Bail-out - EPS – Economics Political Science – Milano

... The resolution of failed business is an inherently distributional exercise (losses) Socially unacceptable: it is a political rather than an economic matter When the distribution of losses through liquidation preset rules is socially unacceptable then there is a bail-out. Not only banks (Chrysl ...

... The resolution of failed business is an inherently distributional exercise (losses) Socially unacceptable: it is a political rather than an economic matter When the distribution of losses through liquidation preset rules is socially unacceptable then there is a bail-out. Not only banks (Chrysl ...

Leverage Restrictions in a Business Cycle Model Lawrence J. Christiano Northwestern University

... • Wish to address the following sorts of questions: — What restrictions should be placed on bank borrowing? — How should those restrictions be varied over the business cycle? • Want an environment with the following properties: — model includes problem that restrictions on bank borrowing are suppose ...

... • Wish to address the following sorts of questions: — What restrictions should be placed on bank borrowing? — How should those restrictions be varied over the business cycle? • Want an environment with the following properties: — model includes problem that restrictions on bank borrowing are suppose ...

International Capital Flows and US Interest Rates

... – not implausible – after all, who knows what motivates foreign central bankers? – hard to assess precisely because of data limitations, and confidentiality of foreign central bank holdings • “benchmark consistent flows” more accurate measure of total foreign (not just foreign official) purchases • ...

... – not implausible – after all, who knows what motivates foreign central bankers? – hard to assess precisely because of data limitations, and confidentiality of foreign central bank holdings • “benchmark consistent flows” more accurate measure of total foreign (not just foreign official) purchases • ...

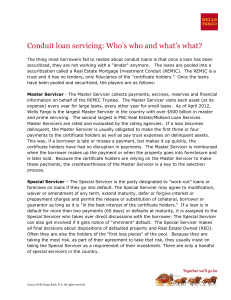

Conduit loan servicing: Who`s who and what`s what?

... expense) every year for large loans, every other year for small loans. As of April 2012, Wells Fargo is the largest Master Servicer in the country with over $500 billion in master and prime servicing. The second largest is PNC Real Estate/Midland Loan Services. Master Servicers are rated and evaluat ...

... expense) every year for large loans, every other year for small loans. As of April 2012, Wells Fargo is the largest Master Servicer in the country with over $500 billion in master and prime servicing. The second largest is PNC Real Estate/Midland Loan Services. Master Servicers are rated and evaluat ...

Private Equity Demystified

... The PE company makes an investment in order to buy a lot more companies in that sector and put them ...

... The PE company makes an investment in order to buy a lot more companies in that sector and put them ...

Financing Infrastructure Through Capital Market

... Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and distressed bond company ...

... Started in response to government appeal to private sector Structured as intermediary between infrastructure providers and capital markets Listed and rated bonds on market Created two subsidiaries:non profit capacity building fund and distressed bond company ...

Comparisons of OECD Debt

... expected to exceed 100% of GDP in 2011 – something that has never happened before in peacetime. 1 As bad as these fiscal problems may appear, relying solely on these official figures is almost certainly very misleading. Rapidly ageing populations present a number of countries with the prospect of en ...

... expected to exceed 100% of GDP in 2011 – something that has never happened before in peacetime. 1 As bad as these fiscal problems may appear, relying solely on these official figures is almost certainly very misleading. Rapidly ageing populations present a number of countries with the prospect of en ...

EC381: Financial and Capital Markets

... The supply and demand should show a decrease in demand for rising inflation expectations and high yields; an expansion in supply and higher yields; an increase in demand for relatively low risk government bonds and lower yields; and, a reduction in demand and an increase in yield for less liquidity. ...

... The supply and demand should show a decrease in demand for rising inflation expectations and high yields; an expansion in supply and higher yields; an increase in demand for relatively low risk government bonds and lower yields; and, a reduction in demand and an increase in yield for less liquidity. ...

High Yield Bond Prices – Are They Exhausted?

... warranty, express or implied, is made by RBCDS-Canada or any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBCDS-Canada’s judgment as of the date of this report, are subject to change without notice and are provided in go ...

... warranty, express or implied, is made by RBCDS-Canada or any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBCDS-Canada’s judgment as of the date of this report, are subject to change without notice and are provided in go ...

Personal Finance - Carl Junction Schools

... finance, debt and credit management; and evaluate and apply insurance and taxes. This course will provide a foundational understanding for making informed personal financial decisions. (One-half credit, one-semester practical art floating requirement for grades 10-12.) ...

... finance, debt and credit management; and evaluate and apply insurance and taxes. This course will provide a foundational understanding for making informed personal financial decisions. (One-half credit, one-semester practical art floating requirement for grades 10-12.) ...

Capital Structure: Basic Concepts

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

Bulletin Reserve Bank of New Zealand Economic implications of

... High and rapidly rising levels of household debt can be risky. A high level of debt increases the sensitivity of households to any shock to their income or balance sheet. And during periods of financial stress, highly indebted households tend to cut their spending more than their less-indebted peers ...

... High and rapidly rising levels of household debt can be risky. A high level of debt increases the sensitivity of households to any shock to their income or balance sheet. And during periods of financial stress, highly indebted households tend to cut their spending more than their less-indebted peers ...

Credit crisis

... • Leading up to mid-2007, the growth of the PE market was fueled by a flood of capital and easy lending standards. However, liquidity dried up following the credit crisis, causing the buyout markets to collapse ...

... • Leading up to mid-2007, the growth of the PE market was fueled by a flood of capital and easy lending standards. However, liquidity dried up following the credit crisis, causing the buyout markets to collapse ...

Press Release on results of monetary policy management and

... the objectives and the major measures on monetary policy management in 2015 as follows: " manage the monetary policy in a proactive and flexible manner in close association with the fiscal policy to control inflation (below 5%), stabilize macro-economy, support economic growth at a reasonable level ...

... the objectives and the major measures on monetary policy management in 2015 as follows: " manage the monetary policy in a proactive and flexible manner in close association with the fiscal policy to control inflation (below 5%), stabilize macro-economy, support economic growth at a reasonable level ...

Trends in Spanish corporate bond issuance

... and their predominantly bullet-amortisation structures. These characteristics have prompted companies to opt for debt financing even when it may have been more expensive than traditional bank debt. ...

... and their predominantly bullet-amortisation structures. These characteristics have prompted companies to opt for debt financing even when it may have been more expensive than traditional bank debt. ...

Lecture 3 securitization

... when the teaser rates ended. Others had negative equity and recognized that it was optimal for them to exercise their put options. U.S. real estate prices fell and products, created from the mortgages, that were previously thought to be safe began to be viewed as risky ...

... when the teaser rates ended. Others had negative equity and recognized that it was optimal for them to exercise their put options. U.S. real estate prices fell and products, created from the mortgages, that were previously thought to be safe began to be viewed as risky ...

Document

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

... Since the mid-1980s, securitization has spread from the mortgage market to other markets including credit card balances, automobile and truck loans and leases, accounts receivable, computer leases, home equity loans, student loans, railroad car leases, small business loans, and boat loans. Banks, fi ...

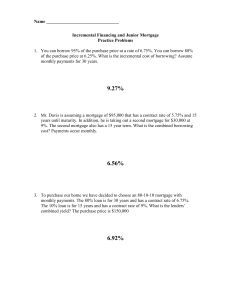

Adjustable Rate Mortgage

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

Is the weakness of formal rural finance a supply

... The lack of rural credit is an obstacle to agricultural development. ...

... The lack of rural credit is an obstacle to agricultural development. ...