Insurance Asset Management Trends in 2014

... advice. It is not an offer to sell or a solicitation of an offer to buy any security. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Past performance is not a guide to or indicative of ...

... advice. It is not an offer to sell or a solicitation of an offer to buy any security. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Past performance is not a guide to or indicative of ...

November 2005 Course FM/2 Examination 1. An insurance

... A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question creator was that you would see this and realize it is not in the syllabus, and reject this answer. Same as if the answer were: The Easter Bunny. In any case, the ...

... A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question creator was that you would see this and realize it is not in the syllabus, and reject this answer. Same as if the answer were: The Easter Bunny. In any case, the ...

bonds plus 400 fund - Insight Investment

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

The impact of corporate distress along the supply chain

... Beyond the traditional theories, more recently a distinctive role for trade credit was identified like a mechanism to coordinate supply chains (Luo and Zhang, 2012) that are targeted to optimize the flow of goods, information and financial flows in inter- and intra- company boundaries ...

... Beyond the traditional theories, more recently a distinctive role for trade credit was identified like a mechanism to coordinate supply chains (Luo and Zhang, 2012) that are targeted to optimize the flow of goods, information and financial flows in inter- and intra- company boundaries ...

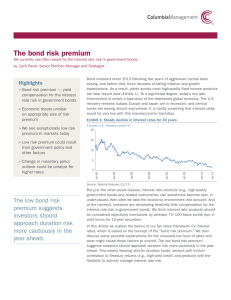

The bond risk premium

... Bond risk premium — yield compensation for the interest rate risk in government bonds On average, the U.S. Treasury yield curve slopes upward, with long-term interest rates above short-term interest rates. One reason for this shape could be investor expectations that short-term interest rates will t ...

... Bond risk premium — yield compensation for the interest rate risk in government bonds On average, the U.S. Treasury yield curve slopes upward, with long-term interest rates above short-term interest rates. One reason for this shape could be investor expectations that short-term interest rates will t ...

File

... Vertical Analysis (component percentages) A. Show each amount as a percentage of another amount on the same financial statements. 1. Income statement items are shown as a percentage of sales. 2. Asset items are shown as a percentage of total assets. 3. Liability and equity items are shown as a perce ...

... Vertical Analysis (component percentages) A. Show each amount as a percentage of another amount on the same financial statements. 1. Income statement items are shown as a percentage of sales. 2. Asset items are shown as a percentage of total assets. 3. Liability and equity items are shown as a perce ...

Matson, Inc. - Investor Relations Solutions

... Northbound volume represents ~75% of total Southbound volume more seasonal, driven by seafood industry Kodiak and Dutch Harbor operations are strategic Critical lifeline to these communities Important terminal and slot charter services for Maersk and APL 2X Weekly 1X Weekly 2X Weekly Matson’s 3-Ship ...

... Northbound volume represents ~75% of total Southbound volume more seasonal, driven by seafood industry Kodiak and Dutch Harbor operations are strategic Critical lifeline to these communities Important terminal and slot charter services for Maersk and APL 2X Weekly 1X Weekly 2X Weekly Matson’s 3-Ship ...

Download attachment

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

Understanding Credit Reports

... *Medical information is not on a consumer’s credit report, but late medical payments are. © Family Economics & Financial Education – Revised October 2004 – Credit Unit –Understanding Credit Reports Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences ...

... *Medical information is not on a consumer’s credit report, but late medical payments are. © Family Economics & Financial Education – Revised October 2004 – Credit Unit –Understanding Credit Reports Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences ...

International Fixed Interest Fund

... This risk indicator is not a guarantee of a fund's future performance. The risk indicator is based on the returns data for the five years ended 31 March 2017. While risk indicators are usually relatively stable, they do shift from time to time. The risk indicator will continue to be updated in futur ...

... This risk indicator is not a guarantee of a fund's future performance. The risk indicator is based on the returns data for the five years ended 31 March 2017. While risk indicators are usually relatively stable, they do shift from time to time. The risk indicator will continue to be updated in futur ...

The Role of Corporate Bonds for Finance in Austria

... interest and the promise that the capital will be repaid. Bonds are subject to fewer legal provisions and constraints than shares. They do not require the issuing company to have a particular legal form, and they may be tailored to the requirements of the issuing entity or to capital market conditio ...

... interest and the promise that the capital will be repaid. Bonds are subject to fewer legal provisions and constraints than shares. They do not require the issuing company to have a particular legal form, and they may be tailored to the requirements of the issuing entity or to capital market conditio ...

CH 3 Objectives

... *How to compute and interpret important financial ratios *The determinants of a firm’s profitability and growth *Understand the problems and pitfalls in financial statement analysis ...

... *How to compute and interpret important financial ratios *The determinants of a firm’s profitability and growth *Understand the problems and pitfalls in financial statement analysis ...

Interest Rate

... Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a financial instrument (coupons plu ...

... Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a financial instrument (coupons plu ...

Volume 74 No. 4, December 2011 Contents

... Of course, many households do not (either consciously or unconsciously) take their future income into account when deciding how much to spend today. Some just behave as ‘rule-of-thumb’ consumers who purely consume their current income, and others have no capacity to do anything else, living week to ...

... Of course, many households do not (either consciously or unconsciously) take their future income into account when deciding how much to spend today. Some just behave as ‘rule-of-thumb’ consumers who purely consume their current income, and others have no capacity to do anything else, living week to ...

MONETARY POLICY IN THE US BEFORE AND AFTER THE CRISIS

... banks’ reserves and monetary base The Federal Reserve conducts reverse repurchase agreements (reverse repos) by selling Treasury securities and federal agency debt securities to counterparties who agree to sell the securities back to the Federal Reserve on a stated future date. In normal times, the ...

... banks’ reserves and monetary base The Federal Reserve conducts reverse repurchase agreements (reverse repos) by selling Treasury securities and federal agency debt securities to counterparties who agree to sell the securities back to the Federal Reserve on a stated future date. In normal times, the ...

Chapter 9 - Tamu.edu

... the amount of current liabilities. Therefore, it is particularly important that liabilities be considered carefully before classifying them as current versus long term. The shifting of a liability from one of these categories to the other often may affect the current ratio significantly. This ratio ...

... the amount of current liabilities. Therefore, it is particularly important that liabilities be considered carefully before classifying them as current versus long term. The shifting of a liability from one of these categories to the other often may affect the current ratio significantly. This ratio ...

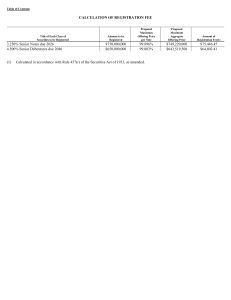

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

THE SUB-PRIME MORTGAGE MESS Kevin M. Bahr, Ph.D

... the lender has a first lien. As a result, lenders could charge higher interest rates to borrowers with low credit scores. This allowed interest rates to increase high enough to compensate the lender for the risk of lending to sub-prime borrowers. The variety of mortgages available was greatly expand ...

... the lender has a first lien. As a result, lenders could charge higher interest rates to borrowers with low credit scores. This allowed interest rates to increase high enough to compensate the lender for the risk of lending to sub-prime borrowers. The variety of mortgages available was greatly expand ...

Disclaimer

... offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings an ...

... offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings an ...

Agent Based-Stock Flow Consistent Macroeconomics: Towards a

... Gertler (1989) and Kiyotaki and Moore (1997). Formally, financial frictions emerge when trade in certain assets cannot take place because markets are incomplete. This may happen because there is no market at all for certain state-contingent assets, or because parties are not willing to engage in cert ...

... Gertler (1989) and Kiyotaki and Moore (1997). Formally, financial frictions emerge when trade in certain assets cannot take place because markets are incomplete. This may happen because there is no market at all for certain state-contingent assets, or because parties are not willing to engage in cert ...

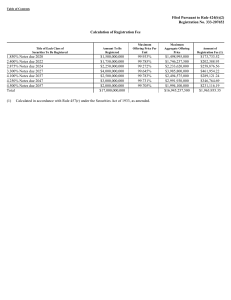

MICROSOFT CORP (Form: 424B2, Received: 01/31/2017 16:20:44)

... means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus supplement and the accompanying prospectus from the date we file that document. Any reports filed by us with the SEC after the d ...

... means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus supplement and the accompanying prospectus from the date we file that document. Any reports filed by us with the SEC after the d ...

Banking crises and the lending channel: Evidence from industrial

... Our paper is related to several strands of literature. First, it is related to the huge body of literature on firms' capital structure. In particular, it is related to the literature that has extended the traditional analysis of the trade-off theory (TOT) and the peckingorder theory (POT) to a cross ...

... Our paper is related to several strands of literature. First, it is related to the huge body of literature on firms' capital structure. In particular, it is related to the literature that has extended the traditional analysis of the trade-off theory (TOT) and the peckingorder theory (POT) to a cross ...