

... trades / deals actions of the client, the same shall borne by the client.The right to sell client’s securities or close client’s positions, without giving notice to the client, on account of non payment of client’s due. Without prejudice to the stock brokers other right (Including the right to refer ...

Asset market participation and portfolio choice over the life-cycle

... Our data suggest a double adjustment as people age with a very specific timing: a rebalancing of the portfolio away from stocks before households reach retirement; exiting the stock market after retirement. Existing calibrated life cycle models can account for the first behaviour but not the second. ...

... Our data suggest a double adjustment as people age with a very specific timing: a rebalancing of the portfolio away from stocks before households reach retirement; exiting the stock market after retirement. Existing calibrated life cycle models can account for the first behaviour but not the second. ...

A Theory of Repurchase Agreements, Collateral Re-use

... natural borrowers and natural lenders. In practice, dealer banks indeed make for a significant share of the market by intermediating between hedge funds and money market funds or MMF. This might seem puzzling if direct trading platforms are available for both parties to bypass the dealer bank.5 Our ...

... natural borrowers and natural lenders. In practice, dealer banks indeed make for a significant share of the market by intermediating between hedge funds and money market funds or MMF. This might seem puzzling if direct trading platforms are available for both parties to bypass the dealer bank.5 Our ...

Day Trading Skill 110523

... (2009), we use complete transaction data for the Taiwan Stock Market, but use a much longer sample period of 1992 to 2006. We focus on day trading for two reasons. First, we are interested in analyzing the cross-section of speculator skill, and day traders, given their short holding period, are alm ...

... (2009), we use complete transaction data for the Taiwan Stock Market, but use a much longer sample period of 1992 to 2006. We focus on day trading for two reasons. First, we are interested in analyzing the cross-section of speculator skill, and day traders, given their short holding period, are alm ...

Ingrid`s PowerPoint presentation

... “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” Warren Buffett ...

... “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” Warren Buffett ...

MultiFractality in Foreign Currency Markets

... is a function of time, H = H ( t ) , allowing the foreign currency markets structures to vary over time. The introduction of this dynamic dimension permits the generalization of the FMH into the MultiFractal Market Hypothesis (MFMH). Briefly, the MFMH provides a theoretical framework to account for ...

... is a function of time, H = H ( t ) , allowing the foreign currency markets structures to vary over time. The introduction of this dynamic dimension permits the generalization of the FMH into the MultiFractal Market Hypothesis (MFMH). Briefly, the MFMH provides a theoretical framework to account for ...

ASX Understanding Trading and Investment Warrants

... Your adviser is obliged to disclose to you any commissions or other benefits which may influence his/her recommendation. ...

... Your adviser is obliged to disclose to you any commissions or other benefits which may influence his/her recommendation. ...

Limit Order Markets: A Survey 1

... trades and orders. The high dimensionality of limit order markets is a challenge for theoretical modelling and empirical estimation as well as, more practically, for trading. Dynamic trading strategies also involve decisions about how frequently to monitor changing market conditions and when and how ...

... trades and orders. The high dimensionality of limit order markets is a challenge for theoretical modelling and empirical estimation as well as, more practically, for trading. Dynamic trading strategies also involve decisions about how frequently to monitor changing market conditions and when and how ...

Chapter VIII (pdf format)

... Now, suppose that a U.S. multinational has a subsidiary with positive cash flows in EUR and another subsidiary has negative cash flows in GBP. The U.S. multinational knows that there is very high and positive correlation between these two currencies. The U.S. multinational will take this correlation ...

... Now, suppose that a U.S. multinational has a subsidiary with positive cash flows in EUR and another subsidiary has negative cash flows in GBP. The U.S. multinational knows that there is very high and positive correlation between these two currencies. The U.S. multinational will take this correlation ...

Avalon Advanced Materials Inc. (Form: 20-F

... estimates, projections and views only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances, except as required by applicable law. Cautionary Note to United States Investors Concerning Reserve and ...

... estimates, projections and views only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances, except as required by applicable law. Cautionary Note to United States Investors Concerning Reserve and ...

Market Signals Associated with Taiwan REIT IPOs

... Supervision Commission will approve the application, which can be regarded as the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the filing approval event. Many news reports are issued after the filing is approved, and the maximum number of news rep ...

... Supervision Commission will approve the application, which can be regarded as the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the filing approval event. Many news reports are issued after the filing is approved, and the maximum number of news rep ...

Sharī`ah and SRI Portfolio Performance in the UK: Effect of Oil Price

... This study attempts to evaluate the effect of oil price on capital market performance, specifically stock returns, which many previous empirical studies have conducted and they found different findings whether there is an effect or not and whether the effect is positive or negative. Studies conducte ...

... This study attempts to evaluate the effect of oil price on capital market performance, specifically stock returns, which many previous empirical studies have conducted and they found different findings whether there is an effect or not and whether the effect is positive or negative. Studies conducte ...

Comvita Limited - Takeovers Panel

... Cerebos Pacific Limited (Cerebos Pacific) is a major food and health supplements business headquartered in Singapore and listed on the Singapore Stock Exchange. As at 16 November 2011, the market capitalisation of Cerebos Pacific was approximately NZ$1.5 billion. Cerebos New Zealand Limited, the veh ...

... Cerebos Pacific Limited (Cerebos Pacific) is a major food and health supplements business headquartered in Singapore and listed on the Singapore Stock Exchange. As at 16 November 2011, the market capitalisation of Cerebos Pacific was approximately NZ$1.5 billion. Cerebos New Zealand Limited, the veh ...

The Valuation and Risk Management of a DB Underpin

... defined benefit pension might be calculated as 1.5% of average salary for the final 5 years of employment, for every year of service with an employer. The benefits in most traditional DB plans may be protected, within certain limitations, by federal insurance. For example, in the U.S., such insuranc ...

... defined benefit pension might be calculated as 1.5% of average salary for the final 5 years of employment, for every year of service with an employer. The benefits in most traditional DB plans may be protected, within certain limitations, by federal insurance. For example, in the U.S., such insuranc ...

Frequently Asked Questions about Exchange

... income securities, futures or any combination of two or more of these reference assets. Who issues ETNs? ETNs are issued by companies registered with the Securities and Exchange Commission (the “SEC”) that are bank holding companies or banks. What is the difference between a listed debt security ...

... income securities, futures or any combination of two or more of these reference assets. Who issues ETNs? ETNs are issued by companies registered with the Securities and Exchange Commission (the “SEC”) that are bank holding companies or banks. What is the difference between a listed debt security ...

Stock Splits, Liquidity and Limit Orders

... information that allows us to identify orders that originated directly from individuals and therefore assess changes in individual trading activity without being forced to use trade size as a proxy for trader identity. It should be noted that not all orders are executed, so total order flow will gen ...

... information that allows us to identify orders that originated directly from individuals and therefore assess changes in individual trading activity without being forced to use trade size as a proxy for trader identity. It should be noted that not all orders are executed, so total order flow will gen ...

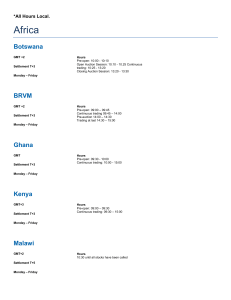

Global Trading Hours

... previous day’s closing price is set for most securities. Volatility auctions occur within the day if a stock moves static +/-10% from last close and dynamic +/-2% from previous trade. They last approximately 5 minutes. Closing Auction As of January 30th, 2017: If a stock indicates more than +/- 3% f ...

... previous day’s closing price is set for most securities. Volatility auctions occur within the day if a stock moves static +/-10% from last close and dynamic +/-2% from previous trade. They last approximately 5 minutes. Closing Auction As of January 30th, 2017: If a stock indicates more than +/- 3% f ...

The Development of Secondary Market Liquidity for NYSE

... suggest that limit order use and disposition tends to stabilize by the second or third day of trading. Examining the cross-sectional determinants of initial depth, we find that depth is significantly related to the design choices of the firm and to information revealed during the book-building peri ...

... suggest that limit order use and disposition tends to stabilize by the second or third day of trading. Examining the cross-sectional determinants of initial depth, we find that depth is significantly related to the design choices of the firm and to information revealed during the book-building peri ...

The conceptual and empirical relationship between gambling

... derivatives market, where people enter into offexchange contracts relating to the performance of a stock, commodity, or index on the actual exchange and where the asset may in fact never actually be purchased. The purchase of “options” to buy or sell a commodity or stock at a specified price before a ...

... derivatives market, where people enter into offexchange contracts relating to the performance of a stock, commodity, or index on the actual exchange and where the asset may in fact never actually be purchased. The purchase of “options” to buy or sell a commodity or stock at a specified price before a ...