ABC-Clio American Government Feature Story: Toward Economic

... Amid concerns over the vulnerability of the national banking system, numerous proposals were made to reform it. In 1913, the Federal Reserve was created as a central bank with powers to regulate banks, set credit policies, and loan money to any individual or group in "unusual or exigent circumstance ...

... Amid concerns over the vulnerability of the national banking system, numerous proposals were made to reform it. In 1913, the Federal Reserve was created as a central bank with powers to regulate banks, set credit policies, and loan money to any individual or group in "unusual or exigent circumstance ...

press release ojk issues regulation on capital market investment

... The issue of the POJK is also expected to give a stronger legal basis and answer some concerns that the public has about investment products in the Capital Market, which are offered as implementation of the Law on Tax Amnesty. The main points of the POJK include the following matters: 1.! Simplifica ...

... The issue of the POJK is also expected to give a stronger legal basis and answer some concerns that the public has about investment products in the Capital Market, which are offered as implementation of the Law on Tax Amnesty. The main points of the POJK include the following matters: 1.! Simplifica ...

Problem Sheet 1

... What is the value of saving and investment in this country? What is the value of private saving? What is the value of public saving? Is the government’s budget policy contributing to growth in this country or harming it? Why? Why don’t countries reduce their budget deficits? ...

... What is the value of saving and investment in this country? What is the value of private saving? What is the value of public saving? Is the government’s budget policy contributing to growth in this country or harming it? Why? Why don’t countries reduce their budget deficits? ...

LR Global Bangladesh: Weekly News Update Reporting Week: 12th

... zero-coupon bonds by a company in Bangladesh yet. A zerocoupon bond, also known as discount bond or deep discount bond, is bought at a price lower than its face value, with the face value repaid at the time of maturity. The proceeds of the bonds will be utilized for BSRM Steels' capital expenditures ...

... zero-coupon bonds by a company in Bangladesh yet. A zerocoupon bond, also known as discount bond or deep discount bond, is bought at a price lower than its face value, with the face value repaid at the time of maturity. The proceeds of the bonds will be utilized for BSRM Steels' capital expenditures ...

Slide 1 - Bank of America Merrill Lynch

... commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, capital markets, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of ...

... commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, capital markets, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of ...

Pension Fund Management Private Client Investment Portfolios

... With over USD140 million pension funds under management, Datvest Asset Management offers Pension fund Portfolio management services for portfolios that vary in size from $250,000 to over $20 million. Portfolios are structured in line with agreed Investment Policy Statements and fees vary in line wit ...

... With over USD140 million pension funds under management, Datvest Asset Management offers Pension fund Portfolio management services for portfolios that vary in size from $250,000 to over $20 million. Portfolios are structured in line with agreed Investment Policy Statements and fees vary in line wit ...

Managing Risk Through Diversification Video Transcript

... WFII is a registered investment adviser and wholly-owned subsidiary of Wells Fargo & Company and provides investment advice to Wells Fargo Bank, N.A., Wells Fargo Advisors and other Wells Fargo affiliates. Wells Fargo Bank, N.A. is a bank affiliate of Wells Fargo & Company. The information in this r ...

... WFII is a registered investment adviser and wholly-owned subsidiary of Wells Fargo & Company and provides investment advice to Wells Fargo Bank, N.A., Wells Fargo Advisors and other Wells Fargo affiliates. Wells Fargo Bank, N.A. is a bank affiliate of Wells Fargo & Company. The information in this r ...

more of something often means less of something else

... cannot be guaranteed. Opinions expressed are current as of the date of this publication and are subject to change. Certain statements contained within are forward-looking statements including, but not limited to, predictions or indications of future events, trends, plans or objectives. Undue relianc ...

... cannot be guaranteed. Opinions expressed are current as of the date of this publication and are subject to change. Certain statements contained within are forward-looking statements including, but not limited to, predictions or indications of future events, trends, plans or objectives. Undue relianc ...

Wells Fargo Securities_Sales and Trading Analystx

... interest rates, commodities, corporate credit and equities. The teams structure, price and trade customized interest rate, commodity, equity, and credit solutions for clients who want to hedge a financial risk or add a structured investment to their portfolio. The Asset Backed Finance & Securitizati ...

... interest rates, commodities, corporate credit and equities. The teams structure, price and trade customized interest rate, commodity, equity, and credit solutions for clients who want to hedge a financial risk or add a structured investment to their portfolio. The Asset Backed Finance & Securitizati ...

Common Mistakes in Investment Portfolios

... and there is no method for evaluating performance relative to risk. • The portfolio’s risk is high given its potential return. • An Investment Policy Statement setting forth objectives and asset class ranges has never been established. • Cash flow parameters have never been established. • There ...

... and there is no method for evaluating performance relative to risk. • The portfolio’s risk is high given its potential return. • An Investment Policy Statement setting forth objectives and asset class ranges has never been established. • Cash flow parameters have never been established. • There ...

Glass-Steagall - National Conference of State Legislatures

... the Glass-Steagall Act, protected the public interest in matters dealing with ...

... the Glass-Steagall Act, protected the public interest in matters dealing with ...

Welcome to the Lafayette Investment Club

... decisions such as buy/sell stocks Meet new interesting people who have the same passion for finance and investing as you do Educate you on financial statements such as the balance sheet, income statement, and cash flow statement. Learn different types of securities and ways you can minimize the risk ...

... decisions such as buy/sell stocks Meet new interesting people who have the same passion for finance and investing as you do Educate you on financial statements such as the balance sheet, income statement, and cash flow statement. Learn different types of securities and ways you can minimize the risk ...

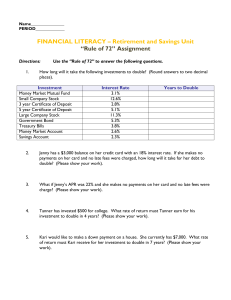

Rule of 72 Assignment

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

Bio: Sharon Pivirotto

... Mario Giganti is a Principal at Cornerstone Capital Advisors (“CCA”) and a nationally recognized investment expert in teaching, training and working with clients in implementing defined Best Practices into a Prudent Investment Process. He works with individual clients and families in integrating the ...

... Mario Giganti is a Principal at Cornerstone Capital Advisors (“CCA”) and a nationally recognized investment expert in teaching, training and working with clients in implementing defined Best Practices into a Prudent Investment Process. He works with individual clients and families in integrating the ...

The Walt Lunsford Financial Advisory Group of Raymond James

... The Walt Lunsford Financial Advisory Group of Raymond James brings over 100 years of combined experience in the practice of growing and preserving wealth for individuals, companies, corporate retirement plans, municipalities and not for profit organizations. The group specializes in portfolio manage ...

... The Walt Lunsford Financial Advisory Group of Raymond James brings over 100 years of combined experience in the practice of growing and preserving wealth for individuals, companies, corporate retirement plans, municipalities and not for profit organizations. The group specializes in portfolio manage ...

Mount Everest Mineral Water Ltd 531096

... body. MIA is a wholly owned subsidiary of Morningstar Associates LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc., and Morningstar, Inc. is a leading provider of independent investment research that offers an extensive line of products and services for individ ...

... body. MIA is a wholly owned subsidiary of Morningstar Associates LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc., and Morningstar, Inc. is a leading provider of independent investment research that offers an extensive line of products and services for individ ...

Investment Opportunities

... Daily activities that are developmentally and age appropriate. Breakfast, lunch, and snack provided daily. Infant and toddler areas separate from others. Outside play area. Drop off from 6:30 AM with pick up at 6:30 PM Monday through Friday State approved and licensed Educational curriculum based in ...

... Daily activities that are developmentally and age appropriate. Breakfast, lunch, and snack provided daily. Infant and toddler areas separate from others. Outside play area. Drop off from 6:30 AM with pick up at 6:30 PM Monday through Friday State approved and licensed Educational curriculum based in ...

resume - Middle East Bankers

... Performing supervisory activities for domestic & international settlement accounts. Over viewing day to day activities involving in the process like analyzing volume for each a/c’s for domestic & international settlements .Followup for the aging items which not cleared by product lines, doing four ...

... Performing supervisory activities for domestic & international settlement accounts. Over viewing day to day activities involving in the process like analyzing volume for each a/c’s for domestic & international settlements .Followup for the aging items which not cleared by product lines, doing four ...

Document

... The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transacti ...

... The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transacti ...

Berkshire-Columbia Investment Network

... Centers in Albany and Pittsfield to review applications prior to presentation in their particular state and region. The association may also stimulate the creation of an advisory group of retired business people to provide support for individuals and institutions seeking financial support from Assoc ...

... Centers in Albany and Pittsfield to review applications prior to presentation in their particular state and region. The association may also stimulate the creation of an advisory group of retired business people to provide support for individuals and institutions seeking financial support from Assoc ...

Investment Companies Insights

... range of passive and active funds direct to the public in the UK has attracted much press comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by ma ...

... range of passive and active funds direct to the public in the UK has attracted much press comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by ma ...

renaissance view - Renaissance Financial

... bond funds may suffer, but wouldn't bond investors be happy to finally invest at rates that could generate more substantial long term income? Further, wouldn't higher rates (if they translate into wider spreads for banks), lead to more bank lending, which in turn would lead to more spending and stro ...

... bond funds may suffer, but wouldn't bond investors be happy to finally invest at rates that could generate more substantial long term income? Further, wouldn't higher rates (if they translate into wider spreads for banks), lead to more bank lending, which in turn would lead to more spending and stro ...

Federated Mid-Cap Index Fund

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...