Investment Consultant Ext 100712

... Mercer is a global leader in investment consulting and fiduciary management and provides investment related services to a wide range of clients including pension funds, insurers and private banks. The firm also has a significant global presence in human resource consulting and related services. Glob ...

... Mercer is a global leader in investment consulting and fiduciary management and provides investment related services to a wide range of clients including pension funds, insurers and private banks. The firm also has a significant global presence in human resource consulting and related services. Glob ...

RESPONSE ON J P MORGAN During the JP Morgan news on

... came in the bank’s chief investment office, which is a unit set up to invest excess deposits. There is controversy about this since hedge funds have alleged that they were taking large proprietary risks. This exposure will be in their corporate division for the second quarter thanks to their losses… ...

... came in the bank’s chief investment office, which is a unit set up to invest excess deposits. There is controversy about this since hedge funds have alleged that they were taking large proprietary risks. This exposure will be in their corporate division for the second quarter thanks to their losses… ...

Structure of Banking Industry

... • Safe custody of valuables. • Providing foreign exchange. • Transfer of money. • Providing guarantee and letters of credit. • Providing business support services such as providing business information, credit reports etc. ...

... • Safe custody of valuables. • Providing foreign exchange. • Transfer of money. • Providing guarantee and letters of credit. • Providing business support services such as providing business information, credit reports etc. ...

Thailand Ends 2014 with Record High Number of Investment

... Thailand Ends 2014 with Record High Number of Investment Applications Thailand wrapped up 2014 with record high number of investment applications from foreign investors. The Thailand Board of Investment (BOI) reported that the value of foreign direct investment applied through BOI totaled 1.02 trill ...

... Thailand Ends 2014 with Record High Number of Investment Applications Thailand wrapped up 2014 with record high number of investment applications from foreign investors. The Thailand Board of Investment (BOI) reported that the value of foreign direct investment applied through BOI totaled 1.02 trill ...

tratamiento a la inversion extranjera en el ecuador

... Ecuadorian IIA policy: a complex and dynamic process ...

... Ecuadorian IIA policy: a complex and dynamic process ...

Meeting 10/19/14

... DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an ...

... DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an ...

Institution: Vilnius College in Higher Education

... This subject provides basic knowledge about investment and how invests efficiently. It identifies characteristics of different asset classes and their sub-classes, which of them and in what proportions to take then forming investment portfolio according to investment goal, how to choose investment s ...

... This subject provides basic knowledge about investment and how invests efficiently. It identifies characteristics of different asset classes and their sub-classes, which of them and in what proportions to take then forming investment portfolio according to investment goal, how to choose investment s ...

Department of Economics - Midlands State University

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

and what can you invest in?

... – I am a Management instructor who teaches in the Information Technology for Business area • (computers and computer technology) ...

... – I am a Management instructor who teaches in the Information Technology for Business area • (computers and computer technology) ...

Corporate Finance What - Hong Kong Securities and Investment

... the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

... the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

Senior Fund Consultant (m / f) Alternative Investment Funds

... • You will manage the fund set-up process, de- fining all necessary activities with fund managers, law firms, depositaries, authorities and financial intermediaries. • You will be the main contact person for initia- tors, internal departments and authorities and responsible for draf ...

... • You will manage the fund set-up process, de- fining all necessary activities with fund managers, law firms, depositaries, authorities and financial intermediaries. • You will be the main contact person for initia- tors, internal departments and authorities and responsible for draf ...

Alexandre ISSAD 67, rue d`Argout, 75002, Paris + 33 6 33 48 13 01

... Portfolio follow-up (financial & strategic follow-up of portfolio companies and screening of potential targets in case of build-up) ...

... Portfolio follow-up (financial & strategic follow-up of portfolio companies and screening of potential targets in case of build-up) ...

ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

Saving and Investing on a Shoestring: Finding Money to Save

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...

ppt

... Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. Determine your own investment philosophy. Recognize the variety of investments available. Identify the major factors that affect the return on investment. Specify ...

... Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. Determine your own investment philosophy. Recognize the variety of investments available. Identify the major factors that affect the return on investment. Specify ...

Investment Guidelines

... In addition, in order to be classified as a Standard Asset, the investment must be capable of being accurately and fairly valued on an ongoing basis and readily realised within 30 days whenever required. If not, it will be viewed as non-standard and not acceptable for the Momentum International SIPP ...

... In addition, in order to be classified as a Standard Asset, the investment must be capable of being accurately and fairly valued on an ongoing basis and readily realised within 30 days whenever required. If not, it will be viewed as non-standard and not acceptable for the Momentum International SIPP ...

Real versus Financial Assets

... the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after only a few years • Hence, professionals analyse the prospects of firms whose shares trade on the s ...

... the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after only a few years • Hence, professionals analyse the prospects of firms whose shares trade on the s ...

15-2

... selling of the security to ensure a liquid market. – Provides research on the firm to encourage active investor interest. ...

... selling of the security to ensure a liquid market. – Provides research on the firm to encourage active investor interest. ...

ADVERTENCIA AL PÚBLICO

... a), b), d), f) and g) of paragraph 2 of Article 63 of the Spanish Securities Market Act, which includes investment advice, in relation to the financial instruments detailed in article 2 of the said Act, including, to such effects, transactions on foreign currency. ...

... a), b), d), f) and g) of paragraph 2 of Article 63 of the Spanish Securities Market Act, which includes investment advice, in relation to the financial instruments detailed in article 2 of the said Act, including, to such effects, transactions on foreign currency. ...

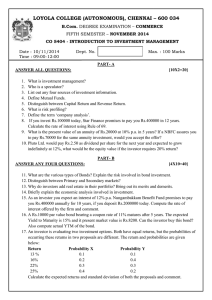

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promises to pay you Rs.400000 annually for 10 years, if you de ...

... 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promises to pay you Rs.400000 annually for 10 years, if you de ...