Degree of Financial and Operating Leverage and

... of different levels of debt. The Pecking Order Theory on the other hand, explains the order in which a company’s capital can be sourced and avoid dilution of control as well as increment in the cost of capital of the company. For that matter, companies would give first preference to the use of inter ...

... of different levels of debt. The Pecking Order Theory on the other hand, explains the order in which a company’s capital can be sourced and avoid dilution of control as well as increment in the cost of capital of the company. For that matter, companies would give first preference to the use of inter ...

Institutional non-bank lending and the role of Debt Funds

... loan volumes fosters the risk of exaggerating to the downside. Morover, there are significant differences between countries. It is not always clear whether weak lending levels are driven by the supply or by the demand side. In general, the availability of loans to SMEs seems to slightly improve; at ...

... loan volumes fosters the risk of exaggerating to the downside. Morover, there are significant differences between countries. It is not always clear whether weak lending levels are driven by the supply or by the demand side. In general, the availability of loans to SMEs seems to slightly improve; at ...

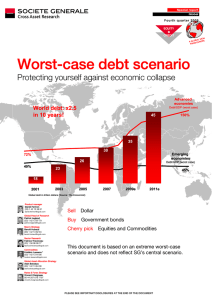

Worst-case debt scenario

... The worst case debt scenario Hope for the best, be prepared for the worst How to position for our bear scenario Analogies with Japan’s lost decade & investment ideas Debt explosion in 2009 The current economic crisis displays compelling similarities with Japan in the 1990s End of market rally for eq ...

... The worst case debt scenario Hope for the best, be prepared for the worst How to position for our bear scenario Analogies with Japan’s lost decade & investment ideas Debt explosion in 2009 The current economic crisis displays compelling similarities with Japan in the 1990s End of market rally for eq ...

Liberty Mutual Holding Company Inc. First Quarter 2016

... I, now referred to as SICAD. Additionally, the new exchange controls established the Marginal Foreign Exchange System (“SIMADI”), which is intended to be a free floating rate. As of September 30, 2015, the exchange rate of bolivars per U.S. dollar for CENCOEX, SICAD and SIMADI was 6.3, 13.5, and 198 ...

... I, now referred to as SICAD. Additionally, the new exchange controls established the Marginal Foreign Exchange System (“SIMADI”), which is intended to be a free floating rate. As of September 30, 2015, the exchange rate of bolivars per U.S. dollar for CENCOEX, SICAD and SIMADI was 6.3, 13.5, and 198 ...

THE NATIONAL DEBT AND ECONOMIC POLICY IN THE MEDIUM

... is expected to yield a higher return than a comparable domestic asset, investors may not be prepared to back their "hunch" and invest abroad due to the possibility of heavy losses if their forecasts prove wrong. Ahernatively, they may be only prepared to invest a limited part of their portfolio in t ...

... is expected to yield a higher return than a comparable domestic asset, investors may not be prepared to back their "hunch" and invest abroad due to the possibility of heavy losses if their forecasts prove wrong. Ahernatively, they may be only prepared to invest a limited part of their portfolio in t ...

Growing NPAs in banks

... Due to intense competition, companies have been engaging in price wars for the last few years. The telecom rates in the country are currently the lowest in the world. Comparison between 2007 and 2014 data reveals that margins have reduced drastically. Thus, lowering prices is putting pressure on tel ...

... Due to intense competition, companies have been engaging in price wars for the last few years. The telecom rates in the country are currently the lowest in the world. Comparison between 2007 and 2014 data reveals that margins have reduced drastically. Thus, lowering prices is putting pressure on tel ...

Long run relationship between budget deficit and long

... an economy is determined by the supply and demand of loanable funds in the capital market. A lot of theoretical and empirical research has been done to further explore the determinants of interest rate. Hoelscher (1983) empirically estimates that expected inflation, monetary factors and economic act ...

... an economy is determined by the supply and demand of loanable funds in the capital market. A lot of theoretical and empirical research has been done to further explore the determinants of interest rate. Hoelscher (1983) empirically estimates that expected inflation, monetary factors and economic act ...

rmb bonds - BNP Paribas Investment Partners

... Source: Bloomberg, onshore Chinese credit rating agencies, 8th March 2016 ...

... Source: Bloomberg, onshore Chinese credit rating agencies, 8th March 2016 ...

Lesson 4 A cost ofcapital

... The cost of debt to the firm is the effective yield to maturity (or interest rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

... The cost of debt to the firm is the effective yield to maturity (or interest rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

Issues in the Financing of Small and Medium Enterprises in China

... fact, there are many obstacles. Under the current circumstance, there is not much incentive for the banks to expand lending to small firms, or even try to reach promising small firms. Most SMEs, on the other hand, have not even tried to get loans from the banks, with the perception that it would be ...

... fact, there are many obstacles. Under the current circumstance, there is not much incentive for the banks to expand lending to small firms, or even try to reach promising small firms. Most SMEs, on the other hand, have not even tried to get loans from the banks, with the perception that it would be ...

Government Bonds and Their Investors

... to risk considerations, causing a secular decline in yields (Warnock and Warnock, 2006). More recently, however, reserve managers started to spread their investments more broadly and apply risk management techniques similar to other investors (Borio et al., 2008; ...

... to risk considerations, causing a secular decline in yields (Warnock and Warnock, 2006). More recently, however, reserve managers started to spread their investments more broadly and apply risk management techniques similar to other investors (Borio et al., 2008; ...

Efficient Bailouts? - Federal Reserve Bank of Minneapolis

... more risk-taking before the crisis actually hits. We study the optimal intervention in this framework and evaluate its macroeconomic and welfare effects. Our main result is that bailouts have an important stabilizing role despite moral hazard effects, provided that these bailouts are conducted durin ...

... more risk-taking before the crisis actually hits. We study the optimal intervention in this framework and evaluate its macroeconomic and welfare effects. Our main result is that bailouts have an important stabilizing role despite moral hazard effects, provided that these bailouts are conducted durin ...

Riding the Stagecoach to Hell: A Qualitative Analysis of

... rapidly throughout the nation until 1917, when the Supreme Court declared them to be unconstitutional (Massey and Denton 1993). Despite this legal ruling, white resistance to coresidence with African Americans intensified and blacks daring to cross recognized residential color lines were met with ho ...

... rapidly throughout the nation until 1917, when the Supreme Court declared them to be unconstitutional (Massey and Denton 1993). Despite this legal ruling, white resistance to coresidence with African Americans intensified and blacks daring to cross recognized residential color lines were met with ho ...

Monetary Policy and Business Investment in the Euro

... that the ECB rate applies to short-term loans the Eurosystem makes to banks while most private sector borrowing is over longer periods.1 More importantly, the ECB prices its loans on the basis of there being no risk: There is always a small chance that a bank may not pay ECB back if it goes into liq ...

... that the ECB rate applies to short-term loans the Eurosystem makes to banks while most private sector borrowing is over longer periods.1 More importantly, the ECB prices its loans on the basis of there being no risk: There is always a small chance that a bank may not pay ECB back if it goes into liq ...

Jamaica: Fifth Review Under the Extended Fund

... 2/ Statutory liquid assets/prescribed liabilities. 3/ If not end-quarter, data corresponds to last quarter. inactive since the February 2013 debt 4/ The significant increase in profitability for 2011 is due to an up-stream dividend from one insurance subsidiary to its parent bank. Without such divid ...

... 2/ Statutory liquid assets/prescribed liabilities. 3/ If not end-quarter, data corresponds to last quarter. inactive since the February 2013 debt 4/ The significant increase in profitability for 2011 is due to an up-stream dividend from one insurance subsidiary to its parent bank. Without such divid ...

Investors Guide To CMOs

... In part, this is because the interest rates paid by home buyers are higher than the interest rates paid by the U.S. government. However, the higher interest rates on mortgage securities also reflect compensation for the uncertainty of their average lives. As with any bond, the yield on a CMO depend ...

... In part, this is because the interest rates paid by home buyers are higher than the interest rates paid by the U.S. government. However, the higher interest rates on mortgage securities also reflect compensation for the uncertainty of their average lives. As with any bond, the yield on a CMO depend ...

chapter 2 2

... project (investment) decisions. It is possible to determine a steady cost for the fund, called its WACC. There is also a separate pool of projects (the capital budget) and projects are accepted or rejected, ideally by using DCF techniques. Although it may appear that the two pools are separate and i ...

... project (investment) decisions. It is possible to determine a steady cost for the fund, called its WACC. There is also a separate pool of projects (the capital budget) and projects are accepted or rejected, ideally by using DCF techniques. Although it may appear that the two pools are separate and i ...

discount rates

... Location based CRP: The standard approach in valuation is to attach a country risk premium to a company based upon its country of incorporation. Thus, if you are an Indian company, you are assumed to be exposed to the Indian country risk premium. A developed market company is assumed to be unex ...

... Location based CRP: The standard approach in valuation is to attach a country risk premium to a company based upon its country of incorporation. Thus, if you are an Indian company, you are assumed to be exposed to the Indian country risk premium. A developed market company is assumed to be unex ...

Classification of Financial Assets and Liabilities

... 4.31. Bank draft (or teller’s check). A DC’s customer, less commonly, may purchase a bank draft (sometimes called a teller’s check) that is a check or similar instrument written by a DC against funds in its deposit account at another DC. For a bank draft purchased by one of its customers, a DC shoul ...

... 4.31. Bank draft (or teller’s check). A DC’s customer, less commonly, may purchase a bank draft (sometimes called a teller’s check) that is a check or similar instrument written by a DC against funds in its deposit account at another DC. For a bank draft purchased by one of its customers, a DC shoul ...