Fund Manager`s Name - Conflict Securities Advisory Group

... I have recently become aware of an important new risk factor for investors that I wish to bring to your immediate attention so that it might be incorporated into your management of my investments. As profiled in a recent “60 Minutes” segment, there are some 400 publicly traded companies that do busi ...

... I have recently become aware of an important new risk factor for investors that I wish to bring to your immediate attention so that it might be incorporated into your management of my investments. As profiled in a recent “60 Minutes” segment, there are some 400 publicly traded companies that do busi ...

Niagara Falls Urban Renewal Agency Investment Guidelines

... unsecured, uninsured and unguaranteed debt issue ranked by two nationally recognized independent rating agencies at a rating category that is no lower than the then current rating of the Agency’s bonds, notes or other obligations. ARTICLE 4 Operating Procedures. Only the following persons shall be a ...

... unsecured, uninsured and unguaranteed debt issue ranked by two nationally recognized independent rating agencies at a rating category that is no lower than the then current rating of the Agency’s bonds, notes or other obligations. ARTICLE 4 Operating Procedures. Only the following persons shall be a ...

techteaching_lubin_presentation

... you going to cover your retirement needs? What do you have to do today to put your children through college? ...

... you going to cover your retirement needs? What do you have to do today to put your children through college? ...

CURRICULUM VITAE

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

Of the Subprime Mess and Securitization

... The relationship manager is knowledgeable of the company, senior management, financial needs and the range of capabilities that the bank offers. They manage the relationship proactively as a problem-solving professional using their knowledge to tailor unique and innovative financial solutions th ...

... The relationship manager is knowledgeable of the company, senior management, financial needs and the range of capabilities that the bank offers. They manage the relationship proactively as a problem-solving professional using their knowledge to tailor unique and innovative financial solutions th ...

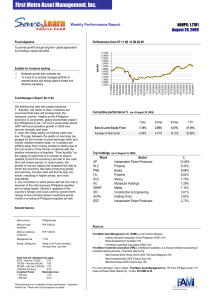

08.20.09-salef - First Metro Asset Management Inc

... low. The gap between the yields on earnings (as gauged by the inverse of price-earnings ratio) and money market remains wide, i.e. investors are shifting away from money market to stocks due to the low returns of the former combined with the positive momentum of equities. “Free liquidity” (or the su ...

... low. The gap between the yields on earnings (as gauged by the inverse of price-earnings ratio) and money market remains wide, i.e. investors are shifting away from money market to stocks due to the low returns of the former combined with the positive momentum of equities. “Free liquidity” (or the su ...

Banks to enable clients to better compare retail investment products

... The European Banking Federation has taken a great interest in the proposed European Union regulation on key information documents on investment products offered to retail investors. The EBF congratulates the Greek EU Presidency on the work done to reach a trilogue agreement on this proposal under th ...

... The European Banking Federation has taken a great interest in the proposed European Union regulation on key information documents on investment products offered to retail investors. The EBF congratulates the Greek EU Presidency on the work done to reach a trilogue agreement on this proposal under th ...

Investment Insights CIO REPORTS

... whole or in part, or in any form or manner, without the express written consent of Merrill Lynch. Any unauthorized use or disclosure is prohibited. The information herein was obtained from various sources that we deem reliable, but we do not guarantee its accuracy. This report provides general inf ...

... whole or in part, or in any form or manner, without the express written consent of Merrill Lynch. Any unauthorized use or disclosure is prohibited. The information herein was obtained from various sources that we deem reliable, but we do not guarantee its accuracy. This report provides general inf ...

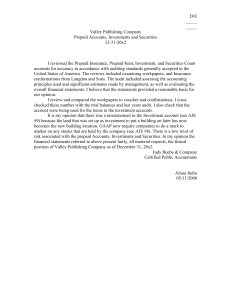

Valley Publishing Company

... checked these number with the trial balances and last years audit. I also check that the account were being used for the items in the investment accounts. It is my opinion that there was a misstatement in the Investment account (see AJE #9) because the land that was set up as investment to put a bui ...

... checked these number with the trial balances and last years audit. I also check that the account were being used for the items in the investment accounts. It is my opinion that there was a misstatement in the Investment account (see AJE #9) because the land that was set up as investment to put a bui ...

Curriculum Vitae

... AIG-FP, Enron Corporation, The Williams Capital Group, and eVentures International; Hired and managed 20 employees in New York and Los Angeles; Sold company to eSpeed Inc. (Nasdaq:ESPD), the world’s largest electronic financial company, May 2001. Managed Software Solutions Group for eSpeed post- ...

... AIG-FP, Enron Corporation, The Williams Capital Group, and eVentures International; Hired and managed 20 employees in New York and Los Angeles; Sold company to eSpeed Inc. (Nasdaq:ESPD), the world’s largest electronic financial company, May 2001. Managed Software Solutions Group for eSpeed post- ...

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form? 6. Explain any two key factors involved in firm specific analysis. 7. What are the fea ...

... 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form? 6. Explain any two key factors involved in firm specific analysis. 7. What are the fea ...

D J AVID

... Managed company finances, product creation and marketing strategy enabling the company to become profitable within the first day of sales Merrill Lynch Columbus, OH Financial Services Intern ...

... Managed company finances, product creation and marketing strategy enabling the company to become profitable within the first day of sales Merrill Lynch Columbus, OH Financial Services Intern ...

Real versus Financial Assets All financial assets (owner of the claim)

... o Post 1999 large investment banks, collectively known as “Wall Street,” operated independently from commercial banks, although many of the large commercial banks increased their investment banking activities, pressuring profit margins of investment banks. o In September 2008 major investment banks ...

... o Post 1999 large investment banks, collectively known as “Wall Street,” operated independently from commercial banks, although many of the large commercial banks increased their investment banking activities, pressuring profit margins of investment banks. o In September 2008 major investment banks ...

Professional profile and biography of Mr Emilio

... b) He has held the following professional positions: from 1998 until present at JP Morgan Chase (UK) Holdings LTD. From 2015 until present he has been Vice-Chairman of JP Morgan Chase & Co (the Bank's listed holding company) and a member of the Corporate and Investment Bank Management Committee. Fro ...

... b) He has held the following professional positions: from 1998 until present at JP Morgan Chase (UK) Holdings LTD. From 2015 until present he has been Vice-Chairman of JP Morgan Chase & Co (the Bank's listed holding company) and a member of the Corporate and Investment Bank Management Committee. Fro ...

Origination Execution

... Raise capital for clients Advise corporations, states, or other entities on capital structure, strategy, business combinations Create and sell securities to institutional and retail clients Manage money for institutional and retail clients ...

... Raise capital for clients Advise corporations, states, or other entities on capital structure, strategy, business combinations Create and sell securities to institutional and retail clients Manage money for institutional and retail clients ...

european investment strategy

... BCA is a world leading provider of independent investment research. Since 1949, the firm has supported its clients in making better investment decisions through the delivery of leading-edge economic analysis and comprehensive investment strategy research. BCA provides its services to financial profe ...

... BCA is a world leading provider of independent investment research. Since 1949, the firm has supported its clients in making better investment decisions through the delivery of leading-edge economic analysis and comprehensive investment strategy research. BCA provides its services to financial profe ...

JP Morgan Corporate iQ.xlsx

... ABOUT: JPMorgan Chase (NYSE: JPM) has assets of USD2.4 trillion and operates in more than 60 countries. JPM focus is on investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management and private equity. The stock is a c ...

... ABOUT: JPMorgan Chase (NYSE: JPM) has assets of USD2.4 trillion and operates in more than 60 countries. JPM focus is on investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management and private equity. The stock is a c ...

Tammy Kiely - Goldman Sachs

... ammy is global head of the Semiconductor Investment Banking Practice in the Technology, Media and Telecom (TMT) Group of the Investment Banking Division (IBD). She is also captain of the IBD Stanford Goldman Sachs Bank USA Recruiting Team. Tammy first served as head of the global semiconductor inves ...

... ammy is global head of the Semiconductor Investment Banking Practice in the Technology, Media and Telecom (TMT) Group of the Investment Banking Division (IBD). She is also captain of the IBD Stanford Goldman Sachs Bank USA Recruiting Team. Tammy first served as head of the global semiconductor inves ...

The Position - CFA Society Boston

... Standard Life Investments is a leading asset manager with an expanding global reach. Our wide range of investment solutions is backed by our distinctive Focus on Change investment philosophy, disciplined risk management and shared commitment to a culture of investment excellence. As active managers, ...

... Standard Life Investments is a leading asset manager with an expanding global reach. Our wide range of investment solutions is backed by our distinctive Focus on Change investment philosophy, disciplined risk management and shared commitment to a culture of investment excellence. As active managers, ...

Title: Senior Credit Analyst (Distressed) (DM0004-017

... Compensation: Commensurate with experience Summary: Boutique investment manager seeks senior analyst to join an absolute return credit strategy team. Ideal candidate will be a seasoned credit analyst with demonstrated technical competency and at least five years of relevant work experience in financ ...

... Compensation: Commensurate with experience Summary: Boutique investment manager seeks senior analyst to join an absolute return credit strategy team. Ideal candidate will be a seasoned credit analyst with demonstrated technical competency and at least five years of relevant work experience in financ ...

MicroVest announces new CIO and MD Equity

... new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible for all the of firm’s Private Equity portfolio, as well as for the development and implementation ...

... new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible for all the of firm’s Private Equity portfolio, as well as for the development and implementation ...

2014 Headwinds, Tailwinds, Trends, Strategy

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

Risk Averse Equity Management

... Risk Averse Equity Management We strive to create risk-averse portfolios that provide clients the dual benefits of high relative returns with low risk. In an industry that has a tendency to gravitate to “the next great thing”, we are skeptical about the new, and take comfort from the proven. We inve ...

... Risk Averse Equity Management We strive to create risk-averse portfolios that provide clients the dual benefits of high relative returns with low risk. In an industry that has a tendency to gravitate to “the next great thing”, we are skeptical about the new, and take comfort from the proven. We inve ...

HELIUM RISING STARS FUND SUCCESSFULLY LAUNCHED We

... The material provided herein is for information purposes only, and does not represent an offer or solicitation to buy or sell any of the funds or other investment vehicles mentioned herein. Any such offering will occur only in accordance with the terms and conditions set forth in the prospectus pert ...

... The material provided herein is for information purposes only, and does not represent an offer or solicitation to buy or sell any of the funds or other investment vehicles mentioned herein. Any such offering will occur only in accordance with the terms and conditions set forth in the prospectus pert ...

About that Bridge to the 21st Century . . .

... The Rationale for Public Investment * Inadequate market provision * A premium on public ownership ...

... The Rationale for Public Investment * Inadequate market provision * A premium on public ownership ...