Buongiorno SpA (BVIT.MI)

... Growth is a composite of next year's estimate over current year's estimate, e.g. EPS, EBITDA, Revenue. Return is a year one prospective aggregate of various return on capital measures, e.g. CROCI, ROACE, and ROE. Multiple is a composite of one-year forward valuation ratios, e.g. P/E, dividend yield, ...

... Growth is a composite of next year's estimate over current year's estimate, e.g. EPS, EBITDA, Revenue. Return is a year one prospective aggregate of various return on capital measures, e.g. CROCI, ROACE, and ROE. Multiple is a composite of one-year forward valuation ratios, e.g. P/E, dividend yield, ...

WKSI Morning Brief - NH Korindo Securities

... Dec 2015 price target at IDR 2,095. Last year SMCB reported declined EPS by 30 percent due to pressure margin. We views that bad result on last 2 years as the time for the company to build its foundation, especially when economic cycle was depressed. We expect favorable macroeconomic and infrastruct ...

... Dec 2015 price target at IDR 2,095. Last year SMCB reported declined EPS by 30 percent due to pressure margin. We views that bad result on last 2 years as the time for the company to build its foundation, especially when economic cycle was depressed. We expect favorable macroeconomic and infrastruct ...

Chapter 15

... future economic “story” of a company, with less regard to share valuation • A value investor focuses on share price in anticipation of a market correction and, possibly, improving company fundamentals. • Value stocks generally have offered somewhat higher returns than growth stocks, but this does no ...

... future economic “story” of a company, with less regard to share valuation • A value investor focuses on share price in anticipation of a market correction and, possibly, improving company fundamentals. • Value stocks generally have offered somewhat higher returns than growth stocks, but this does no ...

TA Securities - Bursa e-Research

... US$4.2mn. PCLCL is a Cambodian company, which is involved in digit number forecasting business. Also, the company has a license to operate casinos and online gaming in Kampot province, Cambodia. To recap, Luster proposed to acquire 60% stake in PCLCL from the vendor, ie: Opal Deluxe Ltd, and the dea ...

... US$4.2mn. PCLCL is a Cambodian company, which is involved in digit number forecasting business. Also, the company has a license to operate casinos and online gaming in Kampot province, Cambodia. To recap, Luster proposed to acquire 60% stake in PCLCL from the vendor, ie: Opal Deluxe Ltd, and the dea ...

Level 3 General Education (Commerce Sream)

... for consideration other than cash, debentures as collateral security, interest on debentures ...

... for consideration other than cash, debentures as collateral security, interest on debentures ...

the effect of exchange rate volatility on share price

... price volatility has been widely debated in the finance literature. The literature suggests mixed results. Whereas some studies suggest causality running from share prices to exchange rate some suggests the traditional approach of exchange rate transmission mechanism and others argue that the exchan ...

... price volatility has been widely debated in the finance literature. The literature suggests mixed results. Whereas some studies suggest causality running from share prices to exchange rate some suggests the traditional approach of exchange rate transmission mechanism and others argue that the exchan ...

Economic Trends in Eastern Europe Vol. 23. No. 3 - Kopint

... moderate levels of energy and non-energy raw material prices. The price level of raw materials has decreased in the past couple of months. The IMF primary commodity prices index has been on the decrease since June, with month-on-month indexes of -2.2% and 3.2% in July and August, respectively. The U ...

... moderate levels of energy and non-energy raw material prices. The price level of raw materials has decreased in the past couple of months. The IMF primary commodity prices index has been on the decrease since June, with month-on-month indexes of -2.2% and 3.2% in July and August, respectively. The U ...

FV View - El Corte Inglés

... the FV View by abolishing ‘more likely than not’ recognition criterion, by adopting measurement at market price of disposal of an obligation, and by extending application to all liabilities not covered by othe standards ...

... the FV View by abolishing ‘more likely than not’ recognition criterion, by adopting measurement at market price of disposal of an obligation, and by extending application to all liabilities not covered by othe standards ...

Corporate Finance

... 11. Valuing Corporate Strategic Opportunities and Flexibility: Corporate Real Options Strategic options of the corporation and the limitations of DCF analysis. Real option valuation: main assumptions, the difference in treatment of parameters between financial and real options. The use of risk neutr ...

... 11. Valuing Corporate Strategic Opportunities and Flexibility: Corporate Real Options Strategic options of the corporation and the limitations of DCF analysis. Real option valuation: main assumptions, the difference in treatment of parameters between financial and real options. The use of risk neutr ...

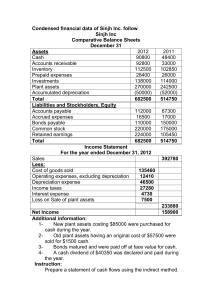

Condensed financial data of Sinjh Inc. follow Sinjh Inc Comparative

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

Analysis of the Discount Factors in Swap Valuation

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

Introduction to Managerial Accounting

... Calculate the present value of cash inflows, Calculate the present value of cash outflows, The difference between the two streams of ...

... Calculate the present value of cash inflows, Calculate the present value of cash outflows, The difference between the two streams of ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... payments lowers corporate taxes.4 (3) The net increase in corporate tax payments reduces dividends and retained earnings, thus lowering tax payments by shareholders. (4) The nominal increase in the value of the corporation's capital stock induces a capital gains tax liability for shareholders. (5) B ...

... payments lowers corporate taxes.4 (3) The net increase in corporate tax payments reduces dividends and retained earnings, thus lowering tax payments by shareholders. (4) The nominal increase in the value of the corporation's capital stock induces a capital gains tax liability for shareholders. (5) B ...

Modeling Price Differentials between A Shares and H Shares on the

... prices are related to the contemporaneous movements of the local markets performance, which is dominated by the local risk-free rate, the local interest rate, and the currency effect. Based on the “investment sentiment” notions, Bailey (1994) proposes that unseasoned or unduly optimistic Chinese inv ...

... prices are related to the contemporaneous movements of the local markets performance, which is dominated by the local risk-free rate, the local interest rate, and the currency effect. Based on the “investment sentiment” notions, Bailey (1994) proposes that unseasoned or unduly optimistic Chinese inv ...

Trading and Profit and Loss Accounts: Further

... The cost of the transport of goods (stock) into a firm is called Carriage Inwards (Purchases Carriages). The cost of delivering goods from the firm to the customer is known as Carriage Outwards (Sales Carriages). If a supplier charges you for the delivery of the goods on top of the cost of the purch ...

... The cost of the transport of goods (stock) into a firm is called Carriage Inwards (Purchases Carriages). The cost of delivering goods from the firm to the customer is known as Carriage Outwards (Sales Carriages). If a supplier charges you for the delivery of the goods on top of the cost of the purch ...

Chapter 3

... recorded in the general journal is transferred to a ledger. The general ledger is really nothing more than a collection of T-accounts for a company, which means that the general ledger contains both the activity and balances of all company accounts. The most basic type of ledger is the general ledge ...

... recorded in the general journal is transferred to a ledger. The general ledger is really nothing more than a collection of T-accounts for a company, which means that the general ledger contains both the activity and balances of all company accounts. The most basic type of ledger is the general ledge ...

6. Derivatives Market

... Exchanges in Asia grew especially rapidly in 2010, with growth rates of 42.8 percent, accounting for 39.8 percent of the global volume, compared to 32.2 percent for North America and 19.8 percent for Europe. Most of the increase in volume came from exchanges in China, India, and Korea. In India, the ...

... Exchanges in Asia grew especially rapidly in 2010, with growth rates of 42.8 percent, accounting for 39.8 percent of the global volume, compared to 32.2 percent for North America and 19.8 percent for Europe. Most of the increase in volume came from exchanges in China, India, and Korea. In India, the ...

November 2005 Course FM/2 Examination 1. An insurance

... Solutions by Krzysztof Ostaszewski 1. November 2005 Course FM/2 Examination, Problem No. 1, and Dr. Ostaszewski’s ...

... Solutions by Krzysztof Ostaszewski 1. November 2005 Course FM/2 Examination, Problem No. 1, and Dr. Ostaszewski’s ...

perceptron, inc.

... In July 2013, the FASB issued updated guidance on the presentation of unrecognized tax benefits when a net operating loss carry−forward, a similar tax loss, or a tax credit carry−forward exists. The update clarifies that an unrecognized tax benefit should be presented in the financial statements as ...

... In July 2013, the FASB issued updated guidance on the presentation of unrecognized tax benefits when a net operating loss carry−forward, a similar tax loss, or a tax credit carry−forward exists. The update clarifies that an unrecognized tax benefit should be presented in the financial statements as ...