From Debt Collection to Relief Provision: 60 Years of Official Debt

... countries to delay necessary reforms. Second, a once-and-for-all programme is superior to one with gradual relief. Rose (2004) documents a significant negative effect of official debt restructurings on trade, which he interprets as one of the reasons why countries pay their debts. Using a gravity m ...

... countries to delay necessary reforms. Second, a once-and-for-all programme is superior to one with gradual relief. Rose (2004) documents a significant negative effect of official debt restructurings on trade, which he interprets as one of the reasons why countries pay their debts. Using a gravity m ...

Bank Bailouts and Moral Hazard?

... default), the banks increase the loan investment as the ex post net worth is getting smaller; when the banks’ ex post net worth is below a certain level, they decrease the amount of loans as they are closer to the default. On the other hand, the risky debt amount shows a monotonically decreasing pa ...

... default), the banks increase the loan investment as the ex post net worth is getting smaller; when the banks’ ex post net worth is below a certain level, they decrease the amount of loans as they are closer to the default. On the other hand, the risky debt amount shows a monotonically decreasing pa ...

Select-Investment-Option-Reporting-Marked-up-Existing-SIO

... 2.1. of which: Benefit payments 2.2. of which: Repatriation to employer-sponsor ...

... 2.1. of which: Benefit payments 2.2. of which: Repatriation to employer-sponsor ...

Count the Limbs: Designing Robust Aggregation Clauses in

... possibilities for abuse. The markets might have rebelled. Instead, they yawned. On October 7, barely a month after ICMA launched its new collective action clauses (CACs), Kazakhstan became the first to use them in an English law bond. The issue, Kazakhstan’s first in fourteen years, was oversubscrib ...

... possibilities for abuse. The markets might have rebelled. Instead, they yawned. On October 7, barely a month after ICMA launched its new collective action clauses (CACs), Kazakhstan became the first to use them in an English law bond. The issue, Kazakhstan’s first in fourteen years, was oversubscrib ...

Covered Bonds in the European Union Reflections on the

... Fixed rate callable mortgage covered bonds Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest ...

... Fixed rate callable mortgage covered bonds Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest ...

Utility Cost of Capital

... • This model suggests that utilities be allowed an ROE similar to the ROEs made by low-risk unregulated companies • Sounds promising – sounds like it would provide the comparable returns available in the market, BUT… • Comparable earnings provide what companies are making on their book value of equi ...

... • This model suggests that utilities be allowed an ROE similar to the ROEs made by low-risk unregulated companies • Sounds promising – sounds like it would provide the comparable returns available in the market, BUT… • Comparable earnings provide what companies are making on their book value of equi ...

Credit Risk and the Performance of Nigerian Banks

... efficient fashion, and thus generate large profits relative to their peers, but also impose better loan underwriting and monitoring standards than their peers which result to better credit quality. Koehn and Santomero (1980), Kim and Santomero (1988) and Athanasoglou et al. (2005), suggest that ban ...

... efficient fashion, and thus generate large profits relative to their peers, but also impose better loan underwriting and monitoring standards than their peers which result to better credit quality. Koehn and Santomero (1980), Kim and Santomero (1988) and Athanasoglou et al. (2005), suggest that ban ...

Chapter 17: Managing Interest Rate Risk

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

... market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is comparatively cheaper than that for its floating-rate debt, then it can issue a fixed-rate bond and swap it into floating, for an all-in cost lower than that for a floating-rat ...

NYU-SEC5 - Wharton Finance

... There is a bubble with the price of the risky asset above the benchmark of 1.5 The more risk there is the greater is the risk shifting and the larger the bubble Note that default and the potential for a financial crisis occurs in this model when the return on the risky asset is low, i.e. 1 Risk shif ...

... There is a bubble with the price of the risky asset above the benchmark of 1.5 The more risk there is the greater is the risk shifting and the larger the bubble Note that default and the potential for a financial crisis occurs in this model when the return on the risky asset is low, i.e. 1 Risk shif ...

annexure

... d. A maximum of 5% of Investments Assets of General Insurers or 5% of Investment Assets of funds relating to life funds, pension and general annuity funds in the case of life insurer can be invested in Immovable Property as per Sec 27A(1)(n) of Insurance Act, 1938. e. A maximum of 25% of Investment ...

... d. A maximum of 5% of Investments Assets of General Insurers or 5% of Investment Assets of funds relating to life funds, pension and general annuity funds in the case of life insurer can be invested in Immovable Property as per Sec 27A(1)(n) of Insurance Act, 1938. e. A maximum of 25% of Investment ...

The Determinants of the Market Interest Rate Given the quoted

... • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds ...

... • More-distant cash flows are more adversely affected by an increase in interest rates – Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds ...

Loan Agreement - Act respecting financial assistance for education

... Afinancial institution may request that a consent clause regarding the collection and communication of personal information be included in the agreement even though the Act respecting financial assistance for education expenses in no way stipulates that entering into a loan agreement is conditional ...

... Afinancial institution may request that a consent clause regarding the collection and communication of personal information be included in the agreement even though the Act respecting financial assistance for education expenses in no way stipulates that entering into a loan agreement is conditional ...

Reputation, Renegotiation, and the Choice between Bank Loans

... choose either to allow the firm to continue functioning under a renegotiated debt contract or to liquidate the firm. Firms may be in financial distress because of one of two possible reasons: Some firms may have intrinsically good projects but may nevertheless be in financial distress due to tempora ...

... choose either to allow the firm to continue functioning under a renegotiated debt contract or to liquidate the firm. Firms may be in financial distress because of one of two possible reasons: Some firms may have intrinsically good projects but may nevertheless be in financial distress due to tempora ...

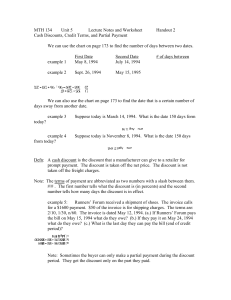

MTH 134 Unit 5 Lecture Notes and Worksheet

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

... Defn: A cash discount is the discount that a manufacturer can give to a retailer for prompt payment. The discount is taken off the net price. The discount is not taken off the freight charges. Note: The terms of payment are abbreviated as two numbers with a slash between them. #/# . The first number ...

Bonds and Their Valuation

... Par value – face amount of the bond, which is paid at maturity (assume $1,000). Coupon interest rate – stated interest rate (generally fixed) paid by the issuer. Multiply by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was iss ...

... Par value – face amount of the bond, which is paid at maturity (assume $1,000). Coupon interest rate – stated interest rate (generally fixed) paid by the issuer. Multiply by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was iss ...

PDP-Working Paper

... enhanced the transparency of problem loans and boosted provisioning. Recent tax reforms have also made it more favorable for banks to set aside loan loss provisions. As a result, banks have increased provisioning against bad loans and raised additional capital, along with announcing plans to offload ...

... enhanced the transparency of problem loans and boosted provisioning. Recent tax reforms have also made it more favorable for banks to set aside loan loss provisions. As a result, banks have increased provisioning against bad loans and raised additional capital, along with announcing plans to offload ...

Evaluate Your Credit

... credit companies — Equifax, Experian and TransUnion — annually. If you’ve been denied credit, you can always get a free credit report (regardless of whether you’ve already received your annual free report). If any of your credit reports contain inaccuracies, contact the credit agency that compiled t ...

... credit companies — Equifax, Experian and TransUnion — annually. If you’ve been denied credit, you can always get a free credit report (regardless of whether you’ve already received your annual free report). If any of your credit reports contain inaccuracies, contact the credit agency that compiled t ...

Read Publication - UKZN Centre for Civil Society

... furthermore that such material conditions provide the organising handles around which a full-fledged progressive political movement can be, and is being, built . The analysis begins with some definitions . Financial capital is, in simple terms, an external source of funding ; i .e ., funding not imm ...

... furthermore that such material conditions provide the organising handles around which a full-fledged progressive political movement can be, and is being, built . The analysis begins with some definitions . Financial capital is, in simple terms, an external source of funding ; i .e ., funding not imm ...

CYCLICAL PATTERNS IN PROFITS, PROVISIONING AND

... determine in practice. Bank lending channel theory argues that monetary policy influences expenditures via the supply of bank credit (Bernanke and Gertler, 1995, Berk, 1998).2 T ightening of monetary policy causes a decrease in banks’ liabilities, followed by a decrease of bank credit, at its worst ...

... determine in practice. Bank lending channel theory argues that monetary policy influences expenditures via the supply of bank credit (Bernanke and Gertler, 1995, Berk, 1998).2 T ightening of monetary policy causes a decrease in banks’ liabilities, followed by a decrease of bank credit, at its worst ...

LBO General Discussion

... 1/2 percent and a maturity ranging from five to seven years. • The remainder of the required 18 to 20 percent all-in-return consists of warrants to buy common stock, which the investor values based on the outlook of the company, or incremental interest paid on a "pay-in-kind" or PIK basis. • The fee ...

... 1/2 percent and a maturity ranging from five to seven years. • The remainder of the required 18 to 20 percent all-in-return consists of warrants to buy common stock, which the investor values based on the outlook of the company, or incremental interest paid on a "pay-in-kind" or PIK basis. • The fee ...

K.3 Your Legal Rights During and After Bankruptcy: Making the Most

... Yes and No. The term ‘‘secured debt’’ applies when you give the lender a mortgage, deed of trust, or lien on property as collateral for a loan. The most common types of secured debts are home mortgages and car loans. The treatment of secured debts after bankruptcy can be confusing. Bankruptcy cancel ...

... Yes and No. The term ‘‘secured debt’’ applies when you give the lender a mortgage, deed of trust, or lien on property as collateral for a loan. The most common types of secured debts are home mortgages and car loans. The treatment of secured debts after bankruptcy can be confusing. Bankruptcy cancel ...

Risk-Adjusted Performance of Private Equity Investments

... risk measures are thus attributed to cash flow distributions, rather than to any inherent characteristic of the investment. By providing specific information on particular PE fund transactions, our dataset permits us to analyse transactions on a deal-by-deal basis, thus making it possible to determ ...

... risk measures are thus attributed to cash flow distributions, rather than to any inherent characteristic of the investment. By providing specific information on particular PE fund transactions, our dataset permits us to analyse transactions on a deal-by-deal basis, thus making it possible to determ ...

Municipal Act, 2001 - O. Reg. 247/01

... 4. (1) Subject to subsections (2) and (3), any municipality that has issued or plans to issue a variable interest rate debenture may enter interest rate exchange agreements for the debenture. O. Reg. 247/01, s. 4 (1). (2) Any municipality that has issued or plans to issue a fixed interest rate deben ...

... 4. (1) Subject to subsections (2) and (3), any municipality that has issued or plans to issue a variable interest rate debenture may enter interest rate exchange agreements for the debenture. O. Reg. 247/01, s. 4 (1). (2) Any municipality that has issued or plans to issue a fixed interest rate deben ...