Fin30233_F2016_Hedging and VAR with DeltaGamma

... What if stock rises 1.65 (Sst) = $13.04, to new price of 129.67? the position changes to: (assume no time lapse) Position short call long shares total ...

... What if stock rises 1.65 (Sst) = $13.04, to new price of 129.67? the position changes to: (assume no time lapse) Position short call long shares total ...

The Relationship Between Individual Stock Trading And Returns

... n 1996, household investments comprised almost 47 percent of stock investment in the United States (Barber and Odeon, 2000). This issue incites Barber and Odeon (2000) and other researchers to study individual investor behavior in the US equity market. But, in the course of the 2020s decade, the dev ...

... n 1996, household investments comprised almost 47 percent of stock investment in the United States (Barber and Odeon, 2000). This issue incites Barber and Odeon (2000) and other researchers to study individual investor behavior in the US equity market. But, in the course of the 2020s decade, the dev ...

DuPont analysis - Fisher College of Business

... The first condition is likely satisfied but the second is not as clear-cut, as it depends on the relative effect on turnover of any accrued expenses related to the fraudulent revenue. ...

... The first condition is likely satisfied but the second is not as clear-cut, as it depends on the relative effect on turnover of any accrued expenses related to the fraudulent revenue. ...

words

... New orders of 958 units for the quarter ended June 30, 2010, represented a decrease of 44.2 percent, compared to new orders of 1,716 units for the same period in 2009. The Company had a monthly sales absorption rate of 1.8 homes per community in the second quarter ended June 30, 2010, versus 2.5 hom ...

... New orders of 958 units for the quarter ended June 30, 2010, represented a decrease of 44.2 percent, compared to new orders of 1,716 units for the same period in 2009. The Company had a monthly sales absorption rate of 1.8 homes per community in the second quarter ended June 30, 2010, versus 2.5 hom ...

Overall the performance of companies on the GSE

... The defining image of corporate performance between 2001 and 2002 in the industrialised economies was the bankruptcy of several ‘Blue Chip’ companies (e.g. World Com, Enron etc). Corporate performance was also exacerbated by a depressed stock market with hardly any growth in the major global bourses ...

... The defining image of corporate performance between 2001 and 2002 in the industrialised economies was the bankruptcy of several ‘Blue Chip’ companies (e.g. World Com, Enron etc). Corporate performance was also exacerbated by a depressed stock market with hardly any growth in the major global bourses ...

Definitions to Basic Technical Analysis Terms

... A preferred stock is a class of stock entitling the holder to receive a specified dollar value per share upon liquidation of the company, and a fixed dividend paid before the common stock holders. Voting rights are usually limited to special situations such as when a certain number of dividends have ...

... A preferred stock is a class of stock entitling the holder to receive a specified dollar value per share upon liquidation of the company, and a fixed dividend paid before the common stock holders. Voting rights are usually limited to special situations such as when a certain number of dividends have ...

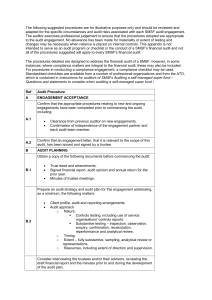

Illustrative financial audit procedures for a self

... o The closing price of the units at the period end. o The method used to value the investments is consistent with that disclosed in the accounting policy notes. o Check if the units are valued cum or exdistribution and that this is correctly and consistently calculated and reported. If the SMSF inve ...

... o The closing price of the units at the period end. o The method used to value the investments is consistent with that disclosed in the accounting policy notes. o Check if the units are valued cum or exdistribution and that this is correctly and consistently calculated and reported. If the SMSF inve ...

Chapter 9

... noncallable bonds with 15 years remaining to maturity is $1,153.72. Coleman does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. ...

... noncallable bonds with 15 years remaining to maturity is $1,153.72. Coleman does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. ...

A Beginners Guide to Investing in the Share Market

... The laws of supply and demand explain why share prices fluctuate. But how do investors and analysts arrive at their decisions as to whether a share is worth buying or selling at a given price? People invest in shares to make a profit. This profit comes in part from the dividends that the company dis ...

... The laws of supply and demand explain why share prices fluctuate. But how do investors and analysts arrive at their decisions as to whether a share is worth buying or selling at a given price? People invest in shares to make a profit. This profit comes in part from the dividends that the company dis ...

(PPT, 202KB)

... preferred issues offer holders the opportunity to receive extra dividends if the company achieves predetermined financial goals. Investors who purchased these stocks receive their regular dividend regardless of company performance (assuming the company does well enough to make its annual dividend pa ...

... preferred issues offer holders the opportunity to receive extra dividends if the company achieves predetermined financial goals. Investors who purchased these stocks receive their regular dividend regardless of company performance (assuming the company does well enough to make its annual dividend pa ...

FIN 331 in a Nutshell

... Asset Management Right amount of assets vs. sales? Debt Management Right mix of debt and equity? Profitability ...

... Asset Management Right amount of assets vs. sales? Debt Management Right mix of debt and equity? Profitability ...

IPPTChap012

... 3. Conservatism: Investors are slow to update their beliefs and under react to new information 4. Sample Size Neglect and Representativeness: Investors are too quick to infer a pattern or trend ...

... 3. Conservatism: Investors are slow to update their beliefs and under react to new information 4. Sample Size Neglect and Representativeness: Investors are too quick to infer a pattern or trend ...

Chapter 6: Reporting and Interpreting Sales Revenue, Receivables

... 6. Companies must make the decision of whether they should pay an accounts payable within the discount period. In order to do this they determine the annualized savings of paying within the discount period. The company then compares this to the rate that they would have to pay on a loan in order to ...

... 6. Companies must make the decision of whether they should pay an accounts payable within the discount period. In order to do this they determine the annualized savings of paying within the discount period. The company then compares this to the rate that they would have to pay on a loan in order to ...

A Portfolio Built on Divident Growth - Presentation by Scott Malatesta

... Performance based on the average calendar year performance since inception to 12/31/12. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, ma ...

... Performance based on the average calendar year performance since inception to 12/31/12. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, ma ...

CHAPTER 10 Capital assets

... Must be tested for impairment (when fair market value for an assets drops below the net book value). ...

... Must be tested for impairment (when fair market value for an assets drops below the net book value). ...