Central Bank of the Republic of China (Taiwan)

... of 2014 and the NPL coverage ratio reached 502.87%, reflecting sound asset quality and abundant loan loss provisions. The average capital adequacy ratio of domestic banks stood at 12.34%, which was well above the statutory minimum requirement of 8%, and there was abundant liquidity in the financial ...

... of 2014 and the NPL coverage ratio reached 502.87%, reflecting sound asset quality and abundant loan loss provisions. The average capital adequacy ratio of domestic banks stood at 12.34%, which was well above the statutory minimum requirement of 8%, and there was abundant liquidity in the financial ...

Convertible Bonds Primer

... usually lack a long-term track record. For these reasons, they are required to raise debt at a significantly high interest cost. By issuing convertibles, they are able to both harness the volatility of their capital structure and reduce the interest payments on their debt. In most cases, the higher ...

... usually lack a long-term track record. For these reasons, they are required to raise debt at a significantly high interest cost. By issuing convertibles, they are able to both harness the volatility of their capital structure and reduce the interest payments on their debt. In most cases, the higher ...

Templeton Global Balanced Fund Annual Report

... during the period. Brazil’s economy continued to be in recession and the country’s central bank cut its benchmark interest rate in October and November 2016 to spur economic growth. Russia’s economic contraction eased in 2016, following a rebound in oil prices and improved industrial production. The ...

... during the period. Brazil’s economy continued to be in recession and the country’s central bank cut its benchmark interest rate in October and November 2016 to spur economic growth. Russia’s economic contraction eased in 2016, following a rebound in oil prices and improved industrial production. The ...

Missing Numbers -- Behind Wave of Corporate Fraud: A Change in

... auditor gains assurance by examining all of the component parts of the financial statements, ensuring that the transactions recorded are complete and accurate." By comparison, under the "top down" risk-based audit methodology, auditors focus "less on the details of individual transactions" and use ...

... auditor gains assurance by examining all of the component parts of the financial statements, ensuring that the transactions recorded are complete and accurate." By comparison, under the "top down" risk-based audit methodology, auditors focus "less on the details of individual transactions" and use ...

Chapter 3 - California State University

... typically hard to measure, unlike the ability to pay that can be assessed by examining the sovereign balance sheet (e.g., foreign exchange reserves, current account balance, debt outstanding, government revenues, etc.). Willingness to pay lies in the hands of the political leadership of the country. ...

... typically hard to measure, unlike the ability to pay that can be assessed by examining the sovereign balance sheet (e.g., foreign exchange reserves, current account balance, debt outstanding, government revenues, etc.). Willingness to pay lies in the hands of the political leadership of the country. ...

Communicating Asset Risk: How Name

... demonstrations of the use of this heuristic, which refers to the rule of choosing the member of a pair that the decisionmaker recognizes whenever only one member elicits recognition, have not looked at investment decisions (i.e., preference tasks), but have been restricted to inference tasks (e.g., ...

... demonstrations of the use of this heuristic, which refers to the rule of choosing the member of a pair that the decisionmaker recognizes whenever only one member elicits recognition, have not looked at investment decisions (i.e., preference tasks), but have been restricted to inference tasks (e.g., ...

role of capital market

... Investments by households in India have increasingly moved either to risk-free, fixed-return, lowyielding instruments or to non-financial assets. Low knowledge among households of financial concepts and products has a direct impact on utilization by households of the financial markets. Financial lit ...

... Investments by households in India have increasingly moved either to risk-free, fixed-return, lowyielding instruments or to non-financial assets. Low knowledge among households of financial concepts and products has a direct impact on utilization by households of the financial markets. Financial lit ...

Mitigating Systemic Risk - A Role for Securities Regulators

... response in relation to its mandate and domestic regulatory structure as well as the relative size and characteristics of its securities market. Individual regulators will consequently need to evaluate the scale of their response and the extent to which they can leverage, rather than duplicate, the ...

... response in relation to its mandate and domestic regulatory structure as well as the relative size and characteristics of its securities market. Individual regulators will consequently need to evaluate the scale of their response and the extent to which they can leverage, rather than duplicate, the ...

Mining, Exploration and Investment

... maintain that one’s strength is revealed through adversity. Having weathered the listing of our company amidst the global economic crisis, there can be little doubt that we have emerged stronger and that the quality of our team has been proven. Sephaku Holdings’ listing on the JSE on 21 August 2009 ...

... maintain that one’s strength is revealed through adversity. Having weathered the listing of our company amidst the global economic crisis, there can be little doubt that we have emerged stronger and that the quality of our team has been proven. Sephaku Holdings’ listing on the JSE on 21 August 2009 ...

- Franklin Templeton Investments

... The Fund’s Class A shares had a -0.32% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government Index: 1-2 Year Component, posted a +0.71% total return.3 The index measures public obligations of the U.S. Treasury with one to ...

... The Fund’s Class A shares had a -0.32% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government Index: 1-2 Year Component, posted a +0.71% total return.3 The index measures public obligations of the U.S. Treasury with one to ...

Chapter 2: A Further Look at Financial Statements

... in cash or sold or consumed in the business within one year of the balance sheet date or the company's operating cycle, whichever is longer. Current assets are listed in the order of liquidity. That is, in the order in which they are expected to be converted into cash. ...

... in cash or sold or consumed in the business within one year of the balance sheet date or the company's operating cycle, whichever is longer. Current assets are listed in the order of liquidity. That is, in the order in which they are expected to be converted into cash. ...

Benchmarks as Limits to Arbitrage: Understanding the Low

... A, B is less likely than A but seems more “representative” of Linda. What does this experiment have to do with stocks and volatility? Consider defining the characteristics of “great investments.” The layman and the quant address this question with two different approaches. On the one hand, the layma ...

... A, B is less likely than A but seems more “representative” of Linda. What does this experiment have to do with stocks and volatility? Consider defining the characteristics of “great investments.” The layman and the quant address this question with two different approaches. On the one hand, the layma ...

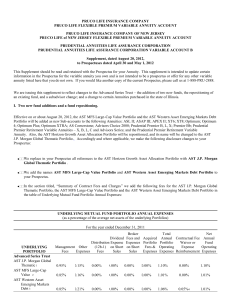

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... annuity listed here that you do not own. If you would like another copy of the current Prospectus, please call us at 1-888-PRU-2888. We are issuing this supplement to reflect changes to the Advanced Series Trust – the addition of two new funds, the repositioning of an existing fund, and a subadvisor ...

... annuity listed here that you do not own. If you would like another copy of the current Prospectus, please call us at 1-888-PRU-2888. We are issuing this supplement to reflect changes to the Advanced Series Trust – the addition of two new funds, the repositioning of an existing fund, and a subadvisor ...

Hedging and Speculating with Interest Rate Swaps

... cash flows have the opposite interest rate sensitivity. Such risk management practices make it more likely that internally generated cash flows will cover both the firm’s interest expenses and its investment needs. This evidence is consistent with the model of Froot et al. (1993), who show that firm ...

... cash flows have the opposite interest rate sensitivity. Such risk management practices make it more likely that internally generated cash flows will cover both the firm’s interest expenses and its investment needs. This evidence is consistent with the model of Froot et al. (1993), who show that firm ...

Do firms in countries with poor protection of investor rights hold more

... across countries. In contrast to other measures of investor protection, the anti-director rights index is negatively correlated with economic development in our sample so that the tradeoff theory predicts that cash holdings are negatively correlated with the anti-director rights index when one does ...

... across countries. In contrast to other measures of investor protection, the anti-director rights index is negatively correlated with economic development in our sample so that the tradeoff theory predicts that cash holdings are negatively correlated with the anti-director rights index when one does ...

Partisan Discrimination in Credit Ratings in Developed Economies

... Fitch for 23 OECD economies from 1995 to 20144, and then compare these results to an identical (OLS) panel analysis of spreads on long-term government bonds (a proxy of market attitudes towards sovereign creditworthiness) for the same sample. We find that, ceteris paribus, downgrades were more likel ...

... Fitch for 23 OECD economies from 1995 to 20144, and then compare these results to an identical (OLS) panel analysis of spreads on long-term government bonds (a proxy of market attitudes towards sovereign creditworthiness) for the same sample. We find that, ceteris paribus, downgrades were more likel ...

Regulatory Guide RG 196 Short selling

... The hold notice is used by prospective borrowers who do not wish to borrow the relevant securities at that time but wish to retain the potential to do so. For example, a prospective borrower may place a hold for a particular security with a lender while contacting another lender to determine the mos ...

... The hold notice is used by prospective borrowers who do not wish to borrow the relevant securities at that time but wish to retain the potential to do so. For example, a prospective borrower may place a hold for a particular security with a lender while contacting another lender to determine the mos ...

Best Practices for Stable NAV LGIPs

... for Local Government Investment Pools in 1989 and updated these guidelines in 1995 to better provide a framework for the formulation of prudent policies and disclosure for LGIPs. Since that time, LGIPs have experienced sizeable growth in assets and complexity. Given their common interest in promotin ...

... for Local Government Investment Pools in 1989 and updated these guidelines in 1995 to better provide a framework for the formulation of prudent policies and disclosure for LGIPs. Since that time, LGIPs have experienced sizeable growth in assets and complexity. Given their common interest in promotin ...

Leverage Cycles and the Anxious Economy

... In the popular story about crises there are usually massive defaults and bankruptcies caused by failures to meet margin calls. But these events are rare, happening once or twice a decade. Our data describe events with 10 to 20 times the frequency, happening roughly twice a year. Moreover, asset trad ...

... In the popular story about crises there are usually massive defaults and bankruptcies caused by failures to meet margin calls. But these events are rare, happening once or twice a decade. Our data describe events with 10 to 20 times the frequency, happening roughly twice a year. Moreover, asset trad ...