“Inflation-Maintenance” Theory of Securities Fraud Liability

... As to the first point, the Court noted that preexisting inflation could remain unchanged in the face of silence, but it might not. However, where, as here, the defendant does not remain silent, it cannot be known whether the inflation would have remained unchanged in the face of silence. And because ...

... As to the first point, the Court noted that preexisting inflation could remain unchanged in the face of silence, but it might not. However, where, as here, the defendant does not remain silent, it cannot be known whether the inflation would have remained unchanged in the face of silence. And because ...

ASX SPI 200 ASX MINI SPI 200

... The Special Opening Quotation of the underlying S&P/ASX 200 Index on the Last Trading Day. The Special Opening Quotation is calculated using the first traded price of each component stock in the S&P/ASX 200 Index on the Last Trading Day, irrespective of when those stocks first trade in the ASX tradi ...

... The Special Opening Quotation of the underlying S&P/ASX 200 Index on the Last Trading Day. The Special Opening Quotation is calculated using the first traded price of each component stock in the S&P/ASX 200 Index on the Last Trading Day, irrespective of when those stocks first trade in the ASX tradi ...

Ch18

... n = the number of years to maturity Ci = the annual coupon payment for bond i i = the prevailing yield to maturity for this bond issue Pp=the par value of the bond ...

... n = the number of years to maturity Ci = the annual coupon payment for bond i i = the prevailing yield to maturity for this bond issue Pp=the par value of the bond ...

IAT FED

... transfer business to non regulated industry (hedge funds) Tailor made synthetic instruments (CDO’s, Power Duals…) may become less secure for investors Workshop on Accounting Risk Management and Prudential Regulation Basel, 11 – 12 November 2005 ...

... transfer business to non regulated industry (hedge funds) Tailor made synthetic instruments (CDO’s, Power Duals…) may become less secure for investors Workshop on Accounting Risk Management and Prudential Regulation Basel, 11 – 12 November 2005 ...

Risk and Return: The CAPM - Dr. Gholamreza Zandi Website

... During the GFC many listed trusts suffered severe falls in value when they were unable to refinance debt and were forced to sell property when the market was at its worst ...

... During the GFC many listed trusts suffered severe falls in value when they were unable to refinance debt and were forced to sell property when the market was at its worst ...

Heterogeneous Risk Preferences in Financial Markets

... prices are rising faster than dividends at the same time and move more than one to one with dividends. This excess volatility and time variation in the stochastic discount factor produce a slightly predictable dividend yield. If we think of individual agents as each having a supply and demand functi ...

... prices are rising faster than dividends at the same time and move more than one to one with dividends. This excess volatility and time variation in the stochastic discount factor produce a slightly predictable dividend yield. If we think of individual agents as each having a supply and demand functi ...

The Conditional Relationship between Risk and Return in Iran`s

... decisions. According to the portfolio theory of Markowitz (1952), investors attempt to maximize the expected return of their investment portfolio for a given amount of portfolio risk, or to minimize risk for a given level of expected return, which means that an investor who wants higher expected ret ...

... decisions. According to the portfolio theory of Markowitz (1952), investors attempt to maximize the expected return of their investment portfolio for a given amount of portfolio risk, or to minimize risk for a given level of expected return, which means that an investor who wants higher expected ret ...

9 - FacStaff Home Page for CBU

... 1. Capital markets are perfectly competitive 2. Investors always prefer more wealth to less wealth with certainty 3. The stochastic process generating asset returns can be expressed as a linear function of a set of K factors or indexes ...

... 1. Capital markets are perfectly competitive 2. Investors always prefer more wealth to less wealth with certainty 3. The stochastic process generating asset returns can be expressed as a linear function of a set of K factors or indexes ...

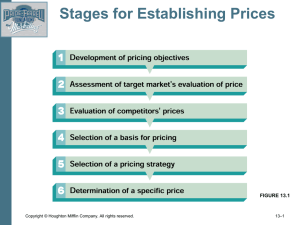

Chapter 13

... If you view a stock as portfolio of characteristic variables, then the stock’s expected return is the sum over all the variables of the amount of each characteristic variable the stock contains times the expected return of that variable. ...

... If you view a stock as portfolio of characteristic variables, then the stock’s expected return is the sum over all the variables of the amount of each characteristic variable the stock contains times the expected return of that variable. ...

Investment Risk Report The Trustees of the A Sample Will Trust

... inflation adjusted growth rate) and the volatility (standard deviation, a measure of the riskiness of the growth rate). The current values are shown in the chart below. These are estimated based on both historical returns and on an in house analysis of market data at the review date, including bond ...

... inflation adjusted growth rate) and the volatility (standard deviation, a measure of the riskiness of the growth rate). The current values are shown in the chart below. These are estimated based on both historical returns and on an in house analysis of market data at the review date, including bond ...

decentralized trade mitigates the lemons problem

... Consider the market for lemons described in Section 2, but assume now that the market operates for infinitely many consecutive periods. Each period t a measure q H ∈ (0, 1) of highquality sellers, a measure q L = 1 − q H of low-quality sellers, and a measure 1 of buyers enter the market. As in Secti ...

... Consider the market for lemons described in Section 2, but assume now that the market operates for infinitely many consecutive periods. Each period t a measure q H ∈ (0, 1) of highquality sellers, a measure q L = 1 − q H of low-quality sellers, and a measure 1 of buyers enter the market. As in Secti ...

The Price to Earnings Growth (PEG) Ratio

... perspective they have the same valuation. To determine which stock is ultimately worth more we would need to estimate how long the EPSG rates would last, and create a more detailed model of future year’s earnings. This is why analysts and portfolio managers, and investors in general, spend so much t ...

... perspective they have the same valuation. To determine which stock is ultimately worth more we would need to estimate how long the EPSG rates would last, and create a more detailed model of future year’s earnings. This is why analysts and portfolio managers, and investors in general, spend so much t ...

MSN Money Articles By Michael Burry 2000/2001

... over $31 million in annual rent, which approximates the annual dividend. The leases are good through 2013, and are of the favored triple net type. Income from the Brookdale leases -‐-‐ 100% private ...

... over $31 million in annual rent, which approximates the annual dividend. The leases are good through 2013, and are of the favored triple net type. Income from the Brookdale leases -‐-‐ 100% private ...

Navn på forfattere

... are some kind of mean-reverting mechanism that ensures that the pairs converges back to their historical mean. The earliest cases of pairs -trading were mostly based on finding highly correlated pairs of stocks that moved in the same correction, and then take a long position in the undervalued and a ...

... are some kind of mean-reverting mechanism that ensures that the pairs converges back to their historical mean. The earliest cases of pairs -trading were mostly based on finding highly correlated pairs of stocks that moved in the same correction, and then take a long position in the undervalued and a ...

“Risk-Free” Liabilities: Efficient Pension Management Requires The

... typically concerned about risk. Consequently, a third strategy many sponsors might consider is to retain pension liabilities and hedge expected benefit payments. (If sponsors target the capital required to hedge expected benefit payments, they could still monitor their ability to use the liability t ...

... typically concerned about risk. Consequently, a third strategy many sponsors might consider is to retain pension liabilities and hedge expected benefit payments. (If sponsors target the capital required to hedge expected benefit payments, they could still monitor their ability to use the liability t ...

Risk Management - Governance

... Risk organizational structure is normally structured by risk type. CRO reports to CEO directly. CRO in general works with CFO, CIO, and actuaries to organize those committee meetings. In general, CRO is the chair. Any changes affecting financial statements have to be worked out with CFO. CIO normall ...

... Risk organizational structure is normally structured by risk type. CRO reports to CEO directly. CRO in general works with CFO, CIO, and actuaries to organize those committee meetings. In general, CRO is the chair. Any changes affecting financial statements have to be worked out with CFO. CIO normall ...

Discount for Lack of Marketability in Preferred Financings

... equity rounds sell stakes in the business rather than individual shares. While the sale of a control ownership stake to a specific investor is not the norm, we need to recognize the reality of venture capital holdings. A lead investor, principally in charge of negotiating t ...

... equity rounds sell stakes in the business rather than individual shares. While the sale of a control ownership stake to a specific investor is not the norm, we need to recognize the reality of venture capital holdings. A lead investor, principally in charge of negotiating t ...

Equity Trading by Institutional Investors: To Cross or Not

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...