Chapter 1: Introduction

... The purchase of a T-bill is, therefore, an investment that pays no cash flow between the purchase date and the bill’s maturity. Hence, its current market price is the NPV of the bill’s Face Value: ...

... The purchase of a T-bill is, therefore, an investment that pays no cash flow between the purchase date and the bill’s maturity. Hence, its current market price is the NPV of the bill’s Face Value: ...

Review of Statistics in Finance

... probability. Although the expected value in this case is $100, the actual outcome (by definition) will be either $75 or $125, not $100. In this case, one way to interpret expected value is that if i) the above situation presented itself many, many times, ii) each time one bought 1 share of the stock ...

... probability. Although the expected value in this case is $100, the actual outcome (by definition) will be either $75 or $125, not $100. In this case, one way to interpret expected value is that if i) the above situation presented itself many, many times, ii) each time one bought 1 share of the stock ...

Factual Overview and Perspective

... value of comparable transactions in the oil industry would, in part, determine what would be paid for Gulf. By the end of 1983, the buyout market was in full swing, and several large oil companies had already been bought by way of highly leveraged transactions. In doing a comparable analysis, the ea ...

... value of comparable transactions in the oil industry would, in part, determine what would be paid for Gulf. By the end of 1983, the buyout market was in full swing, and several large oil companies had already been bought by way of highly leveraged transactions. In doing a comparable analysis, the ea ...

1 - BrainMass

... e. “Restructuring” a firm’s debt can involve forgiving a certain portion of the debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the followi ...

... e. “Restructuring” a firm’s debt can involve forgiving a certain portion of the debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the followi ...

Stock Market Prediction Using Support Vector Machine

... Predicting financial indicators is therefore a difficult task. However, forecasting is important in the sense that it provides concrete data for investment decisions. How can we predict whether the price of a particular stock will go up or down in the upcoming year? In the modern techniques, one way ...

... Predicting financial indicators is therefore a difficult task. However, forecasting is important in the sense that it provides concrete data for investment decisions. How can we predict whether the price of a particular stock will go up or down in the upcoming year? In the modern techniques, one way ...

MARKET REVIEW - Markets pare early Quarter gains as Strong

... with regular rebalancing compensate the client for the tax paid over time. Triggering capital gains associated with rebalancing in order to meet long term objectives at a higher probability and lower risk is good investment practice. This also adjusts your base cost going forward which lowers the Ra ...

... with regular rebalancing compensate the client for the tax paid over time. Triggering capital gains associated with rebalancing in order to meet long term objectives at a higher probability and lower risk is good investment practice. This also adjusts your base cost going forward which lowers the Ra ...

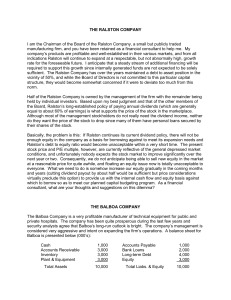

The Ralston Company/The Balboa Company

... do they want the price of the stock to drop since many of them have personal loans secured by their shares of the stock. Basically, the problem is this: If Ralston continues its current dividend policy, there will not be enough equity in the company as a basis for borrowing against to meet its expan ...

... do they want the price of the stock to drop since many of them have personal loans secured by their shares of the stock. Basically, the problem is this: If Ralston continues its current dividend policy, there will not be enough equity in the company as a basis for borrowing against to meet its expan ...

Fact Sheet - Hartford Funds

... guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. Foreign investments can be riskier and more volatile than U.S. investments due to the adverse effects of c ...

... guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. Foreign investments can be riskier and more volatile than U.S. investments due to the adverse effects of c ...

BMO Asset Management Global Equity Fund

... their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The first step is an in-depth historical analysis of the company’s balance sheet and earnings sta ...

... their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The first step is an in-depth historical analysis of the company’s balance sheet and earnings sta ...

PDF - Muriel Siebert

... modify an oftquoted allegorical locution. There are worse things that could befall our economy than a spike in stock prices, rampant consumer optimism, and rising economic growth. No, sixtyplus days does not a trend make, but having begun in the wee hours of November 9, 2016, it shows few signs of ...

... modify an oftquoted allegorical locution. There are worse things that could befall our economy than a spike in stock prices, rampant consumer optimism, and rising economic growth. No, sixtyplus days does not a trend make, but having begun in the wee hours of November 9, 2016, it shows few signs of ...

Current Assets

... » For example computers or the value of the building if the freehold is owned by the business ...

... » For example computers or the value of the building if the freehold is owned by the business ...

Stock Market Analysis and Personal Finance Mr. Bernstein Bonds

... Ratings Agencies rate bonds based on the likelihood of repayment at maturity Moody’s, Standard & Poor’s and Fitch are the three major Rating Agencies Bonds are rated from D to AAA BBB and above are “Investment Grade” BB and below are “High Yield” or “Junk” bonds ...

... Ratings Agencies rate bonds based on the likelihood of repayment at maturity Moody’s, Standard & Poor’s and Fitch are the three major Rating Agencies Bonds are rated from D to AAA BBB and above are “Investment Grade” BB and below are “High Yield” or “Junk” bonds ...

Asian Century: An East Asia Perspective

... • NIE’s accumulated capital and increased labor participation at a much faster rate than other economies • The increase in these two factors far from fully explains their exceptional growth rates • productivity growth also accounts for a significant fraction ...

... • NIE’s accumulated capital and increased labor participation at a much faster rate than other economies • The increase in these two factors far from fully explains their exceptional growth rates • productivity growth also accounts for a significant fraction ...

CREDIT PROFILE OF SPAREBANK 1 SR-BANK

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

Was there a stock market bubble in Hungary?

... rational and irrational players. They argue that prices can rise above their rational level, where behavior of irrational actors determine prices, and usually it gives a warning signal before markets collapse. The rational level is defined as the fundamental value of stocks (equal to discounted futu ...

... rational and irrational players. They argue that prices can rise above their rational level, where behavior of irrational actors determine prices, and usually it gives a warning signal before markets collapse. The rational level is defined as the fundamental value of stocks (equal to discounted futu ...

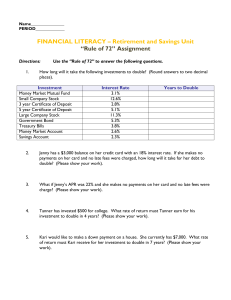

Personal Finance and Portfolio Management Strategies Module Exam

... Joshua Charles plans to buy a house for $60,000. If that real estate property is expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the ...

... Joshua Charles plans to buy a house for $60,000. If that real estate property is expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the ...

Personal Finance and Portfolio Management Strategies Module Exam

... Joshua Charles plans to buy a house for $60,000. If that real estate property is expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the ...

... Joshua Charles plans to buy a house for $60,000. If that real estate property is expected to increase in value 5 percent each year, (a) what is the appropriate value seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the ...