The Capital Structure Puzzle

... some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create only a potential future deduction, usable when and if the firm earns enough to work ...

... some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create only a potential future deduction, usable when and if the firm earns enough to work ...

Taking charge of your finances

... • Installment credit usually has an agreement (contract) which must be signed outlining the repayment terms. ...

... • Installment credit usually has an agreement (contract) which must be signed outlining the repayment terms. ...

Personal Finance Education Overcoming Financial Hurdles

... • Credit – the amount of money available to you through lenders • Debt – the amount of credit you’re using at any given time • Creditor – any person / business that extends credit © 2006 ACA International all rights reserved ...

... • Credit – the amount of money available to you through lenders • Debt – the amount of credit you’re using at any given time • Creditor – any person / business that extends credit © 2006 ACA International all rights reserved ...

JC Clark Yield Trust 2012 Year End Update

... During the year there were two key themes that we followed and continue to focus on – global currency debasement and the potential for fixed income outflows. As part of the first theme, we wrote a piece called “A Cup of Coffee”, where we showed how a 1964 dime would have purchased a Tim Horton’s cup ...

... During the year there were two key themes that we followed and continue to focus on – global currency debasement and the potential for fixed income outflows. As part of the first theme, we wrote a piece called “A Cup of Coffee”, where we showed how a 1964 dime would have purchased a Tim Horton’s cup ...

CHAPTER 6 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... prices up and yields down. Thus, the spread widens during recessions. As the economy improves, investors may be more willing to hold the more risky (corporate) bonds. They buy more corporate bonds and less Treasury bonds, causing the spread to narrow in expansions. 3. What factors do rating agencies ...

... prices up and yields down. Thus, the spread widens during recessions. As the economy improves, investors may be more willing to hold the more risky (corporate) bonds. They buy more corporate bonds and less Treasury bonds, causing the spread to narrow in expansions. 3. What factors do rating agencies ...

1) - Catalyst

... 1) Suppose a savings account pays 5% interest per year, compounded four times per year. If the savings account starts with $600, how many years would it take for the savings account to exceed $2000? 2) If you borrow $500 from a credit union at 12% annual interest and $250 from a bank at 18% annual i ...

... 1) Suppose a savings account pays 5% interest per year, compounded four times per year. If the savings account starts with $600, how many years would it take for the savings account to exceed $2000? 2) If you borrow $500 from a credit union at 12% annual interest and $250 from a bank at 18% annual i ...

NN Global Investment Grade Credit - Home

... reduce exposure on the name given negative technicals on a potential downgrade below IG ratings which would increment selling pressure in the name. We are less concerned about the fundamental story of the company given that its operations and credit profile continues to be attractive, and it is a su ...

... reduce exposure on the name given negative technicals on a potential downgrade below IG ratings which would increment selling pressure in the name. We are less concerned about the fundamental story of the company given that its operations and credit profile continues to be attractive, and it is a su ...

Schroder Fixed Income Fund - Wholesale Class Fund Summary Overview

... Security selection is carried out in a manner aiming to exploit those areas with the most potential for adding value. Independent fundamental credit research and active management at the security level are essential elements of our approach which focuses on the avoidance of default and identifying v ...

... Security selection is carried out in a manner aiming to exploit those areas with the most potential for adding value. Independent fundamental credit research and active management at the security level are essential elements of our approach which focuses on the avoidance of default and identifying v ...

DEBT FINANCING

... Long-term debt typically comprises more than half of the total debt of listed Australian companies. ...

... Long-term debt typically comprises more than half of the total debt of listed Australian companies. ...

Agricultural finance for smallholder farmers

... Cooperation with value chain actors (e.g. vouchers instead of cash) Warehouse receipt system to reduce market price risk ...

... Cooperation with value chain actors (e.g. vouchers instead of cash) Warehouse receipt system to reduce market price risk ...

Chapter 8 Section 2 and 3 Notes

... Include information that will support your case Pay the portion of your bill that is not in question ...

... Include information that will support your case Pay the portion of your bill that is not in question ...

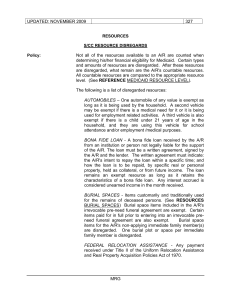

S/CC Resource Disregards - page 327

... Not all of the resources available to an A/R are counted when determining his/her financial eligibility for Medicaid. Certain types and amounts of resources are disregarded. After these resources are disregarded, what remain are the A/R's countable resources. All countable resources are compared to ...

... Not all of the resources available to an A/R are counted when determining his/her financial eligibility for Medicaid. Certain types and amounts of resources are disregarded. After these resources are disregarded, what remain are the A/R's countable resources. All countable resources are compared to ...

Bond Strategies for Rising Rate Environments

... investors should shorten maturity, and thereby reduce duration (the price sensitivity of a bond— longer duration means the price fluctuates more as the yield moves up and down). By reducing maturity, the thinking goes, investors avoid large potential price shocks in their bond portfolio. In today's ...

... investors should shorten maturity, and thereby reduce duration (the price sensitivity of a bond— longer duration means the price fluctuates more as the yield moves up and down). By reducing maturity, the thinking goes, investors avoid large potential price shocks in their bond portfolio. In today's ...

The euro zone: Falling into a liquidity trap?

... Standard theories of the term structure of interest rates suggest that longer-term interest rates are determined mainly by current short-term rates and by market expectations of future short-term rates (plus a risk premium). Central banks largely control shortterm rates by setting a target for the o ...

... Standard theories of the term structure of interest rates suggest that longer-term interest rates are determined mainly by current short-term rates and by market expectations of future short-term rates (plus a risk premium). Central banks largely control shortterm rates by setting a target for the o ...

SBP brings down policy rate to a single digit (9.5%)

... by the SBP, at Rs615 billion as on 14 December 2012, remains high. The size of these injections would not be a source of concern as long as inflation stays low and stable. However, given the current high year-on-year growth in broad money of 17.8 percent, this approach would require more vigilance i ...

... by the SBP, at Rs615 billion as on 14 December 2012, remains high. The size of these injections would not be a source of concern as long as inflation stays low and stable. However, given the current high year-on-year growth in broad money of 17.8 percent, this approach would require more vigilance i ...

(Nedlac) (2013) (part 1). - Lecture Notes

... 1990’s financial deregulation • The 1990’s saw an attempt to control public debt leading to rapidly rising inequality, as a result of weakened trade-unionism, cuts in social spending (as Clinton heralded the end to ‘welfare as we know it” and reduced growth due to austere fiscal policy • Private de ...

... 1990’s financial deregulation • The 1990’s saw an attempt to control public debt leading to rapidly rising inequality, as a result of weakened trade-unionism, cuts in social spending (as Clinton heralded the end to ‘welfare as we know it” and reduced growth due to austere fiscal policy • Private de ...

Introducing the Emerging Market Bond Index Plus

... The timing of the exchange has generally been set after the country has reached an agreement in principle with the banks. Usually, a date when the underlying loans will cease trading has been set prior to the exchange date, so that the interest arrears can be completely settled before the exchange. ...

... The timing of the exchange has generally been set after the country has reached an agreement in principle with the banks. Usually, a date when the underlying loans will cease trading has been set prior to the exchange date, so that the interest arrears can be completely settled before the exchange. ...