Enhancing affordable rental housing investment via an intermediary

... Australian state and territory governments. AHURI Limited gratefully acknowledges the financial and other support it has received from these governments, without which this work would not have been possible. AHURI comprises a network of university Research Centres across Australia. Research Centre c ...

... Australian state and territory governments. AHURI Limited gratefully acknowledges the financial and other support it has received from these governments, without which this work would not have been possible. AHURI comprises a network of university Research Centres across Australia. Research Centre c ...

Client Investing Guide

... Affordability (capacity for loss) Part of conducting a suitability assessment involves assessing the degree to which you are financially able to bear investment risk, consistent with your objectives. In other words, assessing the extent to which a decline in the value of your portfolio would have a ...

... Affordability (capacity for loss) Part of conducting a suitability assessment involves assessing the degree to which you are financially able to bear investment risk, consistent with your objectives. In other words, assessing the extent to which a decline in the value of your portfolio would have a ...

Vanguard Windsor Funds Statement of Additional Information

... comply with certain requirements. If a Fund fails to meet these requirements in any taxable year, the Fund will, in some cases, be able to cure such failure, including by paying a fund-level tax, paying interest, making additional distributions, or disposing of certain assets. If the Fund is ineligi ...

... comply with certain requirements. If a Fund fails to meet these requirements in any taxable year, the Fund will, in some cases, be able to cure such failure, including by paying a fund-level tax, paying interest, making additional distributions, or disposing of certain assets. If the Fund is ineligi ...

EBIX INC (Form: 10-K, Received: 02/29/2016 15:38:27)

... end to another seamlessly. Any acquisition made by Ebix typically will fall into one of two different categories - one, wherein the acquired company has products and/or services that are competitive to our existing products and services; and two, wherein the acquired company's products and services ...

... end to another seamlessly. Any acquisition made by Ebix typically will fall into one of two different categories - one, wherein the acquired company has products and/or services that are competitive to our existing products and services; and two, wherein the acquired company's products and services ...

The Unintended Consequences of Banning Derivatives in Asset Management Alessandro Beber, Cass Business School Christophe Pérignon, HEC Paris

... variable. Popular types of derivatives include forwards, futures, options, warrants, swaps, credit derivatives, and structured products. These different types of derivatives are written on, respectively, interest rates, exchange rates, equity prices, defaults of debt issuers, etc. A growing numbe ...

... variable. Popular types of derivatives include forwards, futures, options, warrants, swaps, credit derivatives, and structured products. These different types of derivatives are written on, respectively, interest rates, exchange rates, equity prices, defaults of debt issuers, etc. A growing numbe ...

Credit Default Swaps and Bank Regulatory Capital

... contracts, sellers of these contracts are not required to hold additional capital to provide the protection because they are typically nonbank financial institutions, such as insurance companies (e.g., AIG), and are thus outside of the reach of bank regulators. Minton, Stulz, and Williamson (2009) f ...

... contracts, sellers of these contracts are not required to hold additional capital to provide the protection because they are typically nonbank financial institutions, such as insurance companies (e.g., AIG), and are thus outside of the reach of bank regulators. Minton, Stulz, and Williamson (2009) f ...

annual report 2015 - RHB Banking Group

... focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as described by our revitalised Brand Promise, ...

... focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as described by our revitalised Brand Promise, ...

sukuk structures

... Over the last decade, sukuk (singular. sak) have become an increasingly popular debt instrument in the international capital markets. Issuers ranging from sovereigns, quasi-sovereign entities and corporates as well as supranational organisations in the Muslim and non-Muslim world have either issued ...

... Over the last decade, sukuk (singular. sak) have become an increasingly popular debt instrument in the international capital markets. Issuers ranging from sovereigns, quasi-sovereign entities and corporates as well as supranational organisations in the Muslim and non-Muslim world have either issued ...

IFRS - PwC

... Question A1 – Assessing power when different investors control activities in different periods ....................................................................................................... 5 Question A2 – Re-assessment of power .............................................................. ...

... Question A1 – Assessing power when different investors control activities in different periods ....................................................................................................... 5 Question A2 – Re-assessment of power .............................................................. ...

broker dealer models - North American Securities Administrators

... areas such as trading, record keeping, supervision and expenses are handled. Franchises bear most of their own expenses (rent, ...

... areas such as trading, record keeping, supervision and expenses are handled. Franchises bear most of their own expenses (rent, ...

predictions, projections, and precautions: conveying cautionary

... panied by “meaningful cautionary statements” identifying important factors that could cause actual results to differ from the forward-looking statement. Second, the Safe Harbor protects corporations from liability if the forward-looking statement is immaterial. Finally, the corporation is protected ...

... panied by “meaningful cautionary statements” identifying important factors that could cause actual results to differ from the forward-looking statement. Second, the Safe Harbor protects corporations from liability if the forward-looking statement is immaterial. Finally, the corporation is protected ...

RITCHIE BROS AUCTIONEERS INC (Form: 8-K

... US$500.0 million aggregate principal amount of senior notes due 2025 (the “Notes”), subject to market conditions. The Notes will be offered and sold only to qualified institutional buyers in reliance on Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”), and outside the U.S. ...

... US$500.0 million aggregate principal amount of senior notes due 2025 (the “Notes”), subject to market conditions. The Notes will be offered and sold only to qualified institutional buyers in reliance on Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”), and outside the U.S. ...

Adopting Enterprise Risk Management (ERM) in high

... Based on our proprietary processes which are aligned with the specific requirements of a high-growth market environment, we would like to make the strategic case for ERM, with a particular emphasis on those elements which do not necessitate major financial investments. As risks become transparent, m ...

... Based on our proprietary processes which are aligned with the specific requirements of a high-growth market environment, we would like to make the strategic case for ERM, with a particular emphasis on those elements which do not necessitate major financial investments. As risks become transparent, m ...

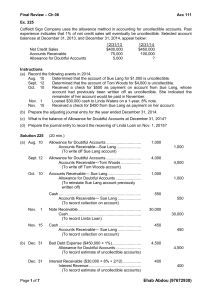

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... Coffeldt Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2013, and December 31, 2014, appear below: Net Credit Sales Accounts Receivable ...

... Coffeldt Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2013, and December 31, 2014, appear below: Net Credit Sales Accounts Receivable ...

1 - Eng_SOMMARIO BILANCIO

... For the first half of 2006, non-recurring costs/income (€5,195 thousand) were made up as follows: ...

... For the first half of 2006, non-recurring costs/income (€5,195 thousand) were made up as follows: ...

ROADRUNNER TRANSPORTATION SYSTEMS - corporate

... over-the-road transportation equipment and provide us with dedicated freight capacity. Purchased power providers are unrelated asset-based over-the-road transportation companies that provide us with freight capacity under non-exclusive contractual arrangements. Although we service large national acc ...

... over-the-road transportation equipment and provide us with dedicated freight capacity. Purchased power providers are unrelated asset-based over-the-road transportation companies that provide us with freight capacity under non-exclusive contractual arrangements. Although we service large national acc ...

call-for-input on the crowdfunding rules

... Furthermore, investors on investment-based crowdfunding platforms are exposed to capital risk – the risk that the funds they will receive upon exit will be less than the capital they originally invested (eg because of lower-than expected company valuations). Similarly, investors on loan-based crowdf ...

... Furthermore, investors on investment-based crowdfunding platforms are exposed to capital risk – the risk that the funds they will receive upon exit will be less than the capital they originally invested (eg because of lower-than expected company valuations). Similarly, investors on loan-based crowdf ...

chimera investment corporation - Morningstar Document Research

... amended, or the Code. If we qualify for taxation as a REIT, we generally will not be subject to U.S. federal income tax on our taxable income that is distributed to our stockholders. To ensure we qualify as a REIT, no person may own more than 9.8% of the outstanding shares of any class of our common ...

... amended, or the Code. If we qualify for taxation as a REIT, we generally will not be subject to U.S. federal income tax on our taxable income that is distributed to our stockholders. To ensure we qualify as a REIT, no person may own more than 9.8% of the outstanding shares of any class of our common ...

Cowen Group, Inc. - Investor Overview

... Other income (loss) Net gains (losses) on securities, derivatives and other investments ...

... Other income (loss) Net gains (losses) on securities, derivatives and other investments ...