STOCCER – A Forecasting Market for the FIFA World

... Sometimes they were also not familiar with the specific rules and therefore traded irrationally. Due to the occasionally large number of stocks traded, markets were rather complex. Besides, the overall number of participants is mostly rather small, ranging from a few tens to hundreds of users. Marke ...

... Sometimes they were also not familiar with the specific rules and therefore traded irrationally. Due to the occasionally large number of stocks traded, markets were rather complex. Besides, the overall number of participants is mostly rather small, ranging from a few tens to hundreds of users. Marke ...

HFRX Hedge Fund Indices Methodology

... n=total number of months reported freq is the reporting frequency (12=monthly, 4=quarterly) ISO is the reporting currency SA indicates the fund is open to transparency screening through separate accounts (1=yes, 0=no) ...

... n=total number of months reported freq is the reporting frequency (12=monthly, 4=quarterly) ISO is the reporting currency SA indicates the fund is open to transparency screening through separate accounts (1=yes, 0=no) ...

American Funds IS Managed Risk Asset Allocation Fund

... volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experience the same degree of regulation as U.S. issuers do and are held to different repor ...

... volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experience the same degree of regulation as U.S. issuers do and are held to different repor ...

Deflation Risk

... In this paper, we focus on the most widely-used type of inflation swap which is designated a zero-coupon swap. This swap is executed between two counterparties at time zero and has only one cash flow which occurs at the maturity date of the swap. For example, imagine that at time zero, the ten-year ze ...

... In this paper, we focus on the most widely-used type of inflation swap which is designated a zero-coupon swap. This swap is executed between two counterparties at time zero and has only one cash flow which occurs at the maturity date of the swap. For example, imagine that at time zero, the ten-year ze ...

bid, ask and` transaction prices in a specialist

... The approach taken in this paper is based on the idea that a bid-ask spread can be a purely informational phenomenon, occurring even when all the specialist’s fixed and variable transactions costs (including his time, inventory costs, etc.) are zero and when competition forces the specialist’s profi ...

... The approach taken in this paper is based on the idea that a bid-ask spread can be a purely informational phenomenon, occurring even when all the specialist’s fixed and variable transactions costs (including his time, inventory costs, etc.) are zero and when competition forces the specialist’s profi ...

FINAL NOTICE: Michael Coscia

... 28. As Mr Coscia’s large orders were so unlikely to be executed (due to their short resting time on the order book and inevitable cancellation once the small order was executed or they were partially executed) they created false impressions of liquidity rather than genuine market supply and demand. ...

... 28. As Mr Coscia’s large orders were so unlikely to be executed (due to their short resting time on the order book and inevitable cancellation once the small order was executed or they were partially executed) they created false impressions of liquidity rather than genuine market supply and demand. ...

TCW High Dividend Equities Fund Summary Prospectus

... • investment style risk: the risk that the particular style or set of styles that the investment advisor primarily uses may be out of favor or may not produce the best results over short or longer time periods and may increase the volatility of the Fund’s share price. • REIT risk: the risk that the ...

... • investment style risk: the risk that the particular style or set of styles that the investment advisor primarily uses may be out of favor or may not produce the best results over short or longer time periods and may increase the volatility of the Fund’s share price. • REIT risk: the risk that the ...

On the Cross-Section of Expected Returns of German Stocks: A Re

... premium on size could equally be due to several other factors omitted in the original CAPM. This unobserved heterogeneity leads to biased and inconsistent estimators when an ordinary least square regression estimation is used to find the linear relationship between risk and return, since the error t ...

... premium on size could equally be due to several other factors omitted in the original CAPM. This unobserved heterogeneity leads to biased and inconsistent estimators when an ordinary least square regression estimation is used to find the linear relationship between risk and return, since the error t ...

the endowment effect: evidence of losses valued more than gains

... Several endowment effect experiments have also been carried out over repeated iterations to test for possible impacts of learning, about the trading institutions or about values. For the most part, little change in the asymmetric valuation of gains and losses has resulted from the repetitions. While ...

... Several endowment effect experiments have also been carried out over repeated iterations to test for possible impacts of learning, about the trading institutions or about values. For the most part, little change in the asymmetric valuation of gains and losses has resulted from the repetitions. While ...

SUMMARY AND CONCLUSIONS

... based on a just-completed survey, the growth rate in the economy is likely to be 2 percent in the coming year, as compared to 5 percent for the year just completed. Will security prices increase, decrease, or stay the same following this announcement? Does it make any difference whether or not the 2 ...

... based on a just-completed survey, the growth rate in the economy is likely to be 2 percent in the coming year, as compared to 5 percent for the year just completed. Will security prices increase, decrease, or stay the same following this announcement? Does it make any difference whether or not the 2 ...

The Economic Analysis of Real Option Value

... Management could implement an option-based strategy that could increase the uncertainty of the investment’s expected future cash flow. An example would be: 1. to make a limited strategic investment in a new market (i.e., to make a “bet” on a new market) and then 2. to wait for the company’s compet ...

... Management could implement an option-based strategy that could increase the uncertainty of the investment’s expected future cash flow. An example would be: 1. to make a limited strategic investment in a new market (i.e., to make a “bet” on a new market) and then 2. to wait for the company’s compet ...

House Prices, Sales and Time on the Market: A Search

... of the housing sector in the US. First, prices and sales co-move (with correlation 0.78), prices are more volatile than GDP (displaying positive auto-correlation at high frequencies), and sales are even more volatile (Rı́os-Rull and Sánchez-Marcos 2007). Also, prices and sales are negatively correl ...

... of the housing sector in the US. First, prices and sales co-move (with correlation 0.78), prices are more volatile than GDP (displaying positive auto-correlation at high frequencies), and sales are even more volatile (Rı́os-Rull and Sánchez-Marcos 2007). Also, prices and sales are negatively correl ...

chapter 7

... What is Foreign Exchange? Investors worldwide can open an account. Buy other currencies. ...

... What is Foreign Exchange? Investors worldwide can open an account. Buy other currencies. ...

NBER WORKING PAPER SERIES QUALITATIVE EASING: Roger E.A. Farmer

... in theory, there is a growing empirical literature that finds significant effects of QuaE on asset prices in practice.5 The case is summarized by Joseph Gagnon, who has made a number of notable contributions to this literature. The evidence shows that Fed purchases affected the prices of a broad range ...

... in theory, there is a growing empirical literature that finds significant effects of QuaE on asset prices in practice.5 The case is summarized by Joseph Gagnon, who has made a number of notable contributions to this literature. The evidence shows that Fed purchases affected the prices of a broad range ...

Risk Perception and Foreign Exchange Risk Management in

... regarding the perception of risks and the risk management between small and large, established MFIs. To analyze this point we split the complete MFI sample, consisting of 95 answers, into two subsamples. Subsample ‘large’ consists of 52 MFIs with a total loan portfolio size larger than 10 mio. USD a ...

... regarding the perception of risks and the risk management between small and large, established MFIs. To analyze this point we split the complete MFI sample, consisting of 95 answers, into two subsamples. Subsample ‘large’ consists of 52 MFIs with a total loan portfolio size larger than 10 mio. USD a ...

Chp 10 Slides File

... Private Equity Private equity is a business that is privately held and the owners cannot sell their shares to the public. Some business owners hope to go public so that: ■ They can obtain financing to support the firm’s growth ...

... Private Equity Private equity is a business that is privately held and the owners cannot sell their shares to the public. Some business owners hope to go public so that: ■ They can obtain financing to support the firm’s growth ...

Products ESQUIRE CAPITAL INVESTMENT ADVISORS LLP

... Invest in securities of companies of any size capitalization, style or sector. ...

... Invest in securities of companies of any size capitalization, style or sector. ...

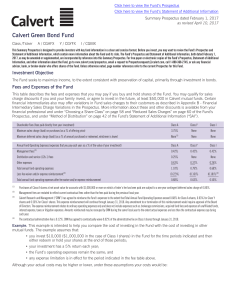

Calvert Green Bond Fund

... price volatility, less liquidity, wider trading spreads and a lack of price transparency in the market. No active trading market may exist for certain investments, which may impair the ability of the Fund to sell or to realize the full value of such investments in the event of the need to liquidate ...

... price volatility, less liquidity, wider trading spreads and a lack of price transparency in the market. No active trading market may exist for certain investments, which may impair the ability of the Fund to sell or to realize the full value of such investments in the event of the need to liquidate ...