mFINANCE FRANCE S.A. €3,000,000,000 Euro Medium Term Note

... is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral). S&P assigns short-term credit ratings for specific issues on a scale from A-1, A-2, A- 3, B, C down to D. Within the A-1 category the rating can be designated with a "+". ...

... is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral). S&P assigns short-term credit ratings for specific issues on a scale from A-1, A-2, A- 3, B, C down to D. Within the A-1 category the rating can be designated with a "+". ...

DebT anD (noT mucH) DeLeveraGInG

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

DebT anD (noT mucH) DeLeveraGInG

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

Chapter 1

... Foreign subsidiary capital structure, continued – Political risk management • The use of financing to reduce political risks typically involves mechanisms to avoid or reduce the impact of certain risks, such as those related to exchange controls or expropriation. – By raising funds locally, if a sub ...

... Foreign subsidiary capital structure, continued – Political risk management • The use of financing to reduce political risks typically involves mechanisms to avoid or reduce the impact of certain risks, such as those related to exchange controls or expropriation. – By raising funds locally, if a sub ...

Credit cycles and systemic risk - Centre de Recerca en Economia

... that most financial intermediaries have limited liability (their losses are limited) and invest money on behalf of others (the final investors). Moreover, they are highly leveraged, notably banks that are funded almost entirely with debt (some banks are funded with 50 units of debt over 1 of equity ...

... that most financial intermediaries have limited liability (their losses are limited) and invest money on behalf of others (the final investors). Moreover, they are highly leveraged, notably banks that are funded almost entirely with debt (some banks are funded with 50 units of debt over 1 of equity ...

Equipment Loan Agreement - Rogers State University

... Phone Number: _______________ Request Date (s): ___________ Return Date: _________ Time: _______ Purpose for Loaned Equipment/Materials: _____________________________________________________ The period of loan is from approved request date until approved return date. Borrower understands that any ex ...

... Phone Number: _______________ Request Date (s): ___________ Return Date: _________ Time: _______ Purpose for Loaned Equipment/Materials: _____________________________________________________ The period of loan is from approved request date until approved return date. Borrower understands that any ex ...

Clean Tech - GreenWorld Capital, LLC

... quantity of stock at set intervals of time at future stock prices. An effective registration statement must be maintained in order for take downs to be completed. ...

... quantity of stock at set intervals of time at future stock prices. An effective registration statement must be maintained in order for take downs to be completed. ...

The Story of CMLTI 2006-NC2

... Tab 4: E-mails regarding the deal Source: New Century Bankruptcy Trustee ...

... Tab 4: E-mails regarding the deal Source: New Century Bankruptcy Trustee ...

Three Approaches to Better Outcomes in Fixed

... along with other sectors such as corporate and hard-currency emergingmarket (EM) debt. All these sectors have historically generated solid returns, allowing for a broad opportunity set. Diversification is another obvious benefit: over the past 10 years, high-yield corporate bonds have had a negative ...

... along with other sectors such as corporate and hard-currency emergingmarket (EM) debt. All these sectors have historically generated solid returns, allowing for a broad opportunity set. Diversification is another obvious benefit: over the past 10 years, high-yield corporate bonds have had a negative ...

Contemporaneous Loan Stress and Termination Risk in Please share

... CMBS market currently has around 200 pools comprised almost exclusively of new loans that were originated since the market decline of the late 1980s and early 1990s. The default rate of these loans has been quite low – generally less than 2% lifetime. Loans originated since 1992 tend to have been ve ...

... CMBS market currently has around 200 pools comprised almost exclusively of new loans that were originated since the market decline of the late 1980s and early 1990s. The default rate of these loans has been quite low – generally less than 2% lifetime. Loans originated since 1992 tend to have been ve ...

Plain Talk Guide

... Independent credit rating agencies, such as Standard & Poor’s and Moody’s, evaluate the ability of bond issuers to meet their interest and principal repayments. These agencies assign credit ratings ranging from Aaa or AAA (highest quality) to C or D (lowest quality). Bond credit ratings are importan ...

... Independent credit rating agencies, such as Standard & Poor’s and Moody’s, evaluate the ability of bond issuers to meet their interest and principal repayments. These agencies assign credit ratings ranging from Aaa or AAA (highest quality) to C or D (lowest quality). Bond credit ratings are importan ...

Debt Levels and Share Price - a Sensitivity Analysis on Vestas

... EUR 30.03. The company’s optimal capital structure is thereafter determined, by employing the two sub-frameworks of the trade-off theory: static and dynamic. The results point out that Vestas is currently either around optimum debt levels (in the dynamic trade-off case), or below them (in the static ...

... EUR 30.03. The company’s optimal capital structure is thereafter determined, by employing the two sub-frameworks of the trade-off theory: static and dynamic. The results point out that Vestas is currently either around optimum debt levels (in the dynamic trade-off case), or below them (in the static ...

download

... level of credit risk." Not only the level of credit risk but the types of holdings can differentiate high-yield bond funds. "Our Pioneer High Yield Fund is the only fund in this category that has a large exposure to convertible bonds," says Steve Graziano, executive vice president, strategic marketi ...

... level of credit risk." Not only the level of credit risk but the types of holdings can differentiate high-yield bond funds. "Our Pioneer High Yield Fund is the only fund in this category that has a large exposure to convertible bonds," says Steve Graziano, executive vice president, strategic marketi ...

THE EVOLVING FACE OF FACTORING By Harvey S. Gross There is

... are in trouble. Nothing could be further from the truth. Since Colonial times, factoring has been a useful financing tool used by many profitable and well-capitalized companies. Firms in the textile, apparel, home furnishing and many other industries have historically sold receivables; the trade-off ...

... are in trouble. Nothing could be further from the truth. Since Colonial times, factoring has been a useful financing tool used by many profitable and well-capitalized companies. Firms in the textile, apparel, home furnishing and many other industries have historically sold receivables; the trade-off ...

harnessing fixed-income returns through the cycle

... it is helpful to start with the price of risk. In bond market terminology, the term premium is the compensation an investor earns for holding longer term bonds. In this case, the term premium is essentially the price of duration risk.1 It can be measured as the difference between 10-year Treasury yi ...

... it is helpful to start with the price of risk. In bond market terminology, the term premium is the compensation an investor earns for holding longer term bonds. In this case, the term premium is essentially the price of duration risk.1 It can be measured as the difference between 10-year Treasury yi ...

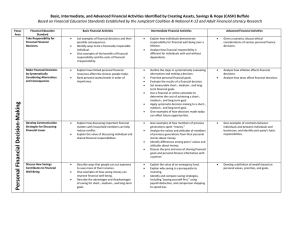

Personal Financial Decision

... compare the total cost of reducing a $1,000 credit card balance to zero with minimum payments versus above‐minimum payments. Using a financial or online calculator, determine the total cost of repaying a loan under various rates of interest and over different periods. Given an “easy access” l ...

... compare the total cost of reducing a $1,000 credit card balance to zero with minimum payments versus above‐minimum payments. Using a financial or online calculator, determine the total cost of repaying a loan under various rates of interest and over different periods. Given an “easy access” l ...

investment management of banks

... • Preferred Habitat Theory: In addition to interest rate expectations, investors have distinct investment horizons and require a meaningful premium to buy bonds with maturities outside their preferred maturity or habitat. Proponents of this theory believe that short-term investors are more prevalent ...

... • Preferred Habitat Theory: In addition to interest rate expectations, investors have distinct investment horizons and require a meaningful premium to buy bonds with maturities outside their preferred maturity or habitat. Proponents of this theory believe that short-term investors are more prevalent ...

OAT/Bund Spread : Recent Trends, Equilibrium Value and

... countries first. Generally, the deterioration of the fundamentals of European countries relative to Germany led to very clear discrimination between countries. The question of the survival of the euro was raised by the markets during the socalled ‘Eurozone crisis’. The upward movement in sovereign s ...

... countries first. Generally, the deterioration of the fundamentals of European countries relative to Germany led to very clear discrimination between countries. The question of the survival of the euro was raised by the markets during the socalled ‘Eurozone crisis’. The upward movement in sovereign s ...

Account for Agriculture, Forestry, Fisheries and Food Business

... In the policy cost analysis, accumulated bad debt write-off is computed based on the average loan loss provision ratio in the preceding 5 years. It is estimated to be ¥1.0 billion. The loan loss provisions are calculated on the assumption that the end-of-term loan loss provisions are calculated acco ...

... In the policy cost analysis, accumulated bad debt write-off is computed based on the average loan loss provision ratio in the preceding 5 years. It is estimated to be ¥1.0 billion. The loan loss provisions are calculated on the assumption that the end-of-term loan loss provisions are calculated acco ...

DOES FINANCIAL LEVERAGE INFLUENCE INVESTMENT

... managers to take prudent and sound financial decision to finance such investment opportunities. Basically we can divide the firms into two categories with respect to their growth, firms having high growth and low growth. As for high growth firms are concerned, these firms can avail any investment op ...

... managers to take prudent and sound financial decision to finance such investment opportunities. Basically we can divide the firms into two categories with respect to their growth, firms having high growth and low growth. As for high growth firms are concerned, these firms can avail any investment op ...

Financial Soundness Indicators: - svgfsa.com

... ◦ Purpose: To measure the adequacy of the provisions for loan losses when compared to all delinquent loans over 12 months . ◦ Items Required: A-Allowance for Loan Loss (Balance Sheet); BPercentage of Allowance Required to cover delinquent Loans > 12 months and C – Loan Balances of all delinquent loa ...

... ◦ Purpose: To measure the adequacy of the provisions for loan losses when compared to all delinquent loans over 12 months . ◦ Items Required: A-Allowance for Loan Loss (Balance Sheet); BPercentage of Allowance Required to cover delinquent Loans > 12 months and C – Loan Balances of all delinquent loa ...

What do low interest rates mean for your retirement?

... As an award-winning firm of Chartered Financial Planners working in Cranleigh since 1994, we know a thing or two about Independent Financial Planning. Our team of Financial Planners use their knowledge and experience to deliver impartial and unbiased independent financial advice which will remove st ...

... As an award-winning firm of Chartered Financial Planners working in Cranleigh since 1994, we know a thing or two about Independent Financial Planning. Our team of Financial Planners use their knowledge and experience to deliver impartial and unbiased independent financial advice which will remove st ...