AN0008 - ANZ Australian Equities Capital

... embedded in the portfolio’s growth orientation. An overweight position to Health Care boosted returns, particularly through our high exposure to CSL Limited (+25.4%) and ResMed (+8.6%). Our next largest sector positions held in Industrials (+2.7%) and Materials (+2.3%) dragged as both sectors posted ...

... embedded in the portfolio’s growth orientation. An overweight position to Health Care boosted returns, particularly through our high exposure to CSL Limited (+25.4%) and ResMed (+8.6%). Our next largest sector positions held in Industrials (+2.7%) and Materials (+2.3%) dragged as both sectors posted ...

Merchandising Operations and the Multiple

... Reliability - information must be free of error and bias Comparability - ability to compare information of different companies because they use the same accounting principles Consistency - use of same accounting principles and methods from year to year within the same company ...

... Reliability - information must be free of error and bias Comparability - ability to compare information of different companies because they use the same accounting principles Consistency - use of same accounting principles and methods from year to year within the same company ...

Assignment Brief - Homework Market

... state pension, with an overall pension income of £178 per week. Jenny is not in the best of health. They paid off their mortgage when they sold their family home and moved to a 3 bedroom bungalow. Harry would now like to spend more time Jenny, so he has come to the view that he should reduce his wor ...

... state pension, with an overall pension income of £178 per week. Jenny is not in the best of health. They paid off their mortgage when they sold their family home and moved to a 3 bedroom bungalow. Harry would now like to spend more time Jenny, so he has come to the view that he should reduce his wor ...

Transactions Related to Shares

... Another Class of Stock • Companies may customize different classes of stock in any way they want. The most common reason for this is the company wanting the voting power to remain with a certain group; hence, different classes of shares are given different voting rights. • Ex. one class of shares w ...

... Another Class of Stock • Companies may customize different classes of stock in any way they want. The most common reason for this is the company wanting the voting power to remain with a certain group; hence, different classes of shares are given different voting rights. • Ex. one class of shares w ...

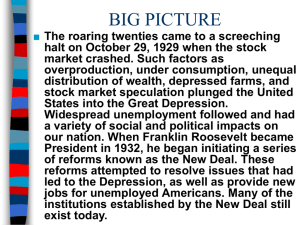

Great Depression

... stock market speculation plunged the United States into the Great Depression. Widespread unemployment followed and had a variety of social and political impacts on ...

... stock market speculation plunged the United States into the Great Depression. Widespread unemployment followed and had a variety of social and political impacts on ...

BILBOARD Spring 2016

... speak about a global recession and according to their definitions, the threshold lies between 2.5% and 3% global economic growth. Whatever the definition is, we can probably conclude that global industrial production has been dropping by 2% and it is forecasted to drop by 4% by 2017. The threat of d ...

... speak about a global recession and according to their definitions, the threshold lies between 2.5% and 3% global economic growth. Whatever the definition is, we can probably conclude that global industrial production has been dropping by 2% and it is forecasted to drop by 4% by 2017. The threat of d ...

Ch. 15: Financial Markets

... maturity value will be paid to the bond holder. Bond maturity dates when issued generally range from 3 months up to 30 years. Coupon rate • Between the date of issuance and the maturity date, the bond-holder receives an annual interest payment equal to the coupon rate times the maturity value. Yield ...

... maturity value will be paid to the bond holder. Bond maturity dates when issued generally range from 3 months up to 30 years. Coupon rate • Between the date of issuance and the maturity date, the bond-holder receives an annual interest payment equal to the coupon rate times the maturity value. Yield ...

stock loan fee increase - The Options Clearing Corporation

... On July 29, 2016, the Options Clearing Corporation filed with the U.S. Securities and Exchange Commission a proposed change to OCC’s Schedule of Fees in conjunction with enhancements to OCC’s Stock Loan Program, which encompasses both the Stock Hedge Program and Market Loan Program. The Stock Loan P ...

... On July 29, 2016, the Options Clearing Corporation filed with the U.S. Securities and Exchange Commission a proposed change to OCC’s Schedule of Fees in conjunction with enhancements to OCC’s Stock Loan Program, which encompasses both the Stock Hedge Program and Market Loan Program. The Stock Loan P ...

Document

... Example: VCR Start-up: new, so sale and earnings go up rapidly Consolidation stage: ◦ product is established, more firms enter, growth rate is stable, and higher than economy ...

... Example: VCR Start-up: new, so sale and earnings go up rapidly Consolidation stage: ◦ product is established, more firms enter, growth rate is stable, and higher than economy ...

Blackstone Real Estate Income Trust, Inc.

... On May 30, 2017, Blackstone Real Estate Income Trust, Inc. (the “Company”) declared distributions for each applicable class of its common stock in the amount per share set forth below: ...

... On May 30, 2017, Blackstone Real Estate Income Trust, Inc. (the “Company”) declared distributions for each applicable class of its common stock in the amount per share set forth below: ...

Expanding the Use of a Pit Market Game_Holmgren

... Supply and Demand Experiment Purpose: This experiment investigates the interaction of supply and demand in a simulated market. Generated data will demonstrate how economic theory can predict “typical” behavior. This simulated market has essentially the same organization as the New York Stock Exchan ...

... Supply and Demand Experiment Purpose: This experiment investigates the interaction of supply and demand in a simulated market. Generated data will demonstrate how economic theory can predict “typical” behavior. This simulated market has essentially the same organization as the New York Stock Exchan ...

outlook 2017: executive summary

... The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set ...

... The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set ...

CREDIT PROFILE OF SPAREBANK 1 SR-BANK

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

No Slide Title

... eliminated that our industry takes for granted? What factors should be reduced well below the industry standard? ...

... eliminated that our industry takes for granted? What factors should be reduced well below the industry standard? ...

the peloton position - Peloton Wealth Strategists

... • Commodity prices are soaring. Gold continues its advance, and oil is again near $90 per barrel. Other commodities have jumped much more than the two headline materials. Copper, iron ore, cotton, and sugar have all rocketed higher. These are primary inputs for many finished goods industries around ...

... • Commodity prices are soaring. Gold continues its advance, and oil is again near $90 per barrel. Other commodities have jumped much more than the two headline materials. Copper, iron ore, cotton, and sugar have all rocketed higher. These are primary inputs for many finished goods industries around ...

www.utahscreditunions.org

... I was with Bank of America for 8 years. That's a quarter of my lifetime. Do you know how long 8 years is to a 32-year-old person? I was with Bank of America since April 2004. I've had 5 different boyfriends since then. I've lived in 4 different apartments in 3 different neighborhoods in 2 different ...

... I was with Bank of America for 8 years. That's a quarter of my lifetime. Do you know how long 8 years is to a 32-year-old person? I was with Bank of America since April 2004. I've had 5 different boyfriends since then. I've lived in 4 different apartments in 3 different neighborhoods in 2 different ...

Copy of Article in PDF

... your portfolio, and never, never margin (borrow against) your blue-chip stocks to buy micro-caps. If you do and the stock market tumbles, there will be no buyers for the micro-caps, so you’ll have to sell your blue-chips to pay for them. What to look for Here are questions Fabrice Taylor of The Pres ...

... your portfolio, and never, never margin (borrow against) your blue-chip stocks to buy micro-caps. If you do and the stock market tumbles, there will be no buyers for the micro-caps, so you’ll have to sell your blue-chips to pay for them. What to look for Here are questions Fabrice Taylor of The Pres ...

The Return Shortfall in Equity Markets

... – If D/P is low, stocks are overvalued and equity premium will be low – If D/P is high, stocks are undervalued and equity premium will be high ...

... – If D/P is low, stocks are overvalued and equity premium will be low – If D/P is high, stocks are undervalued and equity premium will be high ...

the great depression begins

... helped cause the Great Depression. – Making credit available, businesses encouraged Americans to pile up a large consumer debt; – Faced with rising prices, stagnant wages, and high levels of debt, consumers decreased their buying. ...

... helped cause the Great Depression. – Making credit available, businesses encouraged Americans to pile up a large consumer debt; – Faced with rising prices, stagnant wages, and high levels of debt, consumers decreased their buying. ...