Post-Closing Trial Balance

... 3) List all account balances in the “Trial Balance” section of the worksheet. (Draw a single Rule under the last account and all the way across the page.) 4) Add the debit column and the credit column at the bottom of the worksheet (both columns should equal) 5) In the “Income Statement” section of ...

... 3) List all account balances in the “Trial Balance” section of the worksheet. (Draw a single Rule under the last account and all the way across the page.) 4) Add the debit column and the credit column at the bottom of the worksheet (both columns should equal) 5) In the “Income Statement” section of ...

Document

... Advanced by a bank May be syndicated to a group of banks Flexible and quick E.g. Term loans, overdrafts, revolvers (a revolving line of credit is a credit commitment of up to an agreed amount for a specified time, to be drawn and repaid as needed) ...

... Advanced by a bank May be syndicated to a group of banks Flexible and quick E.g. Term loans, overdrafts, revolvers (a revolving line of credit is a credit commitment of up to an agreed amount for a specified time, to be drawn and repaid as needed) ...

Emerging Market Repo

... For the customer who desires the security of delivery repo without the operational requirements, tri-party repo is the ideal product. It involves the use of a third party custodian who receives the cash directly from the customer and then, on the customer's behalf, monitors the movement of cash and ...

... For the customer who desires the security of delivery repo without the operational requirements, tri-party repo is the ideal product. It involves the use of a third party custodian who receives the cash directly from the customer and then, on the customer's behalf, monitors the movement of cash and ...

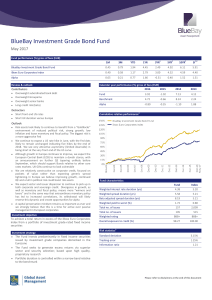

BlueBay Investment Grade Bond Fund

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

Monetary Policy : Instruments and Types

... Rather, they want to reduce their inventories by repaying loans already drawn from the banks. Moreover, the question of borrowing for long-term capital needs does not arise in a depression when the business activity is already at a very low level. The same is the case with consumers who faced with u ...

... Rather, they want to reduce their inventories by repaying loans already drawn from the banks. Moreover, the question of borrowing for long-term capital needs does not arise in a depression when the business activity is already at a very low level. The same is the case with consumers who faced with u ...

Fixed Term Deposit interest rates

... In the circumstance St.George is unable to release the Fixed Term Deposit on the maturity date, St.George will pay interest on the Fixed Term Deposit amount at the Grace Period Rate for the period from date of maturity to the date of redemption to the Manager. The Manager will pass on the interest a ...

... In the circumstance St.George is unable to release the Fixed Term Deposit on the maturity date, St.George will pay interest on the Fixed Term Deposit amount at the Grace Period Rate for the period from date of maturity to the date of redemption to the Manager. The Manager will pass on the interest a ...

1 Introduction 2 Analytical Framework

... However, rj , K j and ε̄j are firm-specific and must satisfy equations (1) and (2). In making its investment (that is, K j − (1 − δ)K0j ) and its financing (loan contract) decisions, the firm takes these constraints into account. Since these decisions are made before ε is known, that is, when all fi ...

... However, rj , K j and ε̄j are firm-specific and must satisfy equations (1) and (2). In making its investment (that is, K j − (1 − δ)K0j ) and its financing (loan contract) decisions, the firm takes these constraints into account. Since these decisions are made before ε is known, that is, when all fi ...

Multi-Seller Commercial Paper - Dorris - Artic

... rating of the conduit’s commercial paper notes. Program-wide credit enhancement is built into the structure of the multi-seller CP conduit. The organizational documents of the conduit set forth the required facilities. Such facilities are constructed so they will be available to be drawn to cover lo ...

... rating of the conduit’s commercial paper notes. Program-wide credit enhancement is built into the structure of the multi-seller CP conduit. The organizational documents of the conduit set forth the required facilities. Such facilities are constructed so they will be available to be drawn to cover lo ...

UNITED THERAPEUTICS Corp (Form: 4, Received: 02/13/2017 17

... This exercise of stock options and corresponding sale of shares was pursuant to a Rule 10b5-1 trading plan entered into by the ...

... This exercise of stock options and corresponding sale of shares was pursuant to a Rule 10b5-1 trading plan entered into by the ...

Municipal Bonds and the Importance of Credit Quality

... In February, American Airlines parent company AMR Corp. asked a bankruptcy judge to permit AMR to stop payments on $1 billion of airport special facilities bonds for the Dallas-Fort Worth International and Alliance Airport. American Airlines filed for bankruptcy in November 2011. It remains unclear ...

... In February, American Airlines parent company AMR Corp. asked a bankruptcy judge to permit AMR to stop payments on $1 billion of airport special facilities bonds for the Dallas-Fort Worth International and Alliance Airport. American Airlines filed for bankruptcy in November 2011. It remains unclear ...

Fair value of financial instruments Amortized cost of financial

... particular security is considered relating to factors including, but not limited to, evidence of significant financial difficulty of the issuer and breach of contractual obligations of the security, such as a default or delinquency on interest or principal payments. The A llianz Group also conside ...

... particular security is considered relating to factors including, but not limited to, evidence of significant financial difficulty of the issuer and breach of contractual obligations of the security, such as a default or delinquency on interest or principal payments. The A llianz Group also conside ...

Investing in Bond Funds

... look at return relative to the market. For example, you hear that fund X has beaten the market by 4.3% in 2012. Hedge funds tend to look at absolute, as opposed to relative, return: they strive to earn a certain return each year (let’s say, 20%), regardless of how the market performs. Hedge fund adv ...

... look at return relative to the market. For example, you hear that fund X has beaten the market by 4.3% in 2012. Hedge funds tend to look at absolute, as opposed to relative, return: they strive to earn a certain return each year (let’s say, 20%), regardless of how the market performs. Hedge fund adv ...

MDM example - IBLF Russia

... Banking offer should be understandable and transparent to the client – besides interest rate, each commission should be clearly stated on paper and the client should understand in advance how much he will really pay ...

... Banking offer should be understandable and transparent to the client – besides interest rate, each commission should be clearly stated on paper and the client should understand in advance how much he will really pay ...

Dry Associates Investment Newsletter

... lowering corporate income taxes from the current 35% to say, 20% or 25% and implementing a tax holiday for repatriating an estimated $1 trillion held by American firms outside the US, the lower tax rate should boost corporate earnings and some of the repatriated money would likely be used for stock ...

... lowering corporate income taxes from the current 35% to say, 20% or 25% and implementing a tax holiday for repatriating an estimated $1 trillion held by American firms outside the US, the lower tax rate should boost corporate earnings and some of the repatriated money would likely be used for stock ...

Developing a Business Plan for the Start-up Law Firm

... measured. For example, in a pure cash format, the only asset is cash and it is offset by equity. All cash transactions are recorded as receipts or disbursements and any non‐cash financial transactions are not recorded. ...

... measured. For example, in a pure cash format, the only asset is cash and it is offset by equity. All cash transactions are recorded as receipts or disbursements and any non‐cash financial transactions are not recorded. ...

Emerging Markets Local Currency

... any investment or strategy is suitable or appropriate to you. The value of any investment may fluctuate. Past performance is not indicative of future results. Specific sectors mentioned do not represent all sectors in which AUIM seeks investments. It should not be assumed that investments of securit ...

... any investment or strategy is suitable or appropriate to you. The value of any investment may fluctuate. Past performance is not indicative of future results. Specific sectors mentioned do not represent all sectors in which AUIM seeks investments. It should not be assumed that investments of securit ...